401(k) Rollovers: No Plan Left Behind

You are pumped to start a new job. You got a pay raise, a signing bonus, and more vacation time than at your old gig. So long, former employer, and thanks for all the fish! But wait. You might be leaving something behind—your hard earned dinero. Don’t get so excited about your new job’s benefits that you overlook one key detail: your previous employer’s 401(k) plan. Leave no plan behind! Below, we cover 401(k) rollovers.

Should I Stay or Should I Roll?

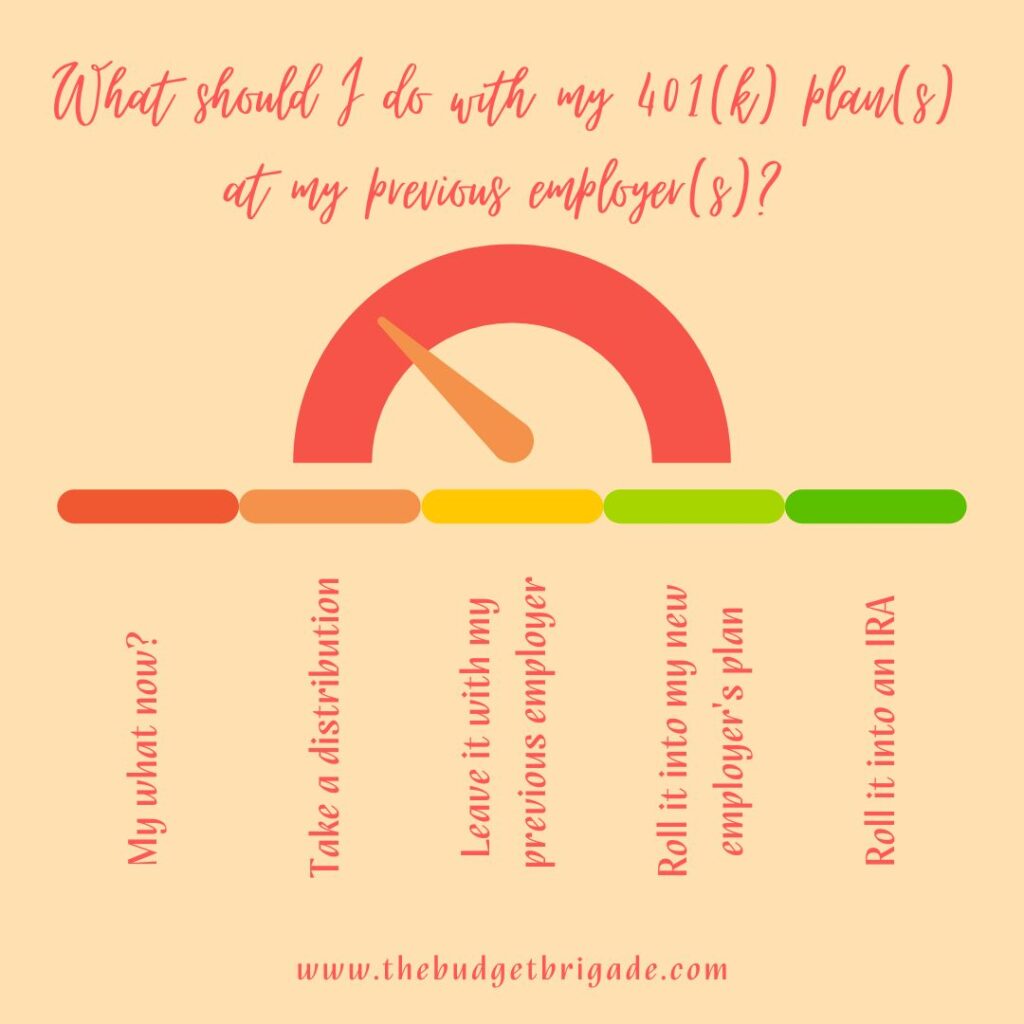

When you leave a previous employer, typically your retirement plan stays with them unless you decide to take it with you. There are four main options when it comes to previous employer plans. Here, I’ve ordered them from our favorite option to the pleaseeeee don’t do this option.

- Roll it into an IRA(s)

- Roll it into your new employer’s plan

- Leave it with your previous employer

- Take your balance as a distribution

If you’re looking at a move or have a lot of debt you’re trying to pay off, number four might be your first thought. Why don’t we want you taking a distribution?

It’s Stealing!

When you take a distribution from your 401k (or other employer plan), you are robbing your future self. Not only are you taking the funds you already designated for the future, but you’re losing the opportunity cost of all its future tax-advantaged growth and earnings. Don’t force yourself to work years longer for a few less months of sacrifice today. Compounding interest is great when it’s working for you, not against you.

If you take an early withdrawal from retirement, you’ll slammed with an early withdrawal penalty. So not only are you stealing from your future compounding interest, but you’re eating away at the growth you’ve already managed and giving a big chunk of that to Uncle Sam.

Don’t Just Let It Go, Let It Gooooo

Out of sight, out of mind. You might not even remember you have an old employer plan. Or worse, you know you have money saved somewhere but don’t remember how to access it.

Taking the time to track down your old HR department and retirement plan information is always worth it. The sooner the easier and thus better. You worked hard for that money. Don’t drop a fat wad of cash on the ground and keep on walking. Backtrack my friend and pick it up!

