I’ll be the first to admit, I love the vroom vroom. I grew up in an IndyCar family and worked in professional motorsports for nearly a decade. Nothing beats the smell of ethanol burning in the morning. The only thing I love more than cars is financial freedom. The tough reality is, the value we put on cars in our society is one of the biggest drains on our personal finances and one of the largest purchase decisions that holds us back financially. The true cost of owning a car isn’t just the purchase price or the monthly car payment. There are several other factors to include that we’ll assess below, such as maintenance, insurance, gas, and more.

Fasten your seatbelts, let’s go.

How much does it cost to buy a car?

While several different budget items add up when assessing the total cost of owning a car, the car’s initial purchase price is one of the largest. How you buy your car also matters. For example, you can buy a new car, you can purchase a “new to you” used car, or you can lease a car. The decision on how you buy (or borrow in the case of a lease) can weigh into the overall cost of your car. We’ll use real world examples as much as we can to demonstrate the differences.

Average cost for a new car

According to Kelley Blue Book, the average cost for a new car in 2024 was right around $47,500. I have to laugh at the title of their article, which states that new car prices are tumbling. While they point out that prices have dropped a “remarkable” 3.5% year-to-year, a $47,500 price tag is still a hefty investment.

To put that into perspective, the median household income in American is around $75,000 as of the 2022 census. That means to purchase just one new car outright, the average American household would have to save over 60% of their gross income to foot the bill. If they purchase two new cars in the same year, they wouldn’t make enough money to foot the bill.

For our analysis, let’s look at a vehicle that has been on our radar for the past few years: A Subaru Outback.

We knew we wanted to move to Colorado, and you can’t live in Colorado without having a Subaru.

The base build 2025 Subaru Outback with the all-weather floor liners (we track a lot of mud and dirt into our car hiking every weekend) and rear seatback protector (we lug around a lot of stuff too) costs $30,586 before taxes, dealer fees, etc. You can probably haggle some, but let’s use $30,586 as our baseline. This is our cost if we buy it outright in cash, which a lot of Americans don’t.

Average cost for a used car

According to Consumer Reports, the average cost for a used car in 2024 was around $28,500, or $19,000 less than a new car. But let’s return to our Subaru Outback to continue our case study.

My husband and I couldn’t stomach paying $30,000 for a new Outback. When we saw the prices, we immediately began researching used options.

We wanted something that had less than 100,000 miles. Ideally, we wanted it closer to 50,000 or less, but knew that the lower the mileage, the higher the cost. There are, admittedly, a lot more options to choose from looking in Colorado versus when we first started searching in Florida, which is a perk. I found a 2019 Subaru Outback 2.5i Limited with 46,623 miles for $19,995. With dealer fees and taxes, the total comes out to around $21,900 if we were to purchase the car in cash.

