A Budget Brigade community member asks: I’d love some info on cash vs credit (pros and cons for each)

This is a big topic in the budgeting world. Some people think credit cards are the spawn of Satan and no one should have one. Others think they’re a great tool.

Here’s an answer you’re used to if you’ve spent any amount of time with me: cash versus credit depends on your particular situation.

Credit Cards

Let’s start with the basics. No one should carry a credit card balance. Paying off credit card debt is one of the first steps of our FIRE ladder. I’m unequivocal here. The average interest rate on credit cards is over 23%. TWENTY-THREE PRECENT! Can you imagine a mutual fund that would pay 23%? I’d be trampling people to get into that sucker. You’re loaning the credit card companies your money at over half the average returns of the market. Don’t do it. That’s the modern day loan shark.

What is my credit card’s interest rate? I honestly couldn’t tell you. In the fifteen years I’ve had it, I’ve never paid a single cent of interest.

Credit card debt is no joke in the United States. 65% of Americans carry a balance at least some of the time. The average credit card balance is $5,315. That’s $102 a month just in interest without lowering your balance a penny!

If Americans are in such trouble with credit cards, are the Dave Ramseys of the world right? Should we stop using them altogether?

For some people, the answer is a resounding yes. If you are paying interest on your credit cards every month, you might not be a credit card person. Or credit cards might not be a tool for you in this season of life. That’s okay! There is nothing wrong with setting yourself up for success by creating roadblocks to help save you from your own spending habits. (My work wife has full permission to throw highlighters at me if I even so much as mention walking into a bookstore this season.) We all need accountability. There’s no shame in cutting up your credit cards to break the cycle.

And did you notice how I used credit cards, plural, above? Half of all Americans have at leave two credit cards. 13% have at least five. The average American has three. Here is where I have a more absolute opinion:

You don’t need more than one credit card, folks.

A. As in one.

If you’re married, that one credit card should be a joint account for both of you. And the limit for that one card should be less than your monthly take home pay so there’s never an opportunity to overspend what you earn. Setting some parameters in place can help keep you out of trouble. I’ve called up the credit card company and had them lower our credit limit when they increased it without asking. I didn’t need a $12,000 credit limit because we didn’t make $12,000 a month. The lady on the other end of the line was a little confused by my request, but the limit was back down within our means the next week.

Don’t make your life a juggling circus of multiple credit cards and credit card payments. That’s a recipe for disaster and a slippery road to “well, it’s only one Amazon charge, I’ll pay it off next month if I work some overtime.”

And I wouldn’t mess with a credit card that charges you an annual fee for the privilege of owning it. Let your credit card pay you rewards, don’t pay the credit card company for the opportunity to earn rewards. There are plenty of free options out there. I also wouldn’t mess with multiple cards to try to game the system to get the best perks. But I get 2% back on gas on this card, or 2% back at Target if I get this second card! It’s such a small difference for the hassle and headache. Do your research up front; find the card that best balances what rewards you want and points based off where you spend your money and then set it and forget it.

