All-American Amazon

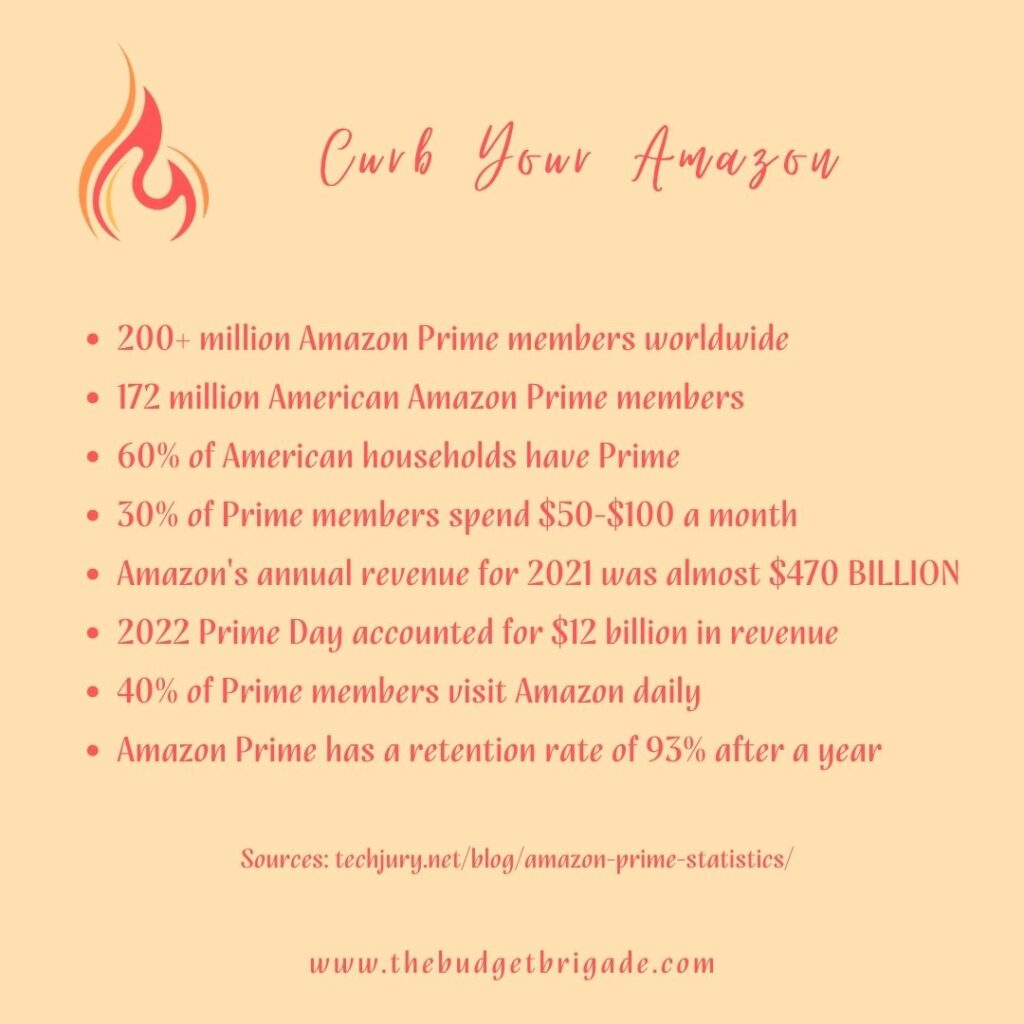

Amazon in a staple in American households and around the world. More than 200 million Amazon users have Amazon Prime. Americans make up around 172 million of those, or about 60% of American households.

Not only do Amazon users pay for the privilege of Amazon Prime perks, but they also spend money on Amazon purchases. 30% of Prime users spend $50-$100 a month on Amazon. That’s $600 to $1,200 a year.

Amazon knows how much their users spend a year. Until March of this year, they used to make it easy for the users to know as well by having an order history report you could download. Now, in order to view your order history, you have to:

Go to this webpage, select Orders from the dropdown, request the information, confirm your request via an email link Amazon send, and then wait up to a month (or more) for Amazon to process your request. It might end up being faster scrubbing your order history and adding it up yourself. (Though I will say I got mine within two days.) This exercise also shows you exactly what you’re purchasing.

I remember when I requested my order history report pre-March and ran it for the past twelve months. I did a deep gulp y’all, the kind that sticks in your throat and makes it difficult to breathe. It was a lot. The purchases were all planned and budgeted for, and credit card rewards cash back were used, but the total amount still made me pause and assess how much I wanted all those purchases over the year that added up to that eye popping total.

