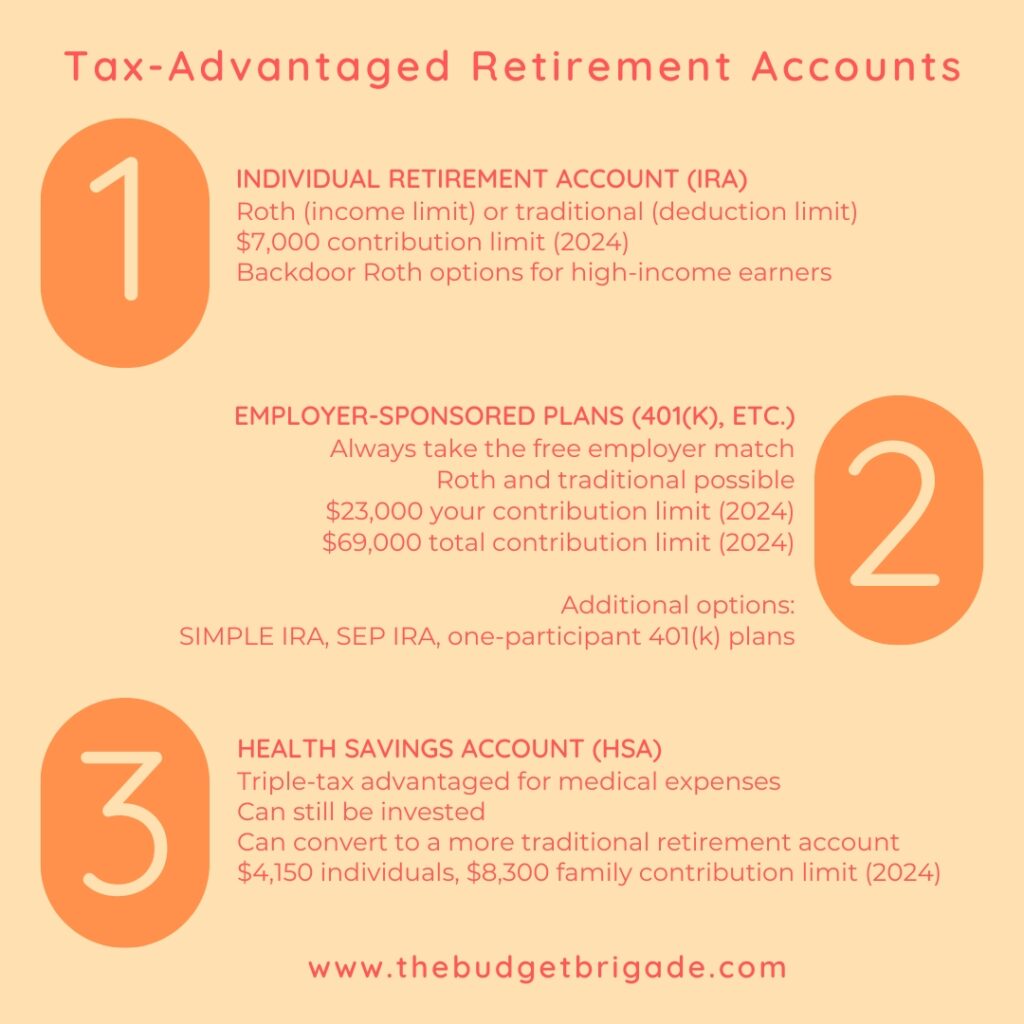

Along with our Basics of Investing: The Complete 101 Guide for Financial Freedom, we wanted to cover tax-advantaged retirement accounts, as they are some of the best options for investing for retirement. Coupled with the power of compound interest that grows your money in the stock market, tax-advantaged retirement accounts, as the name suggests, offer tax advantages, allowing you to keep more of that growth without have to pony up a bunch of moola to Uncle Sam. Below, we cover what you should know about common tax-advantaged retirement accounts including IRAs, employer-sponsored plans like 401(k)s, HSAs, and even options for self-employed individuals.

This is a more comprehensive guide than other regular articles and like Strong Bad sings, it’s got scroll buttons like the day is long. Don’t feel obligated to power read through it in one sitting. We hope you can use this as a reference whenever you need to come back. Use the table of contents to jump to your area of interest.

