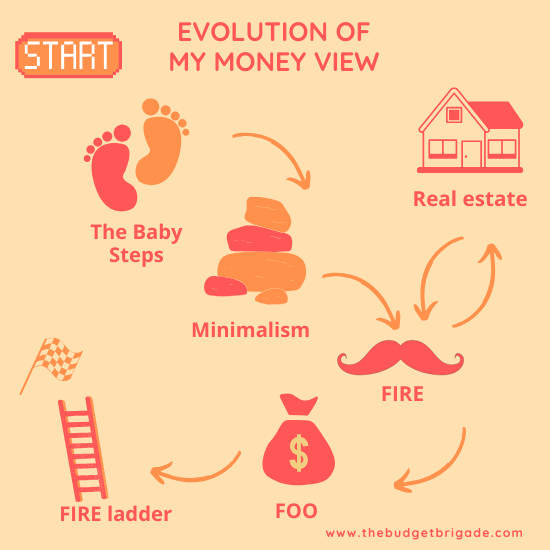

I’ve always been frugal, but I haven’t always had a specific money goal or vision for retirement. Our financial independence journey started one fateful day with a Total Money Makeover audiobook and has grown into my mission with The Budget Brigade. Our journey is probably not that uncommon, and people often don’t know where to start or where to focus when they want to learn how to get a handle on their personal finances. While we’d love to be your one stop shop for all things money related in the future, each brand has its own niche, so below, I cover how my money view has changed over the past decade and the influences that helped shape it.

First, a huge disclosure

As I rushed past in the introduction, each educational outlet for personal finance has its own sweet spot of what it does well. Our walks up and down different avenues doesn’t mean we think the brand has died and doesn’t serve a use anymore. Far from it. We wouldn’t be where we are on our journey without the influences mentioned below. So we aren’t trying to throw any shade at influential figures we’ve “outgrown.”

Celine Dion: the backstory

No, I didn’t take any financial advice from celebrities such as Celine Dion. I just wanted to set the stage for the prequel of our FI journey with Celine’s Flying On My Own:

If you could see what I can see

That nothing’s blocking my view

I look to the sky now

It’s a beautiful day

I’m flying on my own

When we graduated from college, even before we got married, we made it our mission in our lives to get out of student loan and car loan debt as fast as possible. We’d grown up in typical American households that faced money struggles, and we didn’t want that additional stressor in our lives. We had a vision for what we didn’t want. In that sense, we have a clear view of our future, and we didn’t let anything block that vision while we tackled our debt.

The key here is we knew what we didn’t want our financial future to look like. We didn’t want to struggle to pay bills. We didn’t want to have to worry about bankruptcy or foreclosures. We didn’t want to “die in office,” meaning work until we croaked because we couldn’t afford to retire.

Dave Ramsey’s Total Money Makeover: an idea is born

Entering act one of our financial story, we paid off all our debt and celebrated with a fancy hibachi dinner. We got engaged, planned a wedding and honeymoon, and then started saving for a house. We got a dog, we got a home, and we built a life together.

I had a budget… sort of. We had an idea of what we made annually, and an idea of how we wanted to allocate it, and then I kept track of where our money went about once a month when I got around to dealing with it.

We had a goal for retirement, in so far as we knew we wanted to retire at some point. Hopefully early, with a lot of vacations.

But we didn’t have a solid plan for our future or our money.

Then once upon a time, some chatty mice came up to me while I was sewing a dress, and told me about a concept called a zero-based budget. Bibbidi-bobbidi-boo, we became millionaires.

Just kidding.

My husband was at work one day and someone in his band of coworkers discovered the audiobook version of Dave Ramsey’s The Total Money Makeover on the computer. They had no idea how it got there (it wasn’t any of them), but they didn’t have anything else to listen to, so they figured they might as well give it a listen to help the day go by faster.

The audiobook isn’t very long, so they listened to it a couple of times. Nothing livens up a long day quite like a Boomer yelling at you to stop being stupid and irresponsible with your money.

My husband came home and told me about the audiobook. As a nerd who likes budgeting and reading, I figured I might as well see what was so interesting it was worth multiple listens. I employed my favorite budgeting hack and borrowed the audiobook from the library.

