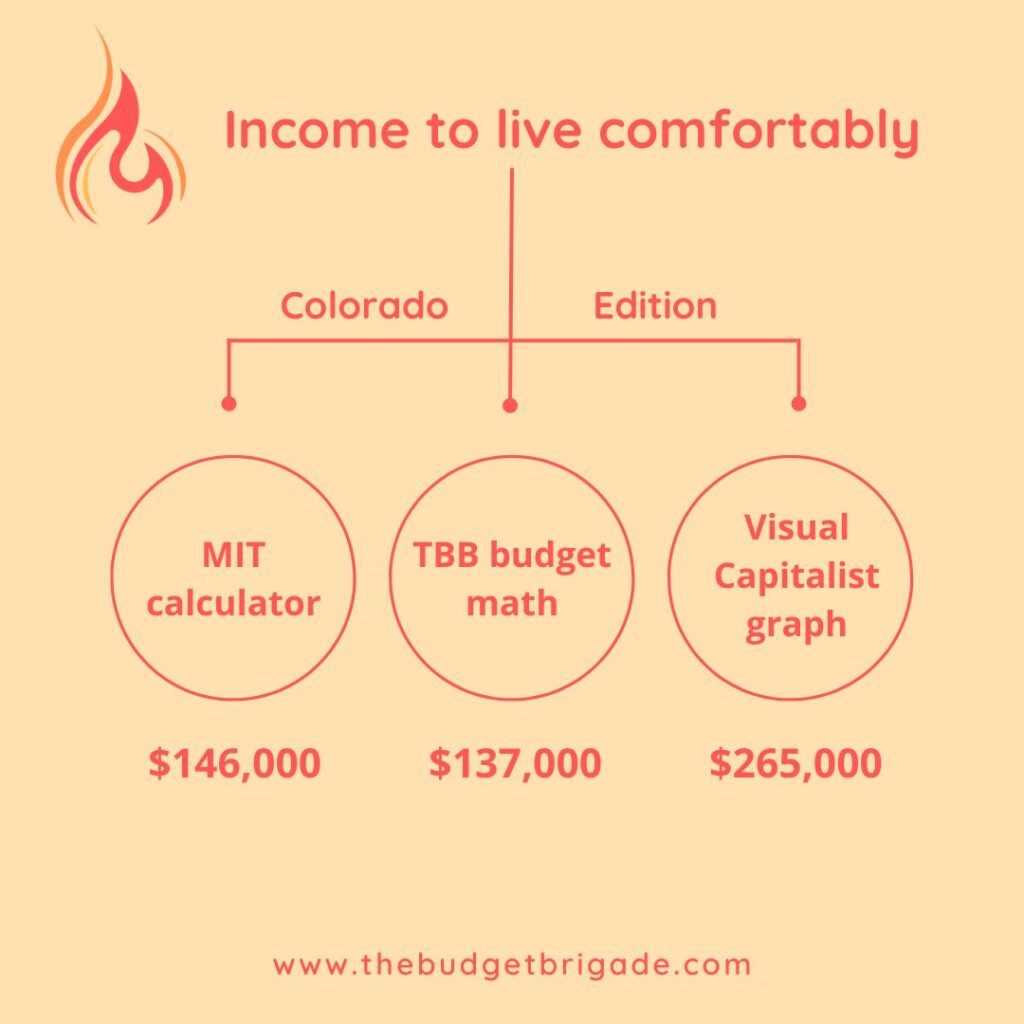

I was sitting outside Chipotle, eating my free chicken bowl (we had gift cards, thank you neighbors!), when my husband brought up this article he saw on LinkedIn by the Visual Capitalist. The infographic they included declared the income a family needs to live comfortably in the United States. We’d talked about doing an article on cost-of-living differences across the country, so I was intrigued. He asked me to take a wild stab at the income to live comfortably in Colorado, our new home state. I ballparked around $150,000 a year.

He told me it was $265,000.

My head exploded all over my pinto beans and cilantro lime rice.

