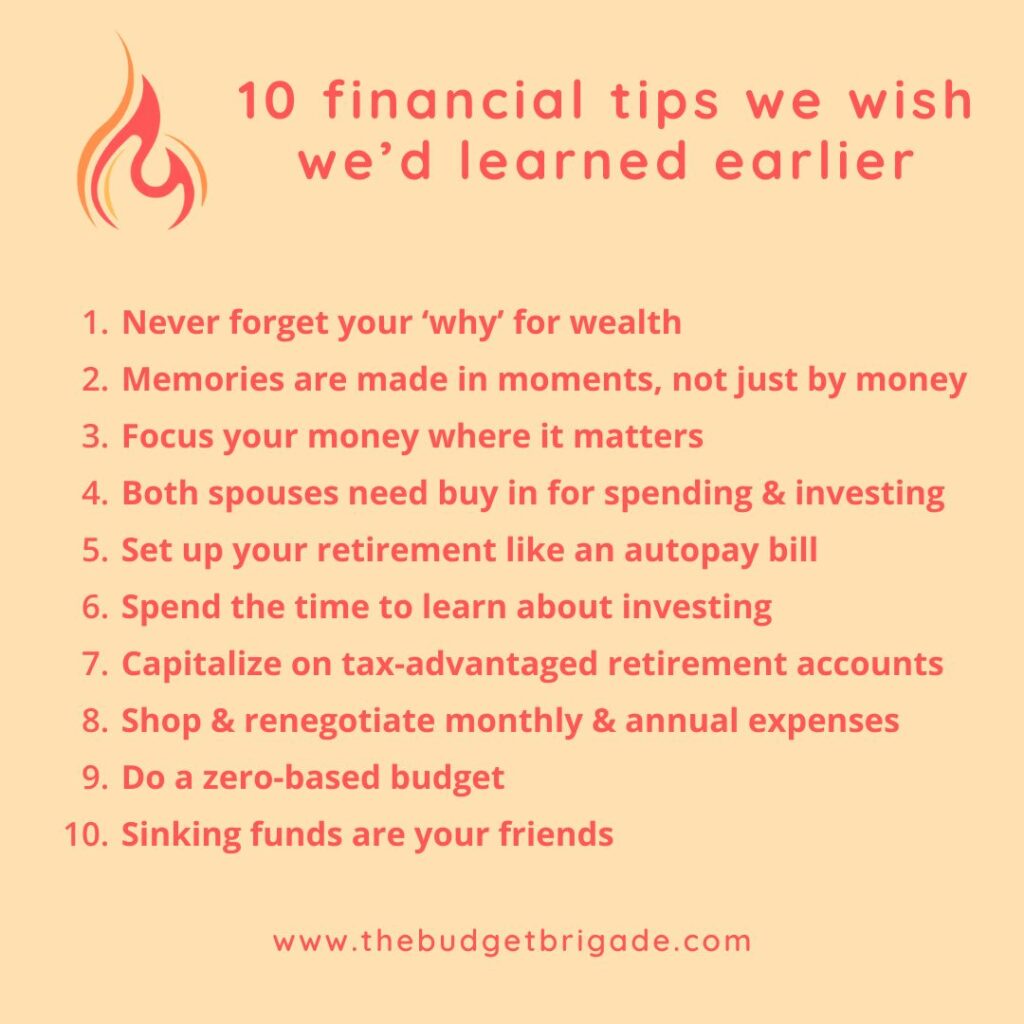

Ready for a sad fact of life? No matter how soon you get on a budget and focus on saving for financial independence to retire early (or even just on time), you’ll wish you’d started earlier. We’re no exception. While we’re happy with where we are on the FIRE ladder, there are mistakes one or both of us made that we wish we’d done differently. Below, we cover the top 10 financial tips we wished we’d learned earlier in our financial independence, retire early (FIRE) journey.

10. Sinking funds are your friends

Sinking funds are a great way to save up for large, planned expenses that can otherwise drop an ACME anvil on your monthly budget. While you don’t need a sinking fund for everything, especially if it’s easy to cash flow from the wants category of your budget, there are plenty of reasons to set up multiple sinking funds, including:

- Car fund

- Christmas gifting

- Capital improvements on your house (solar panels, a fence, a shed, a pergola, a pool, etc.)

