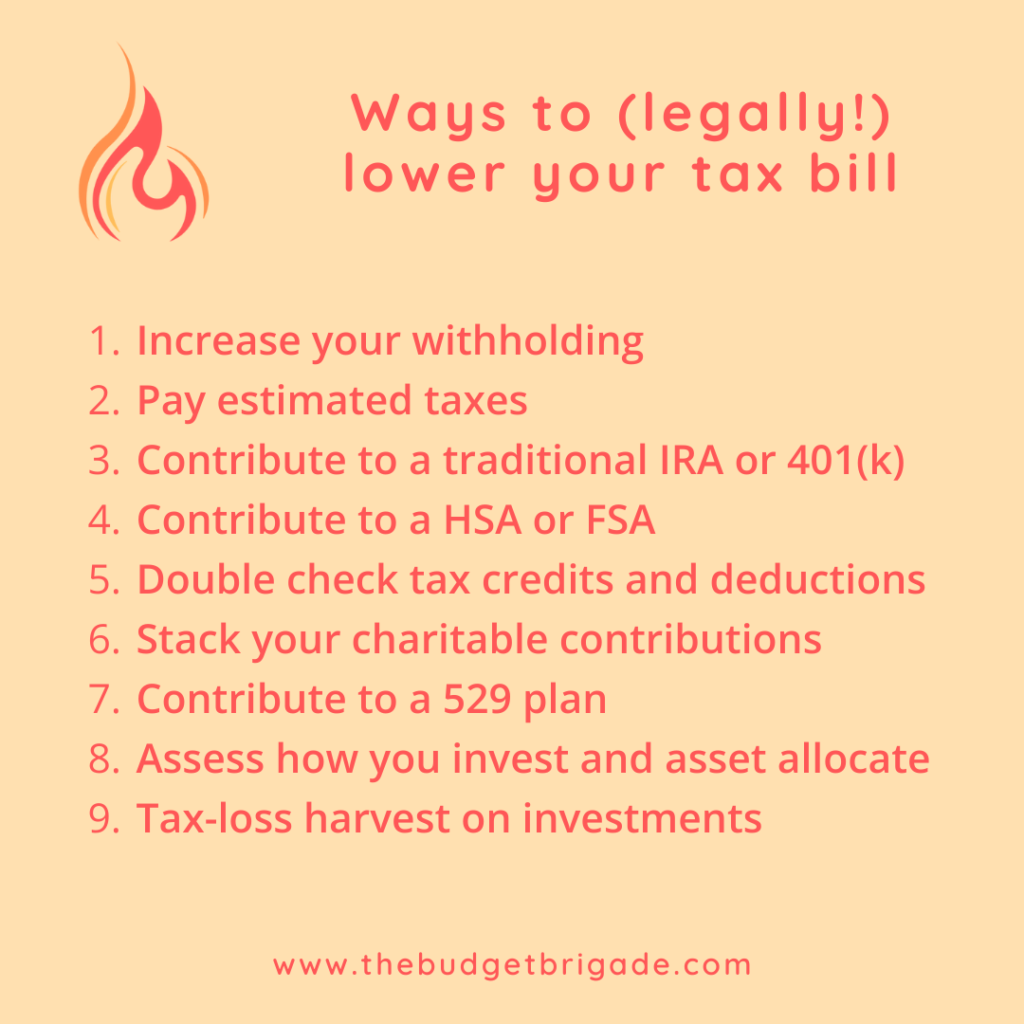

Uncle Sam wants YOU! to pay your taxes. While taxes are fundamental to providing public services and a social safety net, they aren’t always easy to stomach when you finish your tax return and see a large number glaring up at you from the “You Owe” line. Below, we cover legal ways to lower your tax bill and the pain of Tax Day next year if Uncle Sam put a beating on you this season. I pity the fool who pays too much in taxes.

Increase your withholding

When you owe taxes, it means you didn’t pay enough throughout the year. When you receive a refund, you over withheld. The most straightforward solution is to adjust your withholdings. If you’re an employee that receives a W-2, you can submit an updated W-4 to your employer (you can usually do this online through your employee portal or payroll account).

To increase your withholdings, lower the number of deductions you claim.

If you’re already at 0, you can add an additional withholding amount of your choice.

How do you know (Enchanted is now playing in my head) how much to choose? The IRS has a tool to help. Grab your most recent paystub (and your spouse’s) and go to the IRS’s tax withholding calculator.