- The basics of tax-advantaged retirement accounts

- The benefits of tax-advantaged retirement accounts

- Types of tax-advantaged retirement accounts

- Individual retirement account (IRA)

- Employer-sponsored retirement plans

- Additional tax-advantaged retirement account options for self-employed individuals

- Health savings account (HSA)

- The Final Word

The basics of tax-advantaged retirement accounts

While anyone can invest in the stock market through a brokerage account, tax-advantaged retirement accounts are special types of accounts that come with certain tax incentives and breaks determined and regulated by our best buddies at the IRS. You can either set these accounts up through your employer or through an account you control, depending on the type of account.

There are three main ways that you can gain tax advantages through these types of accounts:

- Contributions to the account can be pre-tax, meaning they don’t count toward your taxable income for the year and thus lower your tax bill

- Contributions can grow tax-deferred, meaning all the gains you make in the stock market are exempt from taxes on your annual tax return

- Withdrawals can be tax-free, meaning you don’t pay taxes on the money when you pull it out of the account in retirement

Different retirement accounts mix and match these tax advantages. We’ll dig a little deeper into the specifics of each, but first, let’s see the true power of these types of retirement accounts for your retirement and ultimately your financial freedom.

The benefits of tax-advantaged retirement accounts

Depending on the type(s) of retirement accounts you use, you can either reduce your income tax now or in retirement. In some cases, you can even do both! The more you earn, either now or in retirement, the more of a benefit this tax savings is.

The US tax system works on a marginal tax brackets system with different “buckets” of tax rates. For each dollar you earn within the income bracket for that bucket, you owe that tax rate. So the more you earn, the more you’ll pay, but you won’t owe the highest tax rate on every single dollar you earn.

The higher you climb up the tax bracket ladder, the more you look for ways to pay less. Or, honestly, no matter how much you make, we’re always griping about taxes and asking how we can get around paying so much.

If this is you, tax-advantaged retirement accounts are your best friends for investing toward retirement. They help reduce what the IRS counts as income in those marginal tax brackets, at least for federal taxes. The lower your taxable income, the less taxes you pay.

Types of tax-advantaged retirement accounts

There are a few common types of tax-advantaged accounts. You can often have more than one, which can allow you to optimize your investing strategy and your tax planning for your retirement years by using the tax game with Uncle Sam to your advantage. For example, you may have heard of a three bucket strategy, with allows you to pull:

- taxable income from a standard brokerage account

- tax-fee income from Roth accounts (see below)

- tax-deferred income from traditional accounts (see below)

By balancing these different tax strategies, you can minimize your taxes in your golden years. If you’re like me, this leaves more for camping and cruises.

Individual retirement account (IRA)

An IRA is a type of retirement account you set up yourself. It’s in your name and doesn’t count as a joint asset. So, for example, if you are married, you and your spouse can both have separate IRAs and can each contribute to your own.

Anyone with an earned income can open and contribute to an IRA. Earned income includes all taxable income from employment, such as wages, salaries, and tips. You can contribute up to the max of whichever is greater: your taxable earned income or the annual contribution limit. Given the limits, it’s usually the latter.

There is also something called a spousal IRA, where a non-working spouse can still open and contribute to an IRA without an earned income, so long as they have a household income.

As of 2024, the annual contribution limit for individual retirement accounts is $7,000 for individuals under 50 or $8,000 for individuals over 50. This higher amount includes what the IRS calls a catch-up contribution, which is meant to allow individuals closer to retirement age achieve financial independence faster.

The biggest restraint on IRAs is that you must wait until “retirement age” as determined by the IRS to withdraw funds from these accounts if you want the full tax benefits. If you withdraw funds early, not only will you have to pay taxes, you’ll also have to pay a 10% early withdraw penalty. Yikes. (See an exception for Roth IRAs below.)

Where can I open an IRA?

You can set up on IRA at almost any bank, brokerage firm, or other financial institution. Not all IRAs, however, are created equal. The company offering the IRA controls and manages the fees, and can restrict what investing options are available within your account. Different options have different expenses, so it’s important to do a little research.

It’s generally better to avoid opening an IRA with your bank, as they typically have higher fees and expenses and fewer options to invest into within your account. If you decide to hire a financial advisor, you can usually open an IRA with them and have them manage it for you. If you’d rather be a DIY investor, you can open an IRA yourself with a brokerage firm like Vanguard or Fidelity.