Amazon Prime by the Numbers

As the Budget BO$$, the stats that stuck out to me the most were the last two. Amazon Prime members are loyal. After a year of service, 93% of members renew their Prime subscription. Up until this spring, I was the same. And while I didn’t visit Amazon daily, I was close to it once I accounted for:

- Streaming Amazon Music (almost daily in this use alone until they changed the album streaming to shuffle)

- Watching Amazon Prime videos

- Price checking in-store prices

- Building my shopping cart

- Present shopping

- Saving new wants to our wish lists

Curb Your Amazon Spending

If you’re a loyal Amazon Prime member, I don’t think you need to curb your enthusiasm towards Amazon. But if you’re looking to cut expenses in your monthly budget and pay off debt, Amazon is a likely culprit to target. Here are some quick tips to help you cut your Amazon spending by making it more difficult to impulse purchase, giving you time to consult your budget and your long-term financial goals and decide if you really want the second season of Outlander on DVD.

Pro Tip: These tips apply to all online purchasing sites, not just Amazon!

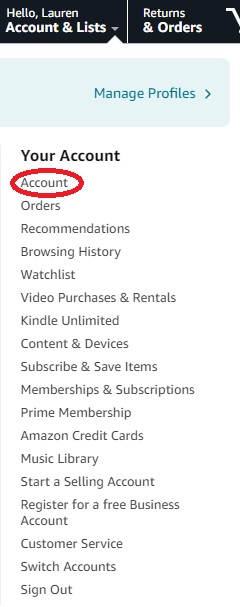

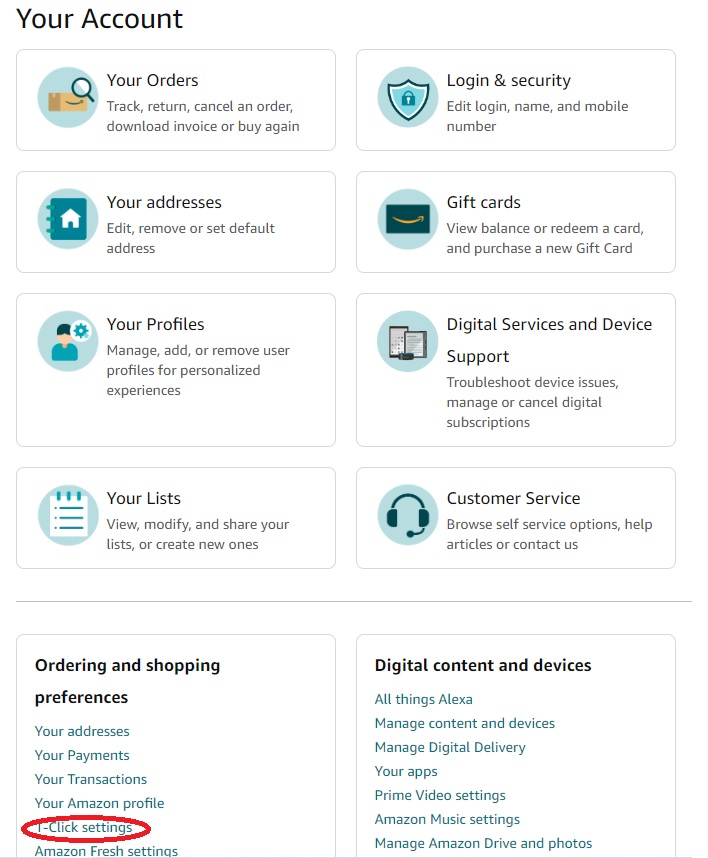

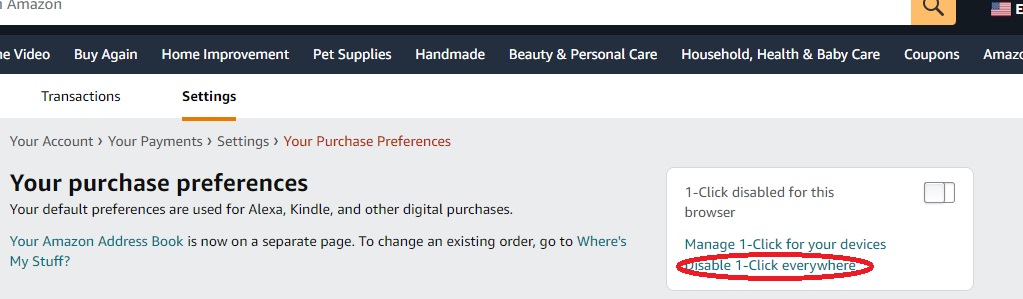

1. Turn Off 1-Click Ordering

More than once I have accidentally clicked that evil one-click button and purchased a digital book (because, what else, I’m a creature of habit) before I even realized it.

To turn off 1-click ordering, go to your Amazon account page, scroll down to the “Ordering and shopping preferences” and select “1-Click settings”. On the purchase preferences page, select “Disable 1-Click everywhere”.

2. Remove Saved Credit Cards

Forcing yourself to get off the couch or out of bed to track down your wallet and dig out your credit card is a great way to make yourself question if you need what’s in your shopping cart or, conversely, if you want it enough to make the effort to pay for it. If you find yourself on the fence, it’s a sign you should remove the item from your cart and go back to streaming The Expanse (which is honestly about the only thing I miss about Prime.)

