While we haven’t seen the newest Ghostbusters movie, we saw the trailer before Dune 2 (which was AWESOME). We couldn’t find the OG streaming, but we hadn’t seen Ghostbusters Afterlife with the same cast as the new one, so we tried it. It was better than expected, especially the extra cameo scene during the credits.

In the opening scene, the young daughter (of Troop Zero fame) says, “To be fair, Mom, you’ve never been good with money.” I immediately thought, “Here’s a great case study for The Budget Brigade.”

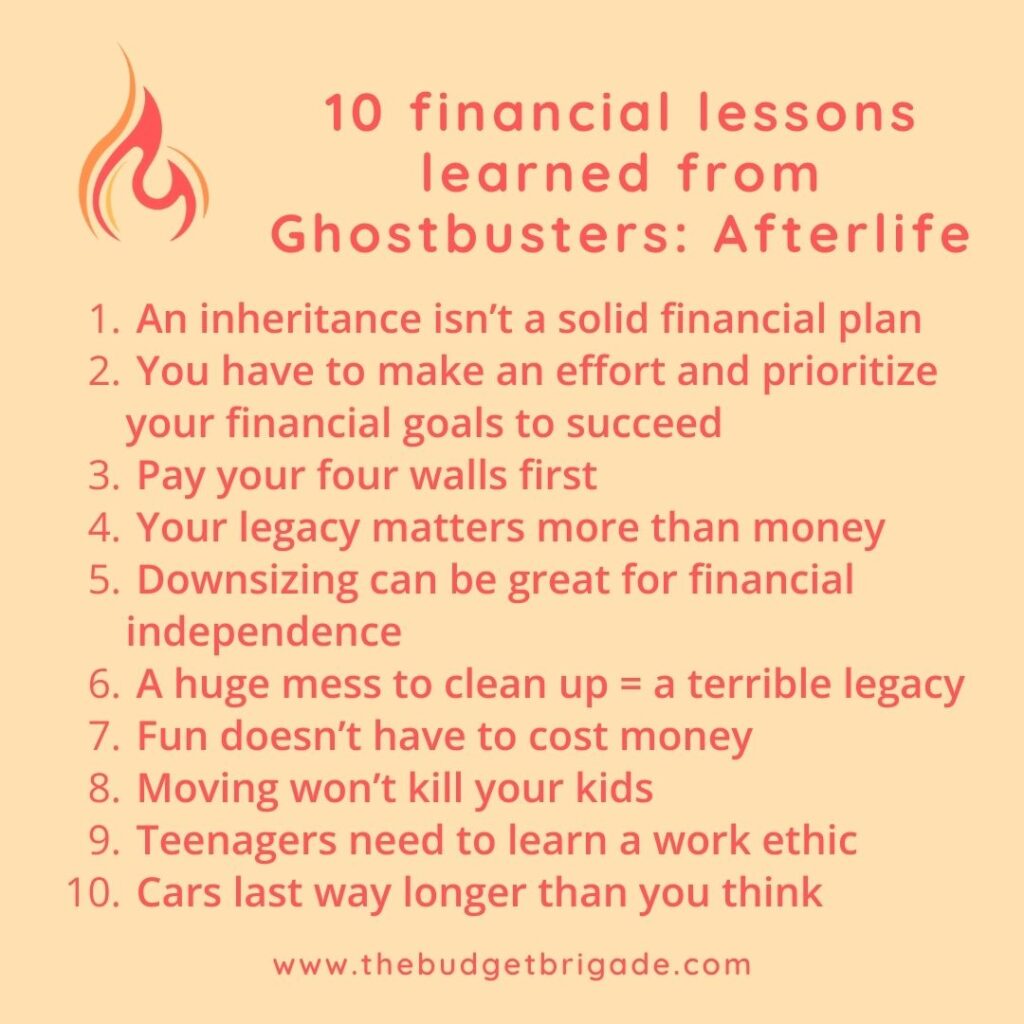

Sure enough, there were quite a few personal finance nuggets you can gain while enjoying the nostalgia value of yet another franchise requel.

Warning: some spoilers ahead. Proceed with caution. And for the love of all that’s holy, if you haven’t seen the original Ghostbusters and Ghostbusters 2, get them from the library this weekend!

