The 50/30/20 budget is a cornerstone of the personal finance community. We agree it’s a good general guideline for certain situations. We caution, though, to stay mindful as your income increases. You want to avoid lifestyle creep that will keep you chained to your current income generation. Below, we cover what the 50/30/20 budget means and what we include in each category.

What Is the 50/30/20 Budget?

The 50/30/20 budget helps you plan how to allocate your pay. Generally, it’s purposed you allocate your take-home pay. We agree, with a few notes:

- Retirement contributions taken out of your paycheck counts toward your savings percentage. So if you’re already maxing out a 401(K) plan on a smaller income, you don’t need to save an additional 20% of your take home pay towards retirement.

- We suggest checking how much your insurance premiums are if you have copays to employer-sponsored plans withheld from your paycheck. Considering them when evaluating your needs, especially if you are teetering close to the 50% mentioned below already.

- If you’re self-employed, make sure you back out your self-employed taxes before adjusting your budget. Taxes can eat up a good 20% to 30% of what you bring home before you make your estimated payments. Do not budget on the contractor “take home” without adjusting for this large chunk of income, as it’s already promised to Uncle Sam.

We recommend doing your budget on a monthly basis to better track your spending and savings for your goals. If you don’t have a goal in mind for your money yet, visit our FIRE ladder page to learn about our path to financial freedom.

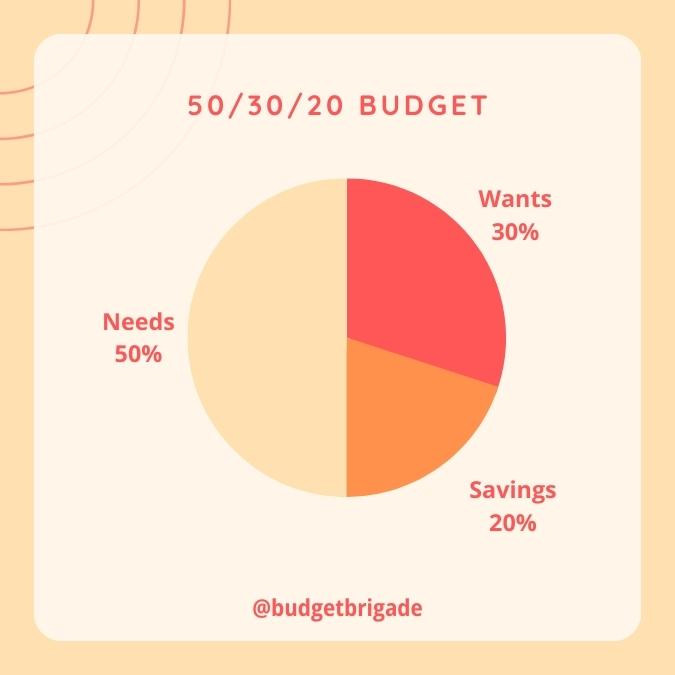

With the 50/30/20 budget, you break the spending portion of your budget down into three broad categories and assign a percentage to each:

- 50% of your income to needs

- 30% of your income to wants

- 20% of your income to savings

We don’t think this is the perfect allocation for every household, but if you’re budgeting for the first time, it’s a great guideline to use at the beginning.

50% Needs

The largest chunk of our 50/30/20 budget goes to needs. A maximum of 50% of your budget should go to needs. Ideally, we’d love to see this percentage as small as it frees up more opportunities for your goals and to achieve your freedom FIRE faster.

Needs include:

- Debt payments

- Housing & utilities

- Transportation

- Insurance premiums

- Food

- Healthcare

We need to dig a little deeper to clarify.

Just because the broad category is a need doesn’t mean everything that falls under it is.

Let’s look at a couple examples.

- You need food, but you don’t need it DoorDashed or Instacarted, and you don’t need to eat out every other night.

- You need clothing, but you don’t need a subscription service or designer brands. I have never once needed to buy anything at Kohl’s crazy prices.

