A HELOC is a Home Equity Line Of Credit. It’s basically what you get if a mortgage and a credit card had a baby. HELOCs have become more and more popular over the years as Americans look for relief from high-interest consumer debt such as credit card balances, or look for ways to fund home improvement projects when they don’t have the cash. While HELOCs can be a cheaper interest alternative and allow higher borrowing limits than credit cards, they aren’t all sunshine and rainbows.

Okay, but what actually is a HELOC?

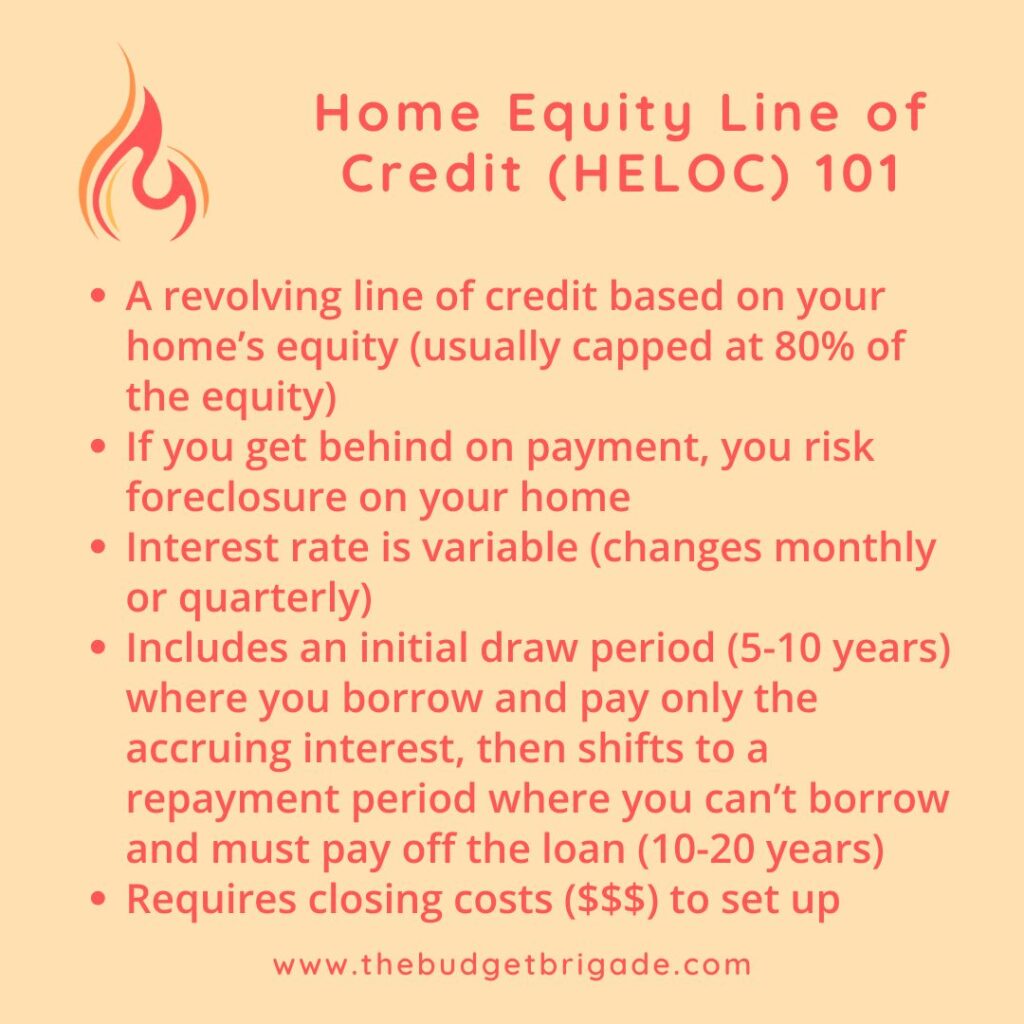

With a HELOC, you have a revolving line of credit, similar to a credit card, with a maximum credit limit you can borrow.

A major difference between a HELOC and its “parents” is that HELOCs often have variable interest rates. This means that, unlike a conventional home mortgage or credit card, the interest rate on your HELOC fluctuates as interest rates change, instead of having a fixed interest rate you lock in. If you’re expecting interest rates to come down, this can be a good thing. If you opened a HELOC when interest rates were around 2%, you likely feel a pinch from the increased payment amount with the interest rate spikes over the past few years.

Your home acts as the collateral for the line of credit. This means that if you fall behind on your HELOC payments, you ruin the risk of having the lender foreclose on your house, just like with a mortgage.

How does a HELOC work?

The lender will determine your maximum credit limit for your HELOC based on how much equity you have in your house. Your home equity is calculated by

Equity = Current market value – outstanding mortgage / loans against it

If, for example, your house’s current market value is $300,000 and you have $150,000 remaining on your mortgage, you would have $150,000 in equity.

This doesn’t mean the lender will give you a home equity line of credit for $150,000. Nor should you want one. Having no equity leaves you zero buffer for market dips or to cover closing costs on selling your home or purchasing your next house. And I can attest from recent experience, those add up quicker than the Flash. Especially this one.

