So many people equate income with wealth, but statistics blow this myth out of the water like Jamie and Adam exploding an old water heater. The key to wealth isn’t the money you can make—it’s how much of that money you keep. If lifestyle creep has all your money going out, you aren’t any wealthier than someone living in poverty. Below, we cover some stats of the real key to wealth, what the average salary for “comfortable living” is, and quick tips to curb your spending enthusiasm so you can get rich.

- Even high-income earners can be broke as joke.

- Wealth is determined by how much of your money you keep, not by how much you make.

- The more you invest, the higher your opportunities for wealth.

- A budget is an important tool to help you focus your spending intentionally so you can keep more of your money.

Cover your basics

While your income isn’t the key to building wealth, it gets you running up that hill (Stranger Things fans, you’re welcome!). Your income doesn’t guarantee wealth, but it’s hard to build wealth when you’re unemployed or living below the poverty line.

Trying to get a baseline “comfortable” living salary is hard as it is very location dependent. A comfortable salary in rural Arkansas could equate to living in a cardboard box on a street corner on the Upper West Side.

Stats thus vary significantly. SmartAsset did a study in 2023 to see what the average across the 25 largest metro areas in the US were, based on the 50/30/20 budget we’ve talked about. They determined, on average, you need a household income of around $68,500. (1) This is significantly higher than the poverty level of around $30,000. (2)

If your expenses are higher than your income, you aren’t ever going to make traction in building wealth. Thus, the underlying foundation for wealth is making enough to cover your basics. Not all the extra add-ons, but the monthly expenses it takes to run your household.

If you make around the $68,500 household income referenced above and live paycheck to paycheck, it’s time to do a serious audit of your budget and see what might have to give in order to make traction. Where is all your money going? To debt? To a huge house payment? Cars? Subscriptions?

You can’t stop paying your bills, but you can cut them down. You might need to house hack with a roommate. Or it might be time to consider moving to a lower cost of living (COL) area or downsizing to a smaller house or apartment. (Or both.) The brand new truck and SUV in the driveway might need to Clark Kent their ways into 10-year-old Toyota and Honda sedans.

If you have an income problem versus expenses, it’s time to look for a better paying gig or to get side hustling.

Visit our budgeting station and entrepreneurship station for all our resources for this first step on the wealth building journey.

Key to Wealth: Minimizing your spending maximizes your wealth

Savings, not income, is the key to maximizing your wealth building potential.

The more you can save, the faster you can own your time, not just your stuff.

“But I don’t want to sacrifice for the next twenty years of my life just for the potential of a good retirement. What if I die before I reach that point?”

Saving for the future doesn’t mean today has to suck. Building wealth doesn’t require a huge sacrifice of no fun or joy long term. In fact, wealth building relies heavily on contentment.

Remember, spending money doesn’t equate happiness.

Intentional spending on what matters to you and your goals is the radioactive spider to your superpowers. By focusing your spending—with the help of your budget—you can find margin in your money to build great wealth.

Using this method, which doesn’t involve sacrificing any key organs or selling off your kids, you can have a wonderful future while enjoying life day to day now.

Think of it like Halloween candy.

If you wait until your kids go to sleep after Trick or Treating and eat their entire pillowcase of candy Jimmy Kimmel style, you’re going to puke your guts out and massively regret it for the next few days as your stomach rebels.

That is spending your money without intention.

If, however, you pace yourself and sneak one mini Butterfinger—your favorite—then your sweet tooth will be content and your kids won’t notice your theft.

This is spending intentionally.

You can learn contentment with practice, and we cover how in my year-end wrap up of my personal journey of learning to be content with what I have. There are plenty of ways to hack contentment to maximize joy while minimizing the financial hangover of fun.

For example, if you’re a foodie, do themed potlucks or one fancy meal a week at home. Add in a nice dinner out each month. This also gives you the advantage of delayed gratification, which can increase your enjoyment of each experience.

One area we hack is new release movies. We only go to the theaters twice a year—my husband and I each pick one movie. Not only does this give us something to look forward for six months until the summer blockbusters drop or over a year until Dune Part 2 finally releases, but it gives us an excuse to have a proper date night and to dress up a little for a special occasion. Win win!

Frugal fun is another great option to put your spending on Jenny Craig. We continually add new frugal fun ideas.

A few other tips to help you cut your expenses so you can jumpstart your wealth.

Pay yourself on autopay like a bill

Prioritize saving in your budget. Right after housing, food, and transportation, give your savings goal the next priority once you’ve paid off debt. Paying off debt is still saving, as it minimizes the interest you pay, making it a great goal along your FIRE ladder journey to financial freedom.

Once you’ve got saving chiseled into the budget (no pencils on this one), set it up on autopay. Your Roth IRA? Automatic $580 bucks gets pulled from your checking account on the same day of each month. Your 401(k) and HSA? That money gets deducted from your paycheck before it even hits your take home pay to go into the budget.

Keep your stuff longer than you usually do.

Let’s talk about one of the biggest budget busters first: vehicles.

Gotta love that zoom zoom or vroom vroom. But you don’t have to love car prices. It’s getting ridiculous. The average monthly car payment is now $729. That’s more than my mortgage, and that’s just for one vehicle. A lot of families have two or three.

This is not a great path to wealth as cars lose value every time you drive them. Consider downgrading your vehicle or keeping your current one longer than you usually do. We create a car sinking fund and pay ourselves $350/month, currently into a high-yield savings account because our cars are getting up there in age and mileage. Our “car payments” make 4% for us instead of costing us 7% to finance. That’s a 11% difference, which beats the stock market average.

