A health savings account (HSA) is an incentive offered to individuals on a high-deductible health care plan (HDHP) that many people leverage as a retirement account. An HSA offers perhaps the best tax advantages available for saving and investing. The catch (and it’s a big, important one) is that you have to use funds for qualifying medical expenses to take advantage of all the tax benefits and avoid penalties. Given its attachment to an HDHP, an HSA isn’t something that makes sense for everyone, and we’ve covered how to choose a health insurance plan during open enrollment separately. If an HDHP fits your budget and medical needs, however, it can be a total game changer. Let’s see how! Below, we cover what an HSA is and how you can use it as a retirement account.

Disclosure: I asked the AI overlords (AKA ChatGPT) which TV show or movie would be a good fit for this article, and it gave me Grey’s Anatomy, The Walking Dead, The Witcher, The Boys, or Brooklyn Nine-Nine as options. Enjoy your Peralta, people.

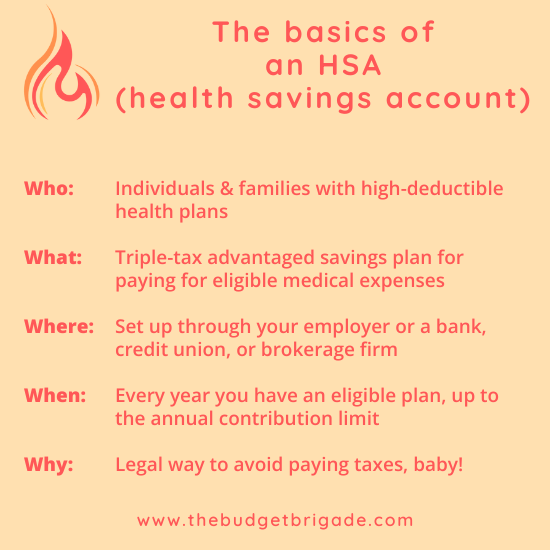

What is an HSA?

An HSA, as the full title suggests, is a type of savings account. It allows you to set aside pretax money (this means income you don’t have to pay taxes on, woohoo) for saving toward future medical expenses. You can invest the money in a health savings account into the stock market to help the balance grow past just what you put in. A warning though: this means that the balance can also drop if the stock market has a downturn. We’ll look at who should use their HSA for investing versus saving for medical bills the way Uncle Sam intended more in depth below.

Regardless of whether you stockpile cash or invest your contributions, as long as you use the funds to pay for “qualified” medical expenses, you never have to pay taxes on them.

Never!

Amazing right?

You might be young and healthy now, but we all grow old, and our bodies generally break down over time. Sometimes literally with broken bones from slip-and-falls, other times from conditions such as cancer or heart disease. While you might look at your today’s self and think you don’t need to save for medical expenses, health problems are coming for us all.

Your HSA can be a growing pot of tax-free money to help you keep the rest of your retirement nest full of money eggs, or can server as a tax-free emergency fund for medical bills so you don’t have to go into debt if you unfortunately face a DEFCON 1 situation.

Getting the most out of your HSA takes a little extra high-level planning, which we cover below. But first, let’s look to see if you can even get one.

How do I qualify for an HSA?

In order to contribute to a health savings account, you have to be on an eligible high-deductible health insurance plan (HDHP). Good ole Uncle Sam defines the relationship of eligibility, and typically redefines the relationship every year, tweaking for inflation adjustments, with requirements for the annual deductible and maximum out-of-pocket amounts.

You can find the requirements for HDHP plans on the IRS website. This links to 2026, but you can search their website for other years.

Some plans may have high deductibles, but still don’t qualify for an HSA. This is almost a double whammy, so try to avoid these plans if you can.

How does a health savings account work?

Often, if your employer offers you a high-deductible medical plan option, they will also offer an HSA that they manage. They may even offer some sort of matching contribution to your HSA, which you should take if you have the space in your budget.

If your employer doesn’t offer an HSA but does offer eligible insurance coverage, you can open your own separate HSA. Beware of fees here! Companies love their fees, and some HSAs may have fees for opening the account, monthly maintenance fees, paper statements, etc. etc. etc.

