Most people who want to retire before they die in office at their desk one unfortunate day know that investing plays an important role in achieving financial freedom and reaching this goal. How to invest wisely, however, can be confusing, especially if you’re just starting out. While our primary focus here is budgeting (shocker, I know), understanding the basics of investing is a critical component to succeeding with your personal finances. And there’s no point in budgeting without that end goal in mind, so we want to help you along the rest of your journey up the FIRE ladder as well.

This week, we are trading in our Budget Brigade hat for our FIRE Brigade cap.

Never fear, Underdog is here.

And by Underdog, I mean The Budget Beagle and her human sidekicks.

Below, we provide a brief overview of what investing is, what different investing options exist, where to start, and what to avoid. We know this is a lot, and we can dig deeper into each of these topics in more detail later if there’s any interest. Just let us know which ones you want us to cover in the comments or in the official Budget Brigade Facebook community.

- Saving means you don’t spend all your money; investing that savings means your money will compound and grow to help fund your retirement

- The goal of long-term investing is to balance risk and volatility with growth

- Only a tiny portion (if any) of your investments portfolio should be in single stocks or crypto

- When it comes to investing, simple and boring is typically your best bet

- Always take the employer match at work, if you have one; it’s the best return you’ll get anywhere

- There’s no set amount you “should” be investing, but aim for around 20% of your income as a benchmark until you fine tune for your freedom FIRE goals

- Investing in real estate is high level game plan; focus on the stock market and buying your primary residence first

- Never invest in something you don’t understand

Savings versus investing

We love saving money. We think you should, too. No one is ever stressed at the end of the month when they discover they have extra money left from their paycheck after paying their bills.

But, saving isn’t enough to propel you to financial freedom. When you tuck away your remaining cash at the end of the month and just let it sit there, you can actually lose money, thanks to the little thing we all love to hate called inflation. As the cost of living rises, if your money doesn’t grow with it, you lose purchasing power. That is one of the reasons why investing is so important.

With investing, your money has the chance to not only grow to keep up with inflation, but to outpace it. Over time, you have to save less and less because your growing pile of money will do what it does best and continue to grow. Many times, the vast majority of your retirement balance will come from growth, not the amount you’ve put into your retirement investing.

This is the not-so-secret key to freedom: compound growth.

Learn more with our key to wealth article.

Your savings can grow some from compound interest in a bank or high-yield savings account, but it’s peanuts compared to investing over time.

When to start investing

You’ve probably heard of the mecca of investing: the stock market. You may even understand how it works. But you may be confused when you should start investing.

If you have to ask, the answer is now. It’s actually likely a while ago, but we don’t have Hermione’s magical time turner device. We can only focus forward, being mindful not to beat ourselves up over past money mistakes.

Investing is critical early on your path to financial freedom. It may look like it’s far up the FIRE ladder given that there are only eight rungs, but many of the early rungs should be quick and easy.

While removing high-interest debt is going to provide a better return on your investment than most investing options, there is one key exception we want to point out: taking the employer match at a workplace retirement plan.

Many employers that offer a 401(k) or similar plan offer some sort of match. The match is often 50% or 100% of what you contribute up to a certain amount or percentage.

If you have this option, take advantage of the full match as soon as you have an emergency fund in place. A 50% or 100% match is a guaranteed either 50% or 100% return on your investment. Considering most investments make closer to 10% and credit card debt usually caps out around 30%, this is a no brainer to take as soon as you have your defensive strategy in place.

After taking your employer match, hold off on any additional investing until you’ve put out the dumpster fire of high-interest debt. Then hit the NOS button and let’s go.

Learn more about our step-by-step personal finance guide.

How much should I invest?

As much as possible as soon as possible.

I’m joking. (Kinda.)

My husband would love to save and invest 50% of our income. I, on the other hand, prefer to buy books, go on vacation, and not live in a van down by the river. As we often say, everything has an opportunity cost. Every dollar we spend now is several dollars (thanks to compound growth) that we won’t have in retirement or additional time we’ll have to work to earn that additional dough.

Guidance for how much you “should” invest varies depending on who you ask. We think it depends on your situation and what your vision for retirement looks like. If you want to party on a G6, you’re going to need to invest a lot more than someone who prefers to park it at a KOA for a week.

This is why Rung 5 of the FIRE ladder (establish your flash point) comes before Rung 6 (fuel your future). Start with the end in mind and then reverse engineer the path you should follow to reach your dream vision of “what would you do if you had a million dollars?”

