Two popular methods exist for debt reduction: the debt snowball and the debt avalanche. With the debt snowball, you start with the smallest consumer debt and work your way up to the largest, letting your payments “snowball” as you free up each minimum payment. We’ll cover the step-by-step guide, as well as the pros and cons of the method, below.

While we hope for a debt free life for all our brigade members, we understand the process and timeline look different for everyone. We don’t care what method you use, so long as you are working toward your goals on the path up the FIRE ladder.

- A popular way of paying off consumer debt

- Prioritizes your debts in the order of smallest to largest balance, tackling them in that order

- Ignores interest rates, focusing on small victories to give you momentum to stay the course

- The accumulation of minimum payments creates a “snowball” effect with each debt you pay off

How the Debt Snowball Method Works

Dave Ramsey, who has been teaching debt-free living for decades, popularized this method. While we don’t agree with everything he teaches, we do like the behavioral philosophy behind the debt snowball method. Dave says personal finance is 80% behavior and only 20% head knowledge.

He has a point. We all know how to get out of debt: pay it off. It’s a simple concept, but it’s hard to accomplish because it relies heavily on brushing off the YOLO mentality and embracing delayed gratification. I’m typically not a patient person, so I have to fight this urge often.

The 80% behavior part is why goals are so important to your financial journey, so much so that we made it the first rung on our FIRE ladder. Being debt free just for the sake of not having debt is a hard goal to sacrifice for. Being able to show your boss where they can put their pieces of flair? Or being able to take a month off work to explore Europe? Now that’s a goal that can motivate you to bypass Starbucks on the way to work and Chick-Fil-A on the way home.

The debt snowball method gives you early wins by focusing on the smallest debts. These wins help you see the progress you’ve made, prepping you for the longer slog through the larger debts. For this method to work, you have to first stop adding new debts. It’s hard to organize and prioritize your debts when the balances change every month.

If you have credit card debt, stop using credit cards. You may be someone who can use credit cards responsibly later, but for now, focus on the debt free task at hand. Once you’ve put out your debt fire, you can reevaluate cash versus credit.

To do the debt snowball, follow these steps:

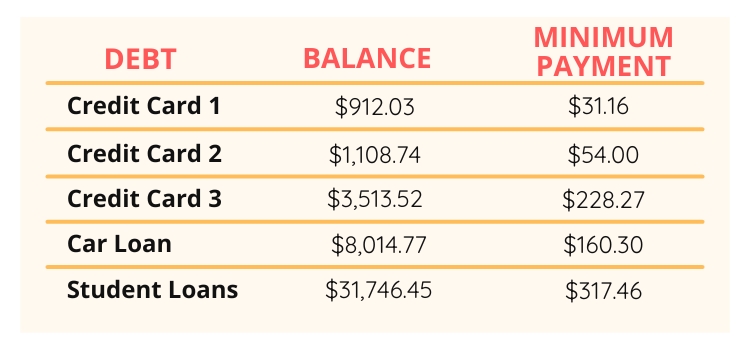

Step 1: List your debts (see below which ones to include) from smallest to largest. For each, include the total balance and the minimum payment due.

Step 2: Make the minimum payments on all the debts listed except the smallest one, unless the minimum doesn’t cover the interest amount. Then recalculate the minimum to cover at least the monthly interest rate so your debts aren’t snowballing against you in the opposite direction during the process. Take any extra cash you can free up in your budget and use it to tackle that smallest debt until it’s gone.

See our 50/30/20 budget for general guidelines on how much income to target for your debt snowball.

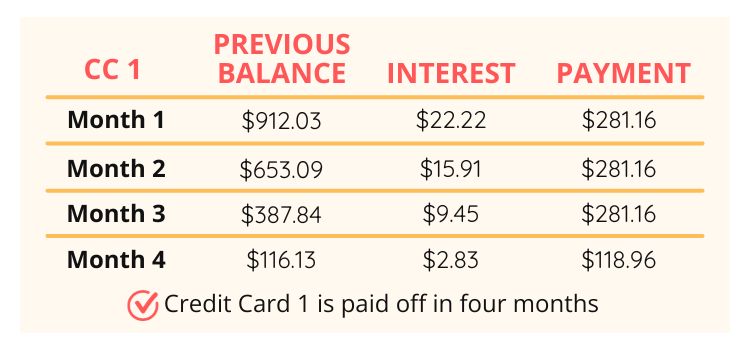

For our example, let’s say you have $250 extra a month to throw at your debt. We start with Credit Card 1, which had a previous balance of $912.03 from the graphic above, and add the $250 to the minimum payment each month until we pay it off.