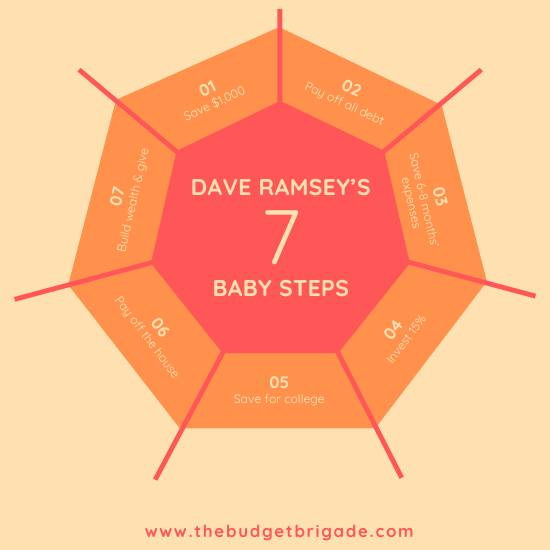

For those unfamiliar with Dave Ramsey, he has a system called The Baby Steps:

We loved the idea of a simple, easy to follow plan for our money. It gave us direction and a goal. And since we’re both pretty competitive, having a goal turned out to be a superpower for our journey to financial independence.

We jumped onto the Dave Ramsey bandwagon and his money view and decided to pay off our house early to tackle Baby Step 6, which is where we currently were in his baby step system.

For over a year, we pounded away at our mortgage like it was high-interest debt in Baby Step 2. When we were done, we celebrated with a fancy surf and turf dinner and wine.

And then we quickly found ourselves in almost the same situation as before we found Dave Ramsey and his Baby Steps. At Baby Step 7, we no longer had direction. So what the flip were we supposed to do now with all the surplus in our new zero-based budget?

The Ramsey Show: a prelude to change

By this point, we’d “drank the Kool Aid” of the Dave Ramsey cult (their words, not mine) and were listening to The Ramsey Show pretty regularly. We even volunteered to teach Financial Peace to help others along their journeys as well. The debt free screams helped motivate us to keep the budget tight and throw every extra dollar we had at the mortgage. And, admittedly, the calls were entertaining.

Dave Ramsey’s teachings are pretty simple and are geared specifically to those in piles of debt looking for a lifeline and unsure of where to start. While the podcast was interesting, we didn’t learn anything from it. And, I’ll be honest, the totalitarian strictness to the Ramsey way didn’t leave enough flexibility for what we wanted for our financial future. After almost two years of listening to debt free screams, I wanted to do one for our mortgage, but since we have one credit card, it was a no way, Jose. They had no interest in celebrating our huge milestone with us because we didn’t do it their way. (My husband told me to just lie and say we didn’t, but I’m not about to lie about that. There is no shame in my game! I have never paid a cent in credit card interest, and I make good use of my credit card rewards points every November.)

Around this same time, my husband changed jobs and found himself in a stereotypical government job where he was working less than he’d ever worked in his life. He’s also a numbers nerd, but he’s more interested in investing than in budgeting. So he took the red pill and dove into the investing and retirement side of our personal finances, first with books like A Random Walk Down Wall Street, then with podcasts with a little more financial savvy than The Ramsey Show. As someone who enjoys watching streamers like LobosJr, he also took to YouTube for financial education.

Finding contentment along the way

I took a different route to the same destination.

Something I’d never paid much attention to was my mindset of money. I had my money view and that was that. I never stopped to think about what shaped that perspective and if it was a healthy perspective.

Enter The Minimalists, who appeared on a guest spot of The Ramsey Show. I knew about minimalism kind of like I knew about index funds: I’d heard of it and understand the very top level idea, but didn’t really get the principle or how it worked. Listening to The Minimalists, something clicked and spurred an entire season of life focused on consuming audiobooks about how less is more. As someone who is kinda OCD and grew up in clutter, having less had a huge appeal for both my lifestyle and finances.