When in doubt, round up. No one gets to retirement and hates having too much money saved up. (Though you can go overboard and hate your life now for the sake of a dream future. We don’t recommend this either.) So many Americans, however, tire of working and look at retirement as the solution, but realize they can’t live comfortably off Social Security, leaving them stuck in the 9-to-5 grind.

As a VERY general rule, you can target investing around 20% of your income to help prepare for your golden years. If you’re young, you can likely get away with less because you’ll have more time for it to grow. If you’re starting later and Catching Up to FI, you very well may need to save more. This is why I hate throwing out boilerplate “one-size-fits-all” advice. But if you need it, there it is.

If you want a more personalized approach, a retirement planner can help. We’re hard at work on putting one together, so check our financial resources page to see when it drops. In the meantime, many people use the 4% rule as a guiding principle.

The 4% rule to determine how much you need to retire

The 4% rule assumes a “safe” withdrawal rate from your investments of 4%. This number came from financial advisor William Bengen in the 1990s. He looked at historic returns in the stock market, as well as inflation rates, to predict what you could conservatively withdraw from your nest egg without running out.

A few key assumptions/factors for the 4% rule:

- Your retirement portfolio is a balanced ratio of 60% equities and 40% fixed income assets

- Your target length of time for retirement is around 30 years

Followers of the FIRE (financial independence retirement early) movement need to keep that second point top of mind. The earlier you retire, the more you’ll need or the less you’ll need to withdraw from your nest egg to get you through decades of retirement.

Say, for example, you have $1,000,000 in your investments. Not too shabby, right? The 4% rule states you could retirement if you could live off of:

$1,000,000 x 0.04 (4%) = $40,000

Possible, but maybe not comfortable, depending on your current lifestyle.

The Rule of 25 to determine how much you need to retire

The Rule of 25 is the inverse of the 4% rule and another way to think about your “FI number.” Take whatever income you need to live comfortably and multiply it by 25 to get what you need your investments to equal to have your desired retirement goal. (Don’t include your house’s equity, as you’ll still need somewhere to live.)

We ran our scenario out when working on the What Is the Income to Live Comfortably in Today’s Economy? article. We had a eureka lightbulb moment that we’d reached Coast FI status, but I wanted to see what that actually meant in dollar and cents.

Once we purchase our next home, we would need about $72,000 gross income a year to live to maintain our current lifestyle without sacrificing anything. To reach financial independence (which is our goal), we need an investment portfolio in today’s dollars (remember that inflation, she’s a sneaky devil) of:

$72,000 x 25 = $1,800,000

I’d love to tell you we have that much in retirement already, but we don’t, which is why we’re at Coast FI status and not fully financially independent yet.

Once you have a target “FI number” you can work backward, given when you hope to reach financial independence, to determine how much you need to be saving and investing to hit your specific target. A retirement planner spreadsheet or program can help with the numbers here if you aren’t a nerd like us and don’t already have three scenarios plotted and monitored once a year.

What should I invest in?

You know when to invest, and you know how much to invest. Now, it’s time to figure out where to put that money to work so it can get to work for you.

We already covered why saving alone won’t cut it.

Similarly, not all investing is equal. There are two major umbrellas of investing:

- Short-term investments

- Long-term investments

When we’re talking about retirement and reaching financial independence, one is better than the other, but they both have their roles.

Short-term versus long-term investments

The names should clue you in on the primary difference. Short-term investments are better for keeping money relatively safe while you invest for a short time period (usually around 5-7 years max) for specific goals.

Since, like with pretty much everything else in life, investing comes with opportunity costs, there is a tradeoff for this relative safety: a lower return rate. That’s why short-term investment vehicles aren’t good for long-term investing, like retirement. With smaller returns, you never truly take advantage of compound interest, as you’re likely to get closer to just matching inflation. Instead of riding epic waves like Kelly Slater, you’ll be hanging out in the shallow end of the community pool treading water with your paddle board.

Short-term investment options include:

- High-yield savings account (HYSA)

- Money market accounts

- Money market funds

- Bonds (corporate, federal, municipal, etc.)

- Treasury bills

Short-term investments are good for short-term savings goals, such as:

- Saving a down payment for a house

- Saving for other real estate investments, such as rental properties

- Parking your emergency fund (this isn’t really investing, it’s saving, so it’s okay to keep in short-term investments long term)

- Your sinking funds for vacations, future vehicle purchases, home renovations, etc.

