Until very recently, mortgage interest rates were at historical lows. There are people out there with mortgages at 2%. 2%! That’s less than what a high-yield savings account pays these days. Which begs the question: if I want to get ahead financially, should I pay my mortgage off early or take the extra payments and invest it instead?

The crazy thing about recent mortgage interest rates aren’t the rates themselves. Historical averages place mortgage rates around 7% to 8%, so right now we’re pretty average. What isn’t normal is how fast the interest rates rose. Many American looking to become homeowners only knew a world of 2% to 4% interest rates, so they were banking on those rates while they were saving up to purchase their first home. With the drastic climb in interest rates coupled with the increase in purchase price tags, many Americans have found themselves stuck in a situation they never predicted that’s caused a pinch on a lot of households hoping to purchase homes or move.

I promise, we’ll dive in that situation later. Today, we want to look at people who have gotten into the real estate market with their primary residence. With interest rates on high-yield savings accounts jumping up over 4% and with the S&P index averaging around 8% over the past thirty years, a lot of people want to know: does it make sense to pay off your mortgage early or is it a better idea to leverage that debt and invest instead, because you can make higher returns?

I wanted to know, so I reached out to The Budget Brigade community and my friends to gather real mortgage data on three different recent scenarios: a mortgage at around 2%, a mortgage at around 4%, and a mortgage for a home purchase this year.

Scenario One: 2% Interest Rate Mortgage

Our first mortgage we’re looking at comes in at 2.25%. The loan balance is $150,000 with 27 years remaining on the loan. The monthly loan payment is determined by the original loan balance at the start of the mortgage without any additional payments made. We don’t have that exact number, so I ran the numbers back for a 30 year assuming no extra payments have been made. It isn’t a perfect match, but it’s close enough to give us some numbers to work with that shows what mortgages from the mid-2020s look like. In this instance, the monthly loan payment without escrow or PMI (we’ll do another blog post on this later) is around $637.08.

Now that we know what the mortgage is, we have to determine how much extra we want to pay on it for our hypothetical situation here. The amount matters, thanks to our friend compounding interest. Different families have different budgets. So let’s look at two different options for each scenario: $150 extra a month to either invest or pay on the mortgage, or $1,500 extra a month.

$150 Extra

Let’s start with $150 extra a month. Since interest is front loaded on mortgages, the more we pay off, the more we’ll save in interest. Paying an additional $150 towards the principal on the mortgage would cut 78 months (6 1/2 years) off the original 324 remaining (27 years) of this 30 year mortgage.

This would save a total of around $13,432.72 in interest over the life of the mortgage. (Keep an eye out on our resources page for a mortgage amortization spreadsheet.) The total amount of extra payments ends up being $36,750 over the remaining life of the loan.