Cost of purchasing a new car

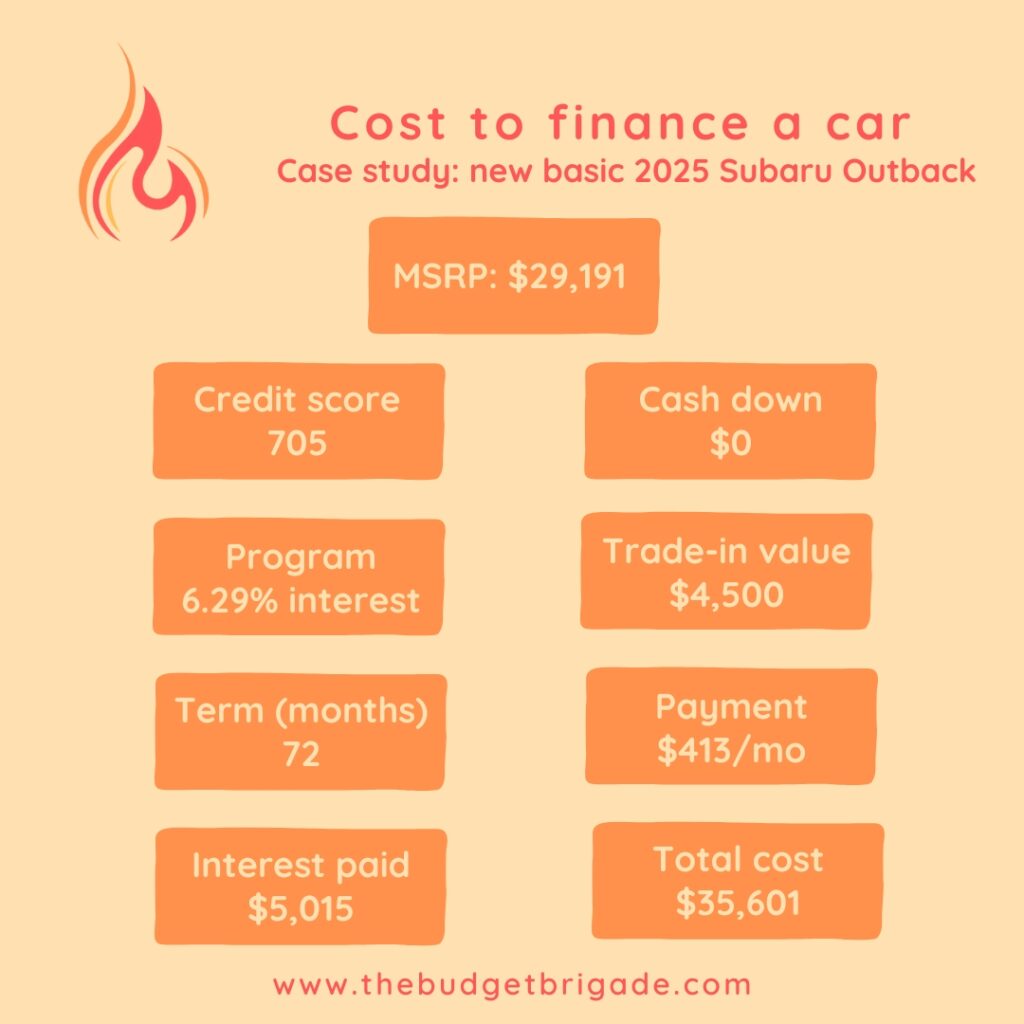

The Subaru website has a handy dandy financing and leasing calculator to help us play out the same example above for the 2025 Subaru Outback. Let’s look at how much it costs to purchase this new car by financing it on a loan.

The average cash down on a car loan is between 10% – 20%. 15% would put us at around $4,500, so let’s say that’s our down payment. Our trade-in value for our little Honda should get us that.

According to Equifax, the average credit score in America at the time of this article was around 705.

Note: Your credit score can factor heavily into what auto loan interest rate you qualify for. According to CNN, for Q1 2024, new car interest rates ranged from around 5.5% – 15.5% depending on your credit score and used car interest rates ranged from around 6.75% – 21.5%.

NerdWallet has a stat from Experian that the average car loan is 67.62 months for a new car. This is about 5 1/2 years, which isn’t an option, so I chose a 72 month loan. At the time of this analysis, the rate Subaru spits out is 6.29% for these conditions.

It doesn’t include the transportation and delivery charges in the Outback price, so it shows a selling price of $29,191. After our $4,500 down payment, we have a financed amount of $24,691.

Our total finance charges are $5,015. This is the amount we’ll end up paying in interest should we make each payment as scheduled over the 6 years of the loan. This brings the total cost of the loan to $29,706.46 and the total cost of the 2025 Subaru Outback up to $35,601 (wrapping back in our transportation and delivery fees and down payment).

The estimated monthly payment would be $413/mo.