Banks and credit unions often offer HSAs. If you’re just building a medical emergency fund, this is a fine option. If you’re planning on leveraging your HSA as a retirement account, it may also be fine, but drill into the details to see if there are restrictions on what invest options (index funds, mutual funds, etc.) you have within the account.

Fidelity also offers an HSA that’s a brokerage account and allows you to invest your funds. I’ve never used this, but it’s probably worth exploring.

What are the contribution limits for an HSA?

There’s an annual limit on how much you can add to the account through your pre-tax contributions.

For 2026, you can contribute up to $4,400 if your HDHP covers just you (self-only coverage) or up to $8,750 if your HDHP covers your family.

If you’re investing your funds in the stock market, there isn’t a limit on how much your contributions can grow, just a cap on how much you can add yourself.

How do I make contributions to my HSA?

If your employer offers a managed HSA with their HDHP, you can typically elect how much you want to withhold from each paycheck during enrollment, and they will automatically deduct the funds from your paycheck and deposit that amount into your HSA for you.

If you have a separate HSA account, you can make contributions yourself and note them on your annual income tax return, which will give you the tax break retroactively (even if you don’t itemize your taxes).

Note though that these funds aren’t always automatically invested. If you plan to invest your contributions, you will need to either set up an automatic investment election or manually make the investments yourself.

Who is an HSA a good fit for?

If you have a kid who tries to reenact scenes from Home Alone or is trying to win their school’s prank wars, this might not be the best fit for you.

I never like to speak in absolutes, as there are always exceptions, but generally, an HSA with an HDHP is typically a good fit for:

- People with low medical expenses

- (or) people such as myself who max out their out-of-pocket expenses every year

- People who can pay medical costs out of pocket & let their HSA grow

- High-income earners looking for ways to legally not pay taxes to the government that they don’t have to

The nice thing about an HSA is that you aren’t tied to an HDHP forever just because you opened one. If you have planned upcoming medical expenses that will add up (such as a pregnancy or surgery) you can always opt to switch to a PPO or HMO, etc. etc. for a year. You won’t lose the money you have in your HSA, you just won’t be able to add more until you have an eligible HDHP again.

Triple-tax advantages: the power of the HSA

HSA, HSA, HSA, why are we harping on it so much? It all comes down to the taxman.

The HSA might be the most tax-efficient savings account available in the US because it offers three different ways you save on taxes:

- You make pre-tax contributions, meaning you don’t pay payroll/income taxes on the money you contribute

- All invested contributions grow completely tax-free, so you don’t have to worry about short- or long-term capital gains

- If you use your money for qualified medical expenses, you don’t pay taxes when you withdraw funds

With a traditional IRA or 401(k), you usually only get the tax break when you contribute. With a Roth IRA or 401(k), you usually only get the tax break when you withdraw funds. An HSA is like a traditional and Roth account got drunk one night and nine months later had a super baby.

What counts as a qualified medical expense?

Hold onto your pants, because there are a lot. Here’s the TL;DR, though there are even more!

- Copays and coinsurance payments

- Health care costs not covered by your insurance

- Vision care

- Dental care

- Prescription drugs

- Over-the-counter health products

- Family planning expenses (contraception, fertility treatments, etc.)

- COBRA premiums

- Medicare premiums

HSAs by the numbers

A few stats on who currently uses HSAs (and who might be missing out):

- There were about 39 million HSAs in 2024 according to the Denevir & HSA Council survey that cover about 59 million Americans. With an estimated population of around 347 million Americans, that’s about 17% of Americans

- Individuals in their 30s held about 30% of all HSAs (yeah, let’s own this, Millennials!)

- Account holders 55+ had over $63 billion in their accounts by the end of 2024. Though this was 21% more than in 2023, the average HSA balance for this group was under $7,000 each. Imagine the missed potential!

- 64% of HSAs are for families with median household incomes less than $100,000 (it isn’t just a rich people tax avoidance scheme)

- Only about 15% of account holders invest in their HSA (this comes from an analysis by EBRI), which means only about 2.5% of Americans are taking advantage of the full potential of this stealth retirement account

While investing your HSA funds isn’t a good fit for everyone, I’m willing to bet some of our HSA balance (not a qualified medical expense, so I’d have to pay taxes and a penalty when I withdrew it if I lost) that more Americans should but are missing out.

