Ahhhh, home sweet home. It’s the ultimate dream to have the white picket fence and the Instagram worthy living space. Go ahead, walk through the grass barefoot and relish in it. I can wait. Companies, especially lenders and real estate agents, are more than willing to sell you the dream, but influencers are less likely to crack your rose tinted glasses. No one likes to talk about the clogged pipes that back the toilets up into the sinks or bathtubs when you flush, or the neighbors who turn your bedroom into a club subwoofer at 11PM. Fortunately for you, I just got a $2,500 quote to trim back three (yup, that’s it!) trees in our yard, so I’m ready to spill the tea all over your new floors that, it turns out, aren’t as waterproof as they claim. Below, we cover all the joys of homeownership we wish we’d known before buying our first house that no one bothered to tell us.

Let’s do this.

Mortgages are throwing money away to interest

People say renting is throwing away money because you aren’t getting any long-term asset for your payments. When you purchase a house, you’re making an investment, they say.

I call BS.

While homes do generally appreciate in value, they aren’t this amazing investment, just like renting isn’t wasting money. In fact, homes are often one of the worst investments you can make, besides cars. If you want a glimpse at why, look at a mortgage amortization schedule and how much of the monthly mortgage payment goes to interest. That interest is like rent to your lender for the pleasure of their loan. It does nothing to build equity in your home. And over the life of a 15- or 30- year loan, it adds up to a lot.

If renting is throwing away money, then buying a home with a mortgage is too, yet no one ever talks about this side of the equation.

Let’s look at an example.

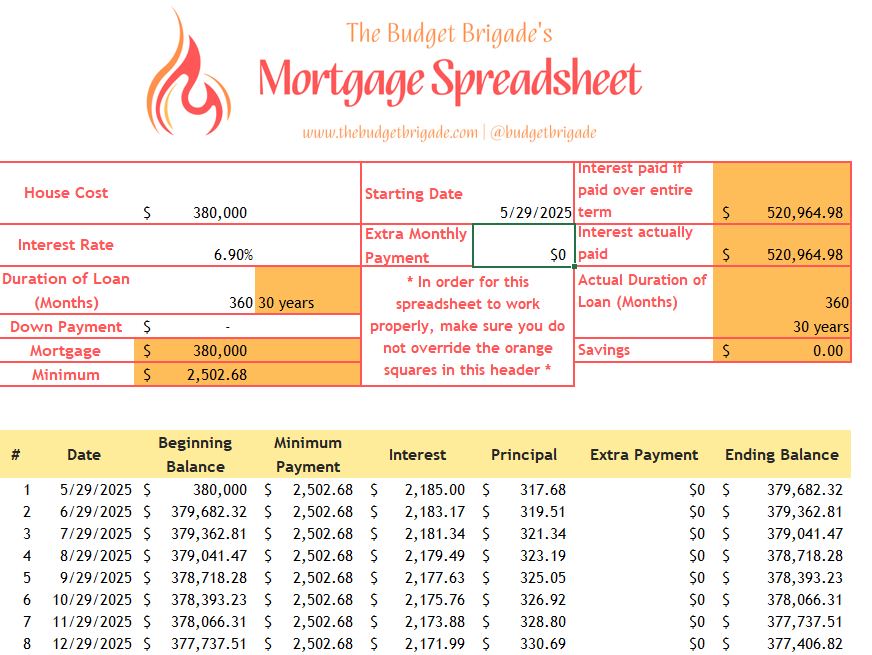

The average mortgage loan size was around $380,000, according to Trending Economics, when I looked for this article. The average mortgage interest rate was at 6.9%. Plugging this into our free mortgage amortization spreadsheet my nerdy husband made, you can see that of a $2,502.68 mortgage payment, only $317.68 of that first payment goes to the mortgage balance. The other $2,185.00 goes to the bank.

That feels a lot like paying rent, doesn’t it?

A fixed interest rate doesn’t mean a fixed monthly payment

While a fixed interest rate can lock in your mortgage payment that goes to interest and the mortgage balance, it can’t lock in the escrow portion of your payment.

Property taxes go up. In states without homestead protections, they can go up A LOT. Just ask the old retires who used to live in California and don’t anymore because they couldn’t afford the taxes on their homes. You don’t have control over how the county assesses your value, and even if you debate their assessment (and win), you’ll be right back at it again next year.

This is especially true if you’re doing a new build. The property taxes the first year or two can be deceptively low, as they may only account for the land value and not the house. The house is where the government makes their big tax money.

