‘Tis the season where I move with CONSTANT VIGILANCE in fear of being Mariah Carey’d. Every store has Christmas music pumping through the aisles, along with end caps of endless holiday merch. While we’ve bah-humbugged and Grinched the holidays, it’s a reaction to the overcommercialization of the season versus the celebration itself. Over the years, we’ve made some fun holiday traditions full of joy that don’t blow the budget. Below, we share our ten favorite frugal holiday ideas so that you can share good tidings with all, even if you’re working through paying off debt on a bare-bones budget.

1. The Beltzenstein State of the Union Address

My favorite accidental holiday tradition is one of the more expensive traditions, but never fear, the budget is here. We fund our annual Christmas card and letter – known affectionately by family and friends as the State of the Union Address – through our November entertainment budget and keep it reasonable. While there are some really cute card designs to select from, some of them are up to $3.95 each.

That is a hard pass.

I only consider the designs under $1. Then I use a coupon code to keep costs low. CVS always has a large discount after Black Friday.

Stamps are expensive, so instead of sending cards to everyone and their neighbors, we limit our mailing list to family and friends who enjoy receiving the card. We make these the only cards we exchange throughout the holiday season, saving on pricier holiday greeting cards. Sorry, not sorry, Hallmark.

We can easily justify the cost in the entertainment budget because we have a blast with this tradition. I spend about two weeks crafting the annual “Hear ye, hear ye! Thy honorable Duchess Bucky humbly requests you to lend ye ears…” letter. That’s right, The Budget Beagle is the star of the holiday show as the duchess of our fictitious kingdom of Beltzenstein. There’s a lot of Photoshop involved (except this year, as The Budget Beagle went on strike and we could not come to a resolution before the cards went to the printer). One year, the chickens even got in on the action.

Be creative and intentional with your holiday traditions. Don’t spend a ton of money on hastily selected Mr. Deeds greeting cards or on photo card you throw together in a rush on the CVS photo website. Enjoy the process. If you don’t, then save your money for what you will enjoy. The cards are going to end up in the trash by January either way.

2. Gingerbread Ghetto

We didn’t make gingerbread houses growing up. This is probably because I was the girl that would accidentally superglue my finger to the floor. When people think of me, hand-eye coordination rarely makes the adjective list.

But I love exploring new hobbies and adventures. So a few years ago, we started this tradition with our neighbors. We buy one cheap kit at Wal-Mart each and spend the evening listening to Christmas tunes or watching classic Christmas movies such as Home Alone, Die Hard, or Gremlins, while worrying about who is going to get murdered in my husband’s gingerbread slasher home.

While they make some really cute gingerbread kit options these days, including a Central Perk Coffeehouse kit and a Harry Potter Hogwarts set, don’t get fancy. I promise, you don’t need the expensive name brand Oreo kit. These boxes have been sitting on warehouse shelves for months. You won’t want to eat them. Stick with a generic knockoff kit. It’s just as fun.

3. Oh Christmas Tree

One year for Christmas, I asked my brother for a Christmas tree. It’s a four-foot artificial tree with pre-strung lights, and it’s honestly one of my favorite presents ever.

I am not a heathen, so on the weekend after Thanksgiving, we set our little tree up in the living room.

While I see the pull of cutting down an actual tree every year, it isn’t something that brings us enough joy to justify the upkeep or the expense. This little tree with its one burnt-out yellow light has been taking care of us for almost a decade now, and I see no point in replacing it.

When’s the best time of year to buy a Christmas tree if Santa doesn’t drop it down the chimney? After Christmas. Wait for the clearance sale and snatch one up for next year.

Having a small tree also keeps the Christmas tree tradition cheap because it limits the number of ornaments we can fit. And oh boy, did I get sticker shock the first time I went to buy an ornament. Greeting cards aren’t the only things Hallmark is really proud of.

We follow the same advice for ornaments that we do for trees – purchase them after Christmas on clearance for 50% off. We also limit it to one or two a year max and make sure they are ornaments we’ll enjoy for years.

Decorating the tree is a fun tradition precisely because we’ve carefully curated our ornaments for optimal frugal fun.

Where will turkey-on-the-head Joey Tribbiani go this year?

Are Ross and Rachel on a break? If so, they better be on opposite sides of the tree.

Has Mario already rescued Princess Peach, or is she still being held captive by Donkey Kong?

Homemade ornaments can be another great way to keep this holiday tradition cheap while maximizing the joy it brings.

