If you’ve ever had an unplanned expense pop up in the middle of a month you weren’t expecting, you need sinking funds in your life. Sinking funds are our BFFs. They are an amazing defensive strategy to help protect your personal finances and to build wealth faster. They also motivate us toward our financial independence goals. But what are sinking funds exactly? We cover this, their benefits, who should use them, and how to use and save for sinking funds below.

- Sinking funds allow you to save up for large, planned purchases or upcoming expected expenses over time.

- Using sinking funds, you can afford things and experiences that aren’t possible right now.

- Sinking funds can be used for a variety of reasons, such as saving up for a home down payment, a future vacation, car maintenance, annual bills, or a new phone.

- How much to save depends on the timeline until you expect to spend the money and how much you think you’ll need.

- Sinking funds can be great in HYSAs; avoid investing them if you’ll need the cash in the next five years.

What are sinking funds?

A sinking fund is planned saving and spending for specific items or experiences that allow you to save up for large purchases over time without having to go into debt to buy them.

You can having sinking funds for both expected upcoming expenses, such as replacing an old car or going on a vacation, and unexpected expenses, such as the air conditioner going out or a dryer that stops working in the middle of a load of laundry with all your work clothes.

With sinking funds, you allocate a certain amount of money in your monthly budget to build up the fund balance. This allows you to save a smaller amount regularly over time versus trying to find $6,000 all at once, which is pretty much impossible for most people to do in a month.

Benefits of sinking funds

Sinking funds are one of the most underrated powerhouses of personal finances. Think of them as the undefeated college football team that gets shafted by the ranking committee. Fans can see their potential and their strengths, but they get no love from the media.

Sinking funds are one of the few topics we’ll cover that have several advantages and almost no disadvantages. The only disadvantage of sinking funds is when you go a little overboard, as I’ve admittedly done, and have too many. And only my husband thinks this is a disadvantage. I felt it was fine. We are a house divided on Sinking Fund Sunday.

We are both Team Taylor, though. Full eyes, clear hearts, can’t lose!

My caution with sinking funds is that if you focus on saving too much for too many things too early, it can severely limit your capacity to pay down high-interest debt early in your journey up the FIRE ladder to financial freedom. If you’ve got $5,000 of credit card debt hanging around, you don’t need to be saving up $5,000 for a vacation yet. Focus on one crime at a time.

Now that we’ve covered the disadvantage of sinking funds, let’s bask in their glory.

- You’ll be able to afford things and experiences you may not think are possible now, like paying cash for a car or a vacation to Hawaii. Or that first home down payment that seems impossible.

- Sinking funds create delayed gratification, which is another secret weapon for success and great leverage for contentment.

- Paying cash versus using a credit card can save you a ton of money, not just in interest, but by setting a realistic budget by weighing the cost versus benefit of the expense.

- With sinking funds, you can dropkick Murphy to the curb and ship him off to Boston if he comes knocking. By planning for inevitable expenses, you can reduce stress and focus forward on goals instead of constantly fighting dumpster fires.

Sinking funds versus savings account

While sinking funds sound similar to a savings account, and sinking funds can be inside a savings account, there’s an important distinguishment.

The money in a sinking fund has a purpose for a specific goal. Your sinking fund is working hard, just like you, to help you reach your future goal.

A savings account balance is likely one pool of money sitting there, waiting for someone to tell it what to do. It’s thus much more likely to be repurposed for something else and dwindle away, leaving you short when the time comes to pony up.

If your sinking funds are the Summa Cum Laude aerospace engineer working on getting their pilot’s license so they can become an astronaut, your savings account is the undeclared freshman strolling down Greek Row every night, looking for a fun time. Give that kid a major and a job so they can tackle their student loans!

You can keep all your sinking funds in the same savings account, just track them separately. You can do this in your budgeting app or with a simple Excel or Google Drive spreadsheet. We’re super nerds, so I do both.

Are sinking funds the same as an emergency fund?

Sinking funds and your emergency fund can have a similar purpose, but they aren’t the same.

An emergency fund is for when shit hits the fan. This is for when you lose your homeowners insurance because they won’t cover your roof anymore and you need to shovel out $15,000 fast. An emergency fund allows you to keep current on your bills with an unexpected job loss. It can cover you for an emergency trip to the hospital that pulls in thousands of dollars of unplanned medical bills.

Sinking funds help minimize and prevent emergencies so you don’t have to break the glass and pull the lever in case of emergency.

Your emergency fund should always be the last resort. It’s the sacred Holy Grail.

