While working on our article about what income it takes to live comfortably in today’s economy, we came to the eureka moment that we’d achieved Coast FIRE (or Coast FI) status. After years of diligent saving and investing, we knew we were doing well, but we also knew we still had several years to go until we reached financial independence. Reaching Coast FIRE (and realizing it) was an exciting new chapter in our FIRE journey. Since it wasn’t a term I was intimately familiar with, I decided we ought to dig into a little for The Budget Brigade.

Below, we look at what Coast FIRE is, what it means to us, and what a Coast FI life can look like.

- A type of financial independence for retiring early

- You generate an income to cover your current living expenses, but no longer have to save for retirement; instead, you let your investments continue to grow in the background

- Can be easier to obtain than regular FIRE status

- Easier/more ideal for individuals in their 20s or 30s

What Is Coast FIRE?

Coast FIRE is a type of Financial Independence, Retire Early (FIRE).

Like other versions of FIRE, you front load your retirement early to give yourself plenty of options for work and life in your later decades. We’ve met several people in their 30s and 40s who have reached financial freedom and have “retired,” though many of them still work, at least part time.

With Coast FI, you have enough in your retirement accounts that you no longer have to add any additional contributions for retirement to eventually reach financial independence.

In Coast FIRE status, you can’t give your notice and show your flair to your boss yet. You still need to generate enough income to cover your cost of living. But at this stage of retirement planning, you can afford to take your foot off the gas of future investing.

This doesn’t mean we have. We continue to invest 25% of our income into our tax-advantaged retirement accounts. Any additional money we have in our monthly budget we throw into our taxable brokerage account to continue to aid our goals for financial independence.

Coast FIRE vs. Standard FIRE

With standard FIRE, the goal is to save, save, save until you can retire and then immediately take your foot off the gas. You hit your target for financial independence, you know (to the best you can predict) that you’re set for retirement, and so off to Key West you go, never looking back. Think of this as the commercial jetplane approach. You want to get from where you are to retirement as fast as possible, so you splurge (or in this case, save) on the fastest transportation method to get there.

With Coast FIRE, it’s more like you’re taking a train. The tickets are cheaper, but it’s going to take you longer to get to where you want to go. Yet, you’re still having fun and on the journey, and it isn’t costing you anything else while you’re traveling. You just have to continue to pay your bills back home, because the railroad won’t do that for you.

How Coast FIRE Works

You may wonder how you can be at a point where you can’t retire yet, but no longer have to invest to retire. How is that possible?

Let me introduce our best friend in investing: Sir Compound Growth.

While you may not contribute anymore to your retirement, if it’s well invested, it will continue to grow, and grow, and grow if left alone. In fact, if you start investing early, a large majority of your retirement nest egg will be that compound growth and not the money you saved and invested.

Wild, I know.

The power of compound growth in investing is the key to building wealth.

Let’s look at an example to see how this works.

Let’s say you are forty-five years old and dreaming about wasting away in Margaritaville, searching for your lost salt shaker. You have been working hard the last decade to save for retirement and have amassed a retirement savings balance of $650,000. You are wondering if you’ve reached Coast FIRE and can ease back on saving for retirement, allowing you to shift your focus to traveling more before your kids graduate high school and head off to college, where you’ll be lucky if they come home for all the holiday breaks instead of shipping off to Key West without you.

You pull out your handy dandy notebook (also called a retirement calculator) to check.

Your goal is to retire at the age of 65. You don’t have a pension, but you’ll get some Social Security. You’ll have your mortgage paid off by then, and the kids will be out of college and no longer on your expense sheet every month.

After assessing your monthly budget and forecasting to the best of your ability, you determine you could live off of 40% of your household income (we look into this calculation more below), which is currently $150,000 combined for you and your spouse before taxes or any deductions.

You hope to live to at least 100, so you want to know if you stop all retirement contributions and have a 0% annual savings rate, will you be able to throw that big retirement party on your 65th birthday?

I plugged this scenario into the retirement financial planner we use, along with a few other assumptions:

- 2% annual inflation and income increases

- 6% investment return on average

- 3% investment return uncertainty

Without adding any additional contributions, your $650,000 now at the age of 45 will grow to $2,084,638. We don’t know how much of that $650,000 current balance is already growth versus what you saved, but even just from this starting point, only around 32% of your retirement you will have to save. The rest is compound growth over the next two decades.

