We’ve covered the debt snowball and the debt avalanche separately, showcasing the pros and cons of each. Using the same debt example from those articles, we wanted to do a showdown in the fight against a mountain of debt: debt snowball vs debt avalanche, winner take all. Who will be left standing on the side of the mountain once winter comes?

The TL;DR version of each method:

Debt snowball: Categorize debts from smallest balance to highest and prioritize paying them off in that order.

Debt avalanche: List debts from highest interest rate to lowest and prioritize paying them off in that order.

- Both methods involve tackling your mountain of debt faster than paying the monthly minimums until the end of the original terms.

- The debt snowball focuses on the behavioral side of personal finances, giving you small wins up front to build motivation for the long slog of larger debts, while increasing your payoff “snowball” of compounding minimum payments as you roll each paid off debt’s minimum into the next smallest debt’s payment.

- The debt avalanche focuses on the dollars and cents of personal finances, knocking out the highest interest rate debt first to accelerate your overall debt payoff timeline and reduce the overall amount you pay.

Debt Snowball vs Debt Avalanche: Head to Head Lineup

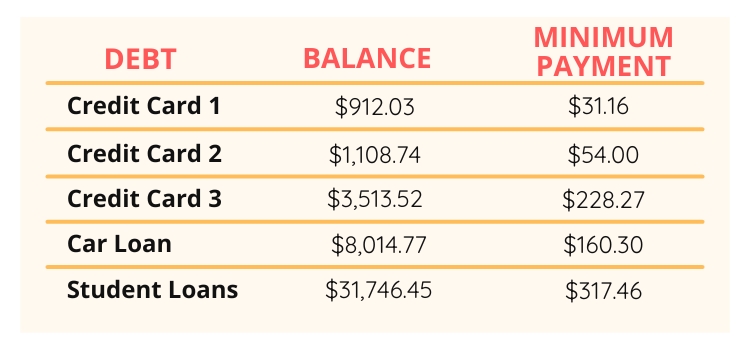

In our example scenario, we have five debts:

- Credit Card 1

- Credit Card 2

- Credit Card 3

- Car Loan

- Student Loan

We also have $250 extra from our example monthly budget to throw at the debt to knock it out as fast as possible.

For the debt snowball, our ordered list of debts is:

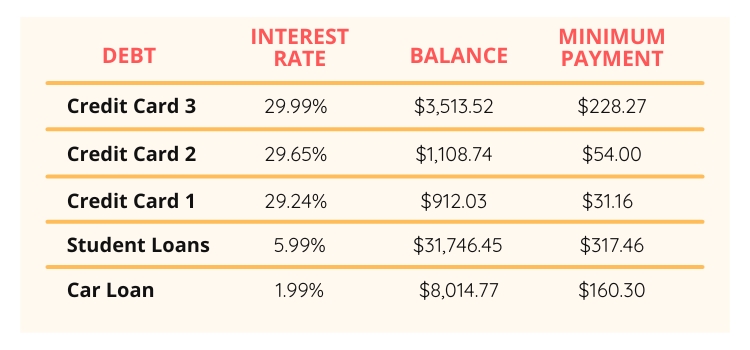

Our debt avalanche lineup is:

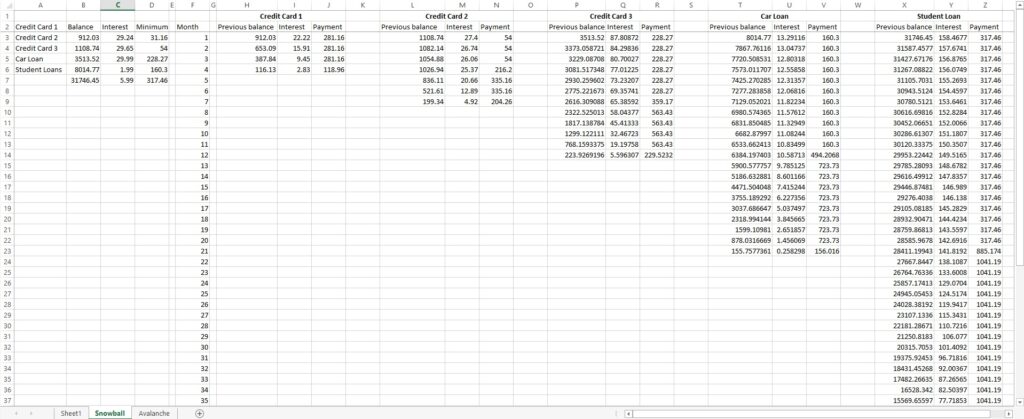

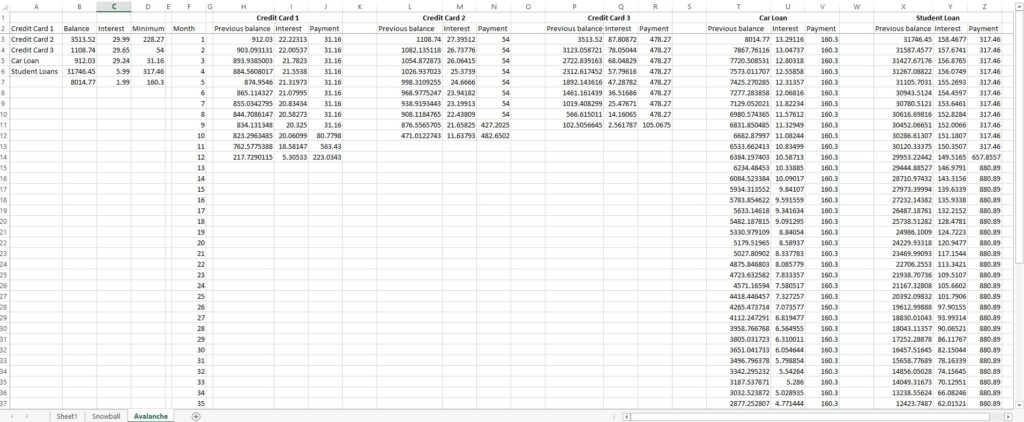

Debt Snowball vs Debt Avalanche: The Math

If spreadsheets make you want to vomit like Comet, skip this section.

Note: There will be some rounding errors because of fractional cents, and interest could differ slightly depending on how early you make payments, but we made the same assumptions for both cases to compare apples to apples for the example situation. For both examples, we also used an exact $250 extra on top of the minimums every month until the end of the payoff.

Debt Snowball Payoff

Credit Card 1: paid off in four months with $50.41 in interest

Credit Card 2: paid off in seven months with $144.04 in interest

Credit Card 3: paid off in twelve months with $698.51 in interest

Car Loan: paid off in twenty-one months with $188.59 in interest

Student Loan: paid off in fifty months with $5,245.76 in interest

Debt Avalanche Payoff

Credit Card 1: paid off in twelve months with $235.65 in interest

Credit Card 2: paid off in ten months with $233.11 in interest

Credit Card 3: paid off in nine months with $417.71 in interest

Car Loan: paid off in fifty months with $357.34 in interest

Student Loan: paid off in forty-nine months with $4,698.41 in interest

Comparison of the Debt Snowball vs Debt Avalanche

The music swells.

Go ahead, queue up the Creed soundtrack, we’ve got one on deck for you. (I 1000% listened to the fighting montage music from all three Creed movies while prepping this article.)

The trainers tape the gloves.

The boxers enter the ring in their robes, pumping up the crowd.

Let’s get ready to rumble.

Round One: First Debt Payoff

The first round is a knockout for the debt snowball. Using the debt snowball, you’d pay off the first debt in four months. With the debt avalanche, it takes nine months to throw the final punch to lay the first debt out.

Round Two: Overall Timeline

The boxers are evenly matched when they come out for the second round. For our example scenario, you’d finish your debt payoff journey in fifty months, regardless of which method you used.

Round Three: Amount of Interest Paid

While the debt avalanche took a beating in the first round, it regroups here for round three. Using the debt avalanche, you’d pay $5,942.22 in interest during your fifty month journey. With the debt snowball, the total comes out to $6,327.32. Using the debt avalanche saves you $385.10 for our example.

Debt Snowball vs Debt Avalanche: The Victor

Looking at our example, which is better?

It depends.

As we’ve mentioned in our separate debt snowball and debt avalanche articles, they each have their advantages. If you need motivation to get you going at the beginning, the debt snowball gives you a victory five months earlier than the debt avalanche for our example debt. If you’re late to the FIRE ladder parade and every dollar counts, the debt avalanche saves almost $400.

Which Do We Prefer?

As future Coloradans, you know we have to be fans of the Avalanche.

But seriously, we prefer whichever one has the highest likelihood of success for your behavioral habits and situation.

If we’re honest, we almost prefer a blend. If there are a few small debts you can knock out in a month or two, that frees up their minimum payments to give you more leverage to tackle the larger interest rate debts while providing some victories before heading into the avalanche.

Get in the Debt Snowball vs Debt Avalanche Ring

Our last advice for debt snowball vs debt avalanche for a mountain of debt? Get started now.

Each day you wait, more interest stacks up on the mountain you have to conquer. You don’t become the heavyweight champion by sitting on the couch watching matches, thinking “one day.” You win the title by pulling cars down the road and having Rocky Balboa yell at you to watch your side, you keep dropping your arm.

If you’re overwhelmed by the process and need help getting started, Book a Session with us to help you formulate a plan. If you just need motivation to get going, drop us a comment below or post in our Budget Brigade Facebook community. We’re happy to be in your corner.