Two popular methods exist for debt reduction: the debt snowball and the debt avalanche. With the debt avalanche, you start with the debt with the highest interest rate and work your way down to the lowest, getting through your debts with the least amount of interest paid possible. We’ll cover the step-by-step guide, as well as the pros and cons of the method, below.

While we hope for a debt free life for all our brigade members, we understand the process and timeline look different for everyone. We don’t care what method you use, so long as you are working toward your goals on the path up the FIRE ladder.

- A popular way of paying off consumer debt

- Prioritizes your debts in the order of highest to lowest interest rates

- By focusing on the highest interest rates, you knock out the largest accumulators first, speeding up your debt payoff timeline

- The combination of minimum payments stacking along with prioritizing the highest interest rates can give you the fastest debt payoff if you can wait for your first debt payoff win

How the Debt Avalanche Method Works

We talk a lot about compounding interest, because it is the most powerful tool when it comes to investing for your FIRE freedom. When it comes to debt, compounding interest is the strongest tool that’s keeping you broke. The higher the interest rates, the more you pay for the privilege of borrowing someone’s money for your purchases.

The debt avalanche focuses on the killer that is your debt’s interest rate and strategically attacks it, knocking out the highest interest rates first.

While the debt snowball method focuses on the behavioral aspect of money by giving you small wins early and building momentum, the debt avalanche method focuses on the math of money by getting you out of debt fastest with the least amount of interest paid.

To do the debt avalanche, follow these steps:

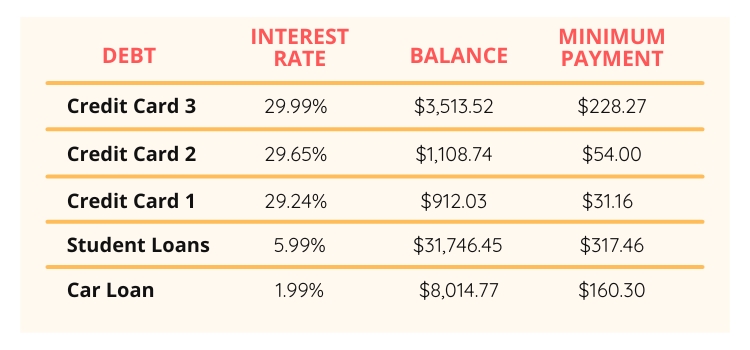

Step 1: List your debts (see below which ones to include) from the highest interest rate to the lowest. For each, include the total balance, the interest rate, and the minimum payment due.

Step 2: Make the minimum payments on all the debts listed except the highest interest one, unless the minimum doesn’t cover the interest amount. In that scenario, recalculate the minimum to cover at least the monthly interest rate so your debts aren’t building up during the process. Take any extra cash you can free up in your budget and use it to tackle that highest interest debt until it’s gone.

See our 50/30/20 budget for general guidelines on how much income to target for your debt payoff journey.

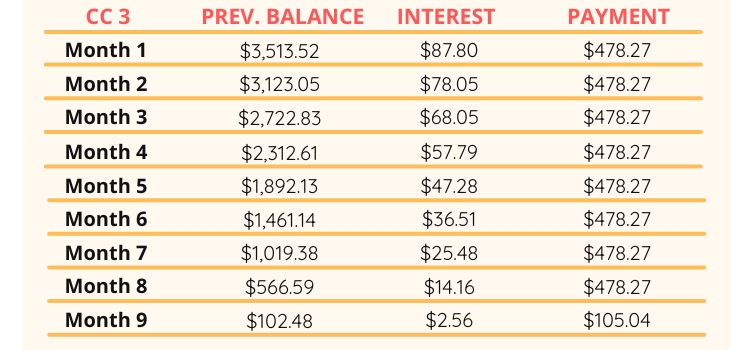

For our example, let’s say you have $250 extra a month to throw at your debt. We start with Credit Card 3, which had a previous balance of $3,513.52 from the graphic above, and add the $250 to the minimum payment each month until we pay it off.

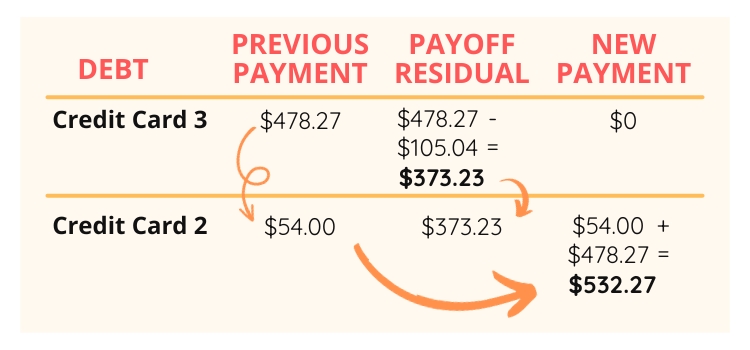

Step 3: Once you’ve paid off the highest interest debt, roll its payment into the next highest interest debt. In this case, Credit Card 2.