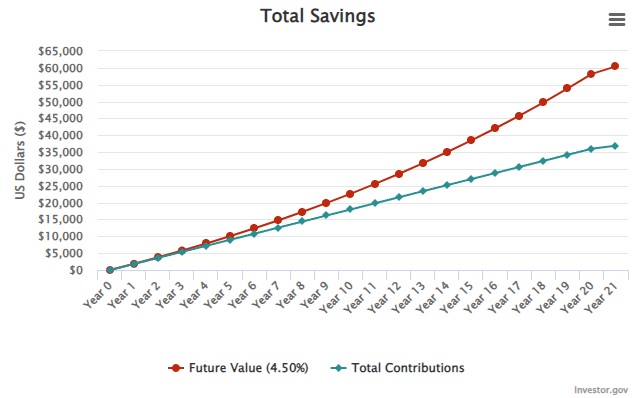

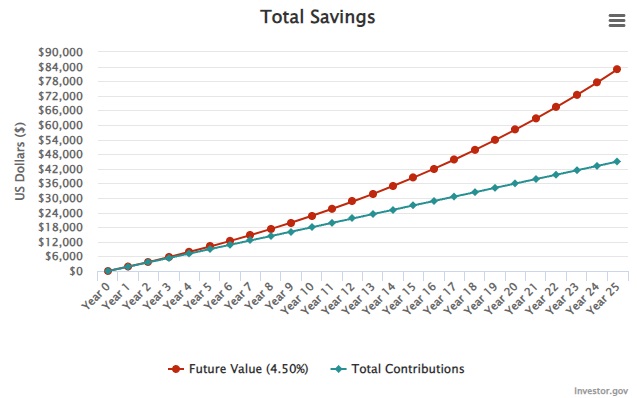

Now let’s say we invest that $150 a month for the 245 remaining months (20 1/2 years) it takes to pay this mortgage off in either a high-yield savings account or in an S&P index fund. (Disclosure: the odds of a high-yield savings account retaining current interest rates for 20 1/2 years is slim, but let’s just assume for discussion’s sake.)

At a 4.5% rate of return for a high-yield savings account, if you invested that money in a savings account instead, your account would grow to $60,449.40 (red line) (I used this investment calculator) by investing your $150 instead of paying it on your mortgage. When you back out the $36,900 (blue line with one extra month of payments due to how the final payment split) in extra payments you invested, this is a growth of $23,549.40.

This isn’t all complete gains, though. Interest income you earn in a savings account is taxable. It is taxed at your marginal tax rate, which could range anywhere from 10% – 37%. Which means your net gain after paying Uncle Sam would be somewhere between $21,194.46 and $14,836.12. Still more than you would save on your mortgage at an interest rate of 2.25%, though again this assumes HYSA rates will remain at 4.5%, which is likely a faulty assumption. So let’s look at the stock market instead.

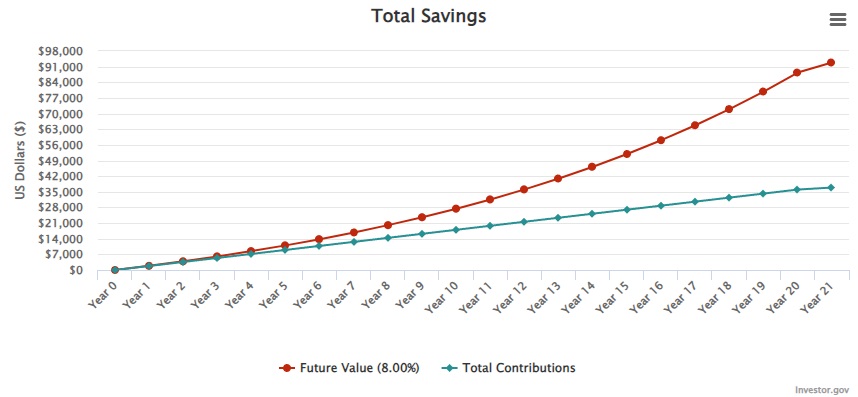

If you invested it in an S&P index fund, it’s even more. In 20 1/2 years, you’d have earned around $92,861.75. With your contributions equaling $36,900, that’s a growth of $55,961.75. While the market is always susceptible to fluctuations, an 8% earning average over 20 years isn’t as crazy an assumption as a steady 4.5% high-yield savings account. Dividends on index funds are taxed at your ordinary income level, but the long-term growth is considered capital gains. If you hold it for a year before selling, then it’s taxed as long-term, which is either 0%, 15%, or 20% depending on your income level. We don’t want to get too far into the weeds running out all of these scenarios, so we’ll use the most common one, which would be a 15% capital gains tax rate. Even after accounting for 15% taxes, you’d still net $47,567.49. Not bad for $150/month!

$1,500 Extra

Here’s what the numbers look like if you change your monthly additional amount to invest to $1,500 instead of $150.

Mortgage paid off in 6 1/2 years after you start making additional payment, in 9 1/2 years total.

Interest saved: $40,126.83

Amount you’d earn in interest within the same time frame in a HYSA: $18,615.99 (pre-taxes). Notice how much closer the red (total account value) and the blue (your investment) is over this much shorter time frame for the higher amount. In the scenario of $1,500 extra a month for 6 1/2 years, you are far better off paying the mortgage down to save $40,126.83 instead of earning $18,615.99 of taxable earned income.