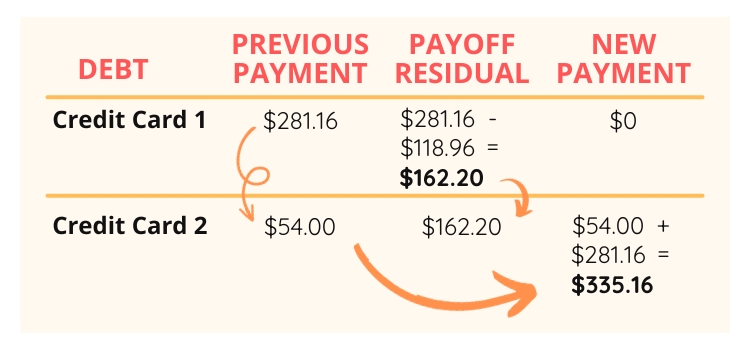

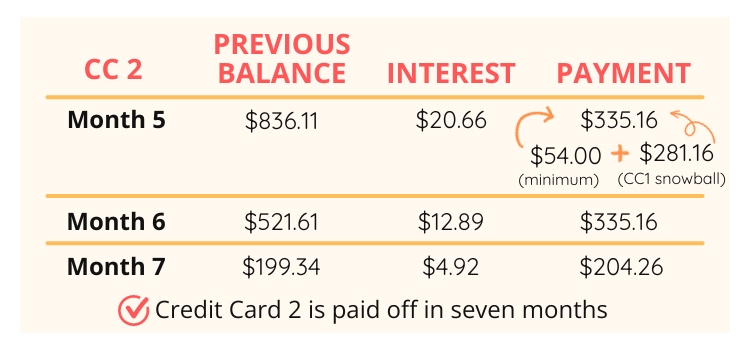

Step 3: Once you’ve paid off the smallest debt, roll its payment into the next smallest debt. In this case, Credit Card 2.

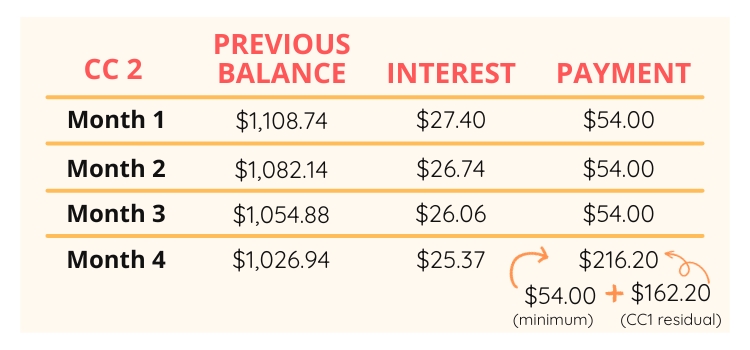

The two graphics below show that snowball effect in action. Credit Card 2 we barely chipped away at in the first four months while paying off Credit Card 1. Even with a higher remaining balance in the fourth month than Credit Card 1 started with, we’re able to pay Credit Card 2 off in just three more months using the snowball from Credit Card 1.

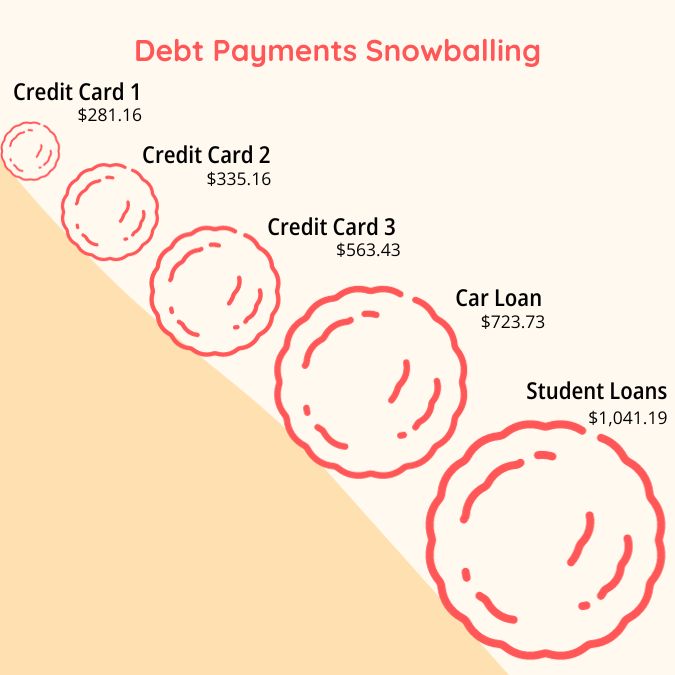

Step 4: Rinse and repeat, letting your payments accumulate as you pay off each debt along the way. While this method leaves the largest debt for last, it also gives you increasing power to tackle it with each debt you knock off the list.