- Home maintenance and repair

- House down payment

- Vacations

- A wedding

I love having a vacation sinking fund. Not only does it ensure I can afford to go on our planned vacations when it comes time to pay the expenses such as airfare, hotels, and rental cars, but it gives me freedom to dream. Where do we want to go next? Japan? Antarctica? The Galapagos Islands? All these trips come with hefty price tags, so I like to step up a monthly amount we put into our vacation sinking fund so we have options when it’s time to take our PTO. Plus, life is always better when you have a vacation on the schedule.

Having a sinking fund for major maintenance and repairs isn’t as fun or sexy. No one enjoys paying $15,000 for a new roof or $6,000 for a new air conditioner. But we enjoy having the money saved up when we know these big repairs are coming because crap is getting old. Planning for maintenance ahead of time also helped with more “fun” projects such as our bathroom remodel and replacing the flooring. A lot of contractors even offer a cash pay discount, which sweetens the sinking fund deal.

9. Do a zero-based budget

For years, we did a “budget” based on our projected annual income, which is a laugh now that we look back because I had a variable income as a self-employed business owner who worked with several clients. Our budget was inaccurate as soon as I finished it. The problem was, we never realized that until a month after because we were always tracking expenses and checking the monthly spending after it occurred.

We’re both natural savers—unless we’re talking books or video games—so this tracking method for didn’t wreck our retirement savings, but it didn’t help us speed up our financial journey either.

Changing to a zero-based budget was a game changer on our FIRE journey. Forget about pennies and lent wedged between couch cushions. We found hundreds of extra dollars a month to put to work for us, instead of wondering where the &#@* it went a few weeks later.

8. Shop and renegotiate your monthly and annual expenses frequently

We were in our mid to late twenties before we even considered this as something one does. #Adulting

We spent soooo much extra on car insurance for years because we kept State Farm after separating our policies from our parents’. It wasn’t until I worked insurance adjacent that I even learned there was a difference between an insurance broker and an insurance agent. And boy, it’s a difference!

An insurance agent sells you just the insurance products they offer. They have no incentive to get you the best deal on the market. If anything, they’re motivated to get you into the most expensive options. An insurance broker shops a bunch of different insurance companies to help you find the best deal. The quotes from the independent insurance broker floored us. Before you could blink, the only thing remaining of ours at State Farm was the dust kicked up in the outline of us hightailing it out of there.

Once we learned to shop our auto policy, we explored all the other options where we could trim our monthly repeating expenses. We’ve saved on our homeowners as well, both intentionally and unintentionally when we got dropped.

Ditto on our phone bills and internet. By switching to a “piggyback” company like Boost Mobile, Consumer Wireless, or Cricket, you can skirt about the insane fees and taxes the big carriers like AT&T, T-Mobile, and Verizon charge, while still using their networks. For internet, we renegotiate our service every year or two as our “discounts” “expire”. *Insert eyeroll here*

But wait, there’s more! Don’t forget your subscription services too! When you cancel a subscription service like Canva, Spotify or Amazon, they often give you free one-month trials to come back. While I’m not willing to pay for their services, I’m sure willing to enjoy them for free. Just make sure you turn off the auto renew option or immediately cancel your subscription after signing up for the trial so it doesn’t bill you next month. Of all the services I’ve done this for, the features still last for the month, even when you cancel right away.

7. Capitalize on tax-advantaged retirement accounts

While my mother helped me open a Roth IRA when I was a teenager, I didn’t carry that retirement investing savviness with me into my first stint of entrepreneurship. Once we got our first “big girl/boy” jobs, we maxed out our Roth IRAs, but I never considered a solo 401(k). I didn’t even realize there was a 401(k) option for self-employed individuals, let alone SEP IRAs and SIMPLE IRAs. It was all alphabet soup to me.

Capitalizing on these types of retirement options in my 20s and early 30s could have been a game changer. Not only would they have allowed us to save on taxes at retirement, but they could have saved us taxes as my own “employer” as well.

Your 401(k), IRA, and other tax-advantaged retirement accounts are some of the best wealth vehicles available to you as you climb the FIRE ladder. Take some time to explore all the different options based on your employment situation.

6. Spend some time learning and understanding investments

While I opened up at Roth IRA in my earlier teens, I didn’t understand a thing about investments. Bonds, stocks, index funds—it was a completely different language. I might as well have been Ron Burgundy trying to understand his dog. Spanish, all of it.

When you ask a teenager how much risk tolerance they have with the money they gave up their after school free time to earn, the answer is next to none. Especially after they realize how much those evil guys FICA and Uncle Sam took out of their gross pay.

