I hear people say all the time they are working insane hours at their side business around their day job, trying to keep it afloat. They are looking for a quick fix, a simple solution to turn a floundering business idea into an overnight success. But when I sit with them and go through their business or look over their books, it’s clear to me the question they haven’t honestly assessed: do I have a business or a hobby? It’s usually obvious to me what isn’t clear to them: they don’t have a business, that have a hobby. Often times, it’s a very expensive one. They opened their LLC or corporation far too soon into the process and are struggling just to keep from going under while their business debt stacks higher and higher through credit cards and personal loans.

Part of being successful as an entrepreneur is admitting where you are in the process. Starting and running a company is hard work. No one, I mean no one, is overnight success. Stephen King? He had an entire stack of rejection letters from agents before he landed his first book deal. Dave Ramsey started his multinational conglomerate at a card table in his garage. Apple has a similar origin story.

Overnight successes take years of work on the front end before they finally gain steam and hit their growth spurt.

So be humble and honest: do you have a legitimate business or do you have a hobby you hope will one day become a business?

Let’s use The Budget Brigade as an example. Would I love to have a business where I get to talk budgeting and personal finance and business all day? Where I could make a living serving others by helping them improve their financial futures? Absolutely! I would love to couple this with my writing/editing to become a full-time job. But I also have a two year horizon before I think that will become a possibility, and those two years have a lot of time allotted to the goal and a dedicated plan to scale up and capitalize on the growth. I haven’t made any profit off of it yet, so I have sunk very little expense, other than my time, into it. It’s a hobby.

What about Lauren Beltz Writes? Do I wish I could sit home and get paid to read and write everyday? It’s only been my dream since I was about six. But publishing is a difficult and slow industry, and editing takes a while to establish a clientele basis that will cover my bills routinely. So I won’t be quitting my day job anytime soon for either of these projects/aspirations.

Business or a Hobby: What’s the Difference?

A hobby can often turn into a side hustle, which can then become a business. But the IRS in particular has specific rules when it comes to determining if something is a business or a hobby. This doesn’t apply just in the realm of taxes; it’s a good overall guiding principle for you to assess where you are and to help you set goals for where you want to go.

So let’s look into the guidelines a little bit.

Self-Evaluation Questions for Small Businesses

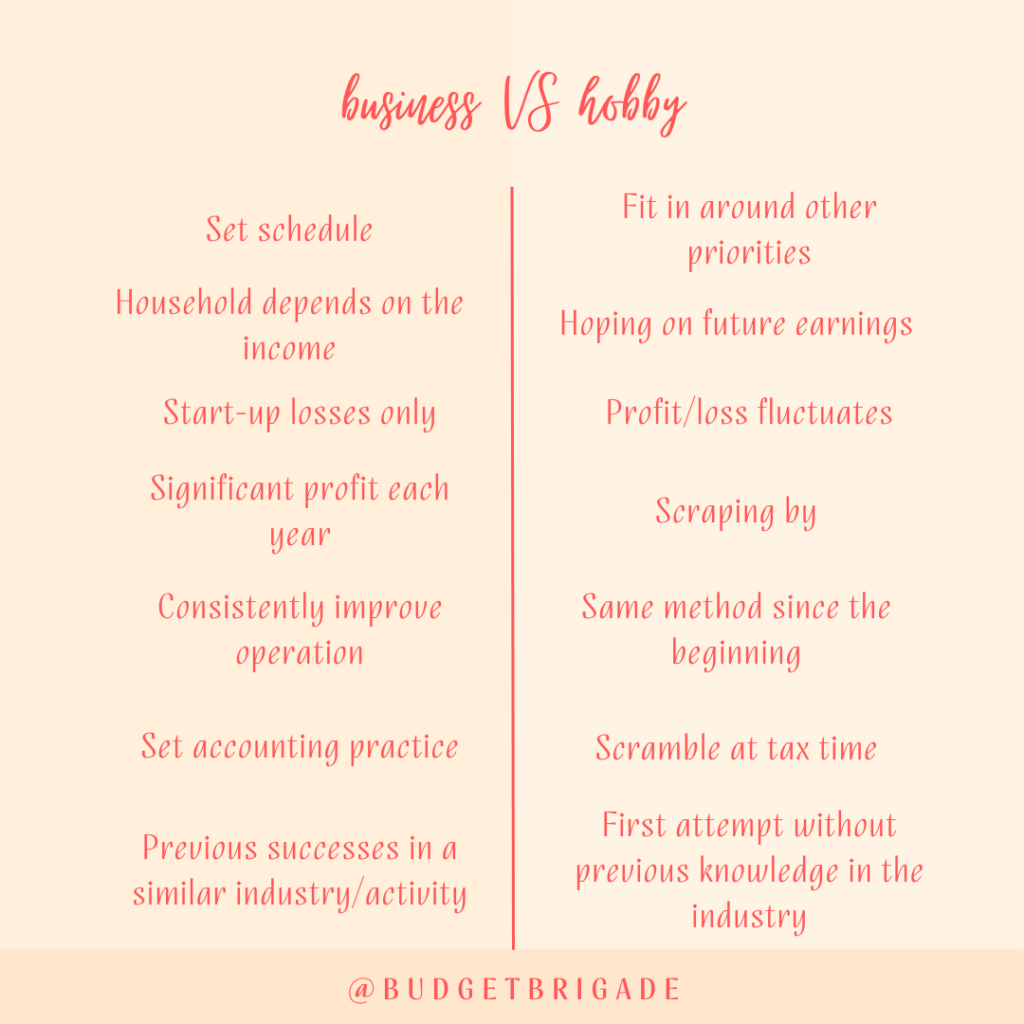

- Do you have a set number of hours a week with a set schedule that you dedicate to running the business? Or it is more flexible, when you can fit it in around other priorities, like a hobby?

- Do you or your household depend on the income in order to eat and pay bills? Or is it future earnings you’re still trying to achieve?

- Did you have one set period of losses in a start-up phase, or does profit/loss fluctuate?

- Do you make a significant profit every year or are you just scraping by with little to no net profit, or net losses, year after year?

- Have you consistently iterated and improved your methods of operation to increase profitability or have you run it following the same method since the beginning?

- Do you have a set accounting practice and maintain complete and accurate separate books throughout the year or do you scramble come tax time to pull everything together to try to deduct as much as possible on your taxes?

- Have you been successful in making a profit in a similar industry/activity in the past or is this your first attempt without previous business knowledge in the industry?

- Do you actively engage with, and promote your product/service to, customers through a targeted and detailed, strategic marketing plan, or do you seem to see what comes of what you’ve done?

- Can you expect to make future profit from the appreciation of the assets used towards this endeavor or is what you have what you got?

The Profit Safe Harbor Rule

The IRS states “an activity is presumed for profit if it makes a profit in at least three of the last five tax

years, including the current year.” Oddly, the rules are slightly different for horse racing, breeding, and showing, which requires at least two of the last seven years. (2)

Be Honest with Yourself

Perhaps what you’ve been considering a small business startup isn’t really a small business yet. It’s okay to admit you jumped the gun! So many of us dream of running our own companies or owning our own jobs, myself included. But to succeed, you have to be able to evaluate your own process and where you are in the journey, just like you evaluate any other partnership or strategy when it comes to running a business.

If you set up an LLC or corporation too soon, consider shutting it down before you start running into lookback period and hobby law issues. There’s no shame in taking a step back and restructuring in order to succeed in the future. You don’t want to be part of the 50% who fail during the first five years. So take the proper amount of time to scale up and prep yourself for success.

References

(1) Add the Chamber of Commerce for the caption