Short-term investing options are not good investing strategies for retirement, with one exception: bonds. As a minority percentage of your portfolio (we’ll look into asset allocation below), bonds can help balance out a robust investment portfolio to provide some stability and help manage risk for your retirement.

Long-term investments involve more volatility without guaranteed returns, but offer greater opportunity for growth. The stock market is where the vast majority of these long-term investments live. Real estate is the other primary investment vehicle people use to achieve financial independence.

Investing for retirement

When looking at long-term investing for retirement, there are certain types of tax-advantaged retirement accounts that offer some amazing completely legal tax incentives that help your money grow faster and with less taxes so you don’t have to save as much. These types of accounts include:

- IRAs

- 401(k)s

- TSP plan

- HSA

You also have the option of traditional accounts versus Roth accounts for many of these options.

It’s such an important topic, we broke it out into the beginner’s guide to the many types of tax-advantaged retirement accounts to walk you through them all.

How to invest your money

Let’s break long-term investing down into two primary categories: the stock market and the real estate market. Both are good to invest in long term, but anything you invest in real estate will be illiquid, meaning you won’t be able to easily sell it and get your investment back to live off of.

Since most people invest for the goal of financial independence and retirement, starting off investing in the stock market is almost always the better strategy. If you’re hoping to purchase your first home, saving up a down payment while also funding some retirement savings is not a bad idea. You could even pause most retirement savings for a short time period (a year or two) to turn your down payment sinking fund up to eleven, but you don’t want to stay in the investing kiddie pool long term, as that cuts your compound growth potential off at the knees.

If you have an employer match, it’s still worth taking that while saving up for a home.

How to get into the stock market

You’re ready to switch from saving money to investing in the stock market, but which stocks do you pick?

This is a trick question, as you shouldn’t invest in single stocks, at least not at first and never as a majority. To maximize your potential with investing, you want to make sure you are growth focused and optimized for risk. This can be a tricky balance to manage, at least by yourself, so we cover popular ways to tackle this portfolio asset allocation goal below.

What are stocks?

A stock is a share of a publicly traded company, buying you a tiny stake in that company. Examples of stocks people talk about are Apple (AAPL), Amazon (AMZN), and Tesla (TSLA). While stock values tend to fluctuate with how well a company is doing, it isn’t always a direct indicator, as GameStop proved back in the early 2020s.

Stocks can be highly volatile, especially if a company goes bankrupt. Office Space nods to the Initrode (AKA Enron) bankruptcy that left many employees holding their retirement in company stock devastated, having to sling magazines to make a living in their golden years.

Monica in FRIENDS learns this the hard way, too, when she buys the stock with a ticker corresponding to her initials. Spoiler alert: it doesn’t go well. And she, like many Americans, don’t have a lot of retirement savings to gamble on single stocks.

It’s best to avoid investing directly into single stocks. Instead, you want to pick investment classes that pull together multiple individual stocks for you, allowing you to diversify your investing, such as a mutual fund, index fund, or ETF.

If you really want to play the stock game (and it’s much more like gambling in Vegas), do so only with fun money you aren’t afraid of losing, not your future.

What is a mutual fund?

A mutual fund is a set of multiple stocks, bonds, and/or other securities. Mutual funds typically include 100 or more different securities. Instead of having to research, purchase, track, and buy hundreds of different individual stocks or bonds yourself to spread your risk, you buy a mutual fund of them already pre-packaged.

Mutual funds are great for investing, especially for DIY investors.

What is a bond?

A bond is like an IOU that gives you a small sliver of ownership in a loan to a company or other entity. While a stock buys you into a company’s potential profits, a bond buys you into a company’s debt. Since we sing the praises of debt-free living around here, you might think bonds are the devil. Government bonds, however, are a lot more stable than stocks, offering less volatility. Corporate bonds are too, to a lesser extent. Like many types of loans, they have a set interest rate, though, which is usually lower than typical returns of the overall stock market.

An investment portfolio heavy in bonds is similar to investing in short-term investments, so we don’t recommend this as a large part of your investing strategy. A bundle of bonds as a minority percentage of your overall investments, however, can help achieve that risk-vs-reward target balance we mention above.

What is an index fund?

An index fund is a type of mutual fund, and it’s our favorite type at The Budget Brigade for our personal investing.

Above, we mention that mutual funds group together stocks, bonds, and other securities with something in common. With an index fund, that something common is that they do their best to track a certain target index for returns.

One of the most common index funds is a S&P 500 index fund, which we’ll use to highlight how they work.