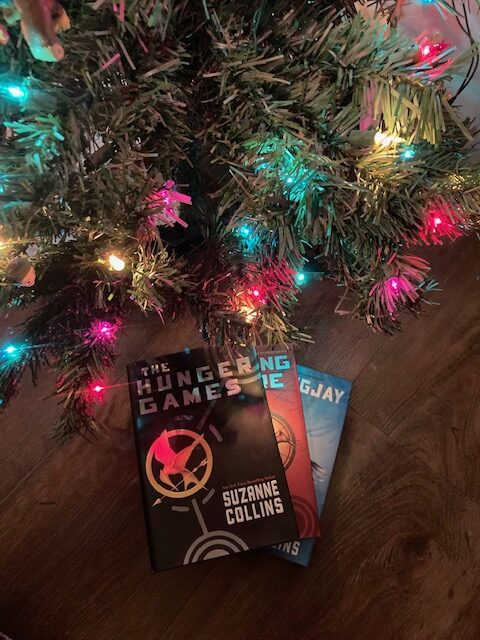

4. Christmas Reading

Bibliophiles of the world, rejoice! This one’s for you.

On Christmas Eve, I like to bundle up on the couch with a comfort read I know will bring me great joy. Confession: every other year, it’s The Hunger Games trilogy. With the bright overhead lights turned off, I read by the warm glow of the table lamps coupled with the multi-colored lights of our little Christmas tree.

When I was in my early 20s and could fall asleep on the couch without waking up with my neck in rigor mortis, I’d allow myself to fall asleep on the couch by the tree. There’s something so magical about waking up Christmas morning in the glow of the Christmas tree lights.

This tradition is great because it’s the ultimate frugal fun – it doesn’t cost me anything. I already own the couch, the tree, the book, and the blanket.

Iceland has a wonderful tradition I think we could learn from: jolabokaflod. On Christmas Eve, Icelanders exchange books and then spend the night reading by the fire. Add a cup of hot chocolate and you can get the Danes to join in for the hygge.

5. Selfish Day

Most people refer to this day as Black Friday. It’s the biggest sales day of the year and when many people begin their Christmas shopping.

We call it Selfish Day, because this is the one day of the year when we allow ourselves to splurge on our entertainment budget. The best part? It doesn’t cost us a penny when we stick to our budget.

By what magic is this possible? We use our credit card rewards.

We have a cash back rewards card and stack up the points all year. Then on the last weekend in October, when we do our November budget, we cash them out. The rewards we redeem are what we use for our Selfish Day budget.

During our debt payoff journey, this was actually the only entertainment fund we had for the entire year. I don’t know if I would recommend this to others, as it was definitely extreme and made it difficult for us to stick to the budget. But Selfish Day is a tradition we continue to this day, and it’s one of our favorites. I highly enjoy the delayed gratification of finally buying those higher priced items I can’t justify in the monthly entertainment budget. It also forces me to prioritize what I really want this year versus what can wait, which makes me appreciate our purchases even more. I already have this year’s carryovers on a list for Selfish Day 2024.

Pro Tip: If you’re Black Friday shopping on Amazon, use camelcamelcamel to make sure it’s actually a good deal.

6. Skip (or Limit) Presents

While we were going through our nighttime routine last night, I asked my husband what his favorite holiday traditions were. He paused, then said, “not giving presents.” I’d already done the skeleton outline for this post and felt validated because I’m already included #6 right here.

Call us Scrooge, but gift giving for the holidays has gotten out of hand. The average American spends around $1,500 on the holidays every year. Given that over half of Americans can’t afford a $1,000 emergency expense and over 30% of Americans have more credit card debt than emergency savings, a lot of this spending ends up on credit cards with killer interest rates.

We went on a gift giving sabbatical during our debt free journey. And yes, we got a lot of pushback from family members the first year or two, especially since we requested to not receive gifts either. We didn’t want to feel guilty about donating presents we had no use for. But the guilt was worth it.

Breaking free of this tradition gave us a new perspective and brought us back to the reason for the season. We became increasingly grateful for what we had, even with Selfish Day. That was just a perk and a way to keep us from being misers all year.

Once we paid off all our debt, we started giving again, but not to the scale that the average American does. We have a fairly low present spending limit per person and only exchange gifts with immediate family and a few found family members. And we don’t always give to the same people every year. It isn’t personal, it’s because we can’t think of something meaningful and thoughtful we think they’ll enjoy. Instead of wasting money on something we’re not sure they’ll like, we wait until we think of something they’ll get value out of.

Gift giving shouldn’t be about quantity or obligation. It should be because we see something that makes us smile, something we think will bring joy into the lives of those we love.

While we’re by far the cheapest gift givers, we spend a lot of time and intentionality planning our gifts. Some years, we spend a lot of time being creative with them too, like with our next tradition.

7. Do You Want to Build a Snowman

This idea popped up on my Facebook feed two years ago and it was instalove even though I have almost no art skills.

Our nephew enjoys his snowman made of presents, so we’ll continue with this tradition until he thinks it’s lame. It doesn’t cost us anything except extra tape. We use the wrapping paper we have on hand and flip it inside out. The ribbon we’d saved from a gift received the year before. And the sticks for the arms came from our yard.

This is a fun way to be creative while limiting spending on young family members. It also helps keep our gift giving in check by limiting the number of boxes in the snowman. The snowman’s body is the main present, and the head is usually one or two of his favorite snacks, grabbed on our regular grocery run.