I’d just worked on some articles on physician salaries at work, so I knew that $265,000 was more than even a lot of doctors made in Colorado.

He went on to mention that Florida was $209,000. That’s right, OVER TWO HUNDRED THOUSAND A YEAR for hillbilly nation, y’all.

I immediately asked him to forward me the link, and then I sent the image to my best budgeting and finance friend in Florida for her hot take while I recovered from my shock.

I know inflation rolled through like a hurricane or tornado, depending where you live, but it was impossible to wrap my head around these numbers, so we decided to do our own hot take, using our actual numbers for both states we’ve lived in this year, to see how our living situation stacks up. Then I dive into where the disparities come from, and if there’s any hope for Average Joe in today’s economy.

Please note: While we haven’t reached financial independence yet, we are well on our way to FIRE. As such, we live what we would call a very comfortable lifestyle. By the comparison below, I’m not trying to suggest that you have to even make the income we reverse engineer below. It’s possible to live comfortably cheaper, as we discuss below our numbers, if you have the right contentment mindset for your life and money.

The fine print assumptions for the income to live comfortably in the US

At the very bottom of the Visual Capitalist graphic, in tiny gray print that blends into the cream background, they state the assumptions and source. The numbers came from SmartAsset as of February 14, 2024. They used the 50/30/20 budget to define what counted as “comfortable.”

We’ve covered the 50/30/20 budget here previously. It’s not a bad budget, but it isn’t a one-size-fits-all solution. In fact, we did an entire article on adjusting the 50/30/20 budget for your situation.

One of the key points I make in that article is how if you have a high income, 50% for needs and 30% for wants are a little rich. At $265,000 a year, Coloradoans would fall into this category in my humble opinion, so the 50/30/20 seems like a bad baseline assumption off the get go. Even $209,000 in Florida would make me scratch my head and consider if you really need to be spending $63,000 a year on fun.

The LinkedIn post mentioned that they use the cost of necessities from MIT’s living wage calculator, so I checked it out.

