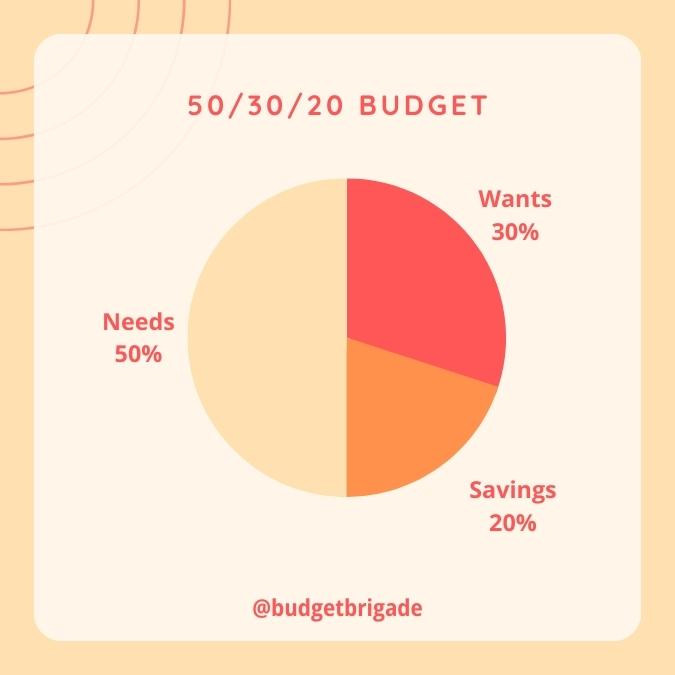

While the 50/30/20 budget is a nice template to guide first timers, we don’t think there’s a one-size-fits-all budget. There are plenty of factors that require adjusting the 50/30/20 budget. We cover several situations below and offer some recommended alternative percentage splits.

Primary Factors That Play Into Adjusting the 50/30/20 Budget

The following are the four major factors that typically drive adjustments to the standard 50/30/20 budget.

- Your income

- The amount of debt you have

- Your savings goals (esp. if you have no savings to start)

- The size and age of your family

Let’s look at specific examples for each.

Adjusting the 50/30/20 Budget for Income

In general, the more income you have, the smaller the percentage of your pay you should target to your needs category.

For example, households with an after-tax income of around $50,000 have a much greater necessity to allocate $25,000 a year toward needs than households with a $300,000 annual income have to spend $150,000 a year on their foundational needs. While the standard of living naturally increases with income, we don’t think it should be a one-for-one increase.

Lifestyle creep is a budget buster that keeps many high-income households living paycheck to paycheck while looking rich in their financed cars they park in the driveway of their mortgaged McMansion after returning from a vacation they put on 30% interest credit cards. We don’t want that future for you, and we hope you don’t either. There’s a huge difference between looking rich and having financial freedom. While the former may look better on Instagram, the latter brings you peace and gives you the power to control your life.

Smaller income households may require over 50% needs to get by, though we challenge you to get as creative as possible to keep your needs category the smallest percentage possible (while staying safe) so that you can maximize your freedom FIRE potential. Affordable housing is a growing issue where we live. Rent prices have nearly doubled since we last rented. We get that life is expensive. But often, there are ways to cut housing expenses. House hacking (renting out a room or portion of your house) has become a popular option. My husband and I lived with a roommate until the year we got engaged. If the housing market was the same then as it is currently, we would have had no qualms continuing to split the townhouse we were renting in order to keep our living expenses low to save faster for our down payment. Sharing a kitchen was nothing compared to cutting our living expenses in half.