Uncle David says he wants to jerry-rig it to squirt fake blood and play a pre-recorded screaming noise this year when our nephew rips the snowman’s head off, but I’m 85% sure he’s joking, as that would bust the present budget.

8. A Very Untraditional Traditional Feast

We aren’t foodies, but we like to eat. Holidays are no exceptions, though my GI problems over the last few years have severely limited how much I’m willing to indulge and pay for it later.

Even pre-GI issues, we never went crazy with holiday feasting. We hosted a huge family dinner all of one Thanksgiving before I realized it was way too much work. Our latest Memorial Day cookout was another reminder of how expensive food has gotten as well.

So for the grand holiday meals, we’ve drastically cut back. We’re not out there buying $25 spiral hams anymore, no matter how good the Honeybaked ones are. We also aren’t doing five casseroles and side dishes and a twenty-pound turkey that we have to suffer through leftovers of for the next six days. There’s only so many turkey sandwiches a girl can stomach.

We’ve scaled back without sacrificing our tastebuds or our traditions. I like to make a family-sized recipe of the family favorite Instant Pot mac n cheese and the classic Stove Top stuffing. Now that my gut is more sensitive, I’ve switched it up to my coworker’s stuffing meatball recipe and alternate between low-FODMAP gluten-free traditional dinner rolls (I promise, they taste better than they sound) and gluten-free vegan cornbread muffins. We potluck with family and friends to save money and cut down the days of leftovers we have to stomach. If we’re flying solo, I’ll throw in some potatoes to round the meal out – mashed potatoes for my husband, sweet potato for me.

My ultimate favorite untraditional holiday feast? My Christmas morning breakfast casserole. We invite the neighbors over to help eat it so it doesn’t last all week.

9. Budget Vacations

We always advocate to focus your money and time on what you really enjoy. And we enjoy our vacations. We never let a single vacation day go unused, even when companies have offered to buy them back.

Holidays are a popular time to vacation because a lot of companies either completely shut down or do far less day-to-day operations.

While we’re all for vacations, we do them on a budget. Shocker, I know. While we usually do an Airbnb for a mountain giveaway, we avoid the prime tourist areas such as Blue Ridge and Pigeon Forge and instead opt for the Hayesville and Maggie Valleys options, as well as opting for the smaller (<1,000 sq ft) cabins and chalets in order to save thousands.

We also usually skip the expensive holiday events and prioritize the cheap or free experiences. One of our bucket lists is to visit all the national parks in the US, which are usually cheap or free. The Great Smoky Mountains National Park is free to visit (although we found out this Thanksgiving that they now charge $5 for a daily parking permit). When we know we’re doing a lot of national parks that have entrance fees, we get the annual pass to save even on our discount fun. We drive for these holidays to save not just on the airline woes around the holidays but on the expensive airfare during peak travel seasons.

This isn’t to say we never do anything fun. While we like to visit the Helen, GAs on the world and pretend we’re in Germany for Christmas Eve, walking the streets and exploring the free decorations and lights, we have also budgeted and splurged on a few key holiday events to experience them once.

While we make sure we enjoy the experiences that are worth the opportunity cost, we try to get the best deal possible.

- We only go once

- We look for coupons and shop for tickets around the holidays for special promotions

- We book on the less popular days and times, as often ticket prices change depending on projected demand

- We spread them out and only do one non-frugal experience a year

10. Chase the Christmas Lights

Do you see what I see? One of my favorite things about the holiday season is seeing hundreds of sparkling Christmas lights illuminating the winter night sky.

While I love the magical allure of Christmas lights, I don’t love the costs associated with the lights themselves, the electricity to power them, or the time to install them. So around our house, we go light on the lights. We have one string of icicle lights we put up on the back porch, where we eat dinner on colder nights. I’m sure it’s no surprise that we bought these lights on clearance after Christmas one year.

If you, too, like the lights but don’t love the hassle or the cost, let other people be the ones that spend hundreds, if not thousands, on Christmas light displays. Throw a couple of bucks of gas in the car and enjoy theirs instead. Some entire neighborhoods go all out, making for a fun evening walk after dark. Towns with small downtown centers often decorate with lights and Christmas trees and throw free holiday events throughout the season. Enjoy those with your family so you can get into the spirit of Christmas without stretching your budget.

‘Tis the Season for Frugal Holiday Fun

We don’t think all holiday spending is a waste – far from it. But we try to be intentional with all our spending, and the holidays are no exception. Each dollar we spend goes toward what brings us happiness and contentment.

So many people go into debt around the holidays trying to make family and friends happy or to live up to the expectations of others. No one should lose sleep at night or slow down their FIRE ladder journey because of holly jolly holidays. Be realistic about what you can do with your holiday budget. Different years can bring different situations and thus different discretionary spending and opportunities, but a lack of an abundant holiday spending line item in the budget doesn’t mean a lack of joy or merriment. If you use a little creativity, frugal fun is all around.

Did we overlook your favorite frugal holiday ideas and traditions? Share them in the comments for others to enjoy as well.