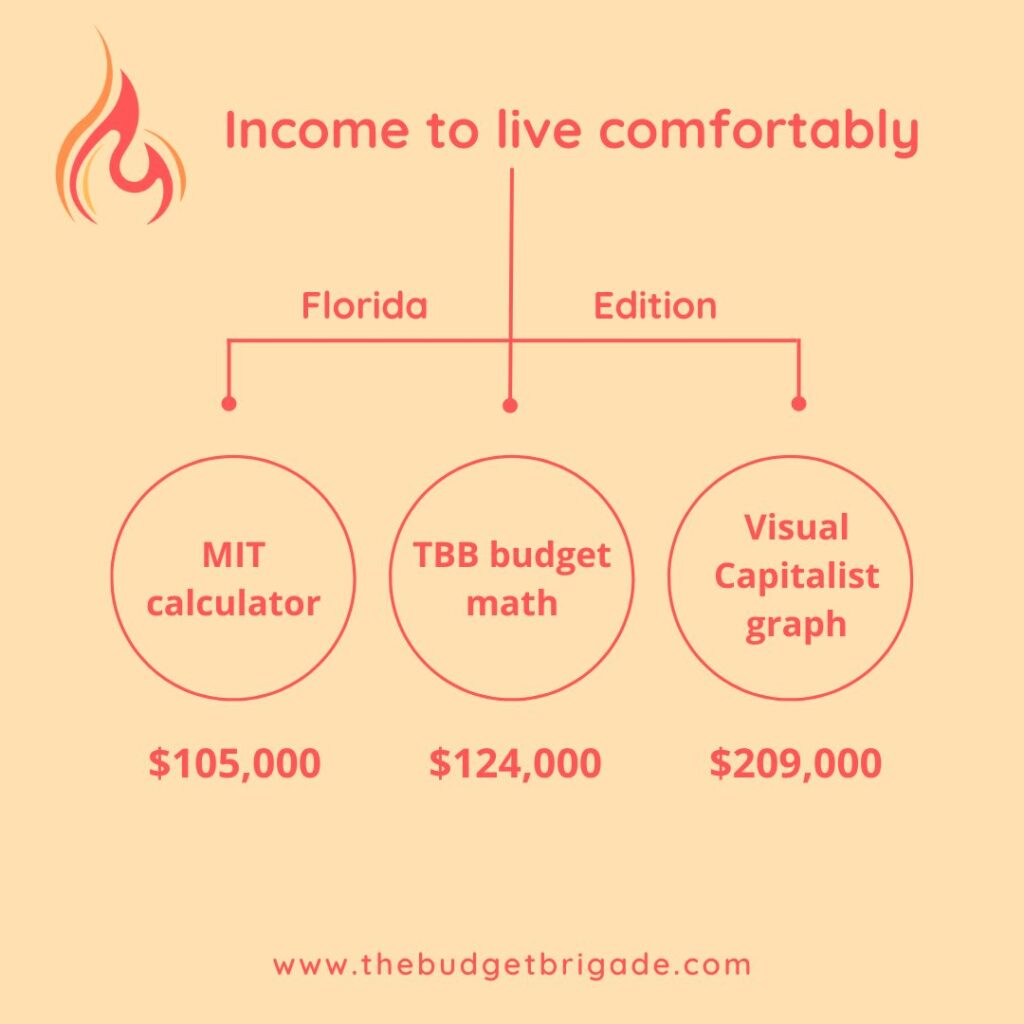

The graphic also states they estimate the income to live comfortably based on a family of two working adults with two children. Using that assumption, I plugged in our previous hometown in Florida and looked up the MIT’s living wage calculator for this assumption: $25.27.

For two full-time (2080 hours a year each) workers at this hourly rate, that my friends comes out to $105,123.20, not $209,000. Around $90,000 is actually close to what my husband and I spit balled after I spit-taked all over my dinner.

How much we needed to live comfortably in Florida

For our first case study, I dusted off our old Florida budget. I’ll be the first to admit we’re biased, but when we polled the audience, survey says we lived a very comfortable life in Florida.