It’s more painful than a trip to the DMV. Depending on the lender and your credit, you may be able to secure a HELOC for up to 90% (still hyperventilating) of your equity, though generally it’s closer to around 80% (now we’re down to a massive gulp).

A HELOC works in two different phases: the draw period and the repayment period.

The names hint at what happens, but we’ll dig in a little deeper.

In the draw period, you can borrow against the line of credit via online transfer, debit card, and/or check. This draw period is typically 5-10 years. During that time, your minimum payment only has to cover the interest the bank is charging you to borrow the money.

That’s right, for 10 whole years, you don’t have to touch the principle balance you borrowed. I’m breathing into a paper bag again.

Once the draw period ends, you enter the repayment period. During phase two, you can no longer borrow against your HELOC. It’s time to pay the piper.

Any Silicon Valley fans in the house? I can’t hear “piper” without hearing Pied Piper.

When you get to the Pied Piper, you pay on your borrowed balance on the home equity line of credit. This repayment period often lasts 10-20 years.

So I have to pay interest on a HELOC?

Yes. Lots of it. While interest rates from HELOCs won’t be as high as credit cards, it can add up quickly, especially if you used your line of credit to put in a pool and give your kitchen a facelift, then let your borrowed balance simmer on your new induction stove for 10 years.

And since the interest rate is variable, this means you may end up paying even more than you originally predicted. Granted, a variable rate also means you could pay less.

Interest rates on HELOCs can adjust every month to every quarter to match the current market trends. The interest rate you pay can also depend on how good a credit score you have. (Don’t even get me started on the nightmare entanglement of credit scores.)

How much does a HELOC cost?

A HELOC is going to cost you more than just the interest you pay every month on the balance. While credit cards can come with annual fees, HELOCs come with closing costs like a mortgage. These can include:

- Application fee

- Origination fee

- Appraisal fee

- Junk fee #1

- Junk fee #2

… you get the picture. A HELOC can be a flexible way to borrow money, but it isn’t necessarily the cheapest, even if the interest rate is less.

What are HELOCs used for?

People often use HELOCs for:

- Making home improvements or major repairs

- Financing flips for rental properties

- Consolidating high-interest consumer debt

- Funding college

- A down payment for a second house or rental property

While you can use a HELOC for all these reasons, it isn’t necessarily a good idea to do so.

With a HELOC, you are potentially taking unsecured debt like personal loans and credit cards and tying them to a secured asset—your home. You’re also eroding away at the equity in your home, which can make it more difficult to move when you need to.

If you don’t have the means to do a project, we recommend pausing and assessing if that project is worth the opportunity cost. If you’re flipping a house and have a steady track record of success with a proven plan, the answer might overwhelming be yes. In that case, HELOC to your heart’s content, but be ever conscious of your budget, as flips can easy flop. So often, in fact, that HGTV made a show about it.

Since many Americans have little to no savings for retirement, their home equity is often the only investment they have. (We don’t recommend treating your home like an investment, because it’s a terrible one, but it’s a reality for many.) Carving away at this equity, especially if you regularly use HELOCs or refinance consumer debt onto your primary mortgage, can be a killer cycle that keeps you chained to the dreaded 9-5 forever.

Should I consolidate my credit cards into a HELOC on my home?

If you need a HELOC as a financial crutch, you likely haven’t resolved your primary issue with your personal finances, which is almost always making and sticking to a budget.

Here, interest rates can be a problem, but they aren’t your biggest problem and not where you should focus your time and efforts.

Before you consolidate your credit card or other consumer debt, address the underlying issue. Prove to yourself that you can show the budget who’s boss. Make yourself a workable path to becoming debt free. Then, you can consider using a HELOC to help expedite the process, but tackle that HELOC quickly to get it out of your life for good.

Learn more about making a budgeting.

Alternative options to HELOCs

There are several alternatives to HELOCs if you decide it isn’t the right path for you. Our favorite?

Budget for the purchase.

We had a host of home improvements we did around our fifty-year-old house, including:

- Adding a shed that wasn’t a piece of… sheet metal

- Adding a fence and gate around the massive property

- Replacing the flooring

- Painting the house, inside and outside

- Replacing the roof (unfortunately)

We didn’t take a home equity line of credit or any other debt out for these purchases. We budgeted for them and saved for them. Instead of paying interest to the bank to borrow their money, we earned interest from the bank by having our sinking funds in our high-yield savings account until we pulled the trigger.

The funny thing about budgeting and saving for these largest home projects is that many that were originally on our list we ended up not doing.

It wasn’t because we couldn’t afford to. We realized when we had to think about it for several months, some weren’t worth what they cost. The value wasn’t there for us.

Instead, we used the money we would have spent on replacing the popcorn ceiling and renovating the kitchen and moved to our dream town two decades earlier than we’d hoped. We also went on a lot of unique, fun vacations we’ll cherish forever.

Slowing down to the speed of cash can help you realize and prioritize what’s important to you and where to focus your money. And while it’s slower than a HELOC, it isn’t DMV Flash slow.

Alright, that’s enough of the ode to budgeting love song from me.

Learn all about budgeting, or drop us a line in our budgeting and personal finances Facebook group for specific advice for your situation. TTFN.