Homeowners insurance? That’s good to have when pipes leak and sewers back up (we talk about keeping Mario and Luigi gainfully employed below). Insurance, like taxes, goes up. With damages from natural disasters costing billions between hurricanes and hail and wildfires (oh my!), more companies are pulling out and the rates for those that stay? Up, up, up they go.

Things will start breaking as soon as you close on the house

When you’re renting, you put in a call to the landlord and don’t worry much when something needs attention. When you own a home, your wallet groans as soon as something breaks. And there are so many things that can break. Kitchen drawers come off rails that, it turns out, were just stapled to the back of the cabinet, not screwed in. Blinds break. The oven doesn’t do anything but warm up a bit, or starts to burn everything. Handles come off doors. The list goes on and on.

And as soon as you replace or fix one thing, something else taps out. Homeownership is one never-ending game of Whack-a-Mole.

You can pay a premium to buy new construction, but builders wrap the cost of maintenance and repair into the upfront selling price. New homes don’t appreciate as quickly, because you’re likely paying over market value to get into a home with new appliances. Even that doesn’t guarantee a hakuna matata home. We’ve heard nightmare stories of new builds where the ceiling caved in within the first few months, or pipes burst, thanks to shotty craftsmanship.

The Home Depot paradox for home improvement projects

When in comes to maintenance and repairs, there’s almost never a “simple” fix. It’s going to take twice as long as you expected and require a minimum of two trips to Home Depot. You’ll realize you need to go back about two minutes after returning from the first trip and getting back to work.

The grass is only greener because it costs a fortune to maintain

It may look nice, but that beautiful curb appeal takes sacrifice of both time and money, no matter which way you trim it.

Yard services: expensive

Landscaping: expensive

Equipment to take care of your lawn yourself: expensive

And that doesn’t even touch on gardening. If you think inflation has hit food hard, I dare you to grow your own. You’ll never complain about the cost of strawberries again. In fact, you’ll wonder how they manage to mass produce it, package it, and transport it as cheap as they do.

And the weeds. Oh my God, the weeds. They always win. You can be out there on hands and knees picking dandelions for hours and when you wake up tomorrow, those smug bastards will be standing and waving in the wind, ready for round two. If it isn’t dandelions, it’s thistle or clover or crabgrass or one of the countless other weeds you can’t identify or manage to exterminate.

Then we get to the shrubbery! Oh, the shrubbery! If you live in a place with a HOA, you may have strict requirements on how many trees you have in your yard and other landscraping laws. Trees make weeds look like chums.

Did I mention the $2,500 quote we just got to trim back a few tree branches? That was the cheap quote to just hack away all the branches that overhang the house without making it look pretty. Like my budget has room for pretty branches these days.

And yet, we have to do something. If you don’t trim trees back, branches inevitability fall on your house (or your shed or your fence), which usually means going through or knocking down the structure, costing even more in repairs.

You’re going to help put a plumber’s kid through medical school

That fun little plumbing ditty in the opener? That’s based on a true story. And that wasn’t even one of the more expensive horror stories told around our campfire.

Cast iron sewer pipes can rot through, turning your entire basement into Shit’s Creek. No cast iron? No problem! PEX pipes can fail too.

Plumbing issues cause water issues, and water issues often cause mold. And mold remediation? Yikes.

Even if your pipes have perfect structural integrity, your kids might clog them by trying to, say, flush hockey figures down them. Yes, I did. No, I have no idea why. I probably wanted them to keep my goldfish company.

There’s no such things as kicking back and relaxing when you own a pool

Yards aren’t the only expensive part of your property that’s outside of the house. Pools can also take a lot of time and money to maintain. The second verse is eerily similar to the first:

Pool services: expensive

Pool chemicals to DIY: expensive

Pool maintenance (heating, draining/refilling, busted pump, resurfacing, etc.): expensive

Cities are OCD when it comes to permits

My husband almost Hulked out when he decided he’d deal with the permit when we were putting a shed in our backyard. It was a shed. No electric, no plumbing, no problem he thought.

Hours later, he was still waiting for the electrical guy to review and sign off on the architectural plans so he could get the permit. Mind you, this wasn’t some she shed we were turning into an office. This was a shed shed. The only thing that lived there were ants and a John Deere rider mower. But it needed a permit, and the permit had to be reviewed and approved by every possible city employee that it didn’t apply to.

Fences, doors, sheds, electrical – if you’re thinking about adding it, replacing it, or upgrading it, chances are you’ll need a permit. Get ready to fork over more money and then wait and wait and oh, did we mention you’ll have to wait?