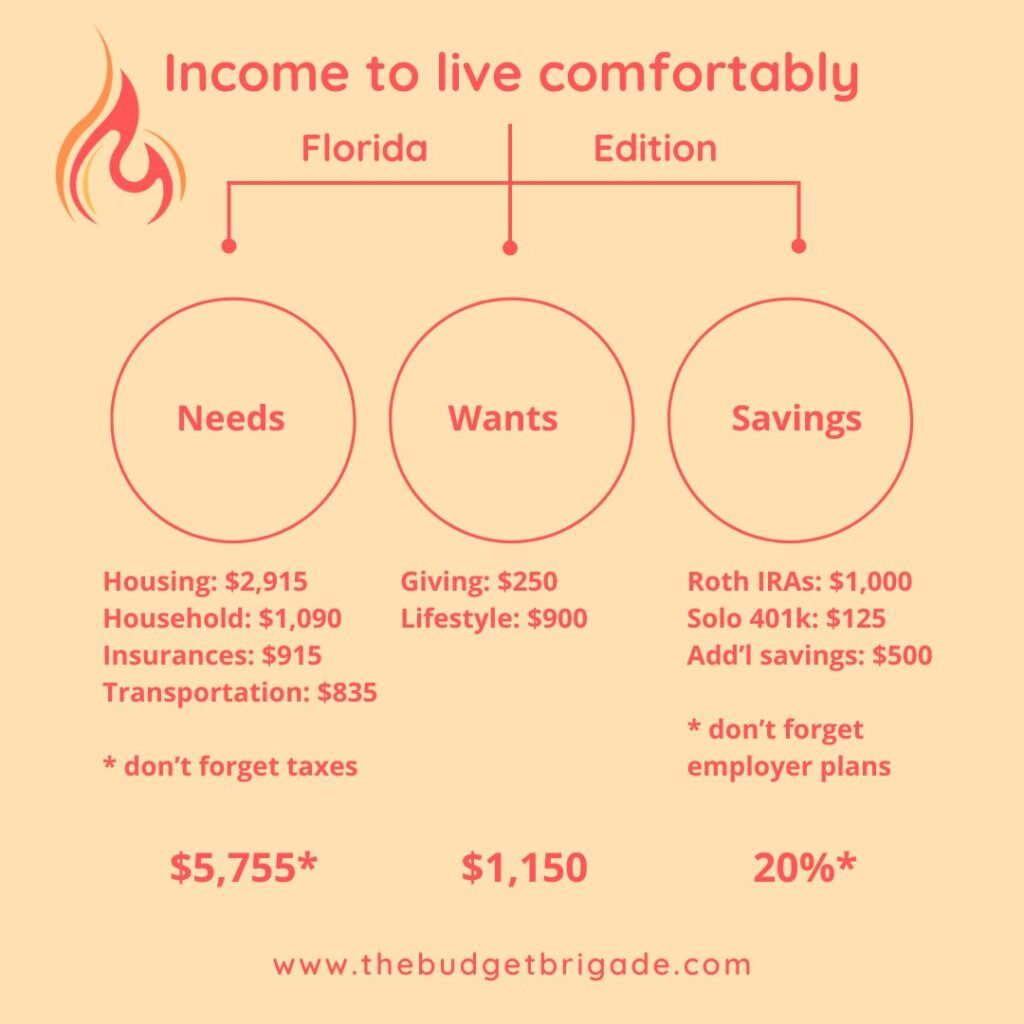

A look into our Florida budget to live comfortably

Giving:

- Presents: $100

- Charity: $150

Savings:

- Emergency fund: $0 (fully funded)

- Roth IRAs: $1,000*

- Lauren solo 401k: $125*

- Savings for our Colorado move (previously known in the budget as “Wyoming Ranch”): $500

* these are going to be treated a little differently for our retirement savings calcs, as they fund tax-advantaged retirement accounts.

Housing:

- Mortgage: $2,500

- Water: $25

- Internet: $80

- Electricity: $200

- Phone: $60

- Trash: $25

- Yard/Garden: $25

We didn’t have a mortgage, so I did a rough estimate based on average rent and mortgage costs in Orlando (which we’re gonna have to chat about separately, because those mortgage amounts also made me gag—that’s a lot of house, y’all).

I also adjusted up our water and electricity to account for additional human bodies of kids in the home.

Transportation:

- Gas: $150

- Tolls: $110 (don’t miss that at all)

- Car insurance: $225

- Car sinking fund: $350

Household:

- Groceries & household: $850

- Restaurants: $150

- Alcohol: $25

- Dog food: $65

I didn’t adjust our groceries budget as we’re already well over the national average of $475/month thanks to all my gut issues and severely restricted diet that aren’t typical.

Lifestyle:

- Entertainment: $250

- Clothing: $50

- Pet care: $100

- Vacation fund: $500

Insurance:

- Medical premiums: $550

- Homeowners & flood: $190

- Property taxes: $175

I used the medical premiums for what an average family plan through an employer costs (you often don’t see this unless you check your paystub, as it comes out before you get paid). This doesn’t include medical expenses for chronic conditions or emergencies, which we touch on below in our budget buster section.

There you have it, our standard Florida budget.

Now let’s figure out our total expenses, add in taxes and retirement investing, and figure out our income to live comfortably. (We can’t use what our actual income was, because we were saving well above 20% by this time.)

The 50/30/20 budget is usually done on your take-home pay, after taxes, but we’re talking income to live here, and the IRS sure as shit is gonna tax you on $200,000+ a year, so they need to be included in our calculations. Plus, your investing should be on your gross income.

We live in a marginal tax bracket world, so calculating taxes isn’t a flat percentage across the top for an easy one line calculation.

Standby while I get down and dirty in the Excel sheets.

That moment when you realize you’ve done half your income as monthly and half as annual.

And forgot to take into account tax credits and deductions.

FML. Recalculating.