Cost of leasing a new car

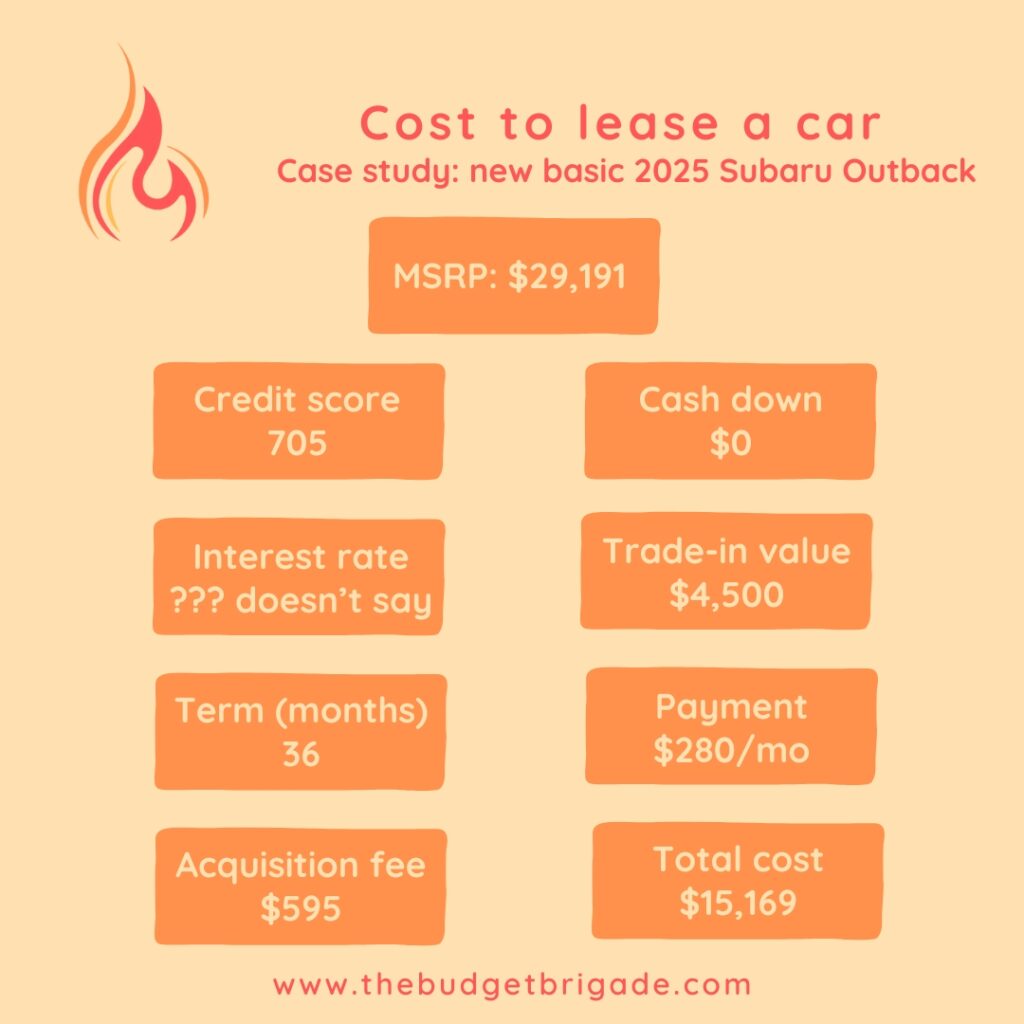

Now let’s look at leasing the Outback instead of buying it.

We’ll keep our average credit score and trade in our same old Honda for $4,500. On average, across all age groups, Americans typically drive about 13,500 miles a year according to the DOT’s Federal Highway Administration. Leases can charge hefty fees for going over the annual miles limit, so we’ll plan higher for 15,000.

The average car lease is 36 months, so we’ll leave the default there.

Subaru charges a $595 “Acquisition Fee” for you to get the car or for them to acquire the lease, who knows. Either way, it gets wrapped into your lease payment, which comes out of the leasing calculator at $280/mo.

$280/mo every month for three years totals $10,080, but don’t forget we took the credit for our old Honda, so the true cost of the lease is $14,580. Subaru is telling me the total lease payment is $15,169, so they must be sneaking in some fees as well. (There is an additional note at the end that a $300 disposition fee is due at the lease end too unless you purchase the vehicle or re-finance again.)

When your three year lease is up, you won’t have a car unless you buy it out at the end of the lease. that’s right, you will either have to purchase the vehicle from them to keep it or find a new ride. You don’t get to keep the Subaru you’ve been driving Miss Daisy around in for the past three years.

Say you could lease another car for the exact same price and terms for another 3 years (unlikely, especially since you no longer have a car to bring into the deal as a trade in, but let’s run it at the same amount to make the math a little easier, because it still makes the point). This would cost another $15,169 for the next lease term. At the end of the two 3-year leases, you would have paid $30,338 and still wouldn’t have a vehicle.

Conversely, if you’d bought the same car originally brand new, it would have cost you $30,586 in cash or $35,601 on a loan. Under these leasing terms, you’d have less than 90,000 miles on your car that still has a resale values and could still keep driving it, versus having no vehicle with this leasing situation.

