Ready to budget but not sure where to start? Below are some common questions when budgeting for the first time. Click through each of the links to take a deeper dive.

What Is a Budget?

A budget is a roadmap of where your money is coming from and where it is going to help you stay on course for your destination, which is your overall financial goal.

How Often Should I Make a Budget?

I used to set a budget based off our annual projected income and divide it by twelve for the months in the year. Then I would typically go through my expenses at the end of the each month (or, let’s be honest, the first week of the following month) to see how we did. The problem with this approach, I found, was that by the end of the month, if we had gone over the budget, it was too late to course correct. This budgeting approach also put the vast majority of the budgeting responsibility on me and made my husband feel like he didn’t have a say in where our money was going as I never sat down with him to go over it.

Now, we have a monthly budget meeting, typically the last weekend of a month to plan out the following month’s budget. Doing the budget month by month gives us a more accurate forecast of what expenses are coming up and helps us account for months with an extra paycheck (there is a THREE PAYCHECK MONTH dance I used to do at work, ask my coworkers.) It also gives my husband a chance to review the budget every month so he has a say in it. That helps us stay on the same page and united toward our shared goal. Now, when he asks me to pick up a video game while I’m out running errands, he gets to throw in a “I checked the entertainment budget in EveryDollar, Dave Ramsey would approve” line.

Where Do I Start When Budgeting?

A budget is typically broken down into in and out categories. The “in” are all your sources of income. The “out” are all your expenses. Start by making sure you have all your incomes and expenses accounted for and categorized.

What Are Common Income Sources?

Income sources can include:

- W-2 wages and tips from your employer

- Independent contractor wages from your employer

- Side gig money

- Money from selling old items

- Alimony

- Child care

- Social security

- Gifted money

- HYSA interest (I include this for our savings account for sink funds – more on these later; every bit counts towards our vacation fund!)

- Dividends on investments (I only count these if they don’t auto reinvest or don’t remain in your brokerage account)

If you are just starting out and trying to pay off debt, I suggest tracking all of these sources as your income. If you are further along in your financial journey and aren’t worried about surviving paycheck to paycheck, you can have a little more leniency with categories such as gifted money and marketplace transactions.

What Are Common Expenses?

I like to break expenses down into separate categories and list sub-items under each. Depending on your situation, here are the categories I would consider. Want to learn more about each category? Check out our budget expenses page.

- Charity & Gifting

- Debts

- Education & Child Care

- Food & Entertainment

- Housing

- Insurances

- Medical/health

- Personal care

- Pets

- Retirement

- Savings & sink funds

- Transportation

- Utilities

I Have My Categories and Line Items Figured Out. Now What?

We have finally arrived to the part that I love most and other people dread: math time! Don’t worry, it isn’t hard math, and we will have resources to help automate this for you.

The goal here is to make your budget zero based. This means:

incomes – expenses = zero

This does not mean that you spend every dollar extra on eating out or entertainment or personal care. Every dollar over your budgeted expenses and saving items goes towards your goal you set up for your budget. Don’t have a goal yet? Check out our Get Started guide.

For example, at brigade headquarters, our current financial goal is saving up for a used camper and truck to pull it. This is a multi-year goal, so every extra dollar we have at the end of the month goes into savings towards it.

If you are currently trying to get out of debt, this extra will go towards your debt amounts. If you’re saving up to buy a house, this would go towards your down payment fund. If you’re trying to pay off your house, this would go towards your mortgage.

The goal here is to have a purpose for that extra amount so that it doesn’t walk off unsupervised. If you get to the end of your budget and your expenses are more than your income, leaving you in the red, turning that number positive should be your first financial goal. And we are here to help you reach it. Explore the different income and expense options above and other articles on the site to help you douse the financial fire.

What Method/Tool Should I Use for Budgeting?

The answer here is one that is very common in our house: it depends. The best tool is the one that is easiest for you to use so you stick with it. As the nerdy bookkeeper, when I used to do my once a year budget, I ran it through QuickBooks since I was already doing our household accounting there with my independent contractor work and sole proprietorship company. Now, I won’t ever go back.

We currently prefer the app-based route, as it makes it easy for both my husband and I to update on the go, and it reflects the information on one shared account. There are several different budgeting apps. Check out our Resources page for suggestions. If you’re early in your financial journey, don’t be tempted to pay for one. That’s an expense you don’t need to mess with.

A simple pen and paper budget is enough to get started. If you’re a spreadsheets fan, an Excel workbook or a Google Sheets file on a shared Drive with your significant other or spouse is another great route. Check out our Resources page for sample spreadsheets as well.