For our S&P Index scenario, the growth is $35,803.69, which is still less than the interest saved in paying your mortgage down before taking into account the capital gain taxes. It’s also important to note that a seven year timeframe in the stock market leaves you a lot more vulnerable to market fluctuations. You could easily find your S&P index fund at a downturn when it came to pay off the mortgage, which might make you less likely to want to pull the money out and realize those loses.

Scenario Two: 4% Interest Rate Mortgage

For our second scenario, we have a $152,000 30-year mortgage at 4.0% that has a minimum monthly payment of interest and principal of $725.67 with 22 1/2 years left remaining on the mortgage.

$150 Extra

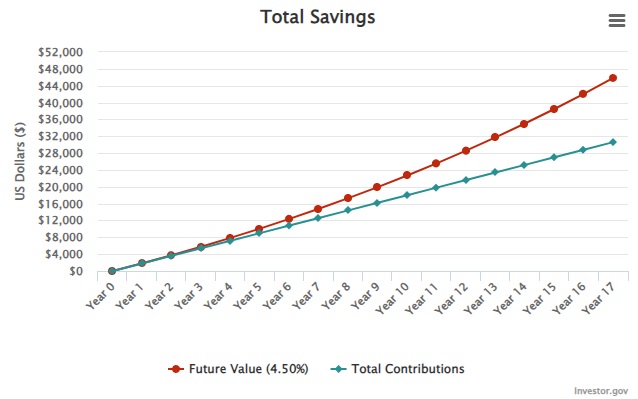

Paying an additional $150 for the remainder of this mortgage would drop the total loan length to around 24 1/2 year, saving 5 1/2 years and $18,235.44 in interest. For these 17 years of additional payments, a HYSA under the same assumptions above would yield:

The total interest earned/growth is $15,236.87. Considering this growth is taxable income and that HYSA interest rates are likely to decline in the next 17 years, by the time you reach a 4% interest rate, even at only $150/month, it starts to make more sense to pay off your mortgage instead of investing and lump summing it.

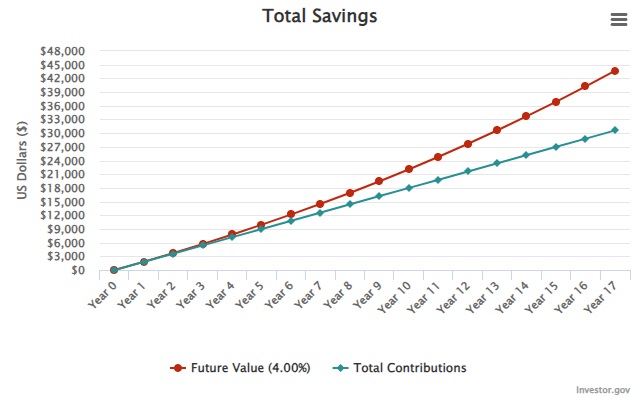

For an S&P Index fund:

The total interest earned/growth is $34,169.59. Let’s assume again a capital gains rate of 15%, netting us $29,044.15. In this scenario, you do better in the index fund and lump summing, even accounting for taxes. And a 17 year timeline horizon is a pretty safe forecast for an overall 8% return.

$1,500 Extra

Adding an extra $1,500 per month would pay off the remaining mortgage in a little over 5 years, saving $52,637.66 in interest. Plugging the $1,500 a month for 5.25 years into a 4.5% HYSA investing calculator shows our red and blue lines running close again, yielding just $11,872.56 in growth pretax. It’s a no-brainer to pay down extra to the mortgage in this situation.

For the S&P Index fund, we yield $22,464.38 at 8% on this time horizon. Comparing this to the HYSA at 4.5%, we notice that the numbers are about double, just like the interest rate. This really shows how time factors into compounding interest. In five years, compounding interest has almost no power to churn and burn in your favor.

For $1,500 at 4% interest, regardless of where you might invest it, you’re better off paying the mortgage directly.