We talk a lot about intentionality here at The Budget Brigade. That’s because you succeed in what you focus on. Letting your retirement sit lets it sleep on the job. You might have your old retirement plan stuck in cash without even realizing it. Subtract monthly account management fees from a stagnant balance and not only are you losing valuable growth opportunity, but your account balance could very well be shrinking in today’s dollars too.

Keeping your investments centralized is less headache for you, and it makes it easier to make sure your retirement is hard at work so you don’t have to be.

Roll Me Further

Now we reach your two real options: should you roll it into your new 401(k) or into an IRA? We always like to roll previous plans into IRA. Why? Money! If you have your IRA(s) set up at a brokerage firm with low overall account fees that offers mutual funds and index funds with low internal fees, you can typically save a lot compared to what employer plans charge, though we’ll say TSP plans offer some of the lowest fees we’ve seen.

Transferring to an IRA can open up more options for investing too. Employer plans can be extremely limited in the funds available for investing, which can make it difficult to diversify and create a balanced portfolio.

Why might you want to roll your 401(k) to your new employer instead? 401(k)s can offer more asset protection than IRAs, depending on what state you live in. If you’re in a profession or situation where you are much more likely to be sued, having your retirement tied up in a protected account has benefits.

If you’re a high-income earner and are looking at doing a backdoor Roth IRA in the future, having your pre-tax retirement funds in your 401(k) can protect you from IRS pro-rata rules as well.

Ready, Set, Roll

Whether you decide to transfer your previous employer’s plan to your new 401(k) or your IRA(s), the process is similar.

First, you have to have the new account that you want to transfer your older plan into open. If that’s an IRA, make sure you have one set up. If your have a mix of Roth and traditional you are transferring, you will want to set up two IRAs, one traditional, and one Roth. If you roll a traditional account to a Roth one, you can create a huge tax bill, which is something we’re trying to avoid. Make sure you know what’s in your old account!

A mix of Roth and traditional funds will involve doing two separate transfers of the two different types of funds within your current 401(k) or IRAs. If you are transferring to a new employer 401(k), you want to make sure that account is set up with the HR department before you schedule a transfer as you will need all the new accounts information. Your new employer might not even offer a Roth option, so make sure you check.

401(k) or IRA, whichever you decide, make sure you do a direct transfer. Depending on who manages your previous employer’s 401(k) (or other employer plan), the process may vary. But no matter what you do, you want to make sure it goes from account to account and doesn’t come to you. Otherwise, the IRS may treat it as an early withdrawal and not only charge you tax on the amount you are trying to transfer but slap you with a penalty fee as well.

Types of Transfers

To initiate the direct transfer, you need to work with your previous employer. Some employer plans make this very easy. When my husband left the military, we were able to directly transfer his TSP to our brokerage account. We never saw the funds. They went straight from the TSP into our brokerage account. We got an email alert and saw the funds were there. This is the easiest of the transfer options if your previous employer allows it. It’s also the least stressful because you don’t have to worry about how checks are written out and how quickly you get them deposited. The IRS has a sixty-day limit from when the transfer is requested to when the funds are put into the new account before they treat it automatically as a withdrawal.

When I left my previous employer, the managing company of the plan could not do a direct transfer. Instead, they had to issue a check and mail it to me. Once I received the check, I had to send it to my brokerage company so that they could deposit it into my IRA. This, at least for me, is the most stressful of the options. You need to make sure that the check is made out properly into the correct account name. It most likely will not be made out to you directly. It will be for the benefit of you through the management company’s name. You also want to make sure you have the mailing address exactly right, along with any forms that the receiver requires so that you can select your investing. Or it might go directly into a settlement fund and then you select the investing once it transfers. If this is the case, you want to make sure that you follow up on it. You do not want your entire rollover funds sitting in a money market account or cash account making little to no earnings.

As there are a lot of potential taxes and penalties if your transfer is not done correctly, I always recommend calling the brokerage company (IRA) or current employer (401(k)) to make sure that you are setting it up the way they need it. For example, with my new day job I am an independent contractor. My original plan was to transfer my previous employer‘s plan into my solo 401(k) to waive the annual fees that the brokerage account charged. When I called the managing company, I discovered I could only roll the traditional part into the solo 401(k). The solo 401(k) wouldn’t accept my Roth portion, so that part had to go to my IRA. My previous employer’s management company did not know this. If I had issued the checks directly to the solo 401(k) without checking, it could’ve been a nightmare situation once I received the checks and tried to send them to the new management company.

Can I Roll Halfway Down the Hill?

Partial rollovers are a thing. In my previous example, I was able to move part of my 401(k) to an IRA and part of it to an individual 401(k) plan. Your ability to do a partial roll over is dependent on what your receiving account(s) will take. This is why it’s imperative to get a hold of someone at the receiving company before you initiate the process to make sure you have all your bases covered and know all the rules regarding what you can, and cannot do.

Ta Da!

Once you set up the transfer process, it should only take a few days to complete. Your previous employer should keep you updated of the status. It’s not a 100% pain free, caveman approved process, but it’s worth the short time investment up front to help better manage your money and retirement. Your future self will thank you.

Questions?

We don’t know what you don’t know, so we’re happy to address any questions you may have, simply leave a comment below!