If you have a more complicated situation with 1099 income from a side hustle, are self-employed, have captain gains from investments, etc., grab the tax return you just finished prepping so you have an estimate of additional income to account for. The IRS withholding calculator will walk you through the process to calculate how much extra you need to withhold from each remaining paycheck so you don’t owe big come filing time.

While their calculator is much better than it used to be, it sometimes contradicts itself, so give it a gut check. Figure out how many paychecks you have left this year. Divide the amount you owe for last year by the number of paychecks remaining. That’s how much additional you need to withhold from each check, less changes to the tax code, your income, or deductions. That number should be close to what the calculator told you.

Pro tip: If you have multiple W-2 incomes coming in with withholdings coming out, drop the deductions and take the extra withholding from the higher grossing income. Why? The US works off a marginal tax system. You pay different tax rates for different levels of income. This helps ensure you’re withholding at the higher tax level when the wizards behind the withholding wave their wands and do that voodoo that they do to calculate how much to pull out.

Pay estimated taxes

If you’re a contractor or have a lucrative side hustle, you might have a lot of 1099 income where taxes aren’t being withheld. Our tax system is a “pay as you go” plan. The government isn’t a fan of 0% interest loans to you throughout the year.

Uncle Sam slaps you with penalties and interest if you don’t withhold a high enough percentage of your taxes due throughout the year. If you have some W-2 income, you can withhold the 1099 taxes from it as mentioned above. We do this as estimated taxes are a pain in the ass.

If your household is straight contract income, you’ll need to make what are pretty much quarterly estimated tax payments throughout the year. I say pretty much because they are due in April, June (not July), September (not October), and January.

The more income streams you have that don’t have tax withheld (contractor income, investments, rental income, etc.), the harder estimated taxes are to throw a dart at and guess. Because of the fines and interest, I like to overestimate here, which means we get a refund back at the year end.

Yes, a refund means we loaned the IRS money at 0% interest (that loan they don’t mind), but that’s worth not getting nailed with penalties come tax time. If you wayyy overshoot your estimated taxes, you can always apply them to next year and then adjust your estimated tax payments using the method above going forward.

Estimated taxes are a complicated calculation that took me a weekend of spreadsheet building to get anything half resembling something workable, so we’ll deep dive into them later if our brigadiers are interested. For now, check out the IRS’s estimated taxes page or enlist an accountant to help.

Open a traditional IRA or invest in a traditional 401(k)

Now, the fun part. Instead of moving when you pay your taxes to Uncle Sam, let’s discuss ways to owe him less in taxes.

One great option is to fund a traditional IRA or invest in a traditional 401(k) at work. Contributions to these tax-advantaged accounts lower the amount of taxable income you have for the year.

The catch? You pay taxes on the money when you pull it out later down the road. If you’re in a high tax bracket now, paying taxes later may benefit you as you’ll likely make less income in retirement, so your highest marginal tax rate will be lower. The caveat is that you have to pay taxes on the money you invest, plus on the growth. The longer you leave your investments in, the more opportunity they have to compound in your favor. If you’re young, a Roth IRA or Roth 401(k) option might be better than lowering your taxes now.

Learn more about these types of accounts at our retirement station.

Contribute to a HSA or FSA

Similar to traditional contributions, you’re able to make pre-tax contributions to a HSA or FSA, which lowers the amount of income Uncle Sam taxes. These tax-advantaged accounts are usually tied to health insurance plans. You’ll have one or the other (or maybe neither) depending on your plan.

Flexible spending accounts (FSAs) are a use it or lose it fund that reset every year. You contribute money pre-tax to pay for eligible expenses throughout the year.

There is also an option for a dependent care FSA you can use for expenses like day care that I just found out about last year.

FSAs are great for planned upcoming expenses. For instance, if you know you’re going to spend over $5,000 in day care, you might as well contribute that amount to the FSA. Since Uncle Same doesn’t tax this money, it can save you anywhere from 10% – 37% depending on your highest tax bracket.

A health savings account (HSA) is an account coupled with a high-deductible health plan (HDHP). It lets you contribute pre-tax funds. You don’t have to pay taxes with you withdraw them. The advantage of a HSA versus a FSA is that you can invest funds in an HSA, as they rollover indefinitely. The gains in a HSA are also tax free when you use them for eligible medical expenses. FIRE followers will often front load their HSA into investments early and pay medical expenses out of pocket, saving the receipts to reimburse themselves later, when they want to withdraw funds in retirement without having to pay taxes and after the money has compounded for decades.

