I’m fairly certain I sprang from the womb with a #2 pencil, a red, squishy face, and the question: “Is it on sale?” If not, I certainly learned at a young age to be thrifty. Growing up, I saw the importance of paying attention to where my money went. Thus, budgeting became an important part of my life during college. While I’ve always budgeted, we didn’t switch to zero-based budgeting until about five years ago. I wish I’d found it sooner, as it’s been a game changer for our freedom FIRE journey.

- With zero-based budgeting, income – expenses = 0 for a set timeframe.

- A zero-based budget generally works best when budgeting monthly.

- It is a great way to plan purposefully and track your monthly spending to stay focused on your personal finance goals.

- Zero-based budgeting can be more difficult if you have an irregular income, but it’s a great way to make sure you don’t have months where your expenses are more than you can cover without debt.

What Zero-Based Budgeting Is

Zero-based budgeting is a method of budgeting where you assign a job to every dollar of income you bring in. It is a way of letting your money work as hard for you as you work for it. By giving each dollar you earn a specific task, you ensure you’re spending intentionally with your financial goals in mind.

We used to budget based on our projected income for the entire year and check in at the end of every month(ish). Switching to a pre-planned monthly zero-based budget has worked so much better.

Using the zero-based method, your budget looks like:

Income – Expenses = 0

“But Lauren!” you say. “Isn’t the goal of budgeting to save money? How as I supposed to reach financial independence and retire if my expenses equal my income every month?”

With zero-based budgeting, your expenses encompass every place your money goes, including saving for retirement. Using the 50/30/20 budget as an example:

Expenses = 50% Needs + 30% Wants + 20% Savings

So a zero-based budget doesn’t mean you have nothing left over at the end of the month. It also doesn’t mean you don’t have a buffer in your checking account to cover expenses between paychecks. Living life with zero margin is the definition of living paycheck to paycheck, and our goal is to help you get away from that stress. A zero-based budget simply means all the money left over at the end of the month (your discretionary income) gets assigned to a specific goal, so it doesn’t disappear in unplanned trips to Starbucks or Target.

How to Start Zero-Based Budgeting

To prepare your first zero-based budget, sit down before the first of the month and plan it out. We always schedule our budget meeting for the last Friday or Saturday before a new month. Sexy date night, I know. We get down and dirty in the (spread)sheets.

Your budget might not be perfect. The first few months, I almost guarantee you it won’t be.

Life happens. Not every situation is predictable, but you can set yourself up so you have stability when life throws curveballs your way.

For example, you could have three months left before your next scheduled oil change, only to have your husband roll up in the driveway like:

In these situations, keep calm and budget on. Open up your favorite app or spreadsheet you use and rebalance to roll with the punches. Or, in our case, the broken motor cables.

1. List your monthly income you have to budget

If all the income in your household is salaried, listing your monthly income is easy. Check the calendar, note how many paychecks will hit this month, and plug that number in.

If you’re an entrepreneur with a small business or if you work as an independent contractor, your monthly income likely fluctuates like mine. Since I get paid monthly in arrears, I know to within $50-$100 how much my income will be by the time we sit down for our budget meeting. I know I work a minimum six-and-a-half hours a day, so that’s the income I plan for the remaining working days in the month to add to the known income I’ve already earned.

No one looks up at the end of the month, pissed that have extra money sitting in their bank account they didn’t plan for. You will, however, be upset if you overspent because you planned for more income than came in.

Planning your zero-based budgeting income with highly irregular income:

If you’re prepaid for services or have product sales and/or commissions that tie into your income, it may be a harder to pinpoint. In this scenario, plan for the guaranteed minimum/base pay you know you’ll bring home.

As your income comes in throughout the month, revisit your budget and adjust it for the actual numbers. Since you’ve planned for the worst, you’ll only go up, up, up from here, which is a good problem to have.

2. List out your monthly expenses by priority

Once you know what your income will be, you know how low you have to limbo with your expenses.

In our budget meetings, we copy the current month’s budget for the next month and adjust based on my variable income and if it’s a three-paycheck month for my husband. Then we prioritize our expenses in the following order. If you have a highly irregular income, pay special attention here:

- Housing: Rent or mortgage and escrow or sinking funds for property taxes and insurances

- Utilities: Electric, gas, water and sewer, trash, phone bill, and internet (if you work from home, otherwise this can drop further down with entertainment expenses)

- Transportation: Car loan payment or car sinking fund, gas, tolls, parking, tag/title, and required maintenance or a metro/bus card

- Groceries and household essentials (this does not include Gatorade and Doritos or funding my Bath & Body Works addiction)

- Insurances, such as: car insurance, life insurance, disability insurance, health insurance, and umbrella insurance

- Childcare covering you while you work

These cover the bases of keeping you housed and fed while getting you to work so you can make sure your income keeps coming in.

