A member of The Budget Brigade asks: How do you alter your budget when you are in the “black” for a given month, but the bulk of bills come out at once, with little to no buffer? If you have a net surplus but feel the squeeze when all your bills are due before the final paycheck hits near the end of the month, the easiest answer is to build yourself an account buffer. This is what we have in our household.

Create a new line item in your budget called Account Buffer and make it your new short-term savings goal. Every extra dollar you can squeeze from your budget temporarily, allocate to this line item.

Note: this is different than your emergency fund. Your emergency fund should be kept in an entirely different account than your day-to-day spending checking account. Your emergency fund is in case of emergency only. Your monthly bills come every month; they aren’t an emergency, they’re a given. So your account buffer should sit in that day-to-day spending checking account.

How Much Do I Need in My Account Buffer?

Ideally, I like to keep an entire month’s take-home income as the buffer in your checking account. That way, no matter when bills or paydays hit, you are covered. While that money isn’t working for you from an income generating perspective, it’s working hard to give you peace of mind. And for me, that’s worth more than 4% in a high-yield savings account or 8% in a money market for such a small percentage of your net worth.

If you are early in your personal finance journey and an entire month’s income makes you want to scramble your brain like eggs, it’s okay to aim for less. A month’s expenses is a suitable buffer as well.

If you are just starting out and you don’t have much breathing room in your budget yet, a month’s expenses might be close to a month’s income. Here, it’s important to look at how much you’re trying to juggle. What’s the total of the bills that hits before how many paychecks? It’s hard to give an exact number here because I don’t know your unique situation, only you do. But let’s look at an example.

Example

John and Jane bring home $5,000 a month take home pay. Jane makes up for $3,000 of that and gets paid every other Friday. John brings home the remaining $2,000 and gets paid every other Thursday of the opposite weeks of the months.

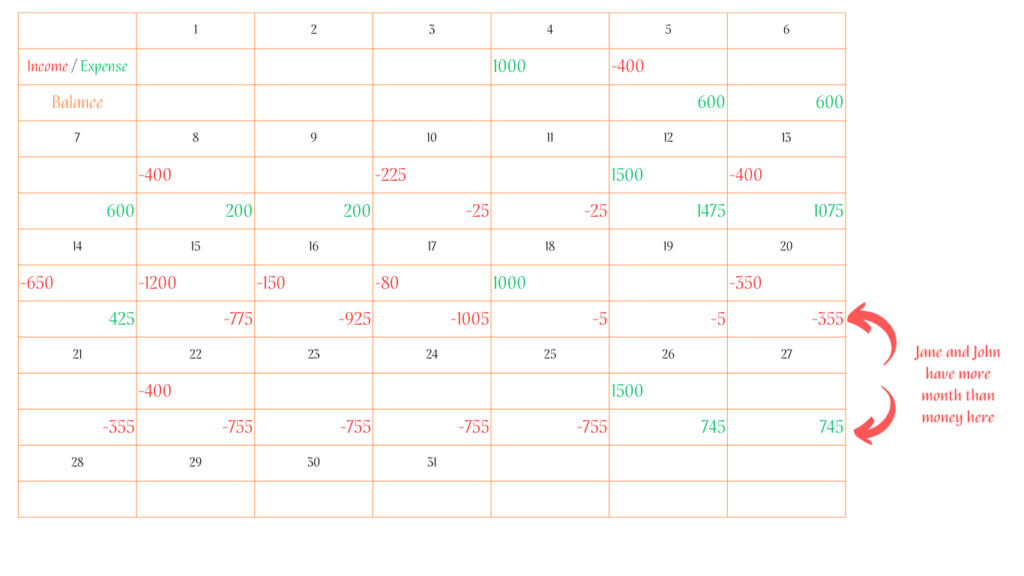

This month, John gets paid $1,000 on the 4th and the 18th while Jane gets paid $1,500 on the 12th and the 26th.

Car insurance of $225 is due on the 10th.

Their car payments of $650 are due on the 14th.

Their mortgage of $1,200 is due on the 15th.

Credit card 1 minimum payment of $150 is due on the 16th.

Credit card 2 minimum payment of $80 is due on the 17th.

Utilities of $350 are due by the 20th.

They are no longer building up credit card debt, so let’s say an average of $400 comes out of their checking account each week for expenses.

So their month would look something like this:

John gets $1,000 on the 4th.

By the 7th, a weekly spending on $400 comes out, leaving $600.

By the 9th, they are creeping up on their weekly spending, leaving $200 in their account.

On the 10th, they’re $25 short of being able to pay their $225 car insurance bill

On the 12th, Jane brings home $1,500, leaving $1,475.

On the 14th, a weekly spending of $400 and the car payments of $650 leaves $425.

On the 13th, Jane does the dreaded Sam’s Club run, and another week has snuck up on them. $400 gone, leaving $1,075.

Car payments time! $650 out the door on the 14th, leaving a lean $425.

They don’t have near enough to pay their mortgage by the 15th, coming up $775 short for their $1,200 due.

But wait, there’s still more month at the end of their money! Their old credit card minimums are due, and now their $1,005 short before John brings home $1,000 on the 18th, which would still leave them short by $5 until Jane’s paycheck. With utilities due two days later and another week of groceries, gas, and life, and they find themselves $755 in the hole before Jane’s final paycheck limps into the bank account on the 26th.

Example Takeaway

If your brain wasn’t scrambled eggs before, I bet it is now. Stressful, isn’t it, setting it all out and seeing how fast your money disappears? Makes me want to tighten up their budget, and I’m only dealing in hypotheticals here!

Running through their budget week by week, we can see that the biggest negative they have would be $1,005. This is the minimum about of an account buffer they would need in their account just to have nothing left. That isn’t much security either. What is Jane needs to fill up her gas up the SUV a few days early? John tries to make a stop at McD’s on the way home, and the buffer is poof, gone!

Ideally, they would want to cover the following week as well to have some breathing room. Since they are $755 short that second week, $1,760 would go a long way to give them breathing room, and is a much easier starting savings goal than their $5,000 monthly income.

Guidelines for Your Account Buffer

When sitting with your paycheck payouts and your expenses, don’t plan for extra paycheck months. Those are great to have and will help you build up your buffer faster, but they’ll throw off how much you need in a typical month.

Also plan to give yourself more than you need. In this type of situation, we are trying to build you breathing room. So don’t paint your scenario for calculating your buffer on a best case basis. Plan for a messy month so you know you’re covered and don’t find yourself scrambling at the last minute to juggle things around or find yourself paying a late fee.

If you have a fluctuating paycheck, plan your buffer amount using the lowest average income you bring in a month.

What To Do While Your Account Buffer Builds

What do you do in the meantime? Your bills aren’t going to pay themselves until your checking account buffer is topped off.

Cut back expenses: The less you spend, the more you can save and the less overage you have to worry about covering until your account buffer is fully funded.

Talk to your account holders: Sometimes, utility and credit card companies will let you change when your due date is. Once you’ve run your scenario out like in the example above, you’ll know when you’ll have enough to pay your bills for the month. Talk to the companies, especially the ones with the higher payments due, to see if they can work with you to adjust your due dates to better fit your income scenario. Just make sure you discuss with them how it will make payments due in that adjustment month so you don’t come up short in the transition.

Hustle and grind: The more you can bring in, the less buffer you’ll need this month and the faster you can build the buffer in your checking account. Take extra hours at work if you get the option of paid overtime. Uber or DoorDash as much as you can for a short season. Babysit. Dog sit. Do something to get your income up temporarily until your situation stablizes.

Great stuff! Definitely some things to think about. Thanks!