Who Wants to Be A Millionaire

Feels like a trick question, right? Is there anyone who doesn’t want to win the Powerball and become a millionaire? I certainly wouldn’t hate it!

The status holds an allure that only around 8.8% of Americans hold. While purchasing power might not be what it used to with recent inflation, one million dollars is enough to brighten anyone’s day. A $2 buy in for the opportunity to be a millionaire overnight? That might seem like a no brainer.

And when jackpots for multi-state lotteries like the Powerball grow, so does the frenzy around winning them.

We’re no exception to this rule. When the Powerball payout climbs above the $500 million range, we like to play once or twice a year. That’s half a billion dollars, friends. Even when Uncle Sam takes his almost 40% cut (I haven’t gotten any topic requests from recent lottery winners, so we’ll leave the lump sum or annuity discussion for another day), it’s still more money than we’d ever know what to do with.

Not that it stops us from trying.

Here’s the truth: we don’t play the Powerball because we think we’re going to win. The odds of winning the Powerball are 1 in 292 million. That means we have much better odds of (these are approximate, but you get the idea!):

- Having a toilet related injury: 1 in 10,000

- Getting struck by lightning: 1 in 15,300

- Becoming a billionaire: 1 in 409,000

- Dying in a plane crash: 1 in 11 million

- Getting attacked by a shark: 1 in 11.5 million

- Having quintuplets: 1 in 55 million

In fact, in our search over dinner (yes, true story), the only thing we could find that was less likely to occur than winning the Powerball was getting struck by a meteorite (1 in 840 million). If you find some other fun odds, please share them in the comments!

So why do we play if we don’t think we’ll win? We play because we like to dream. We like to foster conversations about our future (and what, precisely, a toilet injury might include) and sets goals that help us live intentionally in the present, regardless of whether we win the big jackpot. After all, that’s where we start with our budgeting 101 principles. You have to have a goal to guide you. $2 is a small piece of our entertainment budget to help us stay on track overall with our financial journey.

What Would You Do If You Won the Powerball?

What would we do if we had $441.9 million dollars?

First, we’d make sure we paid our taxes on it. So our $441.9 million is down to around $278 million right off the bat. Cry me a river, I know.

Next, we would find us a really good lawyer and set up a trust. While we were at it, we’d hire an accountant.

But once we got all the adulting and legal blah blah blah out of the way, we’d start to have fun. Some of the plans we’ve brainstormed:

- Quit our day jobs. I would hang out here with y’all in the Brigade full time!

- Finally get the truck and camper we’ve been saving up for

- Take our neighbors with us on our bucket list world voyage cruise (we would fly first class and get a balcony suite on the cruise ship)

- Build a custom home on 25+ acres in the heart of the Colorado Rockies

- I would work to help solve the healthcare industry crisis while my husband worked to help overhaul higher education in America

- Finish our all 50 States and all US National Parks bucket lists, cruising in style with our camper

- Open a dog rescue on our property

One of the things I love about this exercise is it shows you what your goals are in life. A lot of these things we plan to do anyway, it would just accelerate our timeline. Knowing what you would do if you had pretty much unlimited money tells you want you really appreciate and value in life. That’s what you should be working towards now, no matter how much net worth you currently have. Always keep this goal in mind.

Statistics on Lotto Winners

Now that we’ve gotten through the fun part, let’s get to the math. Because, as mentioned above, the odds of winning the lottery? Not very high. And the stats once you win the lottery? Well, they’re a bummer.

Confession time: My favorite guilty pleasure reality TV show is My Lottery Dream Home, even though it’s kind of depressing. Watching people who have won a million dollars go out and buy a $500,000 house brings the statistic I’m about to share with you into harsh reality.

Remember, lottery winnings are taxed at ordinary income tax rates, which means, depending on the jackpot payoff and your regular income, you’re looking at 32%-37% taxes. Using my million dollar winner scenario, that drops us to around $630,000 after paying off Uncle Sam.