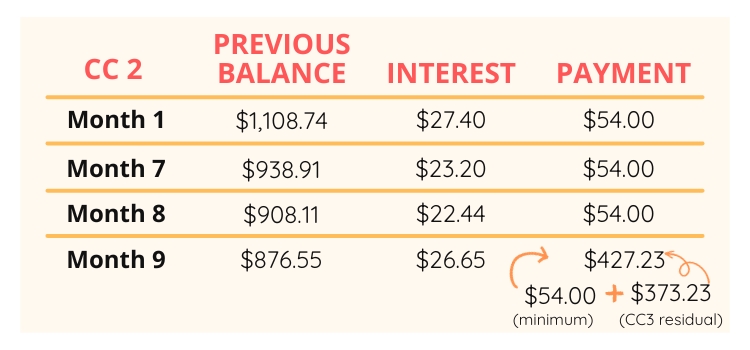

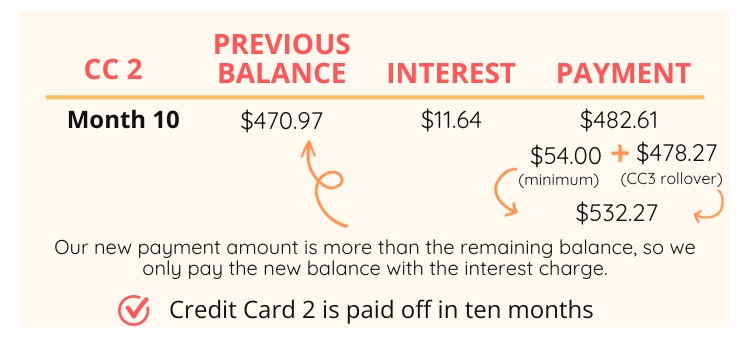

While Credit Card 3 takes nine months to clear up since it was also the highest balance credit card, we get through Credit Card 2 quicker.

I’ve summarized Months 1-9 below that occurred while the debt avalanche focused on Credit Card 3 to save you from math overload.

In this case, since Credit Card 3 had a high minimum payment, freeing that up allows us to pay off Credit Card 2 the very next month, giving us back-to-back victories.

Step 4: Rinse and repeat, letting your payments accumulate as you pay off each debt along the way until you reach the lowest interest rate debt and extinguish it.

When to Pay Off Debt

We created our FIRE ladder to help guide you along your personal finance journey to FIRE (financial independence, retire early) freedom. In our eight rung ladder, paying off debt is Rung 4, after:

- IGNITE your journey: determine your goal to build motivation to reach it.

- ASSESS the smoke: evaluate your current financial situation (AKA make a budget).

- FORTIFY your fire station: get an emergency fund, insurance, and community.

Which Debts to Include in Your Debt Avalanche

Personal finance is, as its name implies, personal. Thus, this can differ for different situations.

Those with higher incomes should have room in their budget to work toward multiple financial goals at once, including paying off debt and saving for retirement. Smaller income households may find more benefit in focusing on a single goal at a time in order to gain traction, though we do recommend taking any employer match for retirement first and balancing your budget with that calculated in when at all possible. Why? Because it automatically has a 100% return on investment, which should be a higher gain than the largest interest rate at the top of your debt avalanche.

Which debts to include can depend on your personality and goals as well. For us, we both grew up in households that worried about money. We knew we didn’t want that stress in our lives, so being unchained from all debt payments was a huge goal on our FIRE ladder. For us, that meant getting rid of all debt as fast as possible, regardless of the interest rate.

We recommend at a minimum including all high-interest debts in your avalanche. Generally, we count this as debt with an interest rate of 8% or higher, though we don’t want you to include your mortgage in your debt avalanche at the cost of saving for retirement.

Debts people typically payoff with the debt avalanche include:

- Buy now, pay later financed items

- Car loans

- Credit cards (an absolute must)

- HELOCs (Home Equity Lines of Credit)

- Medical bills

- Payday loans

- Personal loans

- Phone payment plan balances

- Student loans

A note on HELOCs: depending on how high your balance is and how much room you have in your budget, you might consider this mortgage debt and focus on it when you pay down your house. If possible, we’d like to see the HELOC gone in your debt avalanche, because HELOCs have variable interest rates. The less control you have over your situation, the more likely you are to find yourself in a tight spot.

Don’t Forget Your Budget

We want you debt free as soon as possible, but be mindful of your budget. Unlike the government, you need to make sure you balance your budget. Paying off debt without saving for retirement for a year or two won’t extinguish your freedom FIRE, but slogging through debt for years without saving isn’t likely to leave you much better off in retirement as you’ll lose out on the power of compounding growth. Once you’ve tackled the high interest debt (above 8%) in your debt avalanche, we recommending reassessing your situation.

If you can continue to pay off debt and still contribute at least 15% of your gross income for retirement, then charge on with low-interest debt if you want! This is the method we used. If you have to continue to sacrifice your future for the sake of your past, get that retirement going first and continue to pay down your low-interest debt with the minimums, throwing any extra income you find at the end of the month from a budget surplus at the debt if you want.

Pros & Cons of the Debt Avalanche Method

Like the debt snowball method, the debt avalanche method has both advantages and disadvantages.

Pros

- By attacking the highest interest debts first, you decrease how much money you need to throw at your debt payoff journey overall.

- By decreasing the amount of interest accruing, you also speed up your overall payoff timeline.

Cons

- Since you are prioritizing based off interest rate, not balance, it could be a long time before you see your first win.

- Depending on the balance of your highest interest debt, a long payoff can require a lot of discipline, leading some to be discouraged.

Should I Use It?

If you can wait for the delayed gratification of punching out that first debt, there can definitely be a financial advantage to this method. If you start the debt avalanche and find yourself caught in the snow cascading down the side of the mountain, you can always pivot to the snowball and knock out a few of the smaller debts to gain some traction.

Whether you snowball or avalanche, our goal for you is the same: find financial freedom. So pick the method you will have the most success with. That’s the method that will yield you, personally, the most success.

Learn more about the debt snowball method and then watch the two methods duke it out for the heavyweight championship in the ultimate debt snowball vs debt avalanche fight.