There are a lot of different terms that get thrown around when you’re talking about how much a business makes. Revenue versus profit, gross profit versus operating profit versus net profit: they all have different meanings to you and your small business or side hustle. Revenue versus profit, in particular, can help you determine how successful your business is doing, and if you actually have a small business or just a hobby for now. Below, we provide an overview of common terms you’ll see attached to a company’s P&L (profit and loss statement) and balance sheet.

What is a business’s revenue?

Revenue is the top line income generated by a business before taking into account any business expenses.

Let’s use my previous side hustle of a bookkeeping business as an example. For a bookkeeper, the revenue would be all the income generated by billing out your services.

Revenue is often classified in two ways: gross revenue and net revenue. Gross revenue is the total you bill out in sales before any discounts or refunds. The net revenue is the total billed out after discounts and refunds. (Honestly, this distinction isn’t super big for more businesses; revenue versus profit is much more important to understand.)

It’s important to note when talking revenue, this is still money coming in before expenses. Net revenue is not the same as net income.

Your revenue is impacted by different factors. For our bookkeeping service, these would include:

- Market demand for your services (how many clients you have)

- The price of your services (what hourly rate you charge)

- Competition for your services (if Carol starts a bookkeeping business next door, she might steal some clients, or you might need to lower your prices to compete with her)

- External economic pressures (can people afford to pay for a bookkeeper to help them out or are they going to give their receipts to their spouse and pray they don’t get audited?)

- Seasonality of services (oh shit, it’s tax time? Better call Saul the bookkeeper!)

What is a business’s profit?

Profit is the bottom line net income a business generates. As a reminder, net revenue and net income are not ****the same.

Similar to revenue, profit is often classified in two days: gross profit and operating profit.

Gross profit versus operating profit: what’s the difference?

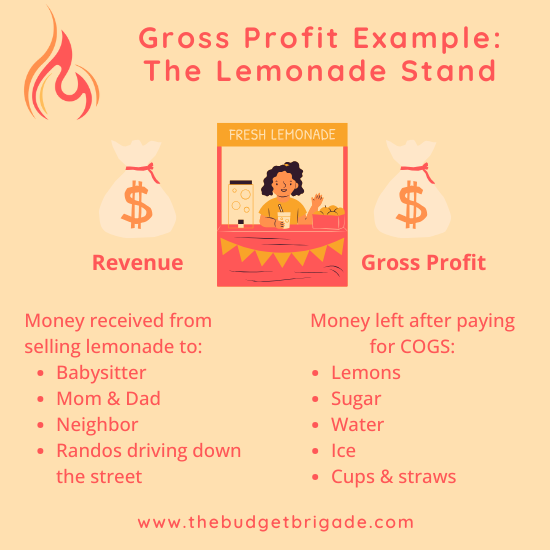

Gross profit is generally used for businesses where you sell a product, as gross profit is your revenue minus the cost of goods sold (COGS). Your COGS is the cost of producing the product you are selling. Our bookkeeping example isn’t a good one here since there are no goods sold. Instead, let’s look at your entrepreneurial kid’s lemonade stand instead. The COGS for this business would be:

- The cost of the lemons

- The cost of the sugar

- The cost of the water

- The cost of the ice

- The cost of the Solo cups they serve the lemonade in

- The cost of straws

If your little entrepreneur corners the neighborhood market and needs help to keep up with the demand, they might flip their friend some cash to make the lemonade while they sweet talk their babysitter they have a major crush on. The cost of labor (AKA whatever they pay their friend) to make the lemonade from the raw supplies would also count in their COGS.

Their gross profit for the day would then be the total revenue (sales of lemonade) minus the supplies and labor to make the lemonade.

The operating profit is the gross profit minus all the other expenses required to run the business. Sticking with our lemonade stand for a moment, expenses to deduct might include:

- Materials to build the physical lemonade stand

- A cash drawer or piggy bank to hold the cash

- The project board and markers to make the lemonade stand’s sign

- Napkins

Our lemonade stand has very little overhead operating expenses, which is why it’s a good fit for young entrepreneurs. Unless you, as their parent, decide to charge them rent for the end of the driveway where they set up the stand every Saturday. Then their profit margins might be too small to handle their operating expenses, leaving no operating profit left. This would be a tough life lesson to learn as a young age, but it’s one small business owners encounter all the time unfortunately.

Now let’s pivot back to our service based bookkeeping business. Potential expenses here include:

- Internet and phone services

- Paper, pens, notebooks, etc.

- A laptop and bookkeeping software, such as Quickbooks

- A printer

You can also streamline the expenses for a small business or side hustle bookkeeping business, which is why this frugal budget lady opted for this type of entrepreneurship. The lower your operating expenses, the more of your revenue you get to keep as profit. And since the operating profit is the only part of the revenue you get to bring home in the budget, the higher the better.

What is a company’s net income?

Now that we know revenue versus profit, let’s go one step deeper into a company’s P&L report (also referred to as an income statement, since we don’t already have enough terms we’re trying to memorize).

Above, I mislead you just a smidge and said that the operating profit is what you get to bring home. While this is true, this isn’t how much you can actually budget with, because you have to pay Uncle Sam his cut first. And boy, it can be a hefty cut.

The net income accounts not only includes all COGS and operating expenses, but taxes and interests paid as well. As such, the net income is almost always smaller than both the gross profit and operating profit. (Unless Saul Goodman is the one doing your taxes, and then it’s probably bigger.)

WTF is EBITDA?

When I first heard the term EBITDA, I thought my boss was referencing Taco’s EBDB in The League and boy, was I confused to say the least. Don’t worry, the EBITDA has nothing to do with Eskimo brothers.

EBITDA is some fancy accounting that investors like venture capitalists use to assess the value of a company. It’s an acronym for:

Earnings

Before

Interest,

Taxes,

Depreciation, and

Amortization

The EBITDA is the net income with these four factors Frankensteined back in. While it can be useful for large corporations and investors to gauge what a company might be “worth” and its potential, it’s not super useful for us small business hustlers because it doesn’t take into account what it costs to actually run your business. If your kid is bringing in $200 a weekend with their lemonade stand, but it costs them $210 to produce the lemonade because he friend is gauging him on the labor in formal protest on not being able to play Fortnite instead and because he’s buying organic lemons that are personally hugged on the tree before their picked, then he doesn’t have a successful business, he’s got a wasted weekend and a hobby he needs an allowance in order to fund. We’ve covered this is more detail in our article exploring if you have a business or a hobby.

The final word

Revenue, profit, income and all their variations aren’t critical to understand to make lemonade or reconcile someone’s bank statement, but they are important for small business owners and entrepreneurs to understand. Even if you don’t want to sell out your company to investors in the future, you want to have a fundamental understanding of how your business runs, where your money goes, and how much money you actually make. So many small business owners I’ve met discuss their revenue when you ask how much they’re bringing home, but many end up having a hobby and not a business when they account for their COGS and expenses. You want your business to bring in the revenue and make a profit, so that you can take some of that net income and invest for financial independence. It’s also really nice to have enough net income to budget for a vacation. Just sayin’.

If you have questions while puzzling through the income statement your bookkeeper (sorry, my bad) provided you, drop us a line in the comments below, or in our budgeting and personal finance Facebook group. We always like to help small businesses succeed. If you need help with a deeper dive into your company’s finances, we offer some small business consulting, depending on availability and complexity of the project.