Life happens. You lose your job. Your furnace goes out in the middle of winter or your air conditioner busts at high noon in July. Your appendix bursts and you get to spend your Friday night at the hospital. Emergencies crop up, and they seem to target us when we’re the least prepared for them. Below, we cover how to budget for unexpected expenses. When Murphy in a Scream mask is standing behind your refrigerator door, we want you to be able to stab him to death before your budget bleeds out.

Make sure you’re actually budgeting

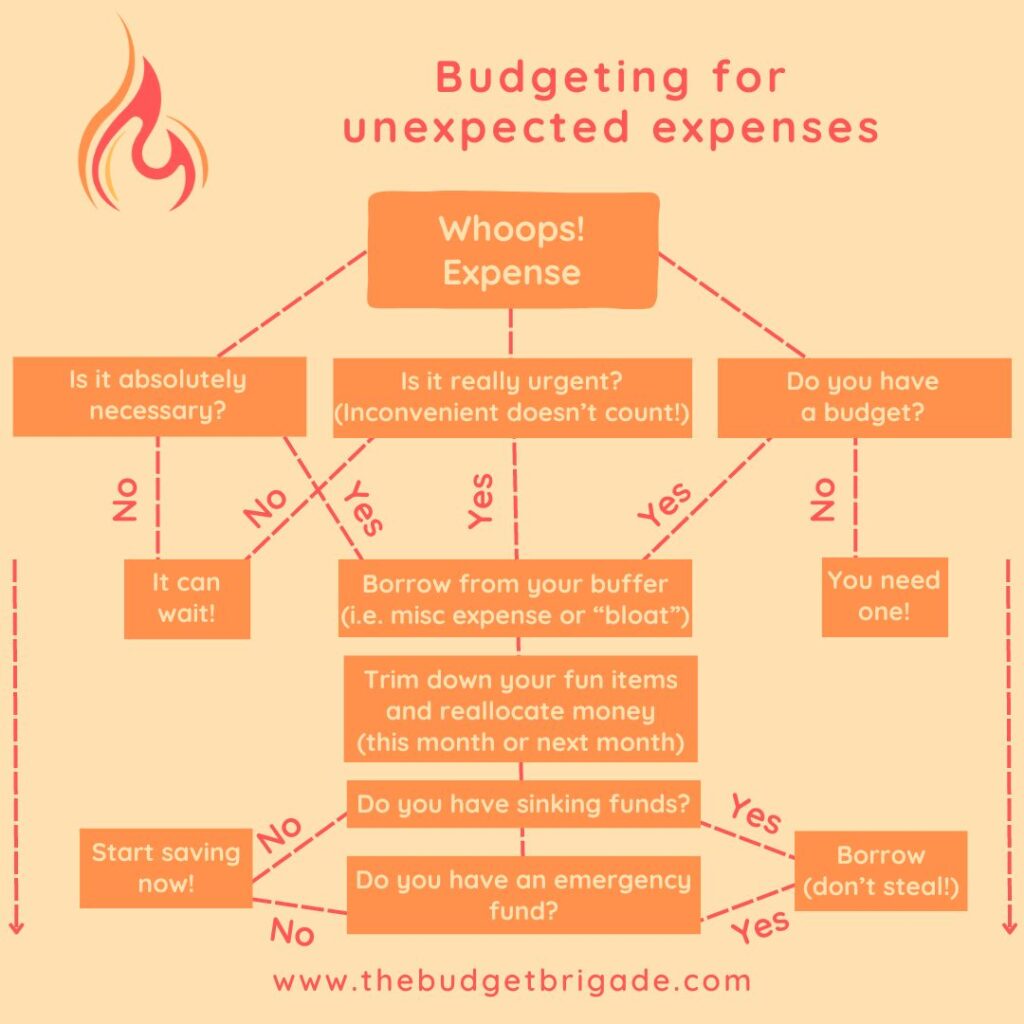

If you aren’t budgeting, you may have less of an unexpected expense and more of an unplanned one. A budget isn’t something that confines and controls you. Au contraire, my friend! A budget puts you in the driver seat so this guy isn’t in charge of your finances:

By sitting down and budgeting before every month begins, you’re already three lights ahead of those pesky little unexpected “surprises” that pop up because you aren’t paying attention.

Your budget is like your security alarm system in your house. It’s the first line of defense to alert you that hey, some whack job just broke the back window and crawled in wearing a Halloween costume, carrying a really sharp kitchen knife.

Learn more about making your first budget.

Have a buffer in your monthly budget

While a budget is a great first line of defense, it isn’t foolproof. Sometimes, you forget to set the alarm, or the slasher murder finds the one window in the house that doesn’t have the shattered glass sensor installed.

In this situation, we shift our tactics from running Wall Street or into the basement like idiots always do in horror movies and channel our inner Kevin McCallister and put out a booby trap.

There are two types of traps we put in our budget for unexpected expenses: the purposefully padded budgeting line items and the junk drawer expense, AKA the miscellaneous expense.

The miscellaneous expense line item typically only gets $25 because after several years of doing a zero-based budget, we’ve got our budget pretty dialed in.