If your car is getting up there in years, a sinking fund for car maintenance and another for a new car down payment can help avoid having to steal money from your emergency fund when you drive over a nail or sideswipe the cart corral in the grocery store parking lot.

A sinking fund can also help plan for medical bills if you have a chronic condition or have an upcoming surgery/procedure you know you need to plan ahead for, like a root canal or the birth of a child.

Who should have sinking funds?

Everyone!

Just kidding. Kind of.

While we recommend budgeting for everyone, the Elon Musks and Taylor Swifts of the world probably don’t need sinking funds because they can blink and make money.

For the non-uber wealthy, sinking funds can be a powerful insurance policy against high-interest debt. Not everyone needs the same sinking funds. There may be seasons where you don’t have any at all, but sinking funds can help everyone from Joe Dirt to JGL better optimize their finances to build wealth smarter and faster.

Do you have to have sinking funds to succeed?

Not necessarily, especially if you have a large discretionary income every month to work with or you’re a natural saver who stockpiles cash. But I still think sinking funds can be useful in these situations. When you have a large discretionary income, it’s easy for it to evaporate quickly, which can leave you just as broke as someone with half your income. Sinking funds help keep you on track. Plus, I love the dopamine hit of reaching a goal.

If you’re a super saver, sinking funds can give you permission to loosen the purse strings and enjoy some of the money you’ve worked so hard for. Take that non-stop flight in the middle of the day and upgrade to first class. Or buy that Stanley cup everyone and their mother has been yacking about for the past several months. (Sorry, but if it’s not hockey, I don’t get the hype.) If you’ve been wanting to put a pool in for ages but can’t justify the expense because it won’t ROI in your house’s market value, start a sinking fund and then enjoy those hot summer days, my friend.

What expenses should I have sinking funds for?

It’s choose your own adventure time. Which sinking funds you set up depends highly on your situation and goals.

If you’re on a lower rung of our FIRE ladder and don’t have much in the way of an emergency fund, you might prioritize less sinking funds but start them earlier so that they don’t eat up too much of your income. Let them help protect against a small flint becoming a raging wildfire while continue to douse the current flames.

The more discretionary income you regularly have, the more you’re able to cash flow on a monthly basis when issues arise, so the less sink funds you’ll need for smaller purchases, repairs, or emergencies.

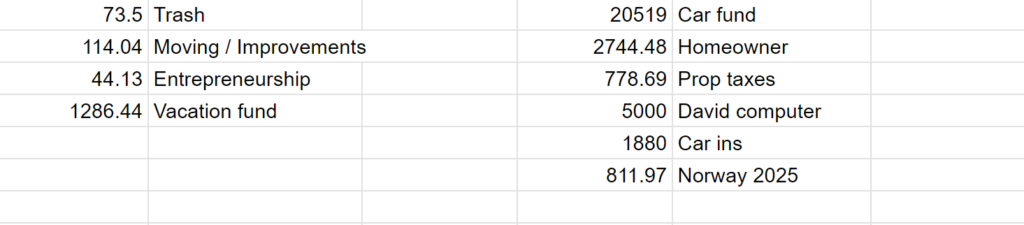

Here are the sinking funds we currently have in our monthly budget:

- Our emergency fund

- Subaru and truck fund

- Moving fund

- Home improvements

- Car insurance (we pay once a year to save a couple hundred bucks)

- Entrepreneurship (for my Budget Brigade aspirations)

- Vacation fund

- Homeowners/flood insurances

- Property taxes

We could float the flood insurance bill the month it posts, but I like to break larger annual payments up and save in a sinking fund for them monthly to better see and understand how much our cost of living is. This helps keep lifestyle creep away and avoids a big surprise come payment time, especially if the Budget Beagle eats something off the floor she shouldn’t or the car window falls into the door the same month. The more I’m covered with higher expenses, the better I sleep at night.

Other expenses you may consider a sinking fund for, depending on your situation:

- Down payment for a new home

- Saving up for a remodel or home addition

- Wedding and/or honeymoon

- Pet care and vet bills

- New appliance (washer, dryer, fridge, etc.) or furniture (mattress, couch, etc.)

- Christmas gifts, decor, and celebrations

- Car maintenance

- Back to school shopping

- Summer camp / activities

- Medical procedure

- College fund, new certificate class, etc.

- Small business start-up fund

- Self-employed estimated taxes

- New phone, TV, tablet, smart watch, or computer

Visit our common budgeting expenses page to explore budgeting ideas for these expenses and more.

How much should I save in my sinking fund?

For our sinking funds, we like to save the same amount of money each month. This helps keep the monthly budget meeting short and makes our known monthly expenses more predictable.