The average car on the road in America right now is 12 1/2 years old. (3) That doesn’t mean the average American keeps their car that long. A lot are used cars sold to new owners. We have one “new” car (now about 10 years old) and one “used” car we’ve have almost 15 years that was used when we bought it.

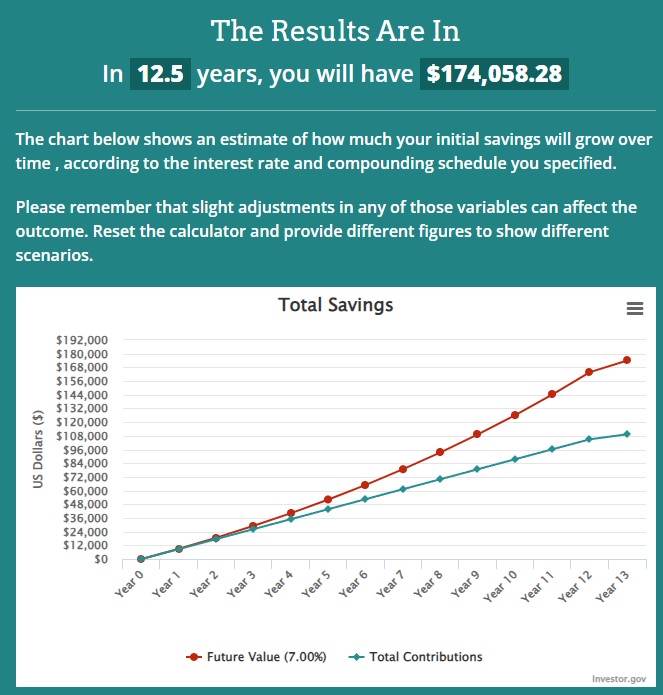

Cars will last. And all that money you’re funneling into payments has staggering growth potential. Don’t believe me? Let’s assume for the average life of a car on the road, you invest the average new car payment for a 7% return versus paying it to a car dealership. This isn’t a perfect example as car loans are usually 6-7 years, not 12.5, but keep that sinking fund going for the sake of the example.

By the time you’re ready to replace your car, you’ would’ll have invested $109,350 and your balance with growth will be $174,058.28.

What about when it’s time to buy a new car?

The average new car costs $48,000. If you skim that off just the growth, you would still have over $64,000 on top of what you saved. We won’t dive into the weeds of capital gains because I don’t want to bore you to death, but even with that, you could easily buy a new car without touching what you invested.

Cars aren’t the only culprits here. Other less mind-blowing possession to consider include:

- Phones

- TVs

- Clothes

- Decor

- Toys for kids

Marie Kondo your life

Haven’t heard of the KonMari method yet? Check out The Life-Changing Magic of Tidying Up to learn why I fell in love with decluttering. Is it life changing? No. But it has definitely made a difference in my path to contentment.

Asses all the shit in your house collecting dust that you have to vacuum up and wipe away on your weekends of “fun.” If it doesn’t spark joy, give it a proper send off to a new home. You’ll likely donation many of your things as they won’t be worth the cost of dealing with spammers on Facebook marketplace, but I bet the money potential sitting around will surprise you. Resell it and save that money.

We made over $400 in the last year selling stuff we no longer use, and I wasn’t even trying.

Key to Wealth: Invest to compound your savings

Saving is great, but if you do nothing with the money you squirrel away, your cash loses purchasing power every year with inflation.

When building wealth, you want to grow your savings in tried-and-true investments that have long success records.

This is the second leg of the relay team key to building wealth.

Tax-advantaged retirement accounts are your best friend here. Our buddies/guys/pals over at the IRS know Social Security sucks, so they try to incentive Americas to save by providing tax breaks and benefits when you invest into plans like IRAs, 401(k)s, HSAs, and 529s.

While the tax benefits of the retirement accounts are great, you also want to focus on what you’re investing in within the account. Putting that money in the cash account won’t benefit you over stashing it in a regular savings account because it won’t have any growth. Asset classes like target date funds, mutual funds, and index funds are great options to keep up with the stock market and ride that compounding interest wave to wealth.

A well-balanced portfolio of different funds within these asset classes can help cover risk and secure your wealth generation. There are a lot of different strategies out there, but we like to keep it rather simple. For example, our last additional IRA contribution to hit the annual contribution limit went to:

- 10% growth fund

- 10% small-cap fund

- 20% total international fund

- 60% S&P 500 fund

To dive deeper into building wealth by investing, check out our retirement station for all our resources.

Why be wealthy?

For our conclusion, I want to bring you back to where we always start—your why/goal.

Fair, it would be cool to be a member of the dos comas club. The tres comas club? That’s Russ Hanneman level.

But being a millionaire for the sake of being a millionaire is a vague goal. Why do you want to be a millionaire? Why do you want to build wealth?

Let this goal drive you.

For me, I grew up seeing money struggles and the strain that puts on people.

I’ve also experienced seasons of that myself, where I had to live in less-than-ideal situations to make the money work. I never want to do that again.

Wealth is like everything else in life—you succeed at what you focus on. So set your life goals and focus on generating wealth to knock them out of the park.

If you haven’t already, check out our FIRE ladder, where we walk through the wealth building journey, rung by rung, to help you climb to financial independence. If you need encouragement along the way, join The Budget Brigade Facebook community for support. We’re always excited to cheer people on.