Adjusting the 50/30/20 Budget for Debt

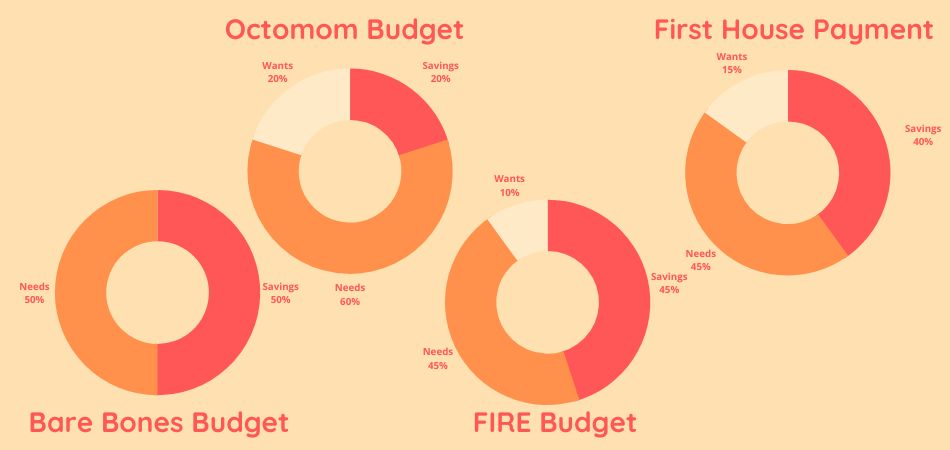

We call this the Bare Bones Budget. It’s the Budget Beagle’s least favorite, because there’s no money for bones or treats in this budget.

If your needs are too high, your budget should focus on getting your debt and other required payments out of your life. You can skimp on some savings for retirement, though we want to make sure you at least have an appropriate account buffer to cover your bills and enough of an emergency fund to get you out of trouble.

We want you to take any free employer-sponsored retirement matching at this stage, but then we want every other spare penny going to your debt. That means that the usual 20% for savings should be closer to 50% because I want to rob you momentarily of almost all of your 30% wants and use that to attack your debt. Think of paying off debt as paying for the ghosts of wants past if you want to trick your brain into thinking you’re still working the 50/30/20 budget. I like to think of it as saving your future self from more interest payments and stress. Almost all of your 30% wants category should go to your credit cards and loans in this situation, not to Regal and Chick-Fil-A.

If you don’t know where to start with your debt payoff, we’d covered the debt avalanche and debt snowball, two popular methods to help you climb past Rung 4 of the FIRE ladder.

If you’ve paid off high-interest debt, we want you investing more in retirement, but you can shift some of your savings goal temporarily for your first house or to paying off lower-interest debt.

Adjusting the 50/30/20 Budget for Kids

Anyone who has spent a year buying diapers and formula will tell you – kids are expensive. And that’s before they have hobbies. Having more kids costs more money. Shocking, I know!

There will be a decade or two where the budget is going to be tighter in order to keep your family alive. Octomom is going to have more needs than a DINKWAD situation. Such is life.

Just don’t sacrifice your future for your kids’ present. While we want to make sure they are fed and cared for, you don’t need a mortgage on a 3,000 square foot house with a pool that’s 40% of your pay, especially if you have daycare you need to factor into your needs category as well.

Kids can also put a strain on the wants category. Organized sports, summer camps, and other activities can add up quickly, as can vacations with kids. While a single Octomom may need to spend more than 50% of her $50,000 household income to get through the month, a $150,000 household family with car loans, student loans, and credit card balances already stretching their 50% needs categories doesn’t have the luxury of space camp and ballet classes overreaching their 30% wants. If this household wants to help send their kids to college, we urge them to budget that into their 30% wants category instead of stealing from their retirement. If Junior has to choose between T-ball in the sweltering summer heat and not drowning in student loans for college, he’ll probably be fine setting up a makeshift diamond in the front yard with his friends. Especially when he grows up and doesn’t have to support his parents because they have health issues but not enough saved retirement. While it’s fine to trade off between needs and wants in the crazy middle years of raising kids, we don’t want you stealing from the 20% savings, especially if you have a six-figure household income. If anything, we want you to trim your needs and wants down in order to save closer to 25% for your retirement, though we realize this may be a stretch in your 30s-40s until the kids get out of the house.