Hopefully, you’re starting to see what a rip off leasing a car is.

Cost of financing a used car

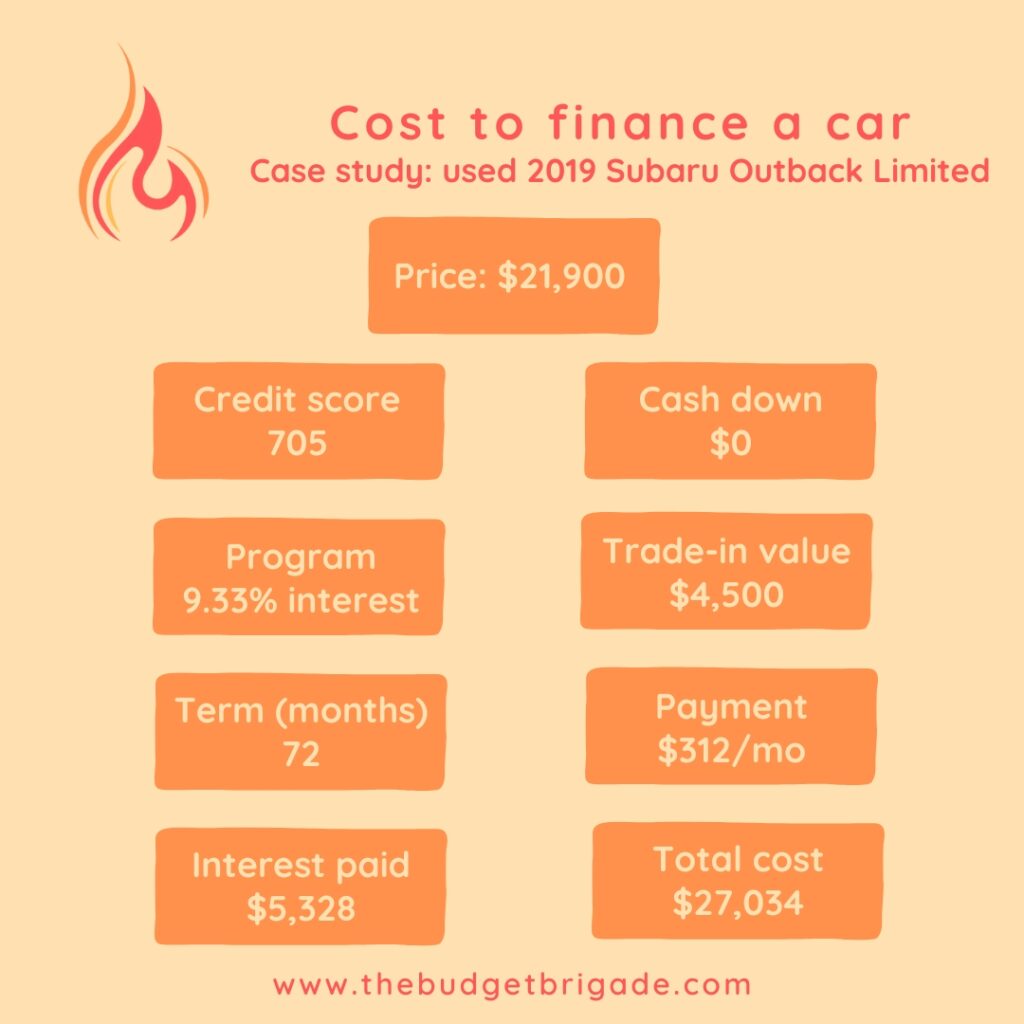

Now let’s return to that jet black 2019 Subaru I was eyeballing. Autotrader includes a handy dandy financing calculator as well (companies make it easy to make money off you).

Using the same assumptions as the scenario above ($4,500 trade-in value on the Honda, 705 credit score, 72 mo loan payment), I get an offer of 9.33% APR from Ally.

Note: Another stat from Consumer Reports that blew my mind: the average interest rate on a car loan for a used car is a whopping 12%! This, my friends, is what we call high-interest debt.

For our used car, it wraps in the taxes and fees of $1,711 to the amount financed, which equals $17,206. This becomes an estimated monthly payment of $312/mo.

