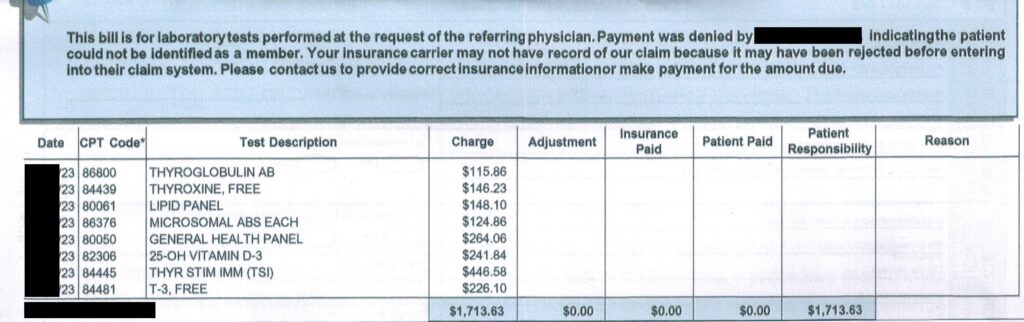

Last month I danced with my least favorite date at the budgeting ball: medical bills. I got a bill from Quest Diagnostics for some thyroid labs I got done more than two months previously. It had been so long, I’d honestly forgotten about it. Rest assured, Quest had not.

Uhhhhh, yeahhhhhh. NOPE. In no realm was $1,713.63 going to fly.

You can bet your Powerball dollars that I called up Quest and corrected the issue immediately. This is one of several reasons that I never prepay for services when they are run through insurance and why I still request paper bills. I don’t trust the healthcare medical industry (which is almost an entirely separate industry than healthcare itself). I barely trust the people who work in the benefits department of my insurance company.

This wasn’t my first woe with these tests. I have just switched jobs before I went in and, as a result, insurances as well. The first time I went into Quest as 6:30AM to get my blood drawn, the phlebotomist, AKA vampire, couldn’t pull up my insurance in their system. She said I was welcome to go ahead and get the labs done and see what the benefits came out to once they ran through billing.

Again, yeahhhhhhhh, NOPE. That was a $1,000+ gamble (she quoted me this billed price without insurance). Guess who has two thumbs and doesn’t have a spare $1,700 sitting around? That’d be me.

I called my insurance company, who had no idea what the issue was and wasn’t able to tell me what their own negotiated rates with Quest were. I called Quest’s main billing department next. They weren’t sure either.

So I went back into Quest, thinking maybe the issue was the new benefits hadn’t kicked in yet. The second vampire told me there was a special way to enter my main insurance company’s specific employer sponsored plan in their system so that it linked to the correct benefits. She was able to figure out the insurance in the system and quoted me closer to $50. I had $50 in my medical budget, so I let Bella Swan draw the blood to run the tests.

Then I get this invoice in the mail. It turns out, the insurance information did not get linked to my account for some reason. Quest had an insurance in their system that I haven’t had in years, so that company (no surprise) couldn’t find my benefits and denied the claim. Three days of hair pulling and frustration across the two encounters saved me almost $1,700. (My revised bill is under $30.)

That’s worth double checking. And double check I do, for every single medical bill I receive.

How Bad Is Medical Billing?

Like with any medical bill, I could have paid it blindly and went on my merry way. Nut this is not my first rodeo. My husband and I have both been emitted to the hospital in the past.

If you’ve ever been to a hospital with insurance, you’ve gotten a slew of hospital bills that rolled in months after your visit that were on top of the “Good Faith Estimate” they charged you before they released you.

Here are some quick statistics when it comes to medical billing.

Whether it’s a bill for labs, a statement from your primary care physician or specialist where your payments wasn’t applied after the insurance payment came in, or an avalanche of medical bills, it’s worth keeping detailed records of your medical encounters, payments, EOBs (Explanation of Benefits), and corresponding bills. Never, ever be afraid to file a claim to dispute a charge or go back to the hospital with a “WTF is this? I was in pain, but I was conscious. Three doctors did not come in and evaluate me. I’m not paying for the second and the third, but nice try.” Certainly don’t shy away from asking for an itemized bill, especially at the hospital.

I know better than most that keeping track of medical bills can be a right headache. All three of the examples in the previous paragraph have happened in our household more than once. With an 80% chance there’s an error, it’ll be worth your time.

What’s the biggest error you’ve found and disputed in a medical bill? Were you able to get the charges reduced or removed? Have you ever reviewed your medical bills in the past?