The student loan problem

According to the Peter G. Peterson Foundation, over 20% of American households deal with student loan debt, with the amount having doubled in just three decades. Student loans appear to be more and more common, with over 40% of households led by someone 25 to 39 years of age having some form of student loan debt. Student loans are now the second most common form of debt Americans have, behind mortgages. More people have student loan debt now than car loan debt.

Having a large amount of student loan debt can hinder Americans in their financial goals, such as buying their first house or saving for retirement. The average student loan debt balance is around $41,000.

Over 90% of student loans are owed by the federal government, and these public student loans are not bankruptable. Americans increasingly feel the weight of this burden. While we like to talk about school choice and degree selection to balance the opportunity cost of higher education with potential earnings, this discussion doesn’t help everyone already saddled with student loans.

If you have student loan debt, we hope the guidance below can help you reach your goals for financial independence.

Federal student loan programs as a solution

Since the federal government holds more than $1,700,000,000 (sweet Jesus, that’s a lot of zeroes) in student loan debt, it knows the burden these loans carry. The government thus offers some student loan relief programs, but they aren’t all created equal and we’ve seen over the years how programs can change at the whim of the White House, depending on who’s reporting to work in the Oval Office.

The most common “help” the federal government offers are repayment plans. These plans, highlighted on the Federal Student Aid website if you’re curious and want to dig into the details, typically base your monthly payment on your income or give you a fixed monthly payment over a set repayment period.

While an income-driven repayment (IDR) plan can be helpful to help Americans breathe in their monthly budget, they often don’t address the issue of the student loan debt balance. Some may only cover the interest occurring on the loan, meaning you never make a dent in your student loan balance. We’ve also heard horror stories where the minimum monthly payment didn’t even cover the interest occurring, which meant that even though people were paying on their loans monthly, their student loan debt balance was actually getting bigger. Water filled up their ship faster than they could bail it out, so they continued to sink.

Fixed payment repayment plans, at least, are thankfully set up to ensure you pay your loans off.

Less common than repayment programs is the public student loan forgiveness program. (PSLF). This program isn’t available to everyone. Ways you might qualify include:

- Being a teacher

- Being a government employee

- Being a medical professional (doctors, nurses, etc.)

- Working for a nonprofit

- Having a disability

Just because you may qualify for forgiveness doesn’t mean you automatically get all your student loans forgiven. In order to take advantage of the PSLF program, you have to make “the equivalent of” 120 “qualifying” monthly payments under an accepted repayment plan while working for an “eligible” employer. I’m not a lawyer, so don’t ask me what the terms in the quotes mean in actual English.

This is government bureaucracy at its best.

The PSLF program is a legit program, but again is up to the whims of politicians and subject to change depending on legislation. When you’re working your way through a 10+ year program, there should be a healthy dose of concern that the rules might change, especially if your payments aren’t making a dent in your balance thanks to the setup of your repayment program.

And as a reminder, these repayment programs are only for federal student loans. The same holds true for the PSLF program. Private student loans play by different rules.

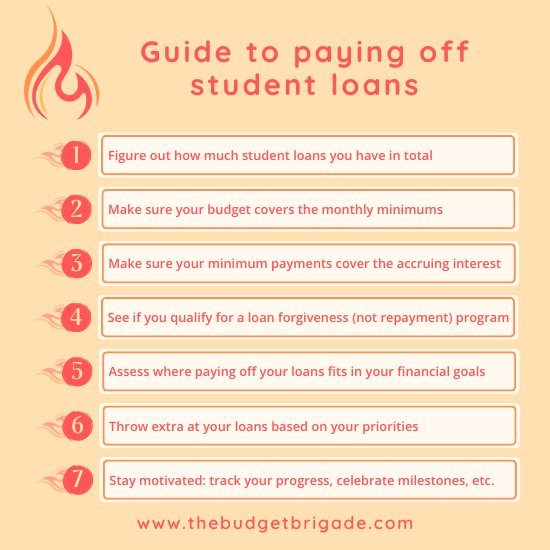

The first step to paying off your student loans is admitting you have a problem

Before you can make a plan to pay off your student loans, you need to know how much you owe. Grab a beverage of your choice, your favorite budget friendly snack and turn on your favorite movie (I recommend Dunkirk) or an episode of your favorite TV show (you can’t go wrong with the original seasons of Arrested Development). Get comfortable in your favorite chair, on the couch, or burrow under the protection of your bed sheets and comforter. Now whip out your laptop, tablet, or phone and get ready to make a handy dandy and maybe a little bit painful list.