Learn more about if a high-deductible plan is a good option for you so you can use this tax hack.

You can also learn about the annual limits on contributions to IRAs, 401(k)s, HSA, and more on our IRS max annual contribution limits page. It includes the tax brackets as well.

Double check tax credits and deductions

If you hire an accountant to help prep your taxes, you’re probably covered here. If you use free or paid software, it’s worth double checking before you file and cut that check or set up a payment plan to Uncle Sam. (In a situation where you don’t have space in your budget to pay your tax bill and set up a payment plan, we consider this a high-interest debt in our FIRE ladder.)

There are some significant tax credits, such as the Child Tax Credit and the American Opportunity Tax Credit for higher education.

There are also tax deductions you can take, especially if you’re a 1099 contractor. Just make sure they are legitimate, qualified work expenses as saving a buck now but risking an audit is not worth it. Talk about penalties and interest to the IRS.

What’s the difference between a tax credit and a tax deduction?

A tax credit reduces the amount of taxes owed. For example, if you owe $25,000 in taxes for the year but have a tax credit for $1,000, you would only owe $24,000 instead.

A tax deduction reduces the amount of taxable income that the IRS calculates your taxes off of. You can think of the traditional IRA, traditional 401(k), and HSA above as tax deductions.

A tax credit is a 1-for-1 break on your tax bill, while a tax deduction is a 10%-37% break, depending on your highest marginal tax bracket. Tax credits are thus the belle of the ball, so take all the eligible ones you have.

Stack your charitable contributions

This one is for our FIRE friends or friends who have a lot of debt and bills and thus itemize, at least until/if the government lowers the standard deduction back down.

If you can’t itemize but are in the ballpark and you give generously every year, consider changing your charity strategy by foregoing giving every other year. Then double your giving in the opposite years in order to itemize and take the tax deduction.

You can create a sink fund of what you would give and then either lump sum give it in January next year or double your weekly or monthly giving as you go.

Even my tithe?

I’m no expert here, and I don’t want to recommend anything that makes you worry you’ll end up on the fast pass express down south when reckoning comes.

BUT

Jesus didn’t have to pay 22%-37% taxes back in his day, so God will probably understand playing the tax game with the government. Churches, after all, do just that.

Contribute to a 529 plan

If you’re on a rung of the FIRE ladder where this makes sense financially, some states offer tax deductions if you use one of their 529 plans, which is a type of college savings plan you can use for your kids (or yourself).

Check the fees and expense ratios for available plans and funds offered. Make sure the tax deduction is worth it compared to other 529 plan options with other states. If you save a couple hundred bucks in taxes but lose out on thousands of growth because of higher annual fees and expenses, you didn’t save any money in the end.

Assess how you invest and asset allocate

This one is for my friends who get a stack of 1099-Bs at the beginning of the year with a laundry list of investments sold.

If you have a high turnover of buying and selling investment assets—either yourself or within the investments you hold—you can get hammered with a high tax bill if they aren’t in a tax-advantaged account. This is especially true if they’re treated as ordinary income and not capital gains.

If you have to report a lot of sales gains every year, it may be time to rethink your investing strategy. Look into low turnover mutual funds, or consider which assets you hold in which accounts. REITs, for example, generate a lot of income, so we have all of ours in our Roth retirement accounts so we won’t ever have to pay taxes on the earnings.

Learn more about asset allocation strategy at our retirement station.

Tax-loss harvest on investments

Our final tip isn’t one of my favorites since you’re resetting the clock on long-term capital gains and upping your cost basis for future sells. That said, if you’re selling investments to pull cash out, you can use this strategy to minimize your taxes by choosing which ones to sell.

Selling assets at a loss locks in that loss, but it also means you don’t have to pay income on the gains. Selling at a loss can help lower your overall taxes.

The same is true for losing at the craps table and deducting your gambling losses, but we don’t recommend gambling as a solid tax strategy. We do, however, recommend watching 21. It’s a great movie based on real events.

You may also be able to sell assets at a loss and buy into an almost identical asset. For example, you could swap out an index fund at Vanguard for the Fidelity counterpart.

This can get complicated if you don’t know what you’re doing, so make a list and check it twice before proceeding.

Other hacks to lower your tax bill we missed?

If we missed your favorite tax hack, let us know in the comments below and we’ll try to go back and add it to the list.

Questions about the tips above? Hit us up in our budgeting and personal finance Facebook group.

If you need help budgeting to pay your taxes before the deadline, check out all our budgeting resources, tricks, and tips to help.