The main exception lately has been our vacation fund. We love to travel and have been planning an epic overseas adventure for the past few years, making our savings a little more sporadic. On three paycheck months, we’ve thrown a bunch into our vacation sinking fund in order to save aggressively since this will be by far the most expensive vacation we’ve ever taken, even more than our honeymoon.

We’ve been saving up my husband’s PTO time as well for the trip, so our current vacation plans for the next year are pretty modest. Now that we’ve already had to pay our epic trip in full, coupled with our upcoming cross-country move, we aren’t putting much if anything into the vacation fund for the next few months until things settle down and we look ahead to fall travel plans.

Short story long, how much to save in your sinking funds depends on the projected expense and timeline. The more expensive and faster it’s coming up, the more aggressively you need to save. For years, we saved $250 a month into a car fund. Now that both our cars have 120,000+ miles on them and we know we’re going to need something that can handle the snow next winter, we started scoping out used SUV and truck prices. Comparing that to our sinking fund balance, we increased that $250 a month to $350.

If you just paid off your car and it’s only a few years old, you might have a decade to save and could get away with $150 a month for now. If you have a teenager you plan on buying a car for next year, you might need to save closer to $500 a month.

Annual expenses are a lot easier to predict. Take your annual bill, divide it by 12 months in a year, and save that amount every month. For insurances and other expenses that tend to increase every year, compare this year’s bill to last year’s and save additionally by the amount it increased.

For example, if your car insurance was $1,400 last year and this year it was $1,500:

$1,500 / $1,400 = 1.07

This means your car insurance increased by 7%. So you can estimate next year will likely be 7% higher than this year, or:

$1,500 * 1.07 = $1,605

Since your sinking fund needs to cover next year’s bill, you’ll want to save every month:

$1,605 / 12 = $133.75

What if I don’t have enough room in my budget for all the sinking funds I want?

Personal finance is all about opportunity cost. Saving for one thing means you don’t have as much to save or spend on something else. Each purchase and each sinking fund is a matter of prioritizing. If you have a bunch of sinking funds you’d like to have, but also have a lot of debt you’re still paying off and high monthly bills, something has to go.

Honestly evaluate your sinking funds. Which are the most urgent? What can you push off or reimagine cheaper? Sure, you’d love to go to Aruba, but this year maybe plan for the Bahamas because your car transmission is on its last leg and Herbie is now less Love Bug and more electrical bugs. The car fund usually needs to come before the vacation fund.

Remember, there’s a difference between a need and a want. There are also different levels of need. You need a car to get to work in order to pay your bills and keep a roof over your head. But you don’t need that car to be a Tesla. It can be a 15-year-old Honda that’s more duct tape than paint for now.

Where do I put my sinking funds?

Once you know what sinking funds you want to set up and how much to save for each, you’re likely wondering where to put them. We keep ours two different places, depending on the timeline.

If your expected expense is a few weeks or months out (like Christmas spending or a new mountain bike) or you dip into the account regularly (like a vacation fund or entrepreneurship fund), we recommended saving them in a regular checking or savings account that’s easy to access, so long as you have the self control to not access it and repurpose the funds for something else. If you impulse buy when you see cash in the account, maybe put it in an account at a different bank that isn’t linked directly to your checking account.

If the planned expenditure is more than a few months out (like annual taxes or insurances or a car fund), we keep them in a HYSA (high-yield savings account). These accounts have much higher interest rates than traditional savings accounts that come with checking accounts at big banks. While a sinking fund’s job isn’t to earn you money but rather keep you from going into debt, getting a little extra cheddar doesn’t hurt.

We don’t recommend investing your sinking funds to leverage the cash. You want your balance secure and available. The last thing you need is to go to replace Herbie the electrical gremlin and realize the market’s down 18%. The only exception here is if your time horizon for when you’ll need the cash is several (5+) years down the road. You can invest that money, though we recommend pulling it out and parking it in a HYSA as you get closer to needing it to make sure you have enough.

Once you’ve built up your sinking funds in a HYSA, the amount of monthly interest that accrues might surprise you. You may also wonder where that interest should go.

Go back to your priorities to determine that. Right now, ours goes toward our epic overseas trip to pay for excursions we’ll book later this year. Next month, that will shift and go into the new furniture fund, since we’re having to sell off half our stuff for the cross-country move.

Sunk in a rut with sinking funds?

Still not sure what to do with sinking funds for your specific situation? Drop us a line in our personal finances and budgeting Facebook group. If you’re stuck with your budget and can’t find room to pay your monthly bills now, let alone plan for future expenses, I can help you debunk your budget to find a clear path forward.

Best of luck and happy saving!