Whole life insurance is one of the most popular insurance products sold. Unfortunately, it isn’t because it’s amazing coverage most people need. It’s pitched to clients so often because financial advisors who aren’t fiduciaries and insurance agents make a killing off its commissions. Life insurance for children is one of the whole life products where they rope people in emotionally. Below, we’ll cover the purpose of life insurance and tackle buying life insurance for your kids.

- You should use life insurance as a tool to help cover your family/dependents who depend on you for financial support.

- Since children are dependents and very few generate an income used to support their family, most children don’t need life insurance.

- Permanent life insurance, such as whole life, can be useful for children if they have a disability or are at high risk of uninsurability in the future because of illness. These types of policies, however, offer very little in coverage, so they still might not be worth the cost.

- A rider on your own term-life policy or a DIY plan of investing what you would have paid in premiums is almost always a better option.

Non-Fiduciary Financial Advisors Love Life Insurance for Children

This article on life insurance was one of the 200+ topics we have stacked to write for The Budget Brigade, but it was low on the priority list. Then the following popped up on my LinkedIn feed, which made me jump it to the head of the queue.

Let me tell y’all, when I stumble across articles like this online, it is hard to stomp down the rage storm that threatens to become a keyboard warrior in the comments section.

Financial advisors who pitch products like whole life insurance – especially for kids – anger me in a way I thought only the “girl math” trend on TikTok could.

Financial advisors should have your best interest at heart. Some probably honestly believe what they’re slinging, just like Walter White was proud of his pure, blue crystal meth. But having financial advisors sell insurance products is the definition of a conflict of interest. As your advisor for your money, they should want you aligned with the best opportunity for financial freedom. Yet these products offer the advisor heavy commissions, skewing their incentives and putting their financial interests at odds with yours.

If you have a financial advisor who tries to pitch you a whole life insurance plan and you don’t have $15 million sitting in your estate, I would think long and hard about finding a new one. It’s certainly a conversation we’ve unfortunately had to have in our household in the past few years.

This type of advice that pitches high cost, high commission products as “investment vehicles” versus the cheaper, higher coverage insurance alternatives is just one way our culture stays broke. Especially since when you die, the insurance companies get to keep all your cash value financial advisors cite as one of the primary benefits, leaving you only with the death benefit, which for policies on kids is minimal.

The Purpose of Life Insurance

Before we cover if you need life insurance for children, let’s have a quick fireside chat about what the purpose of life insurance is. We don’t want to just tell you “you don’t need life insurances on your kids” while the financial advisors tell you to get it. We want to provide insights to help you come to an informed decision for yourself.

Life insurance is a protection plan for when the bodies hit the floor or the crap hits the fan. It is an insurance policy to protect your loved ones who depend on your income to live and maintain their current standard of living.

When you die (sorry, it’s currently inevitable, no matter what Ricky Bobby hoped), the last thing you want is for your grieving loved ones to be stressed about how they’re going to pay the mortgage and monthly bills.

If you aren’t self insured because you’ve climbed to the top of your FIRE ladder and you have at least one person (a partner, child, parent, etc.) relying on you to put food on the table, then you need some amount of life insurance.

So Do You Need Life Insurance for Children?

Unless you’re Britney Spears’s father, you likely don’t factor your children into the income portion of your monthly budget. Apart from a few child stars and hard-working entrepreneurial teens, kids have little to no income. Those that bring money home rarely contribute enough to the family budget to warrant paying a monthly premium to carry a life insurance policy on them.

Ways to Buy Life Insurance for Children

While they aren’t many uses for life insurance for children, there are a few ways to get them and plenty of companies willing to sell your policies.

Some companies that offer life insurance for children include:

- Aflac

- American Family

- Foresters

- Gerber

- Mutual of Omaha

- Nationwide

- New York Life Insurance

- Northwestern Mutual (anyone surprised here?)

- Penn Mutual

- Protective

- State Farm Life Insurance

If you Google “best life insurance for children,” you’ll come across lists that all claim different companies at the top five.

There are two main ways to get life insurance coverage for your children:

- A separate policy specifically for the child, which is typically a whole life insurance policy

- A rider addition to your term life insurance policy

If you are one of the very few who need a policy for your children, adding a rider to a term policy for you is likely the better, and more affordable, option.

What to Know About Life Insurance for Children

If you decide to get a policy for one of your kids, here are a few key notes that differ for kid policies versus adult policies.

- They don’t require a medical assessment/physical during the application process

- Typically available for kids 17 and younger

- Some policies have lower age gaps (when I was looking up different policies for the list above, 14 was another common cutoff)

- Policy values are low ($10k-$50k)

- You can usually convert child riders on term policies into permanent life policies (such as whole life) before they expire, though you can expect to pay significantly more upon conversion

- Child riders are available on parent, grandparent, or guardian policies that offer this feature

As mentioned above, there are two main ways to get life insurance for children: through a whole life policy and through a child rider on your term policy.

For a child rider on an adult term life insurance, a guestimate of annual cost is around $5 per $1,000 as of September 2023, per PolicyGenius. So for a $20,000 policy rider, you might expect to pay around $8.00 – $8.50 a month.

For whole life, you can expect that price to be $8.00-$14.50 per month, depending on their age.

Why Parents Buy Life Insurance for Children

While the overwhelming majority of kids don’t need life insurance, a survey by Life Happens and LIMRA suggests that about 20% of parents and grandparents have purchased life insurance for children.

Why is this percentage so high when the need is so low?

