Here at The Budget Brigade, we are on a mission. We want to make talking about finances fun. And there are few greater kings of comedy than Trey and Matt. So today, we give you the top five financial takeaways we’ve learned from watching South Park. Let us know your favorites we missed in the comments.

5. The latest high tech gadget your kid desperately wants might not be all it’s cracked up to be (or worth the hit to your budget)

Parent guilt is real. We understand that. But your kid doesn’t need the latest and greatest tech when it’s not in the budget and doesn’t align with your overall financial goals. The kids will be fine. And a parent who is calmer and more present because they aren’t constantly juggling bills and worried about losing their job and not being able to survive? That’s a priceless gift you can give them.

4. There is plenty of frugal entertainment for kids.

Frugal fun is my favorite kind because it’s what I grew up on. Back in my day (cue the creaking joints), fancy gaming was Frogger. PlayStations and GameCubes were expensive, a luxury not a given. They’re still expensive today, but we treat them and expensive iPads like necessities. Oftentimes people even purchase them on credit when they can’t afford them. South Park is a great reminder of the best entertainment for kids: make believe. That’s right, the floor in lava. (If you live in the South, they don’t even have to imagine it if you send them outside at high noon.) Best of all? Their imaginations are completely free to use. No monthly subscription fee required.

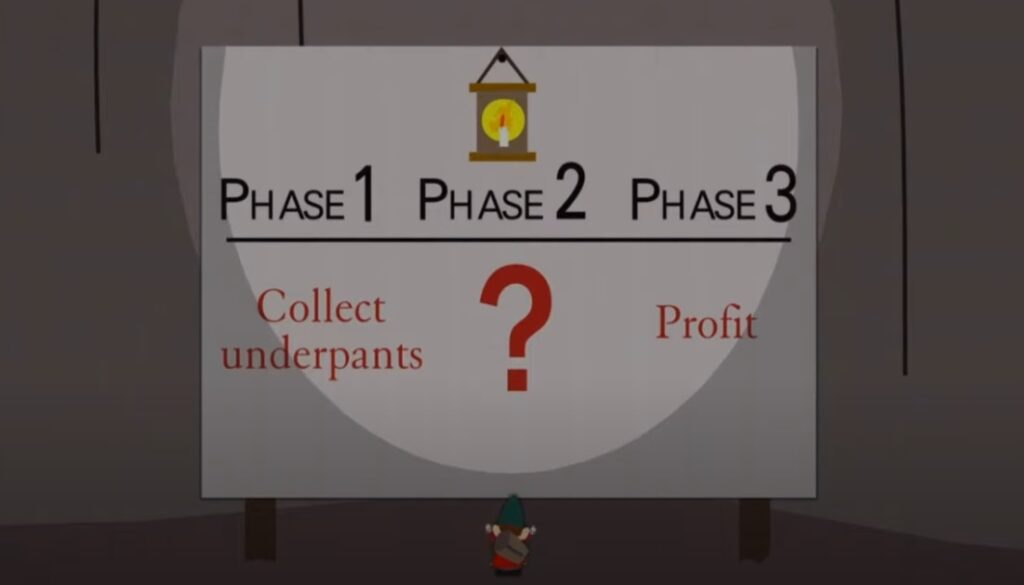

3. Lots of people want to be entrepreneurs, but if you dive in too quickly without a plan, you’re doomed to fail.

Being an entrepreneur is exciting, but it takes a lot of work and planning if you want to succeed. If you come up with a great business idea but hit the ground running without a plan, you’re more likely to faceplant than profit.

2. If your housing costs total too much of your monthly budget, you can end up house poor.

Owning a home is great… when the roof doesn’t need to be replaced or the A/C decides to shut off in the middle of summer. While real estate is an investment you’ll want to get into in order to build wealth, you want to make sure you do it wisely. Otherwise, you might end up sleeping in a Hotdog House and brushing your teeth with ketchup.

1. Don’t Invest in Anything You Don’t Understand

Our favorite of our financial takeaways? There will always be people pitching you get rich quick schemes. “Passive income” is one of the biggest hot topics I hear about because people want to make money without having to do anything to earn it. In reality, reliable wealth building isn’t sexy. It’s downright boring most of the time. Whether it’s money market mutual funds or foreign currency accounts, never invest in anything you don’t understand. When you blindly invest, you’re much more likely to wake up one morning andddddd it’s gone. We’ve built this site and continually update our resources page to help you learn to protect yourself against risky investments.

Want to learn more fun finances from TV? Explore our Pop Culture Financial Advice tag. If you have any other shows you’d like to be featured, let us know! If we overlooked one of your favorite financial takeaways from the show, make sure to mention it below.