While we don’t play the credit card or credit score games, I’m frugal. The less money I spend on interest, the more I have for retirement and travel. In situations where we’ve needed to use debt–such as the mortgage on our first home–having a good credit score not only made the process easier but made us eligible for a better interest rate. We’ve found value in having a good credit score, and we’ve also lived through the hassles of not having a credit score. Below, we cover ways to improve your credit score and your financial situation to help you save money and set yourself up for your money goals.

Why a good credit score is important

Let’s make this clear and get it out of the way up front: credit scores are way overvalued in our culture. A credit score does not show how wealthy you are. All it does is tell lenders how good you are at juggling debt, so they can decide if they should throw another bowling pin in for you to keep in the air.

Still, having a good credit score can be useful because of the way our financial system runs. A good credit score can:

- Help you avoid predatory lenders

- Get you a lower interest rate

- Keep you from having to make (higher) security deposits

- Make is easier to get approved for an apartment or other rental property

- Save you time and help you avoid hurdles when applying for credit

- Help you get through the hiring process in certain industries

We’ve discussed separately why we bother with a credit score if you want to explore the topic more..

Why you should be cautious about focusing too much on your credit score

We covered the good, so now let’s cover the bad and the ugly.

Your credit score can also:

- Pull your focus away from what matters more: achieving a better financial situation

- Encourage overspending, especially with credit cards

- Lead to poor financial decisions, such as securing loans you don’t need just to build credit

Our biggest warning is that focusing on a good credit score can end up costing you more in interest on debt you have than it can potentially save you with a better interest rate on less debt.

While there are legitimate reasons to use debt, we’ve found being completely debt free to be one of the best decisions financially and personally we’ve made, and hope you’ll consider it as a financial goal as well.

How to build a credit score when you don’t have one

A few years ago, we discovered my husband in his 30s didn’t have a credit score. We were planning on moving and with him earning significantly more than I did, plus him having a stable W2 income while I had a new consulting job as an independent contractor, we worried about having issues getting an application approved for an apartment. So we decided to get him a credit score.

Turns out, it was harder than we thought. You see, to get credit, you ironically need a credit score. Yup:to build a credit score, you need to have one to begin with. Which came first: the chicken or the egg?

We came across a few options on our quest for the holy credit grail:

- Use a debit card that builds credit. There are debit cards such as the Fizz card that work like a credit card to help you build credit but operate like a debit card. This is a great option if you have had an “it’s complicated” relationship with credit card debt in the past.

- Use a secured credit card. These function more like a regular credit card, but typically require a cash deposit upfront as collateral to make sure you can cover what you charge. These often have expensive annual fees and we’re personally against paying someone for something we can get for free elsewhere, so we recommend using a free credit building debit card instead or a secured credit card like Chime that doesn’t charge fees.

- Ask someone to cosign for you. This was the backup plan to our backup plan because we don’t like ruining perfectly good relationships over money issues. As a rule, we don’t recommend cosigning for someone else, so we’d be hard pressed to ask someone to do it for us, but it is an option if you are good with money but find yourself in a situation like we did without a credit score.

Tips to improve your credit score without ruining your life

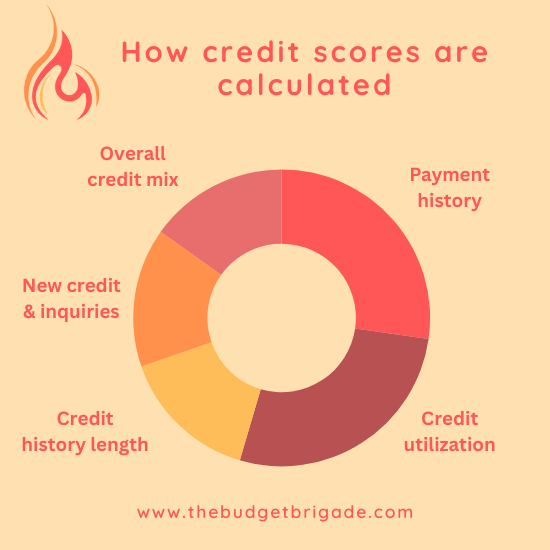

It’s typically easier to improve an existing credit score than to build a credit score from scratch when you don’t have any credit. Like we cautioned above, some ways may bring more harm than good, so I focus on our favorites. To know how to improve your credit score, it first helps to know how your credit score is calculated.