Roth IRA vs Traditional IRA

There are two main types of IRAs – a Roth IRA and traditional IRA. Both follow the guidelines above. The main difference is how the IRS treats them for taxes.

Basics of a Roth IRA

With a Roth IRA, you contribute your $7,000 in post-tax dollars. That means those $7,000 count as taxable income this year. While this might seem like a raw deal, the power of Roth IRAs is in their growth potential. With a Roth IRA, your contributions grow tax-free, and you don’t pay any taxes when you withdraw funds in retirement.

Example: let’s say you’re 35 and your taxable household income for the year is $75,000. If you’re married, your top marginal tax bracket for 2024 is 12%. You would thus have to pay $960 in federal income tax on that $7,000, as well as 7.65% for Social Security and Medicare taxes, plus whatever state and local income taxes you might have. If you live in an income tax free state like Florida, Tennessee, or Texas, you could have saved a total of $1,375.50 in taxes on that $7,000. (But since you’re making the contribution post-tax, it’s more like the true cost of this investment is $8,711.89. If the numbers give you a migraine, the difference isn’t super important.)

Assuming an average stock market gain of 8% until the retirement age of 59 1/2 (the minimum retirement age as of 2024 to generally withdraw funds without penalty), that $7,000 you invested would grow to almost $50,000. In the 24 1/2 years that your single $7,000 contribution in this example grew, you didn’t pay a single dollar of taxes on it. When you withdraw that $50,000, you also don’t pay any taxes on them.

At the same 12% marginal tax rate, this would be a total potential tax bill of $6,000 at today’s tax rates.

By investing in the Roth IRA just for one year, that effect $1,711.89 more you paid upfront ROIed into a potential $6,000 tax savings (though note we haven’t talked inflation or purchasing power).

Now just imagine how that number would grow if you did it every year.

The IRS knows the powerful potential of the Roth IRA, so they limit who can contribute to one. To qualify to contribute to a Roth IRA, your modified adjusted gross income (MAGI)—this is your taxable income after some deductions)—must be under a certain threshold.

Income Limits for Roth IRA in 2024

| Filing single | Married filing jointly | Married filing separately | Contribution amount | 50+ yo contribution amount |

| < $146,000 | < $230,000 | < $10,000 | $7,000 | $8,000 |

| $146,000-$161,000 | $230,000-$240,000 | Prorated amount | Prorated amount | |

| > $161,000 | > $240,000 | $10,000+ | $0 | $0 |

In our income table, we include the “phase out” limits where the IRS prorates the amount you can contribute between $0 – $7,000. As noted in the table header, these numbers are for 2024. If you need more recent data, check out our article on income limits and max contribution limits for IRAs, 401(k)s, HSAs, marginal tax rates, and more.

(Exception to the retirement rule notes above: Roth IRAs let you withdraw up to the amount you contributed early without penalty, but we don’t recommend this since the IRS highly restricts how much you can contribute and you’ll lose out on all that future tax-free growth if you do.)

Basics of a traditional IRA

With a traditional IRA, you contribute pre-tax dollars. This usually means you get a tax break for the current year’s tax bill, although the IRS restricts the ability to deduct contributions to IRA depending on your income. (Are you sensing a theme here with our buddies at the IRS? They have a LOT of deal breakers when it comes to who they want to dance with.)

| Filing single | Married filing jointly (1) | Married filing jointly (2) | Married filing separately | Amount eligible for deduction | 50+ yo amt eligible |

| < $77,000 | < $123,000 | < $230,000 | < $10,000 | $7,000 | $8,000 |

| $77,000-$87,000 | $123,000-$143,000 | $230,000-$240,000 | Prorated amount | Prorated amount | |

| > $87,000 | > $143,000 | > $240,000 | $10,000+ | $0 | $0 |

The difference between married filing jointly (1) vs (2)? (1) applies if you are covered by a workplace retirement plan. (2) applies if you aren’t covered by a workplace retirement plan, but your spouse is.

Your contributions then grow tax deferred, meaning you don’t have to pay taxes on the growth until you pull them from your retirement account. The government does eventually want their tax money, though, so traditional IRAs have required minimum distributions (RMDs) you have to take to draw down the funds in your account once you reach a certain age (73 as of the time of this writing in 2024).