If you have a highly irregular income and your base pay or the minimum you know you bring in every month doesn’t cover these key categories, you either need to:

- Create a sinking fund to CYA in the slim months

- Get a side hustle that makes up the difference

- Find a better paying gig with more reliable income

After covering core expenses, we then work through the following list in this order of priority:

- Minimum debt payments

- Saving up an emergency fund if you don’t have one

- Retirement investing to take the full employer match

- Paying off high-interest debt

- Other retirement funding (targeting 15%-25% of your after-tax income)

- Clothing and personal care

- Entertainment, including eating/drinking out and vacations

- Other savings sinking funds

Planning your zero-based budgeting expenses with highly irregular income:

As long as you can cover your essentials from the first list above, you have wiggle room in your budget. Tackle the second list above as much as you can, depending on the income you bring in that month.

In higher income months, save more for retirement and entertainment. With a highly irregular income, sinking funds are your BFFs.

In the lean months, focus on staying current without adding debt. Using debt as a flotation device is a poor emergency plan that will leave you lost at sea.

3. Zero out your budget

Once you’ve planned out your budget for the month, it’s time to do math. Non-nerds in the back, I heard your whining. I promise, no calculus, just simple calculator numbers here.

- Add up all your income.

- Add up your planned expenses for the month.

- Now compare them.

If you have a surplus (minimum income – planned expenses > $0), congratulations! That’s a good problem to have. Prioritize your surplus to your current FIRE ladder goal(s).

If you have a negative (minimum income – planned expenses < $0), it’s time to get creative. Find ways to cut expenses. Revisit the list of priorities above, making sure you’ve covered your bases first and foremost. If you can’t cover bills and you can’t find margin in your expenses, you need to bring in more income. I’ll play the broken record on this one: do not survive life by living off credit cards and other debt. You will never break the cycle and find your freedom FIRE if you aren’t willing to do the hard work of taking this first step toward a better future.

4. Track your progress throughout the month

You’ve completed your zero-based budget. Now what?

Time to sit back on the beach with your Mai Tai and complain about your salt.

J/K. Don’t be a Milton.

Keep track of your expenses throughout the month.

“But Lauren!” you say. “That sounds like a lot of work.”

It does, but it isn’t. I swear. In fact, after a few months, it becomes second nature, especially if you use a budgeting app or have your spreadsheet saved on the cloud so you can access it on your phone.

It’s so much less hassle than trying to add everything up at the end of the month. Trust me, I’ve done it both ways. Not only was spending an hour and a half combing through receipts and credit card statements wondering “WTF did I buy at Wal-Mart on a Tuesday?!” as much fun as a colonoscopy, it took so much longer. And we often found ourselves at the end of the month with a budget blown out of the water without realizing it, much too late to adjust.

Budget before the start of the month and track as you go. It’s the key to success. Cross my heart, hope to die, stick a needle in my eye.

5. Reassign any surplus at the end of the month

If you get to the end of the month and you’ve spent your exact budget to the penny, then yer a wizard Harry, and you should expect a letter from Hogwarts any day now.

We muggles aren’t that precise. On the last day of every month (or the first day or two of the next month if it’s been a long week), revisit the budget for the closing month and zero it back out.

What the flipping flying mongoose does that mean?

It means if you budgeted $250 for dining out for the month but only spent $40.22, then update your dining out budget line item to $40.22

Do this for every item in your budget and pay attention to the over/under.

If you have a negative, then you need to revisit your budget and ask why. Was it a conscious choice you made for a particular situation that cropped up? If your best friend was in town for the first time in five years and wanted to go out to eat and you ended up overspending the dining out budget item by $20 but are usually under budget, then fine. Get them BOGO margaritas, girl. Update the line item and move along.

But if you find you’re constantly overspending, then reevaluate your budget. Is your budget unrealistic or are you struggling with self control? We don’t want your budget to be a ball and chain dragging you into the pits of hell, but we don’t want it to be something you nod at and then “Bye, Felicia!” with an impulse purchase three days in.

If you have a surplus, then congrats! Take that extra at the end of the month and throw it at your freedom FIRE goal. Or, if you’ve waited this long and still haven’t splurged, for goodness’ sake, get that PS5 already!

6. Second verse, same as the first

As you close out the current month’s budget, don’t forget to plan for the month ahead.