If you spend $500,000 of that on a house, your million dollar earnings are down to $130,000 leftover. And now your half a million dollar house has much higher maintenance costs, property taxes, and insurance you have to pay every year than what you were spending on your old house.

But you’re a millionaire! You have to live the millionaire lifestyle (we are going to do a deep dive on this topic later), which means your cost of living significantly increases as well so you can keep up with the Joneses.

Do you know what happens when you couple all those expenses together?

70% of lottery winners go broke in 5 to 7 years.

Why? Because they never learned to budget. They never learned discipline with money or had a financial goal to make them whole. So they spend, spend, spend, and it’s gone quick.

Now, let’s be honest, it’s probably pretty hard to blow the $276 million in the Powerball scenario pictured above. It takes more creativity for sure (flying in a G6 anyone?).

Statistics on Lottery Dreamers

I try to never give any advice that I don’t follow. So I’m not about to say you should never buy a Powerball ticket. Go get you a ticket! Have that dream meeting with your family – or with yourself. But the statistics on routine lottery purchases? They’re as depressing as my realization about My Lottery Dream Home winners.

In a Bankrate study, the lowest income earners ($30K a year or less) spent 13% of their annual income on lottery tickets. For $30K-$50K earners, it’s around 3%. In comparison, the average savings rate in America is only around 4.0%. This number is across all incomes, so it isn’t a one-to-one comparison, but considering that higher income earners above $50K spend 1% or less on lottery tickets and have more disposable income to save, it’s a daunting stat.

Investing Your Lottery Purchases

Now let’s say you took your lottery ticket purchases and invested them instead. What could that look like? Down the road, I want to build an investment compound interest spreadsheet to show you. (I know I’m a nerd, no one needs to point it out, I swear it’s self proclaimed.) For now, I used this investment calculator.

Powerball tickets are currently $2 a play and they draw winners three times a week.

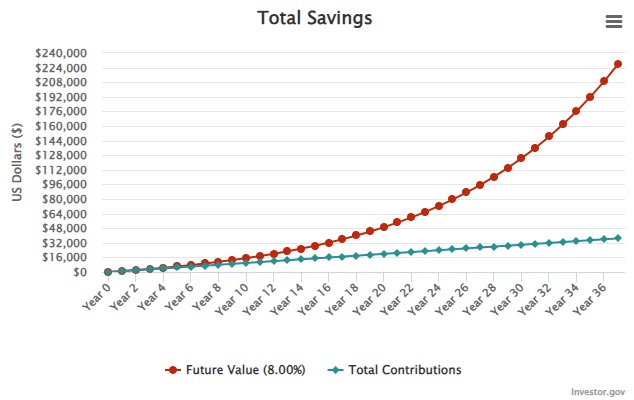

If we say a month averages to 4.3 weeks (52 weeks in 12 months), that’s roughly $25.80 a month. You know what? Keep the change. We’ll invest $25 a month and assume, on average, the stock market is going to yield an 8% return. (Yes, fellow nerds, I know it doesn’t average 8% every year and thus the exponential curve below would not be as uniform IRL, but we’re talking investing lottery tickets here. We just want a general idea.)

Age can be a huge variable as the longer your money is invested, the more the power of compounding interest works in your favor. I’m going to go with a lottery ticker buyer that’s 40 for our example as it seems like a happy medium. The average life expectancy in America is around 77 years. That gives us 37 years of lottery purchases.

The green line shows how much the Powerball tickets cost using the scenario above. The red line? That’s the power of compounding interest, my friends.

In this scenario, purchasing one Powerball ticket for each drawing comes out to around $312 a year.

The same studies used above, however, show that Americans, on average, actually spend closer to $1,000 a year on lottery tickets. So let’s use that average with the same assumptions and compare.

If the average American spending $1,000 a year in lottery tickets invested it instead, that alone would grow to over $220,000 during their lifetime. Crazy stuff, right?

All that to say: be intentional about where your dollars go, because they have amazing potentials of growth.

And good luck on tonight’s jackpot everyone else who’s bought a ticket. What are y’all doing with that sweet moola if you win?