Cash vs Credit

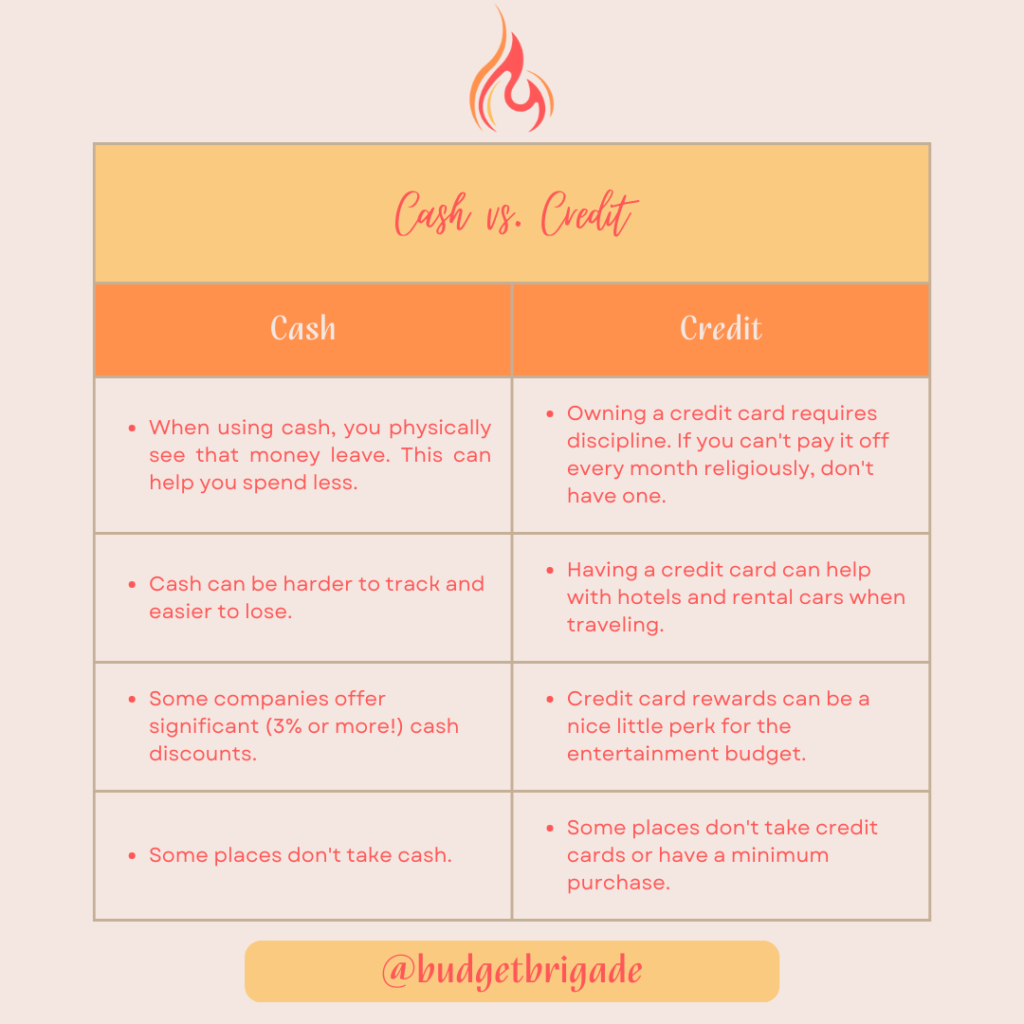

Now that we have the disclaimers and words of warning out of the way, let’s get to the heart of our member’s question: what are some of the pros and cons of both cash and credit?

Infographic time!

Cash

Advantages to Cash

Physically having to hand over your hard-earned money can cause a visceral response, especially in people like me who have an innate built in anxiety of ending up broke and living in a refrigerator box with the Budget Beagle.

We did a cash only experiment for about three months in our household and holy moly, we spent so much less money. I was constantly putting things back on the shelves at the grocery store. Handing over cash caused a deep emotional reaction within me.

This can be great when you’re trying to get out of debt and every dollar you save is another one you can put towards your goal.

You can also save money with cash by taking advantage of cash discounts. Not all vendors offer them, but it’s worth asking. We are currently looking at booking a cruise for an upcoming vacation. My original thought was Think of all the credit card rewards! But then I saw that the cruise line offers a 3.3% cash discount. Credit card rewards come in at less than 1%. So you bet your sweet butt, mama is paying cash! We’ve also saved with a lot of improvements and repairs around the house by asking for a cash discount. We saved a few hundred dollars when replacing our floors.

Always ask if a vendor offers a cash discount or charges a charge card processing fee. Cash is better in these situations as the cash discount is better than what you’re going to get back in reward points.

Disadvantages to Cash

When we did our cash experiment, I’ll be honest: it was hard to track in our budget. My husband’s pockets look like a bird’s nest by the time he empties them on his nightstand at the end of the day. Receipts are all wadded up, if he brings them home.

The envelope system can help with this. Dividing your cash for the month up into different envelopes for each budget item let’s you track within the envelopes on the front end instead of trying to track down receipts to put them in your spreadsheet or budgeting app after the fact, which can end up tedious. So experiment here. Perhaps you do certain items, the ones that are the hardest to stay within budget on (in my case, books) in cash and the rest on a debit or credit card.

Cash is also easier to loose. And when it’s gone, it’s gone. There’s no number to call to request a replacement in three to five business days. So be careful when carrying cash. We keep our cash on hand locked in a secure area at our house and only keep on hand what we need for a regular trip out.

Some places don’t take cash, so it’s nice to have a debit or credit card on hand in these cases. Or a cash app like Apple or Google Pay.

Credit

Advantages to Credit

Some vendors don’t take cash. Others will take debit cards, but put a huge hold on your account. This can be a pain especially when travelling, as it’s common with vendors such as rental car companies and hotels. When travelling, I also like to have a credit card as a backup to my debit card in case the bank decides to put a freeze on the card when I’m at the gas pump in the middle of nowhere Nevada on the way to the Grand Canyon. That gives me the rest of the three hour road trip to prove it was me and get the card unlocked for the remainder of our trip instead of having to wait at the pump to cycle through the endless automated system messages to SPEAK TO A REPRESENTATIVE.

Credit cards typically offer rewards or cash back. I would definitely pick a credit card that does, without an annual cardholder fee. We save up our credit card points and use it as our Black Friday/holiday shopping budget every November/December. We have friends and family that also use credit cards for gift cards for restaurants and stores – either for their own budget or to gift to others.

Credit cards can also offer other fringe benefits, such as theft insurance for the first ninety days since purchased, or rental car insurance coverage, depending on the situation. Look into the benefits information for your credit card to see what other perks you could benefit from.

As opposed to cash being difficult to track, credit card purchases are easier when receipts aren’t on hand because you can log in online and pull up the past transactions, making your budget easier to reconcile at the end of the month.

Disadvantages to Credit

In case you missed the paragraphs of warning above, credit cards require discipline. If you can’t religiously pay off your credit card balance every single month without a late fee or interest, don’t have one! At least not in this season of life. Credit cards are one of the highest interest rate types of debt out there. Don’t let yourself fall into this trap and spend your todays and tomorrows constantly paying for yesterday’s retail therapy and overspending. There is no shame in admitting you aren’t a credit card person. Cut up those plastic devils and don’t look back. Bye, Felicia!

Like with cash, some places don’t take credit cards or have a minimum purchase for cards at checkout. There’s nothing more embarrassing than going into the local corner market here to buy a bulb of fennel without $3 cash and scrambling to find something I actually need to hit the $5 minimum.

The Bottom Line

Cash or credit? If you are disciplined enough to use credit cards (and I cannot stress this point enough; please please please be honest with yourself here), a mixture of cash and credit can work for you in different situations, so long as you don’t carry a balance. It’s always nice to have some cash on hand for small purchases where you don’t met the card minimum or a vendor doesn’t accept cards. And cash is always preferred if you can get a discount. A credit card is nice to have when traveling, and credit card rewards and benefits are a nice perk if you stick with your monthly budget and don’t overspend swiping more than you’re getting back in rewards.