I cannot stress enough the superpowers of compound growth.

With our inflation assumptions, a 40% income replacement from your current $150,000 salary at 45 becomes, at the age of 65, $90,000 a year ($60,000 in today’s dollars). At the age of 99 for this scenario, you will have a balance remaining of over $3 million. Not too shabby.

So if this income is doable for you, then congrats! You’ve reached Coast FIRE. Break out the tequila, salt that rim, and celebrate.

If you’re accustomed to a more lavish lifestyle or hope to expand your lifestyle with a move down to Key West where shacks cost a cool million, then you need to keep investing a while longer.

What Coast FIRE Looks Like

Now that we’ve reached Coast FIRE status, you may wonder how our life has changed. What does this elusive Coast FI status look like?

For our situation, it hasn’t changed anything in our day-to-day lives when it comes to money.

Why? Because with our current numbers and desired income in retirement, we would have to continue to work until we are 48.

Big deal, you might say. And really, it isn’t. But one of the best benefits to financial freedom is having a lot of options. We want to continue to afford ourselves more options in the future. Very few people regret having extra money in retirement, but not having enough in retirement is a huge burden.

A few options we are still saving for:

- A months’ long world voyage cruise ($100,000+ price tag we would have to pay)

- A few months roaming around Europe (we haven’t run the numbers yet, but it won’t be free)

- A month exploring Alaska and its national parks

- An epic road trip across America, as well as the camper and truck for the trip (another $100,000+ line item in the savings budget)

- Adopting a child

- Starting a charitable foundation

None of these options are frugal, so they aren’t things we can easily pay for out of our monthly budget. They require long-term savings, where what we invest compounds so we can afford them in the future.

Hence, we are still squirreling money away.

Your Coast FIRE could look totally different. You may be a lot more like our Jimmy Buffett fans in their 40s above.

Coast FI looks different for everyone, just as each person’s goals and vision for retirement are unique.

I will say, however, that mentally and emotionally, reaching Coast FIRE has been a huge exhale (of a breath I didn’t realize I was holding for all the bookworms out there). We have so much more freedom, and it has changed our mentalities when it comes to our attitudes and goals for work, as well as how we spend our time overall. That has been a massive benefit outside of the dollars and cents.