While I didn’t at the time make the connection on just how powerful mindset and focused intentional spending is for financial planning, I learned how to not just enjoy life, but learned how to be content with what I had.

I don’t actively absorb content by The Minimalists anymore, but I follow Joshua Becker of Becoming Minimalist on Facebook. I love his daily reminders that simple is often better, and that it doesn’t cost money to enjoy life. This helps me stay motivated on my money goals.

The detour to extreme FIRE

As we immersed ourselves in personal finance education, we naturally stumbled upon the concept of Financial Independence, Retire Early. At the time, we were both pretty burnt out at our jobs. I’d come home after a 10+ hour work day with another 1+ hour stuck in traffic and collapse into bed, asking my husband when I could retire.

This seems to be a common thread in the FIRE community: people don’t enjoy their jobs, and they equate that with not wanting to work anywhere ever again.

We jumped on the bandwagon and began saving like crazy after we paid off our house. Save 15% of our income? How about 50% instead? We were doing well financially, yet we have this insane drive to save, save, save, save to the point where saving for vacation meant we weren’t hitting our target retirement investing goal.

It took a while for the record to scratch and the music to stop. I froze mid Macarena and wondered WTF are we doing? What was the point in killing ourselves and hating life now just to hit the “finish line” and be able to quit and have to live off $30,000 a year for the rest of our lives?

$30,000 a year sounds like living on a rice and beans, beans and rice diet until we die. Ummm, that sounds like it would suck. I’m gonna have to hard pass on that idea.

The harder we pushed, the less it made sense. Especially because this was right around the time when my husband took two weeks of staycation while I worked, and he went stir crazy by week two. We learned sitting around the house playing video games and watching movies on a lazy Sunday was great. Having that as a game plan for the rest of our lives? Not so much. In this lightbulb moment, we realized retirement for us likely wouldn’t involve flinging our flair in the air and quitting work altogether. We’d want to do something, even just part time, which meant we didn’t need as much for FIRE as we originally thought.

So I finally convinced my husband to scale back from this arbitrary goal of a 50% savings rate. This doesn’t mean we boomeranged across the money pendulum to YOLO. We found a balance in the middle. Now, we set a minimum automatic investment we never go below (25%) and then save additional in the budget over and above that, but we don’t drive ourselves crazy with guilt if it wasn’t another 25%.

Act Two: evolving my money view with the Money Guy

As we were jumping in and out of the deep end of FIRE, my husband also introduced into my money view Brian Preston and Bo Hanson. And I’m so excited because today, I’m going to tell you guys about what we’ve learned from the Money Guy show.

Like Dave Ramsey, Brian Preston (the OG Money Guy) is based in Tennessee. He is an educator at heart, but he takes Dave Ramsey’s in your face “don’t be dumb” and flips it 180 for a calmer, cooler persona. Unlike Dave Ramsey, who grew up in the real estate game, Brian Preston is an accountant turned financial advisor. You want to talk about being a money nerd, Brian Preston checks the boxes.

The Money Guy show helped us define the mirky gray area of Dave Ramsey’s Baby Step 7. It also filled in a huge gap in Ramsey’s Baby Steps 4 and 5 teachings. Because it’s great to save for college and retirement, but where? In a coffee can buried in the backyard?

While Dave Ramsey was a great motivator to get out of debt, Brian Preston was (and continues to be) a better coach to help us formulate the best plan for our money. This is especially important if you’re a DIYer and don’t want to hire a financial advisor to help you manage your retirement savings.

Like the Baby Steps, The Money Guy had an easy to follow system. Welcome to the FOO (Financial Order of Operations):

One of the things I love about The Money Guy is their reminder that money is just a tool. Dave Ramsey’s messaging focused more on the religious aspect of money management i.e. it isn’t really yours, you are in charge of handling it wisely for God. And again, no disrespect, but this message fell flat for me. I work damn hard for my money. I want to own it.

Brian Preston lets you own what you earn, but also cautions that money should never be the goal.

And wow.

Mind blown.

It’s simple, yet powerful, and I think it’s a message that often gets lost in the FIRE movement. In fact, Brian Preston renamed FIRE, and we like his version better: Financial Independence, Recreational Employment.