What is a S&P 500 index?

S&P 500 stands for the Standard and Poor’s 500. This index fund tracks the performance of the leading 500 publicly traded companies listed on the US stock exchanges. Essentially, buying part of a S&P 500 index fund lets you buy stocks in these 500 companies.

That’s right. With this one purchase, you get 500 different stocks, which is a quick and easy way to diversify your investing and protect your retirement from market volatility. Because let’s be real: if all 500 of the top companies in the US were to go bankrupt, the entire US economy would crash, and retirement would be the least of our concerns. It’s more Fallout meets The Last of Us with a mix of The Oregon Trail at that point. Stock up bullets and don’t step on any snakes.

What is an ETF?

An ETF is like a mutual fund, but with a few key differences. ETF stands for exchange traded fund. ETFs can be bought and sold directly on the stock market, while mutual funds are sold by fund companies like Fidelity. ETFs, like stocks, fluctuate in value throughout the day, while mutual funds only update once a day when the stock market closes.

I hear you snoring in the back, so we’ll skip ahead. The main thing to know about ETFs is that they often offer lower initial investment minimums, which can make them a good opportunity for first-time investors.

What about investing in crypto?

You’ll notice we don’t include cryptocurrencies in our stock market strategy. That’s because crypto isn’t an investment, it’s speculation. It’s more like a commodity like gold or silver, except it’s purely based on speculation and doesn’t have any physical, inherit value.

That’s too much risk for what we’re trying to accomplish above, so we recommend not wasting your time with crypto. If you want to speculate, that the money you want to use for crypto from your wants or fun money category in your budget, not your investing or savings.

Investment asset allocation strategies

A little bit of mutual fund in your life

A little bit of ETF on the side

A little bit of REITs is all you need

A little bit of stocks is what you see

We’ve covered what broad investment security types to consider and which to mostly avoid. Now you’re probably wondering what you should invest where. After all, there isn’t just one mutual fund or index fund. There are thousands. That’s enough to give anyone analysis paralysis.

The good news is, you don’t need a thousand different ones in your investment portfolio to diversify because, like we mention above, they are already diversified by what they hold in each unit you purchase.

No matter what TikTok tells you, investing for retirement the right way is pretty straightforward and honestly kinda boring. There’s no single “perfect” asset allocation strategy to divide your investments among the different types of assets.

Below, we cover popular strategies to get you started, as well as give you an inside look into what we personally do with our retirement.

Investing with the three-fund portfolio approach

One common investing strategy using mutual funds, made popular by John Bogle, is the three-fund portfolio.

The three-fund portfolio builds your investment portfolio out of three common funds (shocker, I know!):

- Domestic stocks

- International stocks

- Bonds

How you split them depends on your approach and your comfort level with risk. Investors with a higher risk tolerance that can afford to lose more but gain more will have less bonds and more stocks. Investors wanting to be more conservative as they reach retirement age and need to rely on that pot of gold will likely lean heavier into bonds to balance it more evenly with stocks.