A special note on debt payments: if you have any debt that is accruing more interest than the minimum payment you’re required to make, you need to up that debt payment in your budget as part of this 50% needs category. You should always tackle at least some of the principle balance. Otherwise, that debt will continue to grow, working against all the hard work you’re going to do in the savings category. Student loans are an example of where this often happens.

30% Wants

Wants is the category everyone enjoys, as they should! The point of budgeting isn’t to tighten the purse strings so tight you have zero life. (Though we believe there’s a lot of free and frugal fun out there.) The 50/30/20 budget assigns 30% of your income as defined above for wants. This includes the upgrades to needs we mention above.

In our personal budget, we fluctuate but push leaner in this category. From our perspective, the more you can save for retirement, the more you can insure you can have fun not just today but in the future as well. Shifting part of the needs and wants into savings means you’ll have more wants spending available, it’s just the delayed gratification kind, which we know can be hard. This is why goals are so important. They can help align your spending on wants and needs now and in the future.

The two categories can have some crossover as well. For example, saving for a grand vacation or mini retirement years down the road could classify as either a want or savings. Don’t get bogged down in the details. As long as you’re focused on saving, you’re hitting the goal. Though we do like a minimum of 15% heading to investing savings for retirement, instead of sinking funds for these goals, but we’ll dig into that in the next few sections.

For now, wants include:

- Entertainment

- Vacations

- Kids’ activities and sports

- Adults’ activities and hobbies (including hopeful entrepreneurial projects)

- Upgrades to your needs

- Eating (and drinking) out

- Subscriptions and memberships

- Beauty and personal care

* We polled family and friends. Survey says: deodorant and toothpaste count as needs, not wants.

20% Savings

Now to our favorite part of the budget. The 50/30/20 budget recommends putting 20% of your income into savings. We want this number to get as high as possible, especially in your prime investing years for compounding interest, so you can reach your freedom FIRE as soon as possible.

Early on your personal finance journey, when you still have high-interest debt such as payday loans, personal loans, and credit cards, we’re okay with you keeping this portion minimal in order to put out those fires. If you want, consider any payments over the minimums into this 20% savings goal. If you get a significant employer match (50% – 100% match), we want you to take that match. Then we want you to attack that devil debt like it’s the fire raging in your home. Because it is!

Once you free yourself from the death grip of high-interest debt, shift your focus on investing for retirement. If you still have a lot of student loans and a high mortgage balance, especially with interest rates above 4%, we’re okay with balancing paying them off in this savings portion with the retirement portion, but we’d like to see at least 15% going into investments once high-interest debt is out of your life.

This balance is why we really prioritize this category. The more you can free up to pay off debt and save for the future, the sooner you can find freedom and unchain yourself from all the obligations in your life. If you have a higher income, we like to see at least 25% heading into retirement investing and the rest chunking down that debt. If you want to leave retirement at 15% in order to knock debt out quickly so that you can use that freed up cash flow to invest like a boss, we won’t be mad about that either.

Savings include:

- Tax-advantaged retirement accounts

- Brokerage investing accounts

- House fund

- Additional payments of debt

- College savings for kids

A Note on College Savings

Please, please, please do not sacrifice your retirement in order to send your kids to college. If you haven’t reached FIRE and you don’t have 15%-20% of your income consistency going into investing, college is a want, not a necessary savings goal. If you have the extra room in your wants category, feel free to move college funds there. Prioritizing a path for your children at the cost of your own GPS will only leave you both lost. Helping put your kids through college just to need them to take care of you when you can’t retire isn’t a gift in the end.

Time to Get Started

That, my friends, is the 50/30/20 budget. Its simplicity is part of what makes it so popular in the personal finance arena.

While we appreciate how having this system can be a great way to get people budgeting for the first time, we understand every situation differs, including ours. These percentages are not concrete rules you have to stick with, although if your needs exceed 50%, I challenge you to assess each aspect of that category and find ways to lower it below 50% overall. It’s hard to start the retirement fire when you’re busy putting out all these smaller fires in your needs category. Visit our budgeting expenses page for ideas.

Different factors can play into how you set your target budget percentages among the three broad categories. Visit our adjusting the 50/30/20 page to learn how to tailor your budget to this season in life.