Let’s look at the true power of the HSA next.

How health savings accounts can operate as a stealth retirement account

Here’s where things get fun. You might look at an HSA and think it’s just a longer term FSA, and it can be. But there’s a nifty little loophole that people leverage that helps turn this medical savings account into a stealth retirement account.

But first, a quick detour.

HSA vs FSA: what’s the difference?

A flexible spending account (FSA) is a use-it-or-lose-it plan. You can contribute pre-tax funds and withdraw them for eligible medical expenses without paying taxes, but if you still have money in the account at the end of the year, you lose it. (Where it goes, I don’t know.) You may be able to roll over a certain amount, but the IRS sets limits, and not all plans offer this option. Even if you could invest the money (which you can’t in an FSA), it wouldn’t have time to take advantage of compounding interest.

Now back to our regularly scheduled programming.

What makes the HSA so powerful is that you don’t have to use the HSA funds at the exact time when you have a qualifying expense above. You can keep your receipts and reimburse yourself at any time. Say, in retirement, when you want to have an income that you don’t want to pay taxes on.

By waiting 10, 20, 30, or more years, you not only have a source of tax-free income in retirement, but you also give that money decades to continue to grow… completely tax free.

How do HSAs compare to other options for retirement investing?

While HSA funds must apply toward medical expenses to avoid penalties or taxes (or both), they are the only tax-advantaged savings plan that offers the triple tax savings we highlighted above. Then at 65, your HSA can act like a traditional IRA, where you no longer have to use the funds for medical expenses to avoid paying a penalty – you just have to pay taxes on the withdrawals. Not a bad hedge, just in case.

Another nice thing about HSAs is that they don’t have required minimum distributions (RMDs) that force you to withdraw a certain amount once you reach an arbitrary age set by the government.

Should I invest my HSA contributions and play the long game or keep my HSA funds in cash?

What you should do with your HSA depends on your financial situation, risk tolerance, and age.

If it were up to my husband, we would likely have more invested within our HSA than we do. I don’t have the same risk tolerance that he does, so I err more on the side of caution.

What we do is hold one year of our out-of-pocket maximum in cash in our HSA. Anything above that, we invest.

Originally, I also wanted to pay my medical costs from the HSA when they arose. It took my husband making a massive spreadsheet to prove to me that paying for the medical expenses in post-tax dollars now actually works out in the long run with the reimbursement game because we are young enough that the compound growth outweighs the tax burden on today’s fund.

If you’re closer to retirement, when you’ll need to draw down these funds, this will be less true in your situation.

If an unexpected CT scan will leave you scrambling to figure out how to cover the cost without running up credit card debt, you should keep your funds in cash and use them now.

If you get stressed every time the market dips, first of all, don’t panic! This is a normal part of the process. Take some time exploring our free retirement and investing resources to get a little more comfortable with the volatility so you don’t miss out on the magic of compounding interest. But if you can’t stand the thought of your medical emergency fund going down, then don’t invest it. Yes, you may lose out on a growth opportunity, but at least you’ll be able to sleep at night, which will help keep your medical costs for chronic conditions down so you don’t rack up future medical expenses.

As a final note, don’t forget to consider the hassle factor. Yes, our HSA is going to grow and grow over the next few decades, and it will be super nice to have that tax-free nest egg in retirement. But it also means we have to keep track of years of medical expenses for those same decades and decades, which is honestly a bit of a hassle and somewhat of a stress factor: I backup my backup of the receipts to make sure we don’t lose them.

A health savings account has tax advantages no matter how you use it. What you decide to do with the contributions depends on your specific needs, and these can change in time.

The final word

HSAs offer some of the best potential tax advantages of any savings account. The less you pay in taxes, the more you can save and the more it can grow for retirement. This is especially true given that you can invest funds in a health savings account in the stock market to leverage the power of compounding growth. This makes HSAs a super attractive tool for your retirement investing strategy if you have the diligence to keep records of your medical expenses for future reimbursements. Since HSAs are tied to high-deductible health insurance plans that require higher out-of-pocket expenses in unexpected medical situations, they may not be the best fit for all individuals and families.