All the pieces of our financial independence puzzle started fitting in place together under the teachings of The Money Guy. While hyper-accumulation was a great target, it was a tool to help us reach our financial dreams.

Only, we’d still hadn’t sat down and pictured concretely what our financial dream was. Financial independence, yes, but what did that actually mean? We didn’t have to work at all? We could become nomads and travel all day, everyday? We could start a foundation or non-profit?

What did we want to do with all this money we saved?

This is where the mindset of money I cultivated with minimalism and contentment popped its head up and waved, as did my bucket list wishlists. All the sudden, our money conversations weren’t just about budgeting and investing anyone. They became: what do we want the rest of our lives to look like, and how do we get there?

The eleven-point turn at real estate

Real estate investing was not how we wanted to get there, no matter what everyone on YouTube wanted us to try. While Grahan Stephan’s story is impressive, his path to becoming financially independent isn’t one we’re comfortable with. For one, we aren’t exactly people persons (people people?). We’re the reason the Jump to Conclusions guy in Office Space even had a job. We don’t have people skills, dammit!

And while I enjoy binging HGTV, I don’t actually want to deal with the headaches of flipping remodels. Our master bathroom remodel in our old house was enough excitement for me.

Real estate can be a great way to elevate wealth, and if that’s your thing, go build yourself a real estate empire like Taylor Swift. We don’t want to be a landlord, so we channeled our inner Gus, did an eleven-point turn, and headed back to a REIT and chill mindset.

This doesn’t mean that we’re anti-real estate and will never own a rental or AirBNB. It just means we’ve decided not to travel down that particular finance trail for now.

The quick pit stop in Texas to visit Caleb

While we’re still very into the Financial Mutant mindset, it doesn’t mean we’re a one-trick pony with our finances. We’re always open to learning and investigating new principles to see if they could help stay on track for our financial goals.

So when I heard about this “little” show on YouTube called Financial Audit that was blowing up, I was intrigued, especially since it focused more on budgeting than investing. So we gave it a try.

If you aren’t one of the 1,000,000+ people that subscribe to Financial Audit and haven’t seen it before, my husband came up with a great analogy: it’s Jerry Springer for money.

We watched a few episodes, but it made The Ramsey Show look like a college level syllabus. The guests grew more and more sensational, with little to no value on the actual budgeting side to help people turn their lives around, which is what we’re all about. And honestly, it kinda just bums me out seeing how terrible people are with money and how unmotivated they can be for a better future.

The final act: where we are now with the FIRE ladder

We’re firm believers that personal finance is highly personal, as the name suggests. What works for one person or family isn’t always ideal for others. That’s part of why there are so many different educators in the personal finance space.

As we grew comfortable in our financial journey, I pulled together all the influences we’ve had to share what’s worked best for us and our situation. You might not be in the same place, at least currently. If that’s the case, we hope you can also use the resources above that have helped shape our financial journey.

Those who can’t do teach, and they flood social media. Following their advice is a great way to lose your retirement in crypto. It’s important for those who have successfully forged the trail to help others along. I was inspired by the educational content from Dave Ramsey, Brian Preston, and others and want to do the same.

While I found their content engaging, not everyone loves obsessing over spreadsheets like my husband and I. People are much more likely to engage with us as we quote our favorite Friends episodes (PIVOT! PIVOT! PIVOTTTTTTT!) than to debate their top choice for an index fund, so I wanted to make personal finance more entertaining and accessible. Plus, everyone seems to focus on the future with retirement (which, don’t get me wrong, is super important), but your spending habits affect both today and what you’ll need in the future to fund your lifestyle. Budgeting get’s no love and it’s my jam, so I wanted to lean into it.

If you would like to wax on, wax on with the brigadiers, we created our FIRE ladder taking what we’ve learned from others. We focus on how to budget and become the boss of your money to take control of your future:

Learn more about the FIRE ladder: your path to financial independence.

The final word

I look forward to a life of learning and adjusting my money view as we continue to define what financial independence looks like for us.

If you have a finance educator who has helped you immensely throughout your money journey, please share them in the comments. We’re always looking for new views.