I actually like to do this before I zero the budget out at the end of the month and reassign the surplus. It might be because I’m OCD like Mr. Monk and don’t like all the random $713.46s, $61.51s, and $40.22s littering the screen when it could be nice, clean $750.00s, $60.00s, and $50.00s.

It doesn’t matter which order you do them in, so long as you budget before the start and zero out your budget at the end of every month.

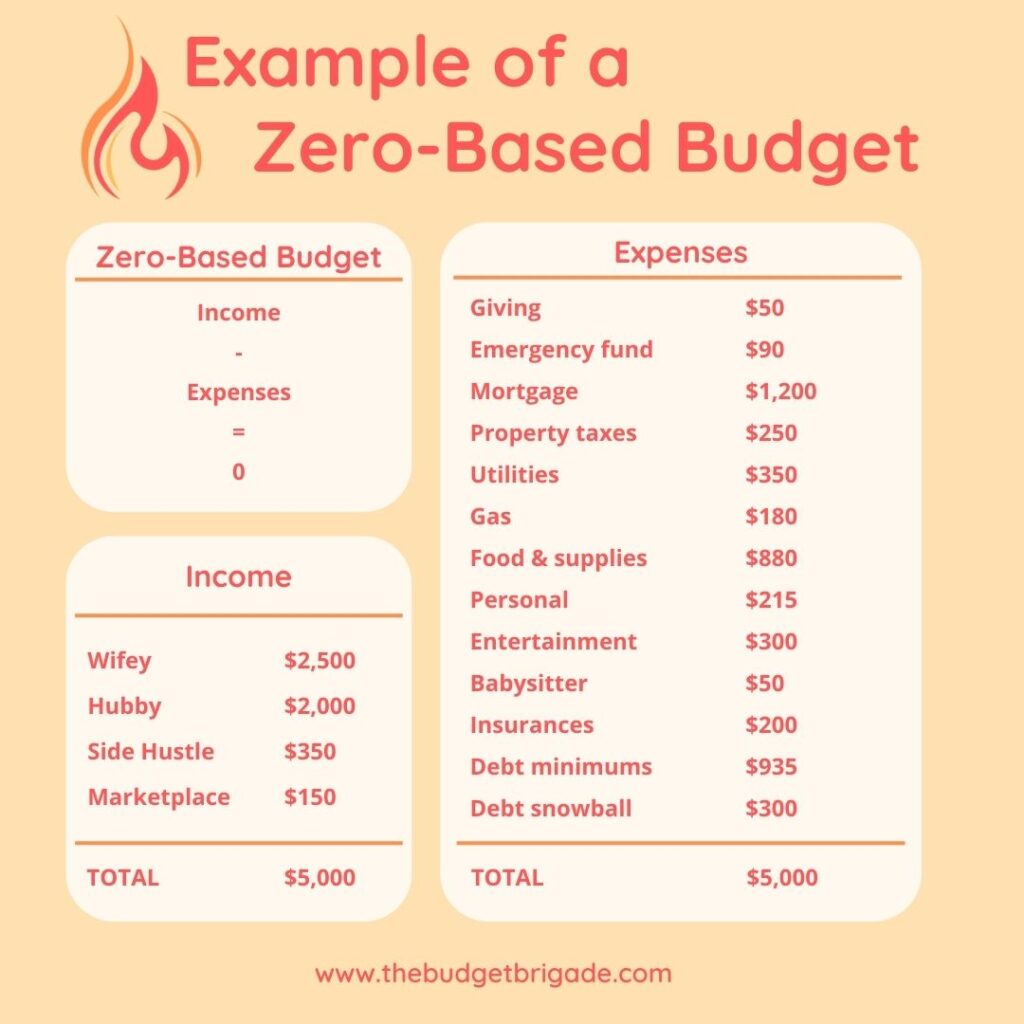

Example of a Zero-Based Budget

To show you an example of a zero-based budget, let’s check in with our favorite Jones family from Budgeting 101 that everyone likes to keep up with like they’re Kardashians.

This budget represents their plan for the month.

If they weren’t sure they were going to sell anything on Marketplace, they could have started the month balanced out to $4,850. When the extra income came in for the bike and old clothes collecting moth balls in the back of the closet, they could readjust the budget for their current journey – paying off their mountain of debt by adding the $150 to their debt snowball.

During our debt-free journey, we were sticklers to the budget. We knew that with every dollar we could add to paying off debt, the sooner we’d be done and the faster we could reach financial independence. Now that we’re debt free and climbing the FIRE ladder to our vision of freedom FIRE, we allow more leeway in the budget for our key areas of focus (food, entertainment, and vacations), but our zero-based budget keeps us on track toward our savings goals so we can hit our big life goals.