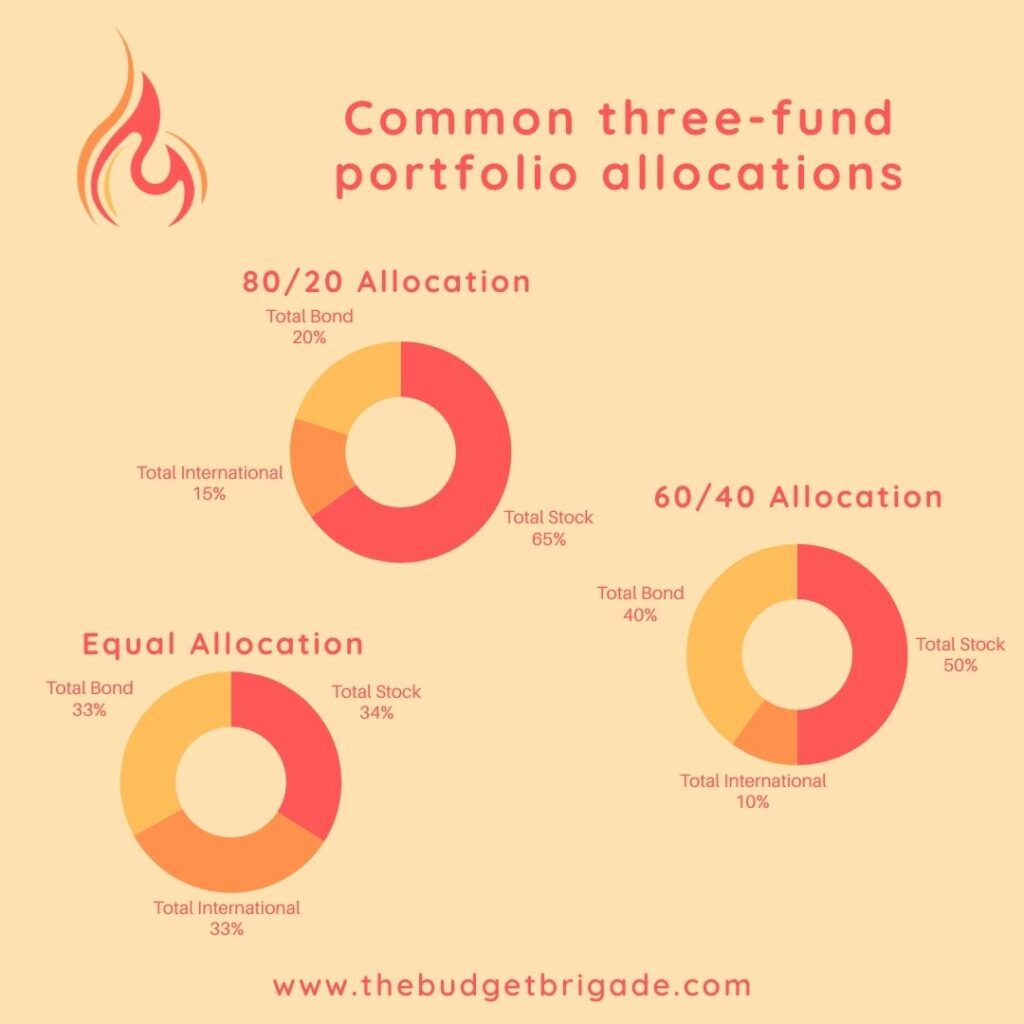

A few common splits for the three-fund portfolio include:

The poker-style approach of all-in index fund and chill investing

While John Bogle has popularized the three-fund portfolio, it isn’t the only asset allocation strategy. If you want low lift and ease of investing while still allowing for growth and diversification, you can invest your entire portfolio into a S&P 500 index fund. For many, that’s enough diversification and all they want to do. If that’s what you’re comfortable with, that’s completely fine.

The same is true for a total market fund versus a S&P 500 index fund. Just note that different funds have different expense ratios, which can impact their overall returns and growth. Check into these for anything you’re investing in as the lower your expense ratios and fees, the more you get to keep and that will compound for your future retirement.

The target date index fund approach to investing

Another common strategy, though it likely has higher fees and expense ratios, but the least amount of work and more diversification, is a target date index fund.

What is a target date index fund?

A target date index fund is a type of index fund for investors who want a “set it and forget it” approach to investing. You pick your target retirement date (year), and the securities within the index fund automatically adjust from more growth to more conservative the closer you get to that target date. Depending on your actual retirement goal, this may or may not be a go thing for you.

Our Budget Brigade programmer and investing nerd also wants to point out that you typically can’t invest in REITs (which we cover below) with target date index funds.

You may be looking for professional help, but not sure if you really want to pay 1% or more of your portfolio to a financial advisor. Explore our Should I Use a Financial Advisor? article for tips on how to make the decision for your situation. A target date index fund can be a great alternative to a financial advisor to consider.

What is the best portfolio asset allocation strategy?

This is a hard question to answer. Since I’m not a financial advisor, I’m not going to attempt to try.

What I can tell you is what we personally do, based on our own research and approach to investing. This doesn’t mean this is the best allocation strategy for you, it just means it’s the best for us for now.

We operate under a seven-fund portfolio that looks something like:

This doesn’t mean that every single one of our retirement accounts has the same balance. When assessing your asset allocation, assess your portfolio as a whole across all your investment accounts, which can include:

- 401(k), 403(b), or other employer-sponsored plan

- Roth and/or traditional IRA

- HSA (health savings account), if invested

- Taxable brokerage account

My 401(k), for example, used to be a four-fund portfolio including four of these seven funds. Now, it goes solely into a S&P index fund as the company managing the account decided to charge us an annual fee per different fund within the account and I didn’t want to eat those fees.