Along with the tips below, you can also use the methods mentioned above–debit cards that build credit and secured credit cards–to improve your credit score as well.

Pay off your credit card balances on time every month

While we’re fine with using credit cards in principle, we hate credit card debt with a fiery passion. High interest credit cards (which are all of them) cause Americans to go backwards financially at 20%+ versus growing their net worth. We would much rather have you save what you’d pay in monthly interest charges and invest it instead.

If you have credit card debt, let’s get going on paying it off. Fast! This will help you save money and increase your credit score because you’ll have less utilization of your revolving credit limit. Win win!

Start your path to financial freedom with our step-by-step FIRE ladder.

Set up automatic payments

Missing a payment or having a late payment can ding your credit and can cost you with hefty fees and penalties. If you’re juggling too many due dates or too much life in general, set up automatic payments so you never miss a payment. If you’re working your way through the FIRE ladder and don’t have much left during paychecks at certain times of the month, make sure to update your budget so automatic payments hit accordingly. Building up an account buffer in your checking account can help you float payments between paychecks posting.

Just don’t skip paying your credit card when trying to build a buffer because to improve your credit score you’ll also want to…

Pay your credit card off before the statement date

When I learned that your credit utilization factors heavily into determining your credit score, my little Sherlock Holmes brain puzzled through how Big Brother at the credit bureaus knew.

It’s rather elementary, dear Watson. Your credit card company reports the monthly balance due to the credit bureaus. So it doesn’t actually matter how much credit you use, but what they think you use.

When we were beefing up our credit before buying a home, I tested out a theory. Instead of paying off my credit card after I got the statement, I paid off the current balance a few days before the statement hit. Then when the statement posted, it looked like I barely used it, which meant my utilization showed as being a lot less even though I spent the same amount of money.

Bibbidi-Bobbidi-Boo! My credit score improved within a month. I just had to remember to pay my credit card twice: once before it posted and then a second for the lingering charge or two that posted between the first payment and the statement date.

We prefer this method versus asking for a higher credit limit to lower your utilization. More credit means more opportunities to find yourself in a pickle, Rick, which can get you into big financial trouble. Our credit limit for the one credit card we have is less than what we bring home a month to ensure we can always pay it off.

Time when to close open accounts

A lot of advice on building your credit score will tell you to keep old accounts open so you have the credit usage history. We did this with my credit card that wasn’t building credit for my husband… for a season. In general, I don’t like having a bunch of accounts out there. It opens up more opportunities for fraud, and there’s a lot of fraud y’all.

If you’re planning on purchasing a home in the next year, leave the account open FOR NOW. Wait until you’ve secured your mortgage and got your utilities all set up, then say bye Felicia and send that card through the shredder while you’re on the phone with customer service to close the account.

A note on diversifying your credit mix

Another common piece of advice is to make sure you have a mix of different types of credit, like a mortgage and a car loan and credit cards. While it’s true this can increase your credit score, this is stupid advice to actively go after for the purpose of building credit. If you don’t need a loan, don’t take out a loan! Credit for the sake of credit plays into their system and costs you money in interest you otherwise could invest for retirement, spend on vacation, or budget for hanging out with friends.

As a general rule, we avoid debt like the plague. We like the Money Guy’s stance on debt: treat debt like a chainsaw. It can be powerful and can help you fell that big beast of a tree faster than a hatchet, but it can also cut your arm off if you aren’t careful. So be careful!

Freeze your credit

Freezing your credit doesn’t directly build your credit score, but it can help prevent you from opening up more revolving credit you don’t need and can’t afford, even if you can make the monthly payment. Having more credit than you can financially manage can decrease your credit score when you miss a payment, so think of frozen credit like an insurance policy to help protect your progress. Freezing your credit also helps protect against all that fraud we were just talking about.

The final word

We have a love hate (mostly hate) relationship with credit scores because we hate its fraternal sibling, Debt. That said, we understand how credit scores are integrated into the American financial system. Having a good credit score can save you money and time, and we’re all about that. Just proceed with caution and be intentional with your focus. Before you sign up for payments and interest, challenge yourself to see if you can cash flow a purchase instead and analyze if that could save you money.