Using an amortization calculator, we can see at the 9.33% APR interest rate that the total cost of the loan for the used 2019 Subaru after 6 years is $22,534, which includes a total interest amount of $5,328. You’ll notice even though the financed amount is less for the used car, the total interest is more, thanks to the higher interest rate.

The total cost for our used 2019 thus becomes $27,034.

Our used Subaru is $8,567 cheaper than financing the new version, which is more than the trade-in value we got for our 10+ year old Honda in this example.

But the purchase price isn’t the only cost for a car. Let’s keeping digging.

Common expenses associated with owning a car

Now that we know what it costs to buy a car, you’d think we’ve gotten a bulk of the bleeding done. But alas, young grasshopper, the true cost of owning a car encompasses so much more. Are finances are not dead yet from the car purchase. Tis but a scratch when we add up everything else.

The depreciation cost of car ownership

The crazy thing about owning a vehicle is that while it costs you a lot of money, it doesn’t retain its value. Unlike a house, even if you keep up with maintenance and keep it clean and shiny, cars go down in value with each passing year and mile.

Vehicles can often lose up to 20% of their value in the first year alone. By year three, many have lost 50%.

Different vehicles depreciate differently. High-end luxury brands and electric cars, for example, tend to depreciate the fastest, while trucks often retain their value better over time.

But wait! That’s not all.

Even though your car depreciates in value, you still have to pay the same monthly payment if you have an auto loan. There is where negative equity–where you owe more on your car than it’s actually worth–can easily become a thing. We didn’t even touch on this above, but some people roll negative equity from Subaru to Subaru, digging themselves deeper and deeper into a hole that becomes increasingly difficult to climb out of.

Maintenance and repair costs when owning a vehicle

People often tote new cars because they are “more reliable” and require less to maintain because they are under warranty. This doesn’t mean that they don’t have any maintenance costs. Tires are still going to wear out. So will brakes. Your oil needs to be changed every 5,000-10,000 miles regardless if it’s 1 or 10 years old.

And just wait for recalls. They come for new cars too, especially if you’re driving a new or recently revamped model. Remember when they found out airbags might explode and projectile sharp metal fragments at you? Those were all new cars at one point.

It’s hard to pinpoint maintenance and repair costs for new versus used vehicles, because costs can vary depending on a variety of factor. For instance, foreign and high-end cars usually have higher labor and parts costs.

One of the hidden costs of owning a newer car is the status and appeal of it. If you get in a car accident or your hood gets beats to hell in a hailstorm, you’ll want to get the cosmetics fixed. If, however, you are driving a ten-year-old car and get sideswiped, you’re much more likely to tell your insurance company you didn’t have any damage so that a claim doesn’t go on your record and jack up your insurance premiums for years to come. Some scratches on your old Corolla? NBD. A dent in your Tesla? Call Scotland Yard!

Averages for car maintenance and repair can also depend on how much you drive a year (wear and tear) and how often you FaceTime or record social media reels while behind the wheel (accident prone), but estimated averages come out around $900 a year.

The cost of car insurance

Each vehicle you own, you also have to insure. Depending on your record, your coverage, and where you live, your premiums can vary significantly, but car insurance can run anywhere from around $100 to $300+ a month on average. Each year you own your car, expect an average $2,400 extra cost toward ownership, thanks to insurance.

I bought my first car for $10,500. 14 years later, I sold it for $1,000. I keep track of all the maintenance costs and registration I put into the car over the life of the car, and it came out to less than $100 a month. My insurance, however, averaged around $125 a month, making it more expensive to insure, ironically, than to own and keep running.

The cost of gas to get around

While electric cars have become more popular, most cars on the road run off dead dinosaurs. The average annual cost of gas fluctuates, just like insurance, depending on where you live, what grade of gas you use, and how much you drive. On average, however, Americans spend around $1,800 a year on gas to get around.

If you have an electric car, your fuel is less expensive when you plug in, but it isn’t free. And you may need to pay to install a special charger, which also has an upfront associated cost.

Vehicle registration and taxes

This can also vary significantly depending on where you live. When we lived in Florida, our cars cost about $40 a year for tag renewals. When we got out to Colorado, it was closer to $125 with emissions testing, but many people raged about registration costs in the several hundreds of dollars. Newer and more expensive cars in Colorado have higher taxes and registration fees, which can add greater hidden costs for car ownership.