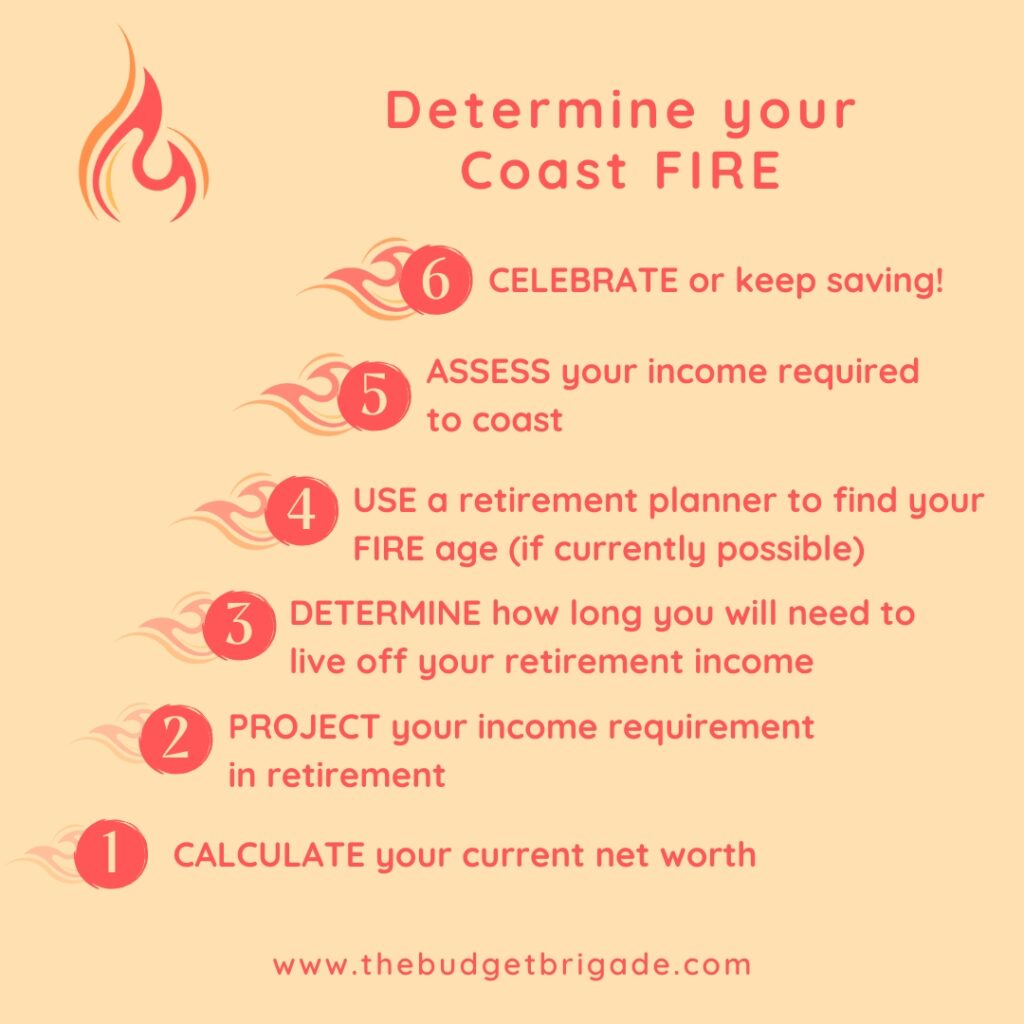

How to Determine Your Coast FIRE Number

By concept, Coast FIRE is easy to understand:

Income coming in > expenses going out (including taxes) while your retirement grows in the background.

Determining that income can be more difficult, thanks to marginal tax rates, tax credits and deductions, etc. And you’ll need a few other numbers to determine if you’ve reached Coast FIRE status first.

One of the biggest inputs into the Coast FI equation is the income you’ll need in retirement. Like we recommend when developing your vision for retirement on our FIRE ladder, start with the end in mind.

Depending on where you are along your financial journey, several expenses should decline during retirement, including:

- Mortgage payment, if you pay your house off before retiring (you should)

- Life insurance premiums (you’ll likely be self-insured)

- Disability insurance (you won’t be working)

- Educational costs and/or savings for kids (daycare, private school, college, etc.)

- Lower household expenses with the kids out of the house

- Any work-related expenses, including commute gas, tolls, parking, etc.

- Saving for retirement

- Your taxes will likely lower

- Only needing one vehicle

There are, however, others that will likely increase, such as:

- Travel expenses (finally take that trip to Hawaii you’ve been dreaming about for decades!)

- Money spent on hobbies (we hear fly fishing can be really expensive)

- Healthcare costs (factor in premiums and copays until Medicare)

- Property taxes and insurances like auto and homeowners (these things never seem to go down)

While we don’t have a crystal ball to determine what the economy will look like decades in the future, we can estimate and determine how much we’ll need in terms of today’s dollars, before inflation does its thing.

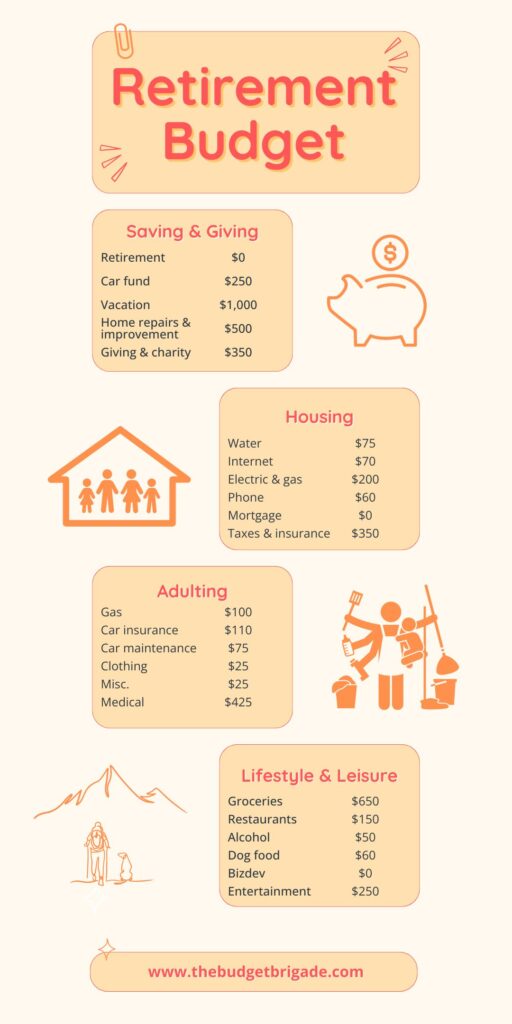

To walk you through the process, I’ll show you how we determined our Coast FI number. First, we put together a projection for our retirement budget.