HOA dues. Dumb

I reached out to some friends and TBB supporters for suggestions on what to include in this article. This response was so perfect I included the direct quote for the title of this section.

I have never understood the concept of HOAs. Yes, let’s all get together and agree to pay people to tell us how to live our lives and then fine us if we don’t comply to their standards. We already do this with our government, but that’s not enough. I want people monitoring my every move and complaining about it. Why not?

Many HOAs have been farmed out to third-party companies, so now you can also tack on skewed incentives because those companies make money when they can charge you fines for noncompliance. I’ve had my car towed from my own house because I got home late and parked over the faded parking lines that they didn’t bother using our HOA fees to restripe.

Not only are HOA dues dumb IMHO as a principle, but they aren’t set. Fees can rise significantly. We had a friend whose HOA dues jumped to $500/month for a house. The HOA didn’t provide any additional services, just raised dues a few hundred bucks a month. And if you own a condo or home where the association has to maintain more than just some shubbery and a neighborhood sign? Look forward to special assessments, which they can tack on if they’ve mismanaged the money you’ve already paid them, and can run thousands of dollars.

Call me biased, but I try to avoid HOAs like a plague. It’s easier said than done though.

Can’t live with bad neighbors, can’t live without good ones

We’ve had neighbors that felt like siblings and others that became our best friends. We’ve also had neighbors who fired live ammunition up in the air, leaving shell casings around the neighborhood, and others who had knockdown, drag out domestic disputes at least once a week.

Good fences can help make better neighbors by blocking out the family that’s auditioning for the next iteration of Hoarders: Yard Edition (how many broken down ovens do you really need, George? The answer is zero.).

But noises and bad personalities? Those carry through wrought iron, wood, and PVC. Enjoy the soothing sounds of the kid who just took a soccer ball to the face, compliments of his older brother, or the music their parents love to blast through the night and into the morning. Their dogs? They’re tied up in the backyard, barking their brains out because they’re hungry and starved for attention. Some nights, you almost beg for the sound of highway traffic directly behind you because it means you’d get a reprieve from the chaos.

You can’t pick your neighbors, and good neighbors are worth their weight in shares of the S&P 500. It only takes having one shitty neighbor to make you wish that one of you could move. When you’re renting, you can move to another apartment or hope they’ll move out within the next year. Moving after you’ve bought a house is a much more complicated process and costs a lot more. Both closing fees and real estate agent fees can cost entire percentages of your home’s value, chipping away at any equity you might have built.

That first major repair hits like a sledgehammer

A leaky faucet or a toilet that doesn’t stop filling? YouTube can help with those annoyances. But when it comes time to replace the roof, HVAC, siding, drain field, foundational issue, or other ~$10,000 capital expense? It’s gonna hurt in places you didn’t know existed.

And rest assured, the air conditioner never breaks in the winter and the furnace never craps out in the fall. It’s when you need it most and it becomes an emergency because you’re worried about pipes freezing or cats passing out from heat stroke.

Speaking of HVAC, how are air filters so expensive?!?!

HVAC systems have air filters you’re supposed to change out about once a quarter. As someone with terrible dust allergies and as someone who is married to someone who was allergic to pretty much everything naturally occurring in the state we used to lived in, we don’t mess around with air filters. At the beginning of each quarter, I swapped them out. It was disgusting how black they got.

It was also disgusting how much they cost. If you want something that’s going to actually do any good filtering the air, you’re looking at $20+ per filter. You can opt to buy a cheaper version that’s basically hay woven into a grid and passed off as a filter, but then expect to enjoy the soot and dust that collects in your home throughout the year.

The final word

Ahhhh, the American Dream.

By this point, it wouldn’t be illogical to assume that we suggest renting forever. And yet, we own our home. That’s right, after learning all the hidden gems above with our first home, we went full eyes, clear hearts into homeownership a second time. And believe it or not, I don’t regret it.

The cake isn’t a lie, it’s just, well, a bit stale. But as much as it downright sucks sometimes, I enjoy having a place to call home. I fully embrace the hygge vibes of our place, and take comfort knowing that some landlord won’t be able to kick us out on the street next year. There are actual joys of homeownership, they just aren’t the full story, and it’s important to understand the full financial commitment before signing a deed and purchasing a home. We highly recommend having a beefy emergency fund that’s completely separate money from your home down payment and moving budget, which can help you weather any of the storms above that might blow through your yard.