We want you debt free as fast as possible so you can take the money you’ve been putting toward paying for past purchases and use it to save for your future instead. Here are our top ten favorite tips to help you pay off debt faster.

Stop the Bleeding

It’s hard to pay off your debt when you’re still using debt as a tool. Before you can tackle your debt, you have to stop taking on new debt. This means no more:

- Buy now, pay later

- Credit cards

- HELOCs

- Payday loans

- Personal loans

We realize life happens, and these debts may have gotten you through rough seasons of life in the past. We want you to take a loan in these situations from yourself (via your emergency fund) instead, which is why we recommend paying off debt only after you’ve built an emergency fund. Visit our FIRE ladder for our entire step-by-step process.

We don’t recommend using buy now, pay later, HELOCs, payday loans, or personal loans after your debt payoff journey. You can use credit cards again, but no credit card debt ever again. That’s death to your personal finances.

Pick a Plan

Debt snowball vs debt avalanche or some hybrid of the two – we don’t care which plan you use as long as you have one. You succeed at what you focus on, and picking a debt payoff plan is a great way to pay off debt faster as it gives you clear guidance along the way, which helps keep you on track.

Once you pick a plan, stick with it! Check in at least once a month. While it might take a while to see debts disappear (depending on the balances and how much extra you have to throw at your payoff list), your plan will show you how far you’ve come. A debt payoff calculator for the method you’ve picked will give you an estimated debt payoff date to give you something to look forward to. Check out our resources page for debt payoff spreadsheets.

Budget, Baby!

As we discuss on our FIRE ladder getting started guide, your budget is your GPS plan. Having a budget gives you an intentional plan for your money so it doesn’t disappear, leaving you scrambling to pay your bills at the end of the month. Visit our budgeting station for tools and tips on how to make your first budget. Your end goal will be your dream for FIRE freedom and what you want retirement to look like. Your budget will help you get there. Knocking debt, especially high interest ones, off your FIRE ladder will accelerate your FIRE.

Find Your Frugal

Budgeting is a balance of what you earn versus what you spend. Spending less frees up more discretionary funds to attack your debt with. Giving up one Chick-Fil-A run a week could easily add $100 monthly. The more you can trim your lifestyle while still having frugal fun, the faster you can pay off your debt.

Increase Your Income

We find trimming expenses easier than increasing income, but both are viable options. If your job offers overtime (especially at time-and-a-half pay), pick up extra shifts. If you like to drive and listen to podcasts, do DoorDash, Uber, or other food and human delivery services. Grab a side hustle that uses your unique talents and abilities. Sell stuff sitting around in your garage and closets collecting dust.

Track Your Progress

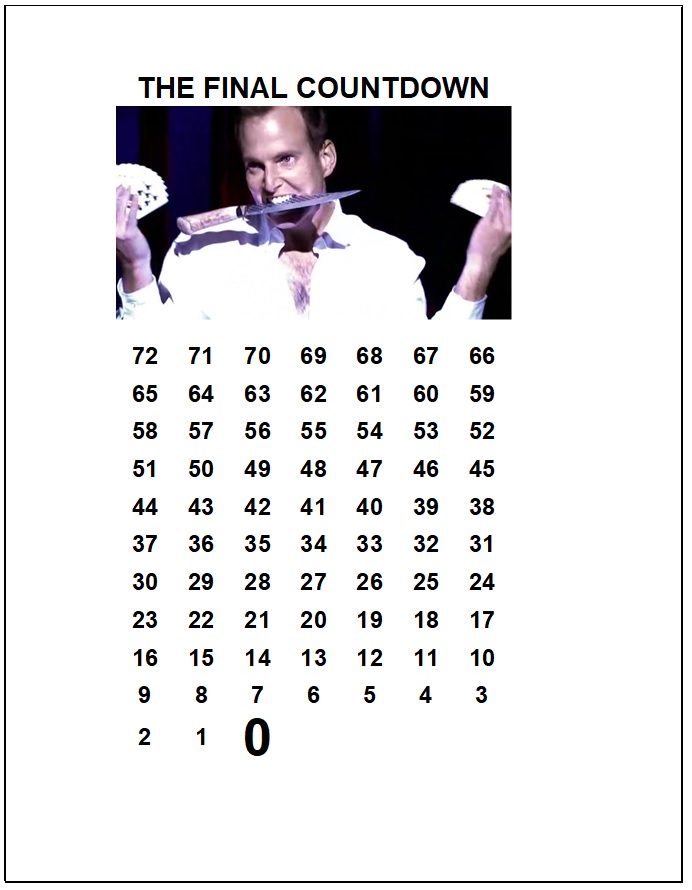

One of our favorite ways to pay off debt faster is to track your debt payoff progress. We had a debt tracker we put on the fridge during our journey. We took turns at the end of each month counting down to our debt free moment. Our debt payoff spreadsheet told us how much debt we had total, so we created and printed out a final countdown until we hit $0 of debt left.

Thanks to my complete inability to declutter my digital life, I was able to dig up our sheet.

Not an Arrested Development fan? (There’s always money in the banana stand!) Make your progress tracker fit your interests because you’re going to be looking at it for a while. There are plenty of ideas you can use for inspiration by searching Google or Pinterest for debt payoff printables.

Gamify Your Debt Payoff Journey

My husband and I are competitive people. When we did our debt payoff journey, we turned it into a game. Some months, we challenged each other to see who could spend the least. Other months, we tried the cash envelopes system to see how much spending we could cut. Finding monthly challenges to help gamify the process can take something daunting and make it (almost) fun. It’s also a great way to get the entire family on board and participating.

Keep the Victory In Mind

The debt payoff scenario we used for our debt snowball and debt avalanche examples took fifty months to become debt free. That’s a little over four years, which is a long time to stay motivated and on track.

No matter which method you use, keep the end goal in mind. While the obvious goal is getting your debt paid off, that’s a step along your FIRE freedom journey. Keep your end dream of what freedom looks like in mind, whether that’s sipping piña coladas on a Hawaiian beach or saying “Bye, Felicia!” to your boss. If you’re artsy, create a vision board.

Celebrate Along the Way

While we want you focused on the journey, which means throwing as much extra money as possible every month at your debt, plan a few celebrations along the way. Trudging through your debt journey for four years with zero fun or motivation isn’t likely to lead you to success (which is one reason we challenge you to free up more cash flow and get it done sooner).

If you have a few large debts in your payoff list, it’s worth doing a small celebration after each one to help maintain motivation for the next round in the ring. This does not mean start the piña colada party in Hawaii or even Mexico. This means a fun date night with your spouse, friend, or family. A quick guideline is to limit your celebration to less than one month of your debt payoff budget. You might do a fun escape room and dinner out after paying off your car before charging hard at your student loan.

Get Started

The last, and most important, piece of the pay off debt faster puzzle is to get started. Today! The longer you wait, the more interest that accrues and the more it’s going to cost you to climb the debt mountain. The sooner you start, the faster you’ll be out of debt.

We know you can do it, and we’re here to cheer on you along the way. Drop us a line in The Budget Brigade Facebook community if you ever need moral support.

If you are drowning in debt and don’t know where to start, we want to help. You can book a session to get personalized one-on-one advice to give you a clear path to follow to get out of debt fast.