Show Me the Money!

Net worth is a phrase that people throw around a lot when discussing personal finance. If you’re new to the budgeting game, you might not know the difference between net worth and income, and it’s an important distinction to make, so let’s dive in.

Math, Math, Baby

In simple terms:

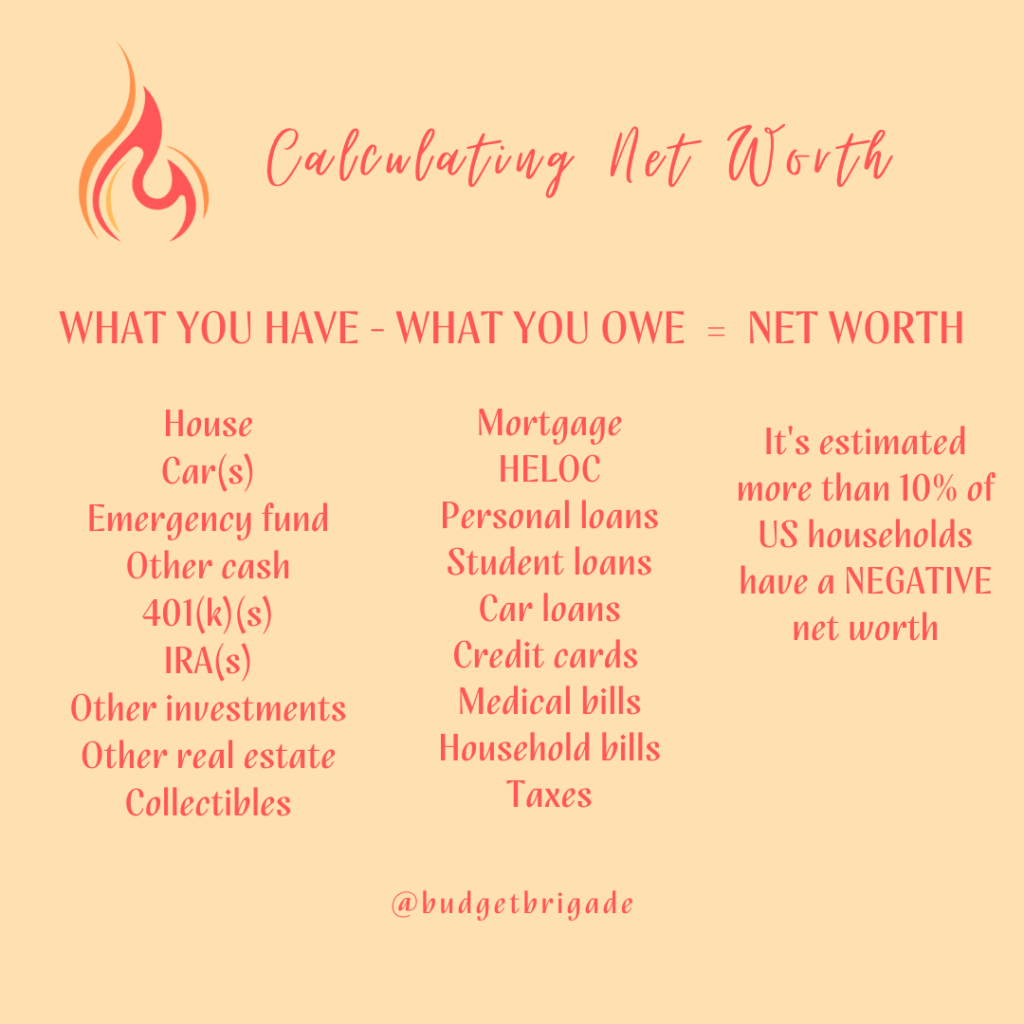

Net worth = what you have – what you owe

What You Have

To calculate what you have, add up all your assets. An asset is anything you own that adds financial value. Common examples include:

- Your house

- Your car(s)

- Your emergency fund

- Other cash in your bank account(s)

- 401(k) balance(s)

- IRA balance(s)

- Other investments

- Other real estate

- Valuable collectibles (jewelry, etc.)

If you run a business, you can take into account your ownership percentage in your business once you’ve calculated its value (this is a little more complicated and something we’ll cover over in the entrepreneurship section).

What You Owe

Let’s be honest, adding up what you have is a lot more fun than admitting what you owe, but this is a crucial part of assessing your net worth and evaluating where you are in your financial journey. And don’t worry, if the number you calculate below freaks you out, check out our Budgeting and Debt Free sections for tips on how to turn that net worth frown upside down.

To calculate what you are, add up all your liabilities. A liability is something you owe to someone else. Common examples include:

- Mortgage loan balances

- HELOC loan balances

- Personal loans

- Student loans

- Car loans (this includes leases!)

- Credit card balances (even if you pay it off every month)

- Outstanding medical bills

- Outstanding household and other bills

- Back taxes or estimated tax payments

- Alimony

- Child support

It’s a lot, I know. But be honest here. The first step to finding freedom is admitting you have a problem.

Notice Something Missing?

People often assume if you make a good salary, you have a high net worth. But salary doesn’t factor in at all above. If you earn a lot but turn around and dole it out to everyone else, you’re still broke! I made $30,000 in my first engineering job after college. It was a lot less than most of my counterparts going into corporate engineering. I swallowed my pride and moved back in with my parents for a season to cut my expenses to almost nothing. Less than a year later, I’d paid off all my car and student loans and found a modest apartment to move into, the first place I ever called my own. My counterparts, on the other hand, used their big corporate salaries to move into luxury apartments and to purchase fancy cars. Their lifestyles increased to match their incomes. As such, I blew past their net worth within a year.

I don’t mention this to humble brag. I raise the contrast to make a point: the fastest way to increase your net worth is to live below your means. It’s not rocket science. (Trust me, I dated a rocket science. Orbital mechanics is wayyyyy more complicated.) Sadly, outspending your income is a problem facing many households in America. In 2017, the US Census determined that more than 10% of US households had a negative net worth.

It’s worth a little sacrifice today for a steady, stress-free future. Explore our site for ideas on how to cut your expenses and increase your income in order to gain traction with your net worth. If you’re stuck or have no idea where to start, book a budgeting session with me for personalized help and advice.