Financial Advice from Ghostbusters Afterlife

1. Don’t let an inheritance be your plan for financial independence.

Would it be awesome to inherit a few cool million from the father that abandoned you to go live in a haunted house on a farm? Sure.

Could it happen? You never know.

That’s why it’s never good to plan your finances, including retirement, around an inheritance. (Or winning the lottery.)

Your family members could outlive you.

They could cut you out of the will.

Or you could show up at the dirt farmer’s homestead and discover he left nothing but a dilapidated house and a lot of debt. Thankfully, you can’t inherit debt, but it can eat away at whatever assets they had, like that rundown haunted house.

Let an inheritance be a special bonus that you can use to accelerate your financial goals, not something you have to have to finally quit working.

2. You’ll never get good with money if you don’t make the effort and prioritize the goal.

Have you ever heard the old saying, “you succeed at what you focus on?” That’s especially true with regard to your finances. That’s why we’re such a huge proponent of budgeting, which puts your money to work for you and helps keep it focused and on track.

“I’ll get to it eventually” is not a great long-term plan. It isn’t even a good short-term one.

Waiting to save until after you have kids won’t make budgeting and paying bills any easier. Money won’t magically appear if you don’t work for it. But it is possible to get good with money if you try. We can help!

3. Prioritize paying your four walls, as getting evicted adds stress on top of stress.

There’s only so many “the check is in the mail” excuses you can make. No one wants to pack up their life for an unplanned move. Plus, moving is hella expensive. We even created a series of articles on moving because of how much surprised me during the process surprised.

Instead of stopping at the drive thru where the waitresses wear roller skates, eat beans and rice and keep your apartment instead. Your kids might tire of box mac ‘n cheese, but they’ll appreciate not have to skip town in the middle of the night and uproot their entire life just to dodge outstanding payments to your landlord.

Your essential four ways to prioritize budgeting and paying first are:

- Groceries (this does not include eatings out)

- Shelter (rent or mortgage)

- Utilities (water, electric, gas, etc.)

- Transportation to get to your J-O-B

If you’re new to budgeting, check out our budgeting 101 guide, then explore our budgeting station with all our resources to help you save money and reach your financial goals.

Also, we couldn’t help but think as we watched the movie: how is she paying property taxes and electricity for this place? It’s one thing not to pay your landlord, another not to pay the government. Her Stranger Things (will the last season EVER get here?!) kid is working, but she seems to just hang around the house. She needs to get a job ASAP.

4. While selfish people may hope you leave them a windfall, what matters in the end is the legacy you leave and the lives you touch.

While Ghostbusters: Afterlife carried a lot of the same light humor and action as the original film, it had this important, deep theme that ran through the movie. While the movie starts with Callie pissed her father left her nothing more than a dilapidated house, her true frustration tied into the fact that her father up and abandoned her to live out in the middle of nowhere and be a dirt farmer.

Spengler lost touch with the other Ghostbusters. He became obsessive in his resolve to take care of a problem he knew was coming, a problem that threatened all of humanity.

Yes, it was an important calling. But at what cost?

Spengler didn’t have any balance in his life. He lost all community, family, and friends. No one missed him when he was gone. The only way he redeemed himself was by helping save the world as a ghost.

Since we aren’t likely to get the same opportunity, don’t lose sight of what’s important on your financial journey. You can’t take your money or your career with you. Memories have better ROIs than other financial investments, especially when done intentionally and budget consciously. (Don’t misunderstand me; this is not an excuse to YOLO.)

5. Downsizing your living situation and lifestyle may not be your first choice, but sometimes you have to make tough decisions to put your life on a better path.

No one wants to live in the rundown farmhouse in the middle of nowhere on a faultline, but a woman’s gotta do what a woman’s gotta do. Free rent is free rent. When we did our tips for moving on a budget, my biggest tip was to consider downsizing during the process.

The US Census Bureau shared a report on home sizes by decades. The average single-family home has increased in size from around 1,500 sq ft to over 2,000 in forty years. That’s in two generations or fewer. And we aren’t having more kids. In fact, the US birth rate has actually decreased.