Total car of owning a car

Take a moment to assess your situation and add up the total cost of owning your car.

Ours looks something like:

Car loan payment: $0 (we paid around $11,000 for it nine years ago). Effectively, so far, it’s been about $100/month, which drops with each month we hold onto the car.

Gas: we average about $100/month

Maintenance: I haven’t kept as good of records for this car. Last year was an expensive year for us, with maintenance costs of around $4,000 (but functioning A/C is definitely more a need than a want in Florida 11 months out of the year). The previous year, it was closer to $200. This year, we spent $500 on a warranty repair (because warranties don’t always cover all the labor and associated costs, something they conveniently don’t tell you until you want your keys to drive away). We also spent around $175 for an oil change and a brake assessment.

Insurance: $125/month

The true cost of owning a car: the opportunity cost

Last but perhaps most importantly, let’s look at the big picture math that people often overlook. This can feel a little abstract, but stick with me.

Along with the actual purchase price and the “hidden” costs of car ownership above, there’s an opportunity cost for the money you spend on purchasing a vehicle.

Let’s go back to our example and say we spent $35,601 financing the new Subaru instead of buying a used vehicle in the $10,000 range like my first car purchase. Then let’s get crazy and say you buy it in cash.

Say we keep either vehicle the average 12.5 years before we drive the wheels off.

If we invested the cost difference between the two options in the stock market, at the end of the 12.5 years, we would have saved around $67,000 instead of the face value difference of $25,601.

Now let’s take it one step further and say instead of paying a car loan of $413 over 72 months that instead, you paid that $413 to yourself by also investing in the stock market. At the end of your six-year car loan, either way you own the car. But if you bought the used car in cash and invested the effective payment, after just six years, you would have around $67,000 along with your used car, versus just a “new” car that is also now used.

One final step: let’s look at the overall opportunity cost of that decision made in our early 20s after graduating college with our first big paycheck. By the time we want to retire at 60, that single vehicle decision cost us close to $550,000 thanks to compound interest we lost out on over those four decades.

And that’s just one car, which gets replaced every 8-13 years.

Are you starting to see how much those cars really cost throughout our lives?

I hope you really love those heated seats.

But wait, you say. It’s impossible to buy a car in cash.

First, it’s not. But let’s just say you’re right for the sake of the argument. Quickly, we return to our Subaru Outback showdown above and compare just the used car versus new car difference. If you were to purchase the used Outback and invest the $101/month you saved for the 6 years of your auto loan, you would have about $9,000 at the end of the loan. (Look at that, you can buy your next car in cash!) If you never invested anything again, but the time you reached 60 (assuming again you made the purchase at 20), that amount would grow to around $120,000.

Next time you are thinking about buying a $30,000 new car, ask yourself if it’s worth six figures more than a slightly older version of the same vehicle.

*This section assumes a conservative average 8% annual yield on your stock market investing.

The final word

When we moved cross country, my car wasn’t worth the cost to ship or drive it, so we sold it. We planned on buying a used Subaru similar to the one presented in the case study above once we got out here, but looking at even the used car prices made us gag. So instead, we defaulted into becoming a one-car household. Instead of spending $27,000 on a used SUV, we spent $900 on an electric bike. It’s paid for itself already in less than a year with what we’ve saved in car insurance premiums alone. And my husband appreciates the extra workout twice a week when he does the grocery runs.

Cars are so common that we’ve forgotten an important fact: it’s a luxury for us to drive as much as we do. A very expensive luxury.

If you’re feeling the pinch in your budget and have one or two car loans you’re paying, consider downgrading your car(s) or getting rid of one completely. It will not only save you money in depreciation, but it will free up money in other areas of your budget as well.

Now granted, part of our obsession with cars is due to urban sprawl. If you commute for work and your big city doesn’t have a decent public transit system (there was no possible bus route to get from our Florida house to my job near the airport), you may need a vehicle to get your paycheck. But reassessing how we value vehicles can be key to achieving that financial freedom we so desire.

When assessing a new car purchase, ask yourself how much you really want that car. Is it worth half a million dollars? Unless you’re already well on your well to financial independence and looking to splurge, probably not.