To delete saved credit cards, navigate back to your Account homepage and select Your Payments. Your default payment method will appear with a tiny blue “Edit” under the “Credit card ending in XXXX” text, to the right of the credit card image. Click “Edit”, then select “Remove from wallet” from the bottom left of the pop-up menu.

3. Sleep on It

Whenever we are making a large purchase (over about $150) or a purchase we aren’t sure we need/really want, we let it sit in the shopping cart overnight. Sleeping on the purchase gives us plenty of time to assess how much we value that item or items and if it’s really how we want to spend our limited entertainment budget, or if we’d rather spend that money on something else.

If you’re an impulse or therapy shopper, this is a great practice to help you slow down and evaluate your purchases, giving the logical part of your brain time to catch up with the emotional part and the endorphin rush of waiting for the Amazon stork to next-day deliver your package.

4. Delete the Amazon Shopping App

Whenever I find myself spending far too much time scrolling through Facebook looking at future destinations to add to my ever expanding travel bucket list, I delete the Facebook app off my phone and turn on a content blocker so I can’t visit facebook.com on my phone. If you find yourself blowing your budget every month or want to slow your shopping impulses, you can do the same with the Amazon app and another other shopping apps. (Target, I’m looking at you next! We have knickknacks to talk about.)

5. Turn Off Targeted Amazon Ads

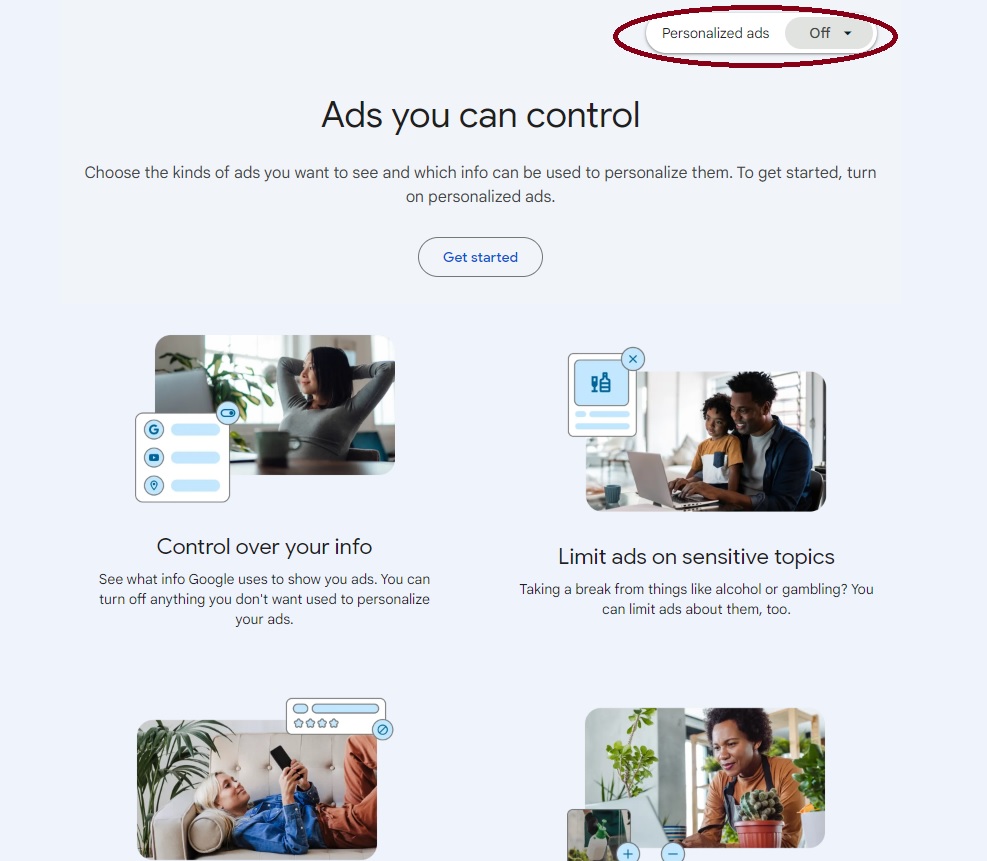

Google is the big brother everyone loves to hate, even though most us of rely on Google as much, if not more, than we rely on Amazon. If you find yourself purchasing what influencers are showing on social media, stop following their accounts. If you find yourself clicking on ads while surfing the internet or social media, turn off targeted ads. While I don’t follow influencers and impulse buy their recommendations, I have been know to purchase things just because they popped up on my Facebook feed. So I found out how to turn off targeted ads.

For Google users: go to https://adssettings.google.com/ and turn the slider next to “Ad personalization is ON” to toggle it off. On your phone, you can do this through the Settings for Google for Android users.

You can also turn off tracking and targeted ads directly through the social media websites’ apps, though I’ve found this isn’t as useful as most of them use Google Analytics.

6. Poll The Audience

Have any of the above tips helped you with your Amazon or other online shopping budget busters? Have you found other ways of curbing your Amazon addiction? Let us know in the comments!