I started my investment journey with a very conservative portfolio… and then never updated it. Ignorance is not bliss in this case. Ignorance was thousands of dollars because I never took the time to understand what I was investing in, which caused me to miss out on the most important decades of compounding growth. Even though I opened and invested in my Roth IRA almost a decade sooner than my husband, his is almost worth roughly the same now, thanks to a more balanced portfolio.

We don’t recommend investing in something you don’t understand. When life is pulling you in a hundred different directions between work and relationships and making sure your kids don’t impale each other with lawn darts, it might be hard to find time to even sleep, let alone dive into the stock market. But there are so many great financial books out there and a lot of them come with audiobook versions so you can learn while you chore it up or shuttle the kiddos around. After all, it’s never too early for them to learn, especially if they’ve lost their car entertainment privileges for said lawn darts.

Learn more about some of our favorite investing books we recommend on our financial resources page.

5. Set your retirement up like an autopay bill to yourself

Early in our working career, we contributed to our retirement plans when we remembered. For me, that often meant $100 here, $150 there. Definitely not enough to be sipping margaritas on the beach next to Milton, complaining that I, too, asked for no salt.

One of the best gamification tricks we learned was to pay ourselves first. While this doesn’t mean missing the mortgage payment because we want to invest in our IRAs, it does mean setting up our IRA contributions like they’re mortgage payments.

By setting our retirement up on auto payments, it makes sure we don’t skip a month or miss an opportunity to maximize our tax-advantaged savings. Coupled with the zero-based budget, this is one of the biggest small changes we made to our monthly habits that showed huge gains in our financial journey.

This strategy can work against you with your 401(k) and HSA, since the contributions are taken out before your income hits your bank account. As you progress up the FIRE ladder, our hope for you is that you’ll be able to saving more toward retirement so that you reach financial independence as earlier as possible. When you set up a 401(k) or HSA contribution, it stays that amount or that percentage indefinitely, which means if you don’t consciously check in on it once a year, you might not realize you’re saving less than you planned.

When assessing your retirement savings, it’s often good to do it independently of your monthly budget. Take your gross income into account and calculate both your pre-tax (HSA, traditional 401(k), etc.) and post-tax (IRAs, Roth 401(k)s, etc.) contributions to get the overall picture. Then update your contributions from your paycheck accordingly.

4. Both spouses need to be in agreement—in the monthly budgeting and investing discussions

During the early years of our marriage, we joked that I handled the today finances and my husband handled the tomorrows. This was because I did the budgeting (poorly, as we’ve already discussed above) and he handled the investing.

While this works for our individual interests and was a nice division of labor, it meant that neither one of us had a full picture of our financial standing. Hence, I wouldn’t let my husband rebalance my Roth IRA because we hadn’t fixed the issue of me having no earthly idea what the heck the different investments were and what the differences between international funds, bond funds, or growth funds were.

My husband, likewise, would want to buy a video game whenever it came out, or would up and decide he wanted to upgrade his computer when the musing struck. He didn’t know what the budget was or what we had in terms of sinking funds (and I can promise, I never saved up a new computer fund for him “just because”).

While the division of labor helped balance the responsibilities in our relationship, it left us both disconnected from what the other was doing, which can cause tension and create conflict in a marriage. While this type of drama is what we love about shows like Grey’s Anatomy and One Tree Hill, it’s not super sexy IRL.

When we switched to the zero-based budget, we started holding a monthly budgeting meeting. Also not super sexy, but it gave us both sweat equity in the decision process and helped us both understand what was happening with our money. When I made our first brokerage account transfer after setting up our new monthly budget, I asked to see our asset allocation calculator my spreadsheets-loving husband made and even asked for some recommendations on investment books to read (i.e. listen to on 1.5x speed) so I could get a better understanding of what he did every month.

In our jobs, we cross train so we can cover for our coworkers. We ought to do the same in our finances and marriages. Not only that, but we should get a say, too. Both voices should be heard, because then both voices have bought into the vision together. Rowing together gets you across the lake of working years far faster than paddling in opposite directions.

3. Focus your money where it matters

I spent years blowing my babysitting money on the Blockbuster rental rejects. As a teenager, I didn’t think it was a waste. I thought I was getting a great deal because they were 5 for $20. That’s practically stealing them!