Assuming I’m not Michael Bolton and didn’t put the decimal point in the wrong place (which honestly feels like a bit of an assumption given the number of corrections I had to make), our income to live comfortably in Florida comes out to roughly $124,000. Or, if we’re being picky, $124,214.50 +/- rounding errors.

Compared to SmartAsset and Visual Capitalist, that’s a difference of $85,000, or almost 50% more.

That’s a big difference. And honestly, more than we thought, thanks to the tax man.

It’s much closer to MIT’s livable wage of $105,123.20, though still about $20,000 higher, which brings me back to the critical point:

Living “comfortably” is completely based on perspective.

The more content you are with your life, the less you’ll “need” to feel comfortable.

Learn more about how to be content with what you have.

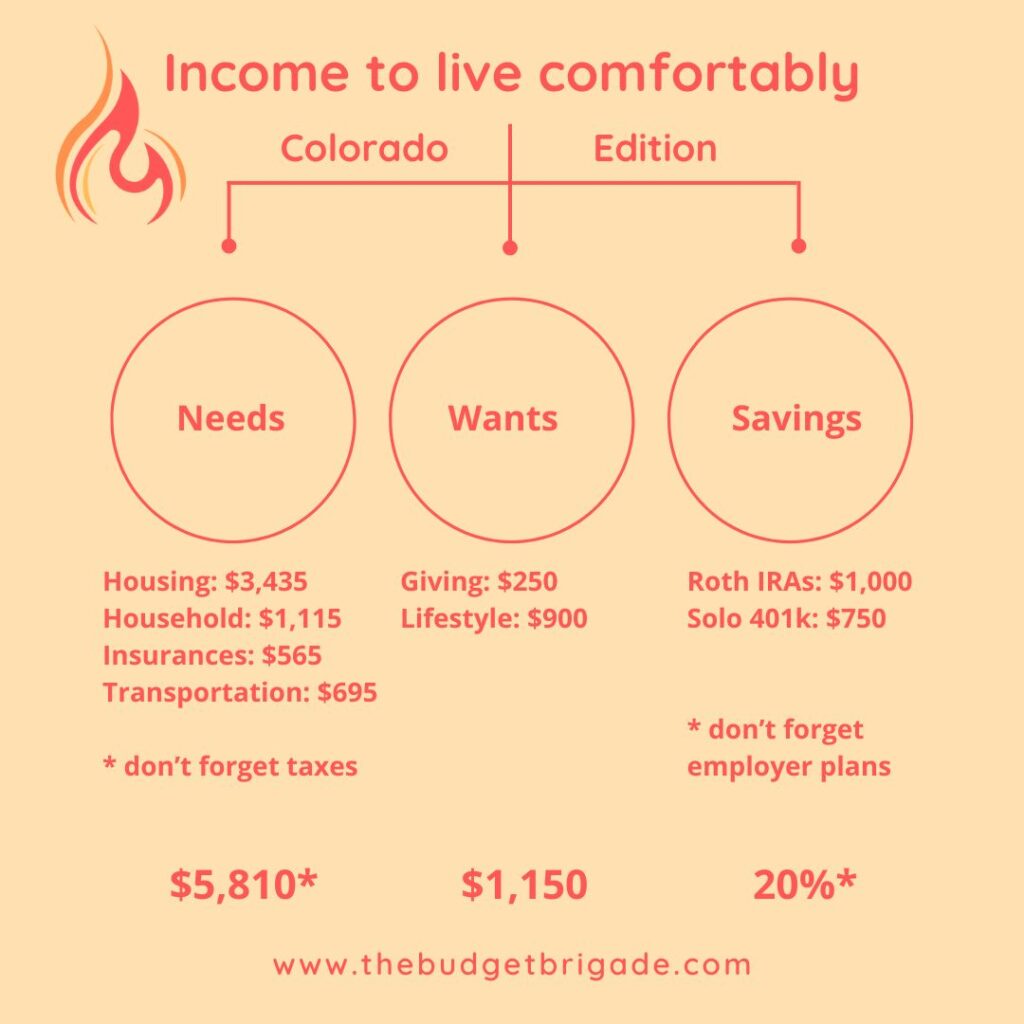

A look into our Colorado budget to live comfortably

For our second case study, we get to add a higher cost of living that includes state income tax, but we are now standard renters, so we have a better idea of the numbers here.