Scenario Three: 7% Interest Rate Mortgage

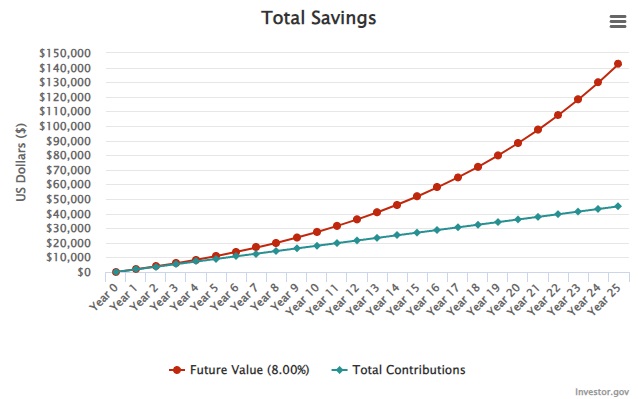

For our final scenario, we have a 7.25% interest rate for a new loan that totals $350,000, giving us a monthly payment without PMI or escrow of $2,387.62. Since this loan is only a few months old, we’re going to assume it’s brand new, just to make the math easier, as I’m sure everyone except the true nerds in the front row have had enough of my numbers by now.

$150 Extra

Paying an extra $150 from the start of the loan cuts just over 5 years off the mortgage, saving a staggering $104,792.55 in interest.

For the HYSA scenario (again, likely a faulty assumption do to long-term interest rates, but for the sake of discussion and comparison):

This yields a growth of $37,949.97 pre-taxes. This should make sense that it would be less than paying off the mortgage directly, since the 4.5% yield is less than the 7.25% interest due to the bank.

For the S&P index fund:

Our S&P holding turns a growth of $97,653.96 which is impressive, but still less than the interest saved on the mortgage, even before you factor in capital gains.

At a 7.25%, it’s better to pay off the mortgage directly than investing. I love this last example because it shows not just how compounding interest can work for you, but how it can work against you as well when you’re paying it to others.

$1,500 Extra

This example really blows my mind. If you pay an extra $1,500 a month toward our mortgage in this example, you would save $352,825.67. Now remember, for this scenario our initial mortgage was only $350,000 for a principal balance to begin with. We actually played around with this when we were building the mortgage amortization spreadsheet. Once the interest rate gets above about 5%, you end up paying more in interest than towards principal over the life of the loan. So by paying extra each month, you’d save more interest than the original amount of the loan! In this scenario, we get the 30-year mortgage paid off in 10 years.

In the HYSA, we have a growth of $46,797.11, which is peanuts compared to our $352,000.

The S&P index doesn’t fare much better, coming in at $94,419.05.

What We’ve Learned

Each scenario is different thanks to the different variables we have to take into account. The interest rate seems to matter the most, but the amount you have extra to pay down your mortgage has a large impact as well because it determines the overall time horizon. With compounding interest, time is powerful. The less time investments have to work, the less time they have to grow.

The same is true when it comes to your mortgage interest. The faster you pay off your mortgage, the less time that interest has to work against you. When you’re looking at hundreds of thousands of dollars, it can add up quick.

The original balance also factors into our calculations above. While I don’t want you to live in a shack that leaks every time someone sneezes, our scenarios above are a good reminder why your purchase up front matters. Sacrificing a little bit of space in order to save a lot of money can compound greatly in your favor over the life of your mortgage.

What the Numbers Don’t Say

Paying off your mortgage early is a decision that comes in two parts: the money aspect and the emotional one. Above, we cover the dollars and cents. Here, I want to at least point out the emotional component missing in the scenarios and numbers. There is something so freeing about not knowing you owe money to anyone. For most people, your house is the largest investment you’ll ever make (though student loans seem determined to give homes a run for their money in recent times). Knowing that a bank can’t come scoop your home out from under you because of a job loss or pay cut is a certain type of peace that many find priceless.

That might not be your case. And that’s okay. Just make sure you’ve balanced both factors when you make your decision.

What About My Specific Mortgage Scenario?

If you want to plug your actual numbers in and see how powerful compounding interest can work for and against you, visit our resources page for our mortgage amortization calculator.