Our total monthly projected expenses in retirement came out around $4,775. This includes some of the assumptions mentioned above:

- More into a vacation sinking fund every month

- Having a paid off house

- Having one car

- No dependent children

We don’t have vet bills in there, and there’s always something that comes up. So if you wanted to be conservative, you could plan for $5,000 a month for this scenario, but we often don’t use all the money we budget for, so I’ll stick with the $4,775 for this example.

Annually, you would need $4,775/month x 12 months/year or $57,300 to live off of.

This, of course, is after taxes.

Not only will we likely be in a lower tax bracket in retirement, but most of our income will come from tax-advantaged retirement savings accounts like a Roth IRA and Roth 401(k), where we won’t have to pay any taxes on what we withdraw, or will be captain gains from our taxable brokerage account. By focusing on selling assets with long-term capital gains, we can lower our tax burden for our marginal tax bracket rate to 0% capital gains for a household income under around $100,000. (This is how the rich stay rich, y’all.)

Our current highest marginal tax rate for income tax is 22%. Assuming the taxes remain the same (not a likely assumption, as the brackets usually increase with inflation every year, but it’s what we have to work with, so humor me), we would drop to a 12% highest tax rate.

Using this and adding state income tax, we can do some math gymnastics to calculate an estimated income a year we would need for our retirement plan to determine our Coast FIRE number.

Retirement income = $57,000 + taxes

In our case, taxes are:

- 4.4% state income tax

- 12% federal income tax

While we pay 7.65% combined Social Security and Medicare taxes on our earned income now, retirement income sources generally don’t count as earnings for these taxes. Unfortunately in our state, retirement income is currently taxed, and we plan to stay here for retirement.

(Sidebar: if you live in a high cost-of-living state or locality now, moving—and downsizing—in retirement can be a great way to lower your expenses and reach Coast FIRE status earlier.)

The standard deduction for a married filing jointly couple such as ourselves is $29,200 as of the time of this writing in 2024. This may drop significantly with previous legislation set to expire, but let’s work with what we’ve got instead of driving ourselves crazy with “what if” scenarios.

Plugging and chugging numbers the way my middle school math teacher taught me, we arrive at a retirement income of $63,794.

Now that we have this number, we know what income replacement of our current salary we’ll need in retirement to determine our Coast FIRE with the retirement calculator we use. (Our programmer is working on a downloadable one for our brigadiers, so check out our free budgeting and personal finance resources page for a download link when it’s available.)

Once you know your retirement income, you have to decide when you want to retire. When I plug the ripe old age of 40 into our retirement planner, I get an ugly red error saying “ask again later when you’ve saved up more.” We’d run out of money before our 80s, and that’s without any buffer for all the big vacation dreams I included above. By playing with the desired retirement age, I can determine when, currently, I can retire under Coast FIRE status.

If you’re playing catch up with retirement, you very well may discover that no matter what retirement age you plug into your retirement calculator, you run out of money. This means you aren’t Coast FIRE yet.

Don’t give up.

The more you can save and invest now, the more that can grow over time while you coast into your dream retirement.

With our current Coast FIRE status, we would have to coast for over a decade until we could retire. I don’t want to have to be working for The Man at 50, which is yet another reason our Coast FI status hasn’t changed our lifestyle yet.

Once you know your retirement number, and once you know you’re set to coast, you can then determine what income you need now to let that compound growth do its thing in the background. This Coast FIRE income is based off your current living situation, with all your bills and expenses. If you haven’t paid off your mortgage yet, then you have to add that back in. Helping the youngest through college? Leave it in your Coast FIRE income calculation for now.

This number is easier to calculate, as you’ll likely just need to take your monthly budget and remove however much you’re saving for retirement every month, they use the same process we did above to include taxes to figure out your gross income. (But don’t forget to add Social Security and Medicare back in for now.)

Don’t have a monthly budget yet? Explore our free budgeting resources and education.

Because we are currently renting, the income we need to maintain for Coast FIRE is around $92,000 a year. That’s a big difference than the Coast FI number we came up with above. This is why having a paid off mortgage heading into retirement is so important.