Again, this does not mean that people making less than this income live in destitution. This is just one example based on our version of living very “comfortably.”

Giving:

- Presents: $100

- Charity: $150

Savings:

- Emergency fund: $0 (fully funded)

- Roth IRAs: $1,000*

- Lauren solo 401k: $750*

* Noticing the big difference in my solo 401k and the missing Wyoming Ranch? We changed our allocation across our taxable and tax-advantaged retirement accounts for 2024, taking into account the move.

Housing:

- Rent: $3,000

- Water: $75

- Internet: $75

- Electricity: $200

- Phone: $60

- Trash: $25

I adjusted our rent for a three-bedroom apartment for the kiddos.

Transportation:

- Gas: $125

- Car insurance: $220

- Car sinking fund: $350

We actually dropped to a one-car household, so our car insurance dropped by more than half, but we’ll assume two cars still, although public transit and biking is wayyyy easier here.

Household:

- Groceries & household: $875

- Restaurants: $150

- Alcohol: $25

- Dog food: $65

Lifestyle:

- Entertainment: $250

- Clothing: $50

- Pet care: $100

- Vacation fund: $500

Insurance:

- Health insurance premiums: $550

- Renter’s insurance: $15

Ladies and gents, our Colorado budget, living the vida loca.

I’m going to throw in a disclaimer here that I know this number is going to be off slightly because my brain was too fried to do all the mental gymnastics of accounting for the tax break for state income taxes on the federal level. Let’s consider this a “conservative” number and call it a day.

Adjusting for cost-of-living differences we’ve experienced so far (primarily housing and income tax increasing while insurances and transportation decrease), our income to live comfortably in Colorado for our dual-income two kid family scenario comes out to roughly $138,000 a year. Or $137,545.16, give or take.

The livable hourly wage MIT states for 2 adults, both working, with two kids is $35.15/hour for our area in Colorado. For two full-time salaries, this comes out to $146,224. So we were a little over on our Florida comfortable living and under on our Colorado living, which could just come down to what area we lived in for each state, as we lived in a quickly growing cost-of-living area in Florida while we geo arbitraged our Colorado situation intentionally.

What wrecks the average income to live comfortably for everyday Americans?

I’d love to dive deeper into this as a separate article, and hopefully I’ll find the time to later, but for now, there are a few different areas that can easily wreck Americans’ ability to live comfortably on a great salary.

Childcare costs

I don’t have first-hand experience here as a DINKWAD, but I have friends and my friends have kids and holy hell can childcare costs climb quickly. This is unfortunately a situation many American families face, and the solution isn’t always simple or “comfortable.”

For us, I plan on rearranging my work hours and becoming the pseudo stay at home to help cover the gap until our kiddo starts public schools. I honestly don’t have any interest in being a stay at home. Ironically, my husband would love the opportunity, but he makes more than double what I do, and we aren’t financially independent yet, so I’m going to take one for the team so that the rest of our lives can be the way we want.

Medical bills and healthcare

Over half of all bankruptcies are caused by medical bills. The healthcare system in the US need a massive overhaul, but we unfortunately aren’t there yet. With many Americans stuck with what their employer offers, they aren’t always great options for coverage. If you, like me, have chronic health conditions, high-deductible plans can cause a pinch in the budget. Having kids that like to jump from couch to couch and play the floor is lava, or run into glass sliding glass doors while having Nerf gun fights, can also cause expensive medical bills. It’s something to certainly think about and weigh the options of every year to help keep life comfortable on a budget.

Explore some of our medical articles, such as choosing a health insurance plan during open enrollment and reviewing and disputing medical bills for tips.

Debt

Debt can easily throw your budget and financial future way out of whack, leaving you feeling way less comfortable. Which is ironic, because a lot of Americans go into debt to have instant, short-term comfort initially.