Which is better: a Roth IRA or traditional IRA?

This can depend on a few factors, including:

Your income. If you make too much money, you can’t contribute to a Roth IRA. You do have the option of a Backdoor Roth IRA, but these require more record keeping and steps and can cause a tax bill if you have any traditional IRA funds.

Timeline until retirement. The younger you are, or the longer you plan to let your money grow, the better a Roth IRA can be, as all that compound growth becomes tax free. The sooner you plan to take the funds out, the less time it has to grow.

Other retirement accounts available. It can help having money in multiple types of tax-advantaged retirement accounts in order to game the tax system to pay the least amount of taxes possible. If you have a Roth 401(k) option but your income is too high for a Roth IRA, you may want to pair a Roth 401(k) with a traditional IRA.

If you’ll need the money in retirement. If you’re a supersaver and will have more money in retirement than you know what to do with, first of all, good for you, that’s awesome! In this case, not having RMDs for a Roth IRA can be a great advantage and can allow you to set up a legacy transfer of an inherited IRA nicely without requiring your beneficiaries to pay taxes.

Employer-sponsored retirement plans

Along with IRAs, you can also have an employer-sponsored retirement plan, depending on where you work. These types of accounts include:

- 401(k)s

- 403(b)s

- 457s

- TSP

All these random strings of numbers correlate to the IRS regulations that dictate how they operate. The numbers don’t really matter as much as the figures, kinda like the points keeping in Whose Line Is It Anyway? The numbers are made up; what matters is that you’re having fun and saving money on taxes.

Your employer-sponsored retirement plan can come in both Roth and traditional options, which follow the same taxation rules as IRAs above.

For example, with a traditional 401(k), you make pre-tax contributions that grow tax-deferred. This gives you a discount on the taxes you pay this year, but you’ll pay taxes when you withdraw the funds in retirement. These accounts have RMDs.

With a Roth 401(k), you contribute post-tax dollars, which then grow tax free, and you can withdraw funds without paying taxes in retirement. Unlike a Roth IRA, however, there are no income restrictions on Roth 401(k)s or other employer-sponsored retirement plans.

If your employer plan offers both Roth and traditional options, you can decide which one you contribute to. We’ve even switched from traditional to Roth in the middle of the year before. You do you!

The retirement age for employer-sponsored retirement plans is generally 59 1/2, but this can vary for some accounts like certain 457s, so make sure you double check before withdrawing anything.

Contribution limits for employer-sponsored plans

Like with IRAs, there is a limit to how much you can contribute to employer-sponsored retirement plans. In fact, there’s two. (Thankfully, the limit isn’t two dollars.)

There’s a limit to how much you, as an employee, can elect to contribute via deferrals from your paycheck (AKA elected deferrals). For 2024, that’s $23,000 combined between all Roth and traditional combinations you have between 401(k)s, 403(b)s, and TSPs in your name. The notable exception is 457 plans. Some 457 plans have different contribution limits. You may also have the ability to contribute to both a 457 plan and a 403(b) or 401(k), as they are treated as different types of retirement plans even though they are both employer sponsored.

For individuals 50 and over, there’s an additional $7,500 catch-up contribution allowed as well. Except for some 457 plans, again, because some of them just refuse to walk the line of standard rules.

Your contribution limit for employer-sponsored retirement plans is completely separate from IRAs, meaning you can contribute $7,000 to your IRA and $23,000 to your 401(k) if you wanted to (and could afford to).

There is also a total annual contribution limit that adds any contributions your employer makes to your elected deferrals. For 2024, that total is a whopping $69,000. And can I say, I’ve love to know which employer is out here giving you an extra $46,000 when you contribute $23,000? That’s a 200% match. I’d love that deal.

Employer contributions to employer-sponsored plans

Speaking of match, this second limit is because a lot of employers who sponsor retirement plans also offer some kind of compensation perk. There are several ways employers do this, such as:

- They contribute a % of your income (up to a limit), even if you don’t contribute anything

- They match every contribution you make, dollar for dollar, up to a certain amount or percentage

- They match a percentage of what you contribute, up to a certain amount

- A tiered matching program; for example, they match 100% of your first 3% and 50% of an additional 2%

Important note: employer contributions will always be pre-tax dollars into a traditional plan.