I Finally Have My Budget. What Do I Do With It?

Track all month long to stay the course! Track your income coming in versus what you planned, as well as your expenses versus what you allocated. Tracking incoming is especially important for non-salary based worked. This is where I think the app-based budget comes in handy or a shared file on a cloud-based program. It allows easy updating on the go in seconds so you don’t have to sit down and remember to go through the days purchases after the fact, as they can often end up neglected or forgotten by the time you get home.

If an unexpected expense comes up, adjust the budget but make sure you cover that with your significant other or spouse before changing the budget. And if your income changes, make sure you’ve discussed what expense accounts to adjust accordingly.

Tracking expenses daily can help keep you accountable to the budget and can keep you clear on where you are throughout the month so you can adjust your spending habits as needed before it’s too late. The last thing we want is more month than we have money for.

Save your goal item where you allocate your for the end of the month to help buffer against these unexpected or emergency expenses and extra income. That way, you aren’t unable to pay an unexpected vet bill because you already paid extra on your credit card.

In our household, the budget gets reconciled at the end of the month. Any budget items we came under in, that extra gets put towards our camper and truck fund. On the first weekday of the following month, I transfer the final goal line item amount to the savings account. If you’re paying off debt, the surplus would be a secondary payment to the debt you’re tackling.

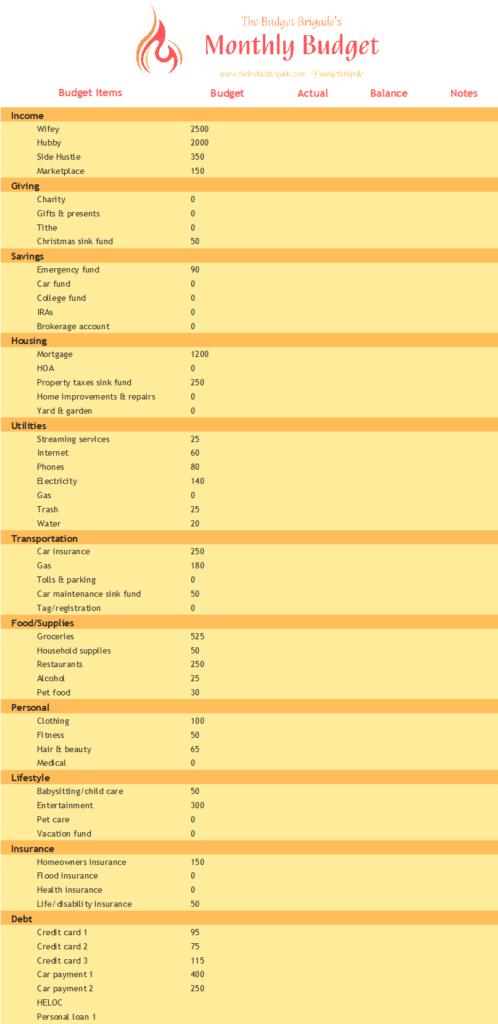

Example Budget

Want to take a look at an example budget using the categories mentioned above? Below, I took data from the Bureau of Labor Statistics Consumer Expenditures report for 2021 to compile an example budget for Jane and John Jones. (This is by no means hard researched data for current numbers, it’s simply a rough estimate example at what a budget might look like in an American household, please don’t blast the comments.)

When I ran the numbers, the total monthly expense to live (housing, groceries, taxes, insurance, entertainment, personal care, and minimum debt payments, etc.) came out to $4,525 before I filled in categories such as saving for the emergency fund and the Christmas sink fund. Out of a $5,000 take home pay, which is what I guesstimated from the average gross salary from the report, that’s 90.5% of the entire monthly income. The average American family has 90% of their income already spent before the month even starts! No wonder as a culture we are broke and struggling. Average debt payments alone for Jane and John Jones are 19% of their income, and that’s a conservative guess based on what averages are for cards and cars.

Two thirds of Americans can’t afford a $400 emergency. Looking and Jane and John’s budget, we can see how that can be a reality. It’s also easy to see why the long term average savings rate for Americans is less than 9%. 9% is all that’s left for the average Joneses. It’s time to stop Keeping up with the Joneses, they are broke!

If you’re in a similar situation as Jane and John, there’s no time like the present to start changing your financial future. Don’t let life happen to you. You are worth more than the 9.5% left at the end of your paycheck.

More Questions?

Working on your budget but have a question not addressed above? Drop your questions in The Budget Brigade community or on our Ask a Question page. We’re happy to help!