Debt would come out of the 20% savings equation in our case studies above, which I’m not a big fan of, as that puts you behind on retirement savings. Especially since many Americans find themselves in a rat race they struggle to—or flat out refuse to—escape. Hitting your 40s and having no retirement because your 20% savings is paying for the YOLO lifestyle instead of your future definitely won’t leave you feeling very comfortable.

This is why we prioritize paying off debt, and staying out of debt, especially high-interest debt, early in our FIRE ladder.

That vroom vroom, baby

One of the worst types of debt is car debt. And my God, we are soooo obsessed with car payments in this country. If you notice in my calculations above, there are no car payments in the transportation category. Instead, there’s a car sinking fund, where we’re saving up for our next two car purchases. (That money is making interest for us and growing while we continue to save.)

Here’s a fact that blew my brains: the average new car payment in American is what our mortgage used to be.

If your car isn’t “comfortable” enough to sleep in as your primary residence, it’s time for our culture to rethink our strategy when it comes to how we get to the grocery store and playground.

Being house poor

I about puked when I saw the average mortgage payments above. We are all living in McMansions like we’re the McCallisters flush on a mob salary. (You know you’ve Googled WTF did the McCallisters do for a living to afford the Home Alone house.)

We’ve started a dangerous trend in this country where “comfortable” means big, new, and expensive. This is a mentality destined to keep us broke. Fight the man! You don’t want to have to clean 3,000 square feet anyway.

Let’s refine “comfortable” in the US

We’ve gotten too comfortable with comfort in today’s society. Hard work and sweat equity have almost become dirty words, yet they are what make us successful and provide us with the means for a “comfortable” life.

Comfortable doesn’t have to mean you can always:

- Buy whatever you want, regardless of the price

- Upgrade to the latest and greatest

- Go on all the trips you want

- Eat out all the time

- Live without a budget

If you want that lifestyle, you’re likely going to have to earn those Visual Capitalist salaries. And in our experience, the stress of bringing home that paycheck because you have to have it to afford your lifestyle is the opposite of comfort. It’s anxiety and being miserable at work but unable to leave because you can’t afford to quit.

I challenge you instead to consider comfortable as:

- Having a budget that you manage, instead of your money managing you

- Being content with your life

- Realizing you will likely get everything you want in life, but not all at once, because you have to weigh the opportunity costs of each decision and purchase

- Not having to worry about money when you go to sleep each night

What do you think? Am I completely out to lunch? Are you closer to MIT and me, or SmartAsset and Visual Capitalist?

As a final note, I’d like to point out that the median American household income is around $75,000. It’s hard to believe that almost all of America is living 3x under “comfortable.”

Great post. Love the comparative case studies. Kiddo?:). Are you pregnant?

No, but we are hoping to start the adoption process in a year or two once we get a few big vacations out of the way. I’m always planning and budgeting =)

So those crazy high numbers are engineered up from the average 50% needs for that state, which includes a lot of car loans and mortgage debt (with rent being similar). Maybe broad geography isn’t the best way to categorize this.

Also I think that cars are the biggest budget-wrecker that isn’t getting enough attention. You hear about home prices and rents skyrocketing, and sticker shock at the supermarket…but 7-yr car loans and the leap in baseline new car prices and car insurance rates shooting up 50% or worse are just as newsworthy.

So true regarding broad geography. Just from my experience in Florida, the cost of living in Polk County versus Miami-Dade County are VERY different. And even here in Colorado, we geoarbitraged our situation to avoid the significantly higher COL near Denver.

And AGREE on cars. I definitely want to do a deep dive on them in the not-to-distant future. Insurance rates are a good point too. I can’t remember where I heard it recently, but someone was saying their insurance spiked around that 50% you’re mentioning because there was a known anti-theft defect with their Kia and thus companies don’t want to insure them anymore. It’s wild. We looked at getting a Subaru, because that’s the thing out here, but I couldn’t stomach the cost even used right now. It’s bananas.