DTI Ratio: What Is It Good For?

If you are in the market for a mortgage or other type of loan, it’s useful to understand this term and what it means. Even if you aren’t in a financial position to buy a home yet, calculating your DTI ratio (debt-to-income ratio) can be a good exercise and visual to understand how much of your paycheck you owe to other people.

What It Means

Your DTI ratio is the percentage of your gross monthly income that goes toward debt. It lets lenders know how leveraged you already are so they can assess if you’re at risk for not making your payment on time. Lenders know as well as borrowers, the more debt you have, the harder it is to juggle.

How to Calculate Your DTI Ratio

Generally, if you are married, we are going to count all the expenses and all the income for the household below. Different lenders can have specific criteria for how they determine your DTI ratio, but the standard guideline is below.

Start by adding up all your monthly debt expenses. While we’re a huge proponent of paying debt off early so you can let compounding interest work for you instead of against you, if you are paying extra to any of your debts, do not include your extra payments when calculating this number. Use the monthly minimum payments. This includes if you pay your credit card off every month. (Broken record time: if you don’t, you need to get rid of your credit cards NOW.) These payments can include:

- Monthly rent or mortgage payment

- Student loan payments

- Auto loan (this includes leased vehicles) payments

- Credit card minimum payments

- Home equity loan payments

- Personal line of credit (LOC) payments

- Child support

- Alimony

Monthly utilities and payments (such as phone, gas, water, electric, etc.) are generally not included, even though they are reoccurring monthly payments.

We’ll use our numbers from our example budget to give you an example to walk through.

Debt Expenses:

- Mortgage: $1,200

- Student Loans: $0

- Car Payment 1: $400

- Car Payment 2: $250

- Credit Card 1: $95

- Credit Card 2: $75

- Credit Card 3: $115

- HELOC: $0

- Personal Loan 1: $0

- Child Support & Alimony: $0

Total monthly debt minimum payment expenses: $2,135

Next, you need to add up your monthly gross income. This is not the amount you bring home, unless you’re an independent contractor. Your gross income is your total income before tax withholdings or any insurance premiums, child support payments, or tax-advantaged retirement (traditional 401(k), HSA, etc.) savings.

In our example budget, we have the take home (net) pay listed, so we need to find an example that might correlate. Our favorite Joneses family in this example doesn’t have much surplus in their budget (only 9.5% left at the end of the month, and I didn’t even give them student loans!) so we’re going to assume they aren’t paying into retirement plans at work. Assuming they each have an average employer sponsored single coverage plan, they pay roughly $3,405.16 combined a year for health insurance premiums from their paychecks, or $283.76 a month.

Adding that into the take home pay of $2,500 and $2,000 (we’ll assume their side gig and marketplace income is highly variable and remove it from this example) and adjusting for current tax brackets, their monthly gross pay is approximately $5,861. (I used this calculator because marginal tax brackets are tough back-of-the-envelope calculations!)

Total monthly gross income: $5,861

Now divide your total monthly debt by your total monthly gross income (debt/income, or debt-to income).

$2,135.00/$5,861 = 0.364, or 36.4%

Our favorite Jones family thus has a DTI ratio of 36.4%

What If I Have a Variable Income?

If Jane or John Jones were self-employed in this situation, or if their $350/month side hustle was something they worked every month, lenders would typically look at their business tax returns to see the annual income made to help determine their gross income.

If you don’t have a business tax return (no, I don’t work for the IRS, but you really, really should. Learn more about side hustles in our entrepreneurship section), you likely won’t be able to include this related side hustle income towards your gross income total.

What About Rental Income and Debt?

Mortgages for rental properties (and vacation homes, etc.) count towards your debt expenses. Lenders, however, don’t normally treat rental income at 100%. Lenders will generally allow you to include around 75% of your rental income toward your gross income calculation.

What Is a Good DTI Ratio?

Kidding, but not really.