Debt Snowball In Action

Using the example above, let’s look at the debt snowball in action.

For Credit Card 1, we started with a minimum payment of $31.16 and an additional $250 from our budget to throw at the debt snowball.

Once we paid off Credit Card 1, we added that $281.16 to the $54 minimum payment for Credit Card 2.

As you can see below, your snowball grows bigger as you roll down your debt mountain, which is where the name comes from.

When to Pay Off Debt

We created our FIRE ladder to help guide you along your personal finance journey to FIRE (financial independence, retire early) freedom. In our eight rung ladder, paying off debt is Rung 4, after:

- IGNITE your journey: determine your goal to build motivation to reach it.

- ASSESS the smoke: evaluate your current financial situation (AKA make a budget).

- FORTIFY your fire station: get an emergency fund, insurance, and community.

Which Debts to Include in Your Debt Snowball

Dave Ramsey recommends paying off all non-mortgage debts at once. We think there’s more nuance, depending on your situation. Those with higher incomes should have room in their budget to work toward multiple financial goals at once, including paying off debt and saving for retirement. Smaller income households may find more benefit in focusing on a single goal at once in order to gain traction, though we do recommend taking any free employer match for retirement first and balancing your budget with that calculated in when at all possible. Why? Because it automatically has a 100% return on investment, which is more than the interest rate you’re paying on your debts.

Which debts to include can depend on your personality and goals as well. For us, we both grew up in households that worried about money. We knew we didn’t want that stress in our lives, so being unchained from all debt payments was a huge goal on our FIRE ladder. For us, that meant getting rid of all debt as fast as possible. We didn’t steal from our retirement, but it meant we sacrificed luxuries for a few years in order to reach our goal.

We recommend at a minimum including all high-interest debts in your snowball. Generally, we count this as debt with an interest rate of 8% or higher, though we don’t want you to include your mortgage in your debt snowball at the cost of saving for retirement.

Debts people typically snowball include:

- Buy now, pay later financed items

- Car loans

- Credit cards (an absolute must)

- HELOCs (Home Equity Lines of Credit)

- Medical bills

- Payday loans

- Personal loans

- Phone payment plan balances

- Student loans

A note on HELOCs: depending on how high your balance is and how much room you have in your budget, you might consider this mortgage debt and focus on it when you pay down your house. If possible, we’d like to see the HELOC gone in your debt snowball, because HELOCs have variable interest rates. The less control you have over your situation, the more likely you are to find yourself in a tight spot.

Don’t Forget Your Budget

We want you debt free as soon as possible, but be mindful of your budget. Unlike the government, you need to make sure you balance your budget. Paying off debt without saving for retirement for a year or two won’t extinguish your freedom FIRE, but slogging through debt for years without saving isn’t likely to leave you much better in retirement as you’ll lose out on the power of compounding growth. You want your investments to snowball for you while you snowball your debts. And paying off debt without having emergency reserves means when an emergency happens, you fall right back into the same trap.

Pros & Cons of the Debt Snowball Method

While Dave Ramsey only shows the advantages of the debt snowball, we like to take a more balanced approach. Like the debt avalanche, the debt snowball method has both advantages and disadvantages.

Pros

- The debt snowball method is easy to understand and implement.

- By starting with the smallest debt, you score a victory sooner, building up proof you can knock out your debt, which can be a great motivator for the behavioral part of personal finances.

- By freeing up minimum payments faster, it can help relieve some of your financial stress.

Cons

- Since you ignore interest rates, higher balance, higher interest debt can accrue more interest before your snowball focuses on it, costing you more than the debt avalanche.

- Since you likely end up paying more as higher interest debts continue to accrue interest, it can take longer to complete.

- If you don’t stick with the behavioral gains from the wins, freeing up minimum payments early allows people to move that money away from debt repayment and toward “wants” spending, leaving them in debt even longer.

Should I Use It?

If you have the discipline to stick with the plan but are highly motivated by forward progress, then the debt snowball can be a great method for you to implement on your debt free journey.

If you are someone who can wait for delayed gratification and are highly motivated to save the most amount of money possible (such as someone trying to reach financial independence later in life), the debt avalanche may be a better method for you.

We recommend picking whatever method you’ll most likely stick with, as cutting 8% – 35% interest from your life for good will save you far more than any comparison of debt snowball versus debt avalanche or leaving the debt chained to your ankles.

Learn more about the debt avalanche here and then watch the two methods duke it out for the heavyweight championship in the ultimate debt snowball vs debt avalanche fight.