Compile a comprehensive overview of all your student loans, both federal and private. For each loan, make a note of:

- The total balance remaining on the loan

- The interest rate

- The minimum monthly payment

- The projected payoff date, if available

How are you feeling? I hope that wasn’t too painful. Deep breath. You’ve got this.

Budgeting for your student loan payments

Now that we know what we need to tackle, we can formulate an attack plan. But first, a few pearls of advice we hope you’ll take to heart:

- Make sure you’re covering your minimum monthly payment for each month

- If your minimum doesn’t cover the interest, bump up your monthly payment to pay at least the interest so you aren’t going backwards

- Then prioritize paying off the remaining balances depending where they fall in your debt payoff plan

Adjusting your baseline payments can give you a better idea of what minimum to target for your monthly budget.

What if I can’t cover the minimum payments?

If you’re staring down the barrel of your student loan debt list and the math just isn’t working with the reality of your budget, it can be overwhelming. You might be consider switching to an IDR plan or refinancing your loans. We’ll talk about refinancing your loans in a bit, especially if you have a high interest rate, but for now, let’s look at your budget.

We like using a zero-based monthly budget, as we’d found this the best way to take control of our money. If you’re struggling to meet your minimums, assess where else your money is going and see if you can repurpose some of that toward your student loans. If you wanna be a baller, consider adopting a bare bones budget and cutting any unnecessary spending to pay down your student loans until you can breathe. There’s no one perfect solution, but there are plenty of ways to cut expenses to give yourself more money monthly.

If you’re struggling to cut expenses, you can also increase your income with a side hustle or second job.

Neither one of these options has to be forever, but set a goal to at least pay off the interest accruing so that you aren’t going backwards with your debt growing monthly. This gets you to a point of stability.

If you need help, explore our additional resources on:

From here, we can focus more on paying off those student loans.

Making extra payments to pay off your student loans

Now that you’re chipping away at your student loans, consider leaning into the goal to annihilate them with a sledgehammer. Paying off your loans early not only gives you more room in your budget in the future, but it gets you one step closer to financial independence. And did I mention it can save you a shitload of money in interest? That part’s nice, too.

Again, there’s no one-size-fits all solution here. You may have a lot of income left each month after paying for the necessities, or you might only have $50. You might have really high interest rates where paying off your loans early could save you thousands or tens of thousands of dollars, or you might have a really low interest and want to catch up on investing instead. We’re all about tackling debt and becoming debt free… eventually. Each person may take a different road to get to the same destination, especially if one’s using Google Maps, another is using Waze, and another is still printing off step-by-step directions from MapQuest.

Where you are in your financial journey will impact how much emphasis you should put on paying off your student loans. If you have a ton of credit card debt at 20% interest, for example, you’ll likely want to prioritize that before tackling your student loans. If you only have a small amount of student loan debt left, you might want to knock it out for the sweet taste of victory.

To help you determine how much, if any, you should currently be paying extra on your student loans, we have the FIRE ladder to financial freedom, which is a step-by-step guide to help you prioritize your goals.

Before you start paying off your student loans, we recommend:

- Having an emergency fund in place, which can save you from having to go into other debt

- Taking any 50% or 100% employer match at work for retirement

If you are going to pay extra on your student loans with the objective of paying them off early, you can choose your own adventure in designing your debt payoff plan. Options include:

- The debt snowball, where you pay extra on the smallest loan balance first

- The debt avalanche, where you pay extra on the loan with the largest interest rate first

- Any other plan you think of that you’ll stick to

The ‘stick to’ part is the most important. Even the greatest plan is worthless if you can’t successfully implement it, so pick a plan that works with your life situation and your overall financial goals.