How to rebalance your portfolio

As different funds grow at different rates, your asset allocation goals may stay the same, but your portfolio percent with current holdings will change. For example, a small-cap index fund is an aggressive domestic stock asset. It will likely grow much faster than either the total bond market index fund or the total international bond market index fund. You have two options to right the tilting investing ship:

- Rebalancing all of your different retirement accounts back to your target allocations

- Change the breakdowns of your future investments to shift it back over time

We have a taxable brokerage account where we keep our retirement funds that will help us mind the gap between when we want to retire and when the government deems us able to withdraw from our retirement accounts without penalties. Rebalancing those funds can cause a tax bill that I don’t want to pay, so we usually try to course correct, at least for that account, versus clearing the Etch A Sketch and rebalancing everything.

How to invest in real estate

Above, we cover investing in the stock market. Now, let’s take a quick look at real estate, as “passive” real estate is a hot topic in investing.

First, let me caution you: there’s no such thing as truly passive income. You’re either: putting the time in ahead and feeling the delayed fruits of all that toiling; working your ass off for that money; or paying someone else (who you still have to hire and oversee) to do the work for you, which cuts into your profit.

If you aren’t careful, you’ll find yourself in the position of an underpants gnome with your real estate investing scheme.

When it comes to investing in real estate, we recommend the following order of operations.

Purchase your primary residence, AKA home sweet home

A home is the worst investment everyone should probably make. While your house should appreciate over time, it’ll be the most illiquid asset you own. In order to get money out of it, you have to sell and move. And let me tell you, after moving across country, that’s a PITA.

Don’t treat your house as an investment. Treat is as a place where you sleep and unwind after a long day of work. The less you spend on your primary residence, the more wealth potential you can build for your future FIRE.

Real estate investment trusts, AKA REITs

We have zero interest in becoming landlords, so REITs (not sure how to pronounce it? Imagine a pig squealing) are our favorite way to invest in real estate. This is as close as you can get to passive real estate income, though you won’t hear as much chatter about them on the social feeds because they aren’t sexy and no one makes a buttload of money selling you a course on how to get rich by investing in them.

REITs are like mutual funds, but instead of including bonds or stocks, they include real estate properties and/or mortgages that produce income or interest, which gets paid back to you as a shareholder. No clogged toilets to plunge or squatters you have to figure out how to evict personally.

You’ll thank me later.

Real estate syndication investing

This is an option I learned about in the past year or so. Imagine active real estate investing and a REIT had a baby. That would be a real estate syndication. You pool money with other investors to buy a property or multiple properties, allowing you to own real estate with a lower upfront investment and without personally carrying a mortgage.

This is like setting up a partnership with a bunch of dudes you vaguely met through Craigslist. They may or may not have foot fetishes. Tread lightly in knee-high boots and make sure you do heavy vetting before forking over tens of thousands of dollars to one of these groups.

At this level of real estate investing, we recommend treating this as “fun money.” If you want to dabble, that’s fine, just pull it out of the “wants” or “fun money” side of your budget and not your retirement investing. Or wait until you’re already comfortable with your retirement balance before you try to let it grow, let it grow.

Purchasing real estate properties

Our final level of real estate investing is for the poor souls (we’re admittedly biased, you do you) who want to be a landlord or run a short-term rental like an Airbnb. This is not for the faint of heart. No matter what anyone tells you, this is not passive income. It can be both a time and money suck, especially if you don’t know what you’re doing. Most success in real estate investing comes on the purchase, not from the appreciation of the home’s value, which typically underperforms versus the stock market. Add in fees to a property manager, maintenance costs, vacancies, and/or mortgage, as your profit margins as a real estate mogul can be a lot less than you expect when you set your rent.

Please, please, please don’t mess with real estate investing until you have a primary residence you own, you’re out of debt, and you have a solid foundation built for your stock market investing.

Final words of wisdom for your start in investing

A final piece of parting wisdom before we go: never invest in anything you don’t understand. We’ve covered this in our Should I Use a Financial Advisor? article, but it’s worth repeating here. Before investing your money in the stock market or real estate, invest a little of your time into understanding how the system and assets within it work.

We hope the information above helps guide you, but it’s far from an exhaustive overview. Who knows, maybe one day we’ll have an entire course to walk you all the way through the process. In the meantime, check out our recommended books on investing on our resources page for a more in-depth walk down Wall Street.

If you have a specific question we didn’t address above, drop a comment below, or ask the hive mind in our budgeting and personal finance Facebook group. You can also explore the additional education on our retirement station or use the search feature for more coverage.

We wish you the best of luck as you climb the FIRE ladder on your way to financial freedom!