SIMPLE IRA

A SIMPLE IRA stands for Savings Incentive Match Plan for Employees. (You’d think it would be SIMPFE then, but no one asked me.)

This is a type of employer-sponsored retirement plan available for small businesses who have less than 100 employees. With a SIMPLE IRA, the employer must contribute to the employees’ plan accounts on their behalf. This is typically done through a match.

Higher-level planning: Since this is a type of IRA, it can count against you with the pro-rata rule for Backdoor Roth IRAs.

Additional tax-advantaged retirement account options for self-employed individuals

If you’re like me, you’re a self-employed independent contractor. This means you can have an IRA, but you don’t have an employer to provide you with a 401(k).

Except… you are that employer, and there ARE some options for us, too.

One-participant 401(k) plans

A rose by any other name… will likely be some iteration of a one-participant 401(k). This type of tax-advantaged retirement account has more nicknames than Shawn and Gus in Psych. You might also see it referred to as:

- Individual 401(k)

- i401(k)

- Solo 401(k)

- Self-employed 401(k)

Whatever you call it, this is a 401(k) plan you can open if you’re self employed. You’re both the employer and the employee, so you can take advantage of both traditional and Roth advantages, so long as you pick a plan that offers a Roth option.

There are slightly different contribution limits for one-participant 401(k) plans, depending on your amount of self-employed income. These limits are even more complicated than the charts above, but we’d be happy to tackle them in the future if anyone is interested. Just let us know in the comments below.

If you have a main job but also have a side hustle or small business you run on the side, you can still open a one-participant 401(k) plan, but note that the contribution limit of $23,000 above applies across all your 401(k) plans, including a one-participant one (for the employee side at least).

SEP IRA

A SEP (Simplified Employee Pension) IRA is another common retirement instrument you see for self-employed individuals. Unlike a 401(k), though, with a SEP IRA, the employer is the only one who makes contributions. There is no employee side.

SEP IRAs have high contribution limits, like a one-participant 401(k), so they can be a great way to stash away a lot of money if you’re trying to catch up with your retirement goals.

Higher-level planning: Since this is a type of IRA, it can count against you with the pro-rata rule for Backdoor Roth IRAs.

Health savings account (HSA)

While a HSA isn’t technically a tax-advantaged account for retirement, many offer an investing option. This is high-level planning and not something to worry about early in your financial independence journey, but taking advantage of a health savings account can help elevate your retirement savings. This is because HSAs offer some of the best tax advantages. With an HSA:

- You make pre-tax contributions (which can give you a tax deduction this year)

- Your balance grows tax free (and can often be invested in the stock market)

- You withdraw funds tax free*

So basically, you NEVER pay taxes on HSA funds you use. The catch is that itty bitty asterisks on withdrawing funds. * To qualify for tax-free withdraws without penalties, you must spend that money on qualified medical-related expenses. Once you reach the age of 65 (current rule as of 2024), you will be able to withdraw funds for non-medical uses without penalty, but you’ll still owe taxes, similar to a traditional IRA.

There are hacks on saving and tracking receipts and reimbursing yourself in retirement for past medical expenses that people (myself included) do, but I don’t want to dive into the weeds here as I’ve already rambled on long enough. Just a final note that you only qualify for a HSA if you have a qualified high-deductible health plan (HDHP), which might not be the best financial choice for everyone.

Learn more about choosing a health insurance plan during open enrollment.

The Final Word

Tax-advantaged retirement accounts are powerhouses when it comes to saving and investing for retirement and financial independence. Consider an IRA and a 401(k) or other similar plan, depending on what you have available to you. If you don’t have an employer-sponsored plan but are self-employed, look into opening one for yourself. Deciding how much to contribute where can be complicated, but try to always take advantage of at least your employer match. Fully contributing your IRA every year is another great savings goal on your way to financial freedom.

Not sure when to focus on retirement investing during your financial journey? Check out our step-by-step guide to financial freedom.

If you have more questions about retirement and investing, check out our retirement station for more educational resources. You can also drop us a line in our budgeting and personal finances Facebook group.

If you’re not sure how much you should budget for retirement investing, make sure to also check out our Beginner’s Guide to Investing 101 and our budgeting station.