Adjusting the 50/30/20 Budget for Savings

There are seasons of life when we have big savings goals. A few that come to mind are:

- Saving for a house down payment

- Paying off your mortgage

- Saving for a rental property

- Starting your own business

- Funding college for your kids

- Planning for an epic vacation or mini-retirement

- Front loading retirement for FIRE

In these seasons of life, we want you still saving between 15%-25% for retirement while continuing to save for your other goal(s), so your savings portion of your budget will likely be closer to 30%-50%, depending on your timeline and disposable income.

While this may be phrased as “sacrifice today for a better future,” we don’t think it always has to be a sacrifice. Having a lower cost of living that keeps your needs below 50% and finding frugal fun that brings you joy can minimize your wants and needs categories without you feeling like you’re having to sacrifice.

The High Cost of Living Problem

In some areas of the country, the cost of living has outpaced wages significantly. Lifestyle creep can also cause you to look up and realize your standard of life has outpaced the 50/30/20 budget in the needs category. While we want you to find ways to lower your needs, housing in certain areas, such as New York City and Silicon Valley, can create a pinch on the budget and push your needs past 50%. That’s fine for a season.

If you find yourself without a path to increased wages or a way to reduce your needs, it may be time to sit down with your overall freedom FIRE picture and assess what needs to change in order for you to have a life of peace in the long run. That might include a second job to pay down debt to reduce your needs, moving to the suburbs to get cheaper housing expenses, or starting a new job in a completely new area. Change is hard, but not being willing to change now can lead to even tougher discussions down the road.

Adjusting for FIRE

The sooner you hope to achieve your freedom FIRE, the more you’ll need to save. If you’re hoping to truly retire early, or to at least find financial independence before the standard retirement age, you’ll likely need a savings rate closer to 35%-50% of your income funneling into retirement and investing.

While minimizing your needs and lifestyle will allow you to push hard into investing, we caution not to go too extreme. While financial independence is a goal we want for everyone, hating your life for a decade now just to need to retire early because of burnout from over-revving your budget for years won’t bring you any additional peace. Find a balance with your budget. In our experience, we’ve learned it’s worth working a few extra years in order to enjoy our work week for the next decade and a half versus toughing it out in high-rewarding but high-stress positions that give us a case of the Mondays every week.

Late starters to investing for retirement, depending on their time horizon and current net worth, may find themselves with a similar adjusted budget to early FIRE savers.

The Freedom FIRE Budget

Once you’ve paid off your debt (especially when you knock out your house, too), your needs should be a lot less than 50% of your after-tax income.

Unless you have more money invested than you’ll ever spend in a lifetime, we still want you saving some, but you can likely lower the threshold below 20% and focus on tax-advantaged savings opportunities. Or save, but intentionally for large life goals (perhaps a travel trailer to road trip across the country, or a world voyage cruise).

When you reach your freedom FIRE, don’t forget to enjoy more! There’s no point to this journey if you don’t have contentment and joy along the way.

Readjusting in Different Seasons

The 50/30/20 budget is a basic template to get you started. As shown in the situations above, adjust the 50/30/20 structure to fit your situation.

When your situation changes, which it will several times in life, your percentages should change with your circumstances.

A few key reminders when adjusting the 50/30/20 budget:

- The less your needs, the more freedom you have.

- Focus your wants on what aligns with your FIRE ladder goal(s). Cut excess spending on wants that are impulses that don’t align with your long-term vision.

- Once you’ve got high-interest debt paid off, aim for a minimum of 15% income investing. We’d love to see closer to 25% on average. Remember, the more you save earlier, the more opportunity it has to grow.

If you find yourself in a new season of life and don’t know where to start with your budget, explore our budgeting station or ask for help in either The Budget Brigade Facebook community or in the comments below. If you’re feeling completely overwhelmed, we offer one-on-one consulting to help you design your budget to tackle your FIRE goals.

I like using the 50/30/20 budget as a base for different situations and seasons of life.