The same was true with bargain books at BAM! And BOGOs at Publix. (Okay, fine, the same is still true at BAM! No one’s perfect.)

I have always loved a good sale, but it wasn’t until the last few years when I zeroed in on our budget that I realized just because it’s on sale doesn’t make it a good deal. If it’s something I didn’t need but bought because it was a “good deal” it cost me more than the better alternative, which is to not buy it in the first place.

Mind blown, I know.

When I went through my Marie Kondo phase and stacked those DVDs and books in staggering piles, I got the first visualization of how much money I’d spent over the years. That money would have been better spent on books I knew I actually enjoyed after checking them out from the library, movies I’d watch more than once, and food that didn’t turn my gut into a dysbiosis wrecking ball.

The babysitting money I forked over to Blockbuster every other week could have grown so much in that Roth IRA I under funded or could have helped me go to school with less debt. The Perfect Score, regardless of a young, hot Chris Evans, was not worth loans for college.

2. Memories are made in moments and they have a better ROI than any other investment

The other piece of the puzzle I missed during my movie buying binges and when I staggered out of BAM! with a leaning tower of Pride and Prejudice was that while I might enjoy this stuff for a few short hours, I missed out on a lot of experiences by locking myself away in my room to watch a movie or read a book. And I’m an introvert, so it takes a lot for me to write this like it’s a bad thing. But memories are made in moments of new experiences, not by the stuff we buy for that little hit of the buyer’s high of a “good deal.”

There are plenty of experiences I could have done with my babysitting money that would have cost the same or less. The best memories I have from my high school and college years aren’t the evenings I spent reading Twilight in bed or binge watching three seasons of Supernatural while studying for finals. The best memories are of eating the entire bread bowl full of broccoli cheddar soup at Panera and then feeling sick for two hours while seeing Poseidon in theaters with my best friends. It was skipping prom to watch Disturbia with my bestie and kicking my flip-flop off onto the soccer field during a college game with my roommate. It was basketball games with my engineering BFF and movie nights bundled up under blankets with my roommates and now husband on a questionably clean couch outside the basketball arena.

While I’m a pop culture junkie (shocker, I know!), most of what I love about movies and TV shows—and even books—is enjoying and discussing them with friends.

I try not to have regrets because they’re a waste of wishing, but if could go back, I would have travelled more when I was younger and it was easier between my health and work and all of the adulting things. Even small adventures around my hometown would have been a cheap option I could afford and get to. Geocatching in the mosquito-infested muck with my brother and our friends was still a better use of my time that watching Daredevil (the Ben Affleck one, not the Charlie Cox one, as that one I might sway the other way on).

New memories and experiences don’t have to cost much or anything—you just have to be willing to seek them out. And hopefully share them.

1. While it’s great to build wealth, never forget your why

When you grow up in situations of financial instability, money can seem like the final destination. You might look at the FIRE ladder and proclaim your goal is to make a shitload of money so you never have to worry about your personal finances ever again.

But money isn’t a goal. It’s a tool to help you reach your goals. Similarly, building wealth for the sake of being wealthy isn’t a great motivator either. What does that wealth provide? What do you hope to do with it?

On a journey as long as financial independence, it’s easy to lose the forest from within the trees.

We’ve both completely burnt ourselves out at different points in our careers chasing big salaries, even after we reached big financial goals. Chasing the money ended up putting us in direct opposition to our goals without realizing it. We wanted financial freedom for stability, yet the lives we were leading weren’t stable in the slightest. They left us exhausted and stressed and everything felt off kilter. We had to pause on the savings rung and remind ourselves of our vision of retirement. With that vision, we remembered that the point wasn’t to sprint as fast as possible to a finish line. The goal was to set ourselves up to do whatever the hell we wanted, when we wanted to.

Realigning our decisions with our goals may have momentarily set us back a smidge in our short-term wealth building, but it’s provided great opportunities for advancement and enjoyment in our career we would have otherwise sacrificed.

Everyone should be able to have a dignified and low stress retirement, but you shouldn’t kill yourself trying to get there, as that’s what fuels the push to retire earlier and earlier. This easily becomes a vicious cycle that spirals out of control.

Your FIRE Freedom

Everyone’s financial journey looks different, but we hope the ten tips above help you as much as they’ve helped us. If you have a tip you think should have made the list, drop it into the comments below to share with others.

Sinking funds are sexy is one of our early episodes on Catching Up to FI. Nice list of priorities.