Whichever method you choose, make sure your extra payments will go toward the principal balance, which is the actual loan balance, and not toward future interest. If you’re paying toward future interest, you may not save any money.

Should I pay off my student loans if they are at a low interest rate?

Excellent question, Steve, and once again there’s no perfect one-size-fits-all answer. We’ll get to this in a minute, or maybe thirty seconds depending on how fast you read, but let’s first start by defining “low” interest rate. Again, this can depend. There’s no hard and fast cutoff line. Inflation changes, investment earnings change, and these can both factor how much you can make by leveraging your money with loans. Anything at 8% or above we like to consider a high interest loan. Interest rates under 2% we like to consider as low interest. Everything in between, which we realize is a decent amount of loan payments, is more vague. For the nerds reading this, you can run through the math using our paying off your house early article as an example. When we looked at paying off your house early, even at 4% and above, it often made sense mathematically to pay off the house early. Depending on your student loan balance, the same might hold true. You can use our free mortgage amortization spreadsheet to see what the numbers look like for your specific situation.

Many people, like myself, don’t just consider the math of the problem. We are emotional creatures who don’t sleep well at night knowing that they owe other people money and thus are tied to their office desk chair day in and day out because they have to make enough money to afford their minimum payments. Even if the math hadn’t made sense in our situation, we would have paid off all our debt, because the advantages of living a debt free lifestyle have been priceless for us. The same might not be true for you, and that’s okay, but that should factor into your decision here.

In general, we recommend paying off low interest student loans too, especially since federal student loans aren’t bankruptable so they are that annoying friend that won’t unfollow you no matter how many social media platforms you jump around. But if your student loan debt is at a low interest rate, we wouldn’t necessarily prioritize them at the top of your list of financial goals. High income earners have the ability to multitask on several goals at once. The less disposable income you have to work with, the more focused and intentional on a single goal you need to be. Before tackling lower interest student loans, you may want to get some other financial foundations in place such as:

- Making sure you’re investing a comfortable amount to provide security in retirement (such as 15%-25% of your income)

- Saving up for a downpayment for a house

- Saving up to purchase a car, especially if the interest rate on a car loan would be more than your student loans

Should I pay off my student loans if they’ll be forgiven?

It’s time to Define the Relationship before diving into this hot topic.

If you’re in an actual program like PSLF highlighted above that forgives your student loans versus just setting up a repayment plan, this can be a great employment benefit for jobs that typically don’t pay as much as market value. These established programs are different than hearing rumblings from politicians who want to forgive student loans. We’ve all seen what happens with that. It’s like watching Ross and Rachel for ten long seasons. Will they forgive the student loans? Will the Supreme Court throw another injunction and cause them to go on a break? It’s all highly unreliable and ever changing, so I wouldn’t bank on it.

At the time of this writing, the current administration is also trying to restructure established loan forgiveness programs like PSLF by requalifying what counts in our quoted terms above. It’s all very murky waters with potential sharks swimming about, so I recommend proceeding with caution.

One of the problems with student loan forgiveness programs tied to qualified employers is that they can be golden handcuffs keeping you chained to a job you hate. And again, many of these jobs that qualify for forgiveness programs or offer student loan repayment assistance don’t pay market rate. You might be better off finding a job that offers better compensation, paying your loans off, and investing the difference.

If you love your job and forgiveness or repayment assistance is just a fringe benefit, that’s a different story. In that case, I’d wade probably ankle to knee deep into that water with cautious optimism that nothing’s going to take my leg off. What you’re saving in student loan payments, consider using to lower your other debt obligations or investing into a taxable brokerage account so you have access to a comfy cushion made of money if the piranhas start nibbling on your toes.

Even with all the rumblings about potential student loan forgiveness, my husband and I both paid off our student loans. For one, it was money we’d borrowed that we owed. For another, the government can’t even get their act together to fix the roads or streamline the tax filing process. No offense to them, I’m sure they’re lovely people, but we had a haunting suspicion that we’d be old and gray by the time they got around to agreeing on any kind of large-scale program, especially since they are still writing new student loans every day. We would much rather have our student loans in the rearview mirror so we can focus on spending those minimum payments on road trips and other vacations.