Pros and Cons of Coast FIRE

Whether you actively aim for Coast FIRE as part of your FIRE ladder goals or stumble upon the concept like I did, there are pros and cons to this lifestyle and/or decision that are worth mentioning.

Pros of Coast FI:

- Setting yourself up to save. Regardless of which FIRE movement method you choose, by intentionally budgeting and planning to save early, you can capitalize on the power of compound growth, letting the stock market do most of the work for you while you sip margaritas and work on your tan.

- Easier to achieve than standard FIRE. As noted above with our example, we’ve hit Coast FIRE years ahead of true FIRE status. If you’re late to the retirement game, FIRE might seem impossible. Hell, just retiring at a certain point might be nice. Coast FI is a much better goal in these situations.

- You have buffer for long-term fluctuations. One of the hardest parts about retiring early is managing all the ups and downs in the stock market and general economy along the way. If you plan to retire for 60 years, there’s a lot of room for down economies where you’ll need to pull money out while the market’s down, versus being able to let it ride the volatility back up without taking the loss.

- Benefits. During Coast FIRE, you will likely still have benefits provided through your employer, such as paid time off and health insurance. While health insurance is subsidized on the Marketplace for lower incomes, it can still be more than what you’re paying through work, especially if you work for a large company. (You may not be paying any portion of your monthly premiums currently.)

- Flexibility in what you do—and how much. While we’re still hard at work while our money also works for us, we know we don’t have to now that we’ve reached Coast FIRE status. We don’t need any of my income and my husband could take a huge pay cut and we’d still be fine. This gives us a lot of options. We don’t have to put up with shitty bosses or hostile work environments. When my last job and commute became too stressful, I quit. Now, I work less hours and got to start The Budget Brigade. Coast FIRE afforded me that opportunity, even if I didn’t have a name for it at the time.

Cons of Coast FI:

- Requires patience, young grasshopper. Humans by nature crave instant satisfaction. When working toward any FIRE goal, you have to adjust your mindset for delayed gratification. It’s super rewarding, but it can be incredibly difficult, especially at first.

- Requires you to (potentially) cut your lifestyle. If you and your spouse aren’t both natural savers like myself and my husband, you will likely need to cut your lifestyle down in order to save aggressively enough early on to achieve Coast FI status. While I’m all about finding contentment versus spending money trying to buy happiness, it again can be very difficult at first.

- Requires low monthly bills. Not only do you have to assess lifestyle, but you have to assess your debt obligations as well. If you have $700 a month in car payments, a $2,500 mortgage payment, a HELOC, and credit card debt, your Coast FIRE income is likely close to what you’re already making. When you owe money to others, you have a lot less margin in your budget, making Coast FIRE difficult. Visit our debt-free station if this is currently your situation, but you’re looking for a change.

- You might get bored and/or lonely. This is the dirty little secret about FIRE that no one tells you. Since it isn’t mainstream, most of your friends and peers will still be working when you hit Coast FI status. When you cutback your hours, it may be difficult finding others to spend all that additional free time with. I learned this the hard way when I quit my job to do a DIY MFA full time back in 2019. I lasted a few months before I went stir crazy and realized I’d made a mistake. You have to be intentional with your time, regardless of which FIRE version you pursue.

Who is Coast FIRE for?

Coast FIRE is a great option for individuals or families with more modest lifestyles and little to no debt who can be disciplined and intentional with saving and living frugally. It’s also for people who want to work, but want more say in how much they work and what type of work they do.

Given that Coast FIRE leans heavily on the power of compound growth accumulating in the background, Coast FIRE is a better fit for younger individuals in their 20s and 30s who have decades of their investments working for them in their future.

Final thoughts

I’m glad I stumbled across this term. Money has always been a stressor in my life, even when I had it, because it was sometimes a struggle in my household growing up. I knew I didn’t want that instability in my life. I’m not entirely sure this type of money stress is any healthier than the money stress my parents faced, so I’m actively working on improving my money insecurities.

Coast FIRE helped me with that, as it showed me how far we’ve come in just the past decade. With that insight, I can see the power of our intentionality and what it will do in the decades to come. I hope an evaluation of your situation and your vision for your financial freedom can do the same.

Visit our retirement station for all things investing and retirement.

If you have a specific question that we haven’t addressed yet, drop us a line in our budgeting and personal finances community.