We’ve gotten so used to accumulating stuff and then needing more room to store it all. Not only will downsizing decrease your rent or mortgage, but it also decreases your utilities, property taxes, insurance, maintenance costs, and more. This can have a huge impact over the span of your life.

We’ve lived comfortably in under 1,200 sq feet for a decade now and it hasn’t killed us. In fact, it has provided us great opportunities to save and invest on our FIRE journey.

6. Leaving behind a huge mess for your kids to clean up is not a kind legacy to leave.

Not only does a bigger house mean more expenses and more room to accumulate crap, but it also means you’re much more likely to leave that crap for your kids and grandkids to clean up after you’re gone. While you might have a few sentimental items they’ll want to keep, it’s more than likely that it’ll be far more of a headache than a blessing of an inheritance.

No one wants to have to come in and clean up the rubble of your life. Be kind, minimize.

In the height of my hygge discovery phase, I came across the book The Gentle Art of Swedish Death Cleaning by Margareta Magnusson. It was, as the title suggests, a gentle reminder to declutter your life while you’re around and can intentionally select what you hope to set aside as part of your legacy. Leaving behind a house with stacks of books and a backyard full of crap is not a kindness for your grieving family, who will have to root through it all and throw it out.

Save them the PKE and that nifty antique car with the slide out seat, then chuck the rest.

7. Fun doesn’t have to cost money.

We learned this lesson from South Park too.

Your kids don’t need the expensive toys and gadgets and activities. Let them explore the abandoned mine shafts and use their imaginations.

Or maybe just the second one. The first one could add up quickly in medical bills.

8. Your kids can make new friends—moving will not kill them

While we point out above that having to skip down to avoid past due rent and forcing your kids to uproot their lives isn’t an ideal situation they’ll thank you for, moving won’t kill them if you move for the right reasons. Moving for a better job or to a lower cost-of-living area can be a great way to arbitrage your financial freedom journey.

So often, I hear parents waiting to move, though they desperately want to GTFO. Even when it’s a better financial situation for them, they want to wait until their kids graduate. But I promise, your kids will make new friends. It might be with the slightly nerdy kid who believes in ghosts and is very into podcasting, but that’s not necessarily a bad thing! Kids are resilient. You can be, too. Just make sure you prioritize making friends and connections in your new area as well. Community is one of the key rungs on our FIRE ladder.

9. Letting your teenage kids learn the hard work that goes into earning a wage is a great life skill that also won’t kill them.

My husband and I have a general life rule: everyone should have to work in hospitality for a season in their lives. Cause it can be a lot of hard work for little to no recognition and minimal pay. It can teach you quickly the true value of a dollar, and that if your steak is a little overcooked, it won’t kill you. A lot of adults haven’t acquired the perspective that working in hospitality or the restaurant industry teaches, and it shows. This work experience can also help them learn empathy and to be nice to those working hard for little, especially if you as a parent fall into that same boat. It will certainly make them think twice about wanting to go see the next Ghostbusters movie on the big screen if they have to pay for the tickets themselves. (Just borrow it from the library or wait to rent it from Redbox for $1.50 like us.)

10. Cars can last way longer than you think they will.

There are a few different types of antique cars. There’s a 1970 Chevy Chevelle SS, and then there’s a 2000 Toyota Corolla that you can no longer find OEM replacement parts for because the manufacturer stopped caring about them a decade ago. There’s also the 1959 Cadillac Miller-Meteor Sentinel retro-fitted ambulance, if that’s more your style.

Whether your antique is worth a ton or isn’t worth fixing when you dent the bumper coming out of a parking lot, cars often last a lot longer than we give them credit for, and could run long after we trade them in.

They won’t always be pretty with back-up cameras or a functional Bluetooth capability, but having a fancy car won’t make you financially fit. If you’re just starting to get your finances under control and are catching up to financial independence, give the mechanical systems a quick tune up and keep on driving until it gets to where it costs more to repair it than its worth and is cheaper to replace it.

Explore More Financial Lessons from Pop Culture

Looking for more practical advice learned in a highly unconventional way? We spend way too much time watching TV and movies, so we have you covered! Explore all our favorite financial advice we’ve learned from pop culture.

If you have a favorite TV, movie, book, or video game you’d love to see featured in the series, let us know in the comments below.