Should I refinance my student loans?

Buckle in for another fun “it depends” discussion! Above, we mention federal student loans and private student loans. Repayment programs and PSLF programs only apply to federal loans. If you might qualify for forgiveness programs, refinancing can disqualify you from eligibility. So here, we say again: proceed with caution.

Unlike refinancing a house, refinancing student loans typically doesn’t cost you a kidney in closing fees. Refinancing private student loans (or federal if you don’t qualify for PSLF) may be a good way to lower your interest rate without adding additional fees, which can save you money in the long run. The key here is a lower interest rate. The caution is to mind your terms. Refinancing can reset your payment table. This can be a bonus because it can lower your monthly payment even more by extending the life of your loans, but our hope for you is to get your pesky student loans out of your life once and for all. Refinancing just to end up being in student loan debt longer is going to reverse your progress toward financial independence. So if you’re considering refinancing just to lower your money payment, we recommend having an uncomfortable conversation with your budget instead and seeing where else you can cut expenses so that you can continue to chip away at this debt that plagues America.

How to stay motivated when paying off your student loan debt

If you have a crap-ton of student loans, paying them off might feel like a never-ending story.

While we were fortunate not to have six figures in student loans like some of our friends, we tackled our mortgage over a seven-year timeframe and that was the definition of a slog. It was hard to stay motivated not only on some days but sometimes for months at a time.

I’m not going to bullshit you and tell you it’s all smooth sailing and that you’ll have your loans paid off in no time. It might be a long game. What I can say is that I think it will be worth it in the end, and can offer you some advice on how to stay motivated along the way. We’ve written an entire article on staying motivated to save money, but I’ve included some of my favorite below that may work well for your student loans:

- Track your progress: Seeing your progress will help you stay motivated because you’ll see the progress every month. And don’t just make this a boring old Excel spreadsheet or something as equally lame. Bedazzle, my friend. We let GOB from Arrested Development do The Final Countdown on our fridge for over two years when we went hard at our debt. This helped us laugh when we wanted to cry and made us always question where did the lighter fluid come from?!

- Break it into micro goals and celebrate milestones along the way: This is especially important if you have a lot of student loan debt. If you have multiple student loans, celebrate every time you knock one out. If you don’t, celebrate major milestones, like every $5,000 paid off. You don’t have to spend money to celebrate. Throw a dance party. Create a new fun tracking sheet. Just do something to acknowledge that you are kicking ass and are going to make it to the finish line.

- Make it a competition with a friend! I’m super competitive. I’ll have a contest with you on who is more competitive. So it was natural for me to take something I didn’t necessarily want to do (pay off debt) and turn it into a competition to motivate myself. When I was paying off my student loans after college, I was single and had moved to a new state where I didn’t know anyone. The only people in town were my grandparents, and they weren’t someone I wanted to challenge, so I competed against myself. I pushed myself to see how tight I could stretch my meager paycheck and how much I could save to knock down my loan balance each month. I threw $100 at my loans last time? Let’s make it $110, no $115 this time. If you aren’t as competitive, see if you can gamify it instead. Anything to turn it into a fun challenge versus something you know you should do but dread.

- Get an accountability buddy to cheer you on. I excel on praise, so this was also key for me. Having someone rooting me on kept me motivated. If you have a friend or family member with a similar goal to pay off their student loans, make a pact to start together! Check in and encourage each other. Brainstorm ways to accelerate the process. If all your friends and family think you’re a little crazy for tackling your student loans when you could hang on to them until you retire, this might be harder, but not impossible. See if someone minds just touching base with you every few weeks or once a month to help you stay on course. They don’t have to understand why you’re doing the thing you’re doing or want to do the same thing to be supportive. They just have to care about you.

The final word

Students loans are one of the debts our society seems to have accepted will be around forever, but that doesn’t have to be true. You don’t need to live with this chain around your feet, holding you in place under your current manager who’s an a-hole. We want you to have all the flexibility and opportunities that come with being debt free and financially independent.