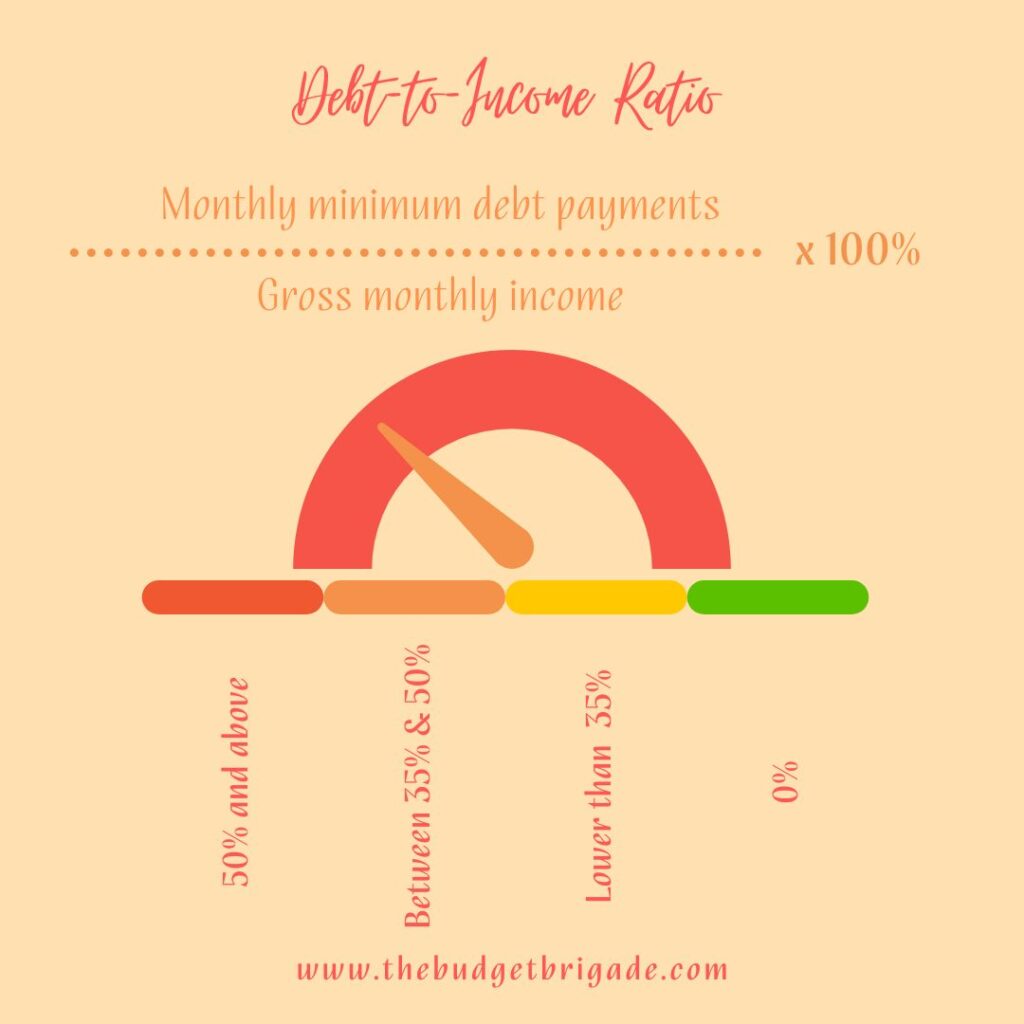

Lenders typically prefer a DTI ratio lower than around 35%, with a ratio of no more than 28% going towards rent or your mortgage. You’ll hear this latter sentiment echoed a lot in the personal finance community as a guideline to see if you’re “house poor” or not. Lenders start to get weary if your DTI ratio is 35%-50%. Anything above 50% is danger Will Robinson and will make it hard for you to get a loan, at least with reasonable terms and interest rate.

So how do our imaginary Joneses stack up? With a DTI ratio of 36.4%, they are right over the top of the normal threshold. With a mortgage payment of $1,200, their DTI ratio for housing is 20.5% (though a lot of personal finance gurus, myself included, like to include the HOA fees, insurance premiums, and property taxes when calculating this amount and using the 28% gut check).

The True Cost of Your DTI Ratio

Regardless of what lenders think is a good ratio, it’s important to remember what your DTI ratio means IRL. The more of your income that goes towards debt and housing, the less you have to invest in your future. It almost means the more chained you are to that current gross income. If you read through our example budget for the Joneses, you’ll remember that they weren’t investing anything because between debt and monthly expenses, they didn’t have much at the end of the month to save.

Earlier this year, I was able to step away from a very stressful job that was no longer serving me. I took a pay cut to work in a new industry and to start a new career so different from anything I’ve done in the past two decades of my working career. Having a low DTI ratio meant I wasn’t stuck in a job that was more hours than I wanted to work and that was affecting my mental and physical health. Thanks to our frugal spending tendencies, our debt free mentality, and my husband’s almost obsession with learning about investing, I could focus on what I wanted to do, not what I had to do in order to survive and pay our bills.

Remember when looking at the “good” DTI ratios above that a lender doesn’t care about your happiness or your wellbeing. They care if you’re going to pay your minimums on time. They don’t factor in if you only get three hours of sleep a night working two jobs while juggling a newborn, trying to make the numbers work. You’re the one who cares about your quality of life. There’s no variable for that in the equations above, so make sure you weigh your ratio with that factor taken into account <3