Plus, I like to leave room for “treat yoself” splurges in the budget now that we’ve reached Coast FI status. I’m a natural saver, so I often feel guilty spending money. In those instances where there is something I want to get or do, I often feel guilty spending if I don’t have this padding, even though I know logically we’re saving enough for the future.

If you’re deep in debt and working to put out the dumpster fire finances of your yesteryears, the padded budget likely isn’t the best strategy for you in this season of life. You should, however, build a buffer in your checking account. We’ll cover more on why below.

Know how to PIVOT! and adjust on the fly

If you have a larger unexpected expense, like a tire blowout or a chipped tooth that needs attention, you may not have enough booby traps to stop this intruder. It’s time to bring out the big guns then and decide which of your children you want to save first.

We don’t have enough intention padding in our budget for a $1,000 car bill, and we refuse to go into credit card debt, so an emergency budgeting meeting is required for this situation. We look at what we’ve spent so far this month and where we can cut back to make up the difference. That’s right, we PIVOT! from our Kevin McCallister tactic to Robin Hood. We rob from the rich budget line items to give to the poor. This is less padding and more intention fasting for the rest of the month.

Common areas where we adjust and tighten the budget include:

- Alcohol (it’s bad for our livers anyway)

- Clothing

- Dining out

- Entertainment

- Entrepreneurship

- Groceries & households (we survived off pasta and marinara in college, it won’t kill us for a few weeks)

- Presents (guess who’s getting a homemade card this year)

- Vacation (this one makes me cry, but you gotta do what you gotta do)

If it’s closer to the end of the month and you don’t have enough pennies to pinch together, you can consider “floating” it for a few days and rolling it into next month if the unexpected expenses can’t wait. We do this by entering the expense on the first of the next month versus on the actual date of the expense. You just have to make sure you have enough cash on hand to pay the expense upfront before your next paycheck. This is where having a buffer in your checking account can save your skin.

Can’t stomach stealing from your fun money either this month or next? Consider if you really need to pay for the unexpected expense after all. Often what we consider at first to be a need is actually a want in disguise. Yes, your car needs tires to get you to work so you can get paid. But if it’s the auxiliary jack or charger cable that stops working, you can live without getting that fixed. And maybe you remove a nail between the treads and plug it versus replacing all four tires. We’ve both survived Florida summers for a season with car A/Cs that didn’t work. We learned to pack a towel to collect the leg sweat and take a spare set of clothes to change into at our destination. Desperate times, desperate measures y’all.

And if it comes down to being able to buy groceries next week or buying a present for your second-cousin-twice-removed’s kid’s birthday party, then maybe you get creative with gifts this year. Not all unexpected expenses have to be purchased at all. Some you can let pass you buy, even if they seem like a good “deal,” like an invitation to a family trip to Disney. Mickey Mouse may have to wait until next month or year.

Know the non-negotiables you never rob

You’ll notice I have preferred budgeting items above we trim down to cover emergency expenses. There are some expenses I refuse to rob unless there is no other option except digging into the emergency fund. These are primarily our investing. Automating your investing and treating it like a bill you’re paying to your future self is one of the top 10 financial hacks we wish we’d learned earlier. I’m not above to reverse that automated investing now, I’m still making up for lost time.

Set up sinking funds for future serial killers

Some unexpected expenses aren’t that unexpected. You know Christmas is coming and that you like to spend a lot on food, decorations, and presents to make it a holly, jolly season. This is not unexpected–you know January 1st you need to start planning.

If your car has 100,000 miles or you’re close to seeing the top of Lincoln’s hat over the treads, you know you have car maintenance coming up. That isn’t unexpected. Be like a Boy Scout and be prepared!

If you had to recharge your air conditioner last summer and the summer before that, a new unit is in your future.

Don’t wait for the “unexpected” to become an emergency that catches you off guard. Jump on the offense. When Kevin McCallister sees the thieves poking around, he doesn’t wait for them to kidnap him. He gets to work booby trapping the entire house.

In this case, sinking funds are your booby traps.

With sinking funds, you save a little every month ahead of an “unplanned” expense so when your car or A/C finally dies, you have the cash to repair or replace it.

Learn more about sinking funds.

In case of fire, break glass on your emergency fund

This is the absolute last step, but this is what the emergency fund is for. The best offense can be a good defense, and your emergency fund is your largest line of defense against unexpected expenses.

We think everyone should have an emergency fund, even though we do everything in our power using the methods above to prevent us from having to touch it.

If you have to use emergency funds, borrow in this situation instead of robbing. At least when you borrow money this way, you only lose out on earning interest versus owing someone else interest.

Learn more about how much you should have in your emergency fund, how to save it up and where to keep it.

The final word

Just because an expense comes up unexpectedly doesn’t mean it has to be addressed right away (or at all), and it doesn’t mean that expense is an emergency worthy of the holy grail of your emergency fund. We hope the process above helps you budget for unplanned expenses as they pop up so you don’t spend your life playing Whack-a-mole with your wallet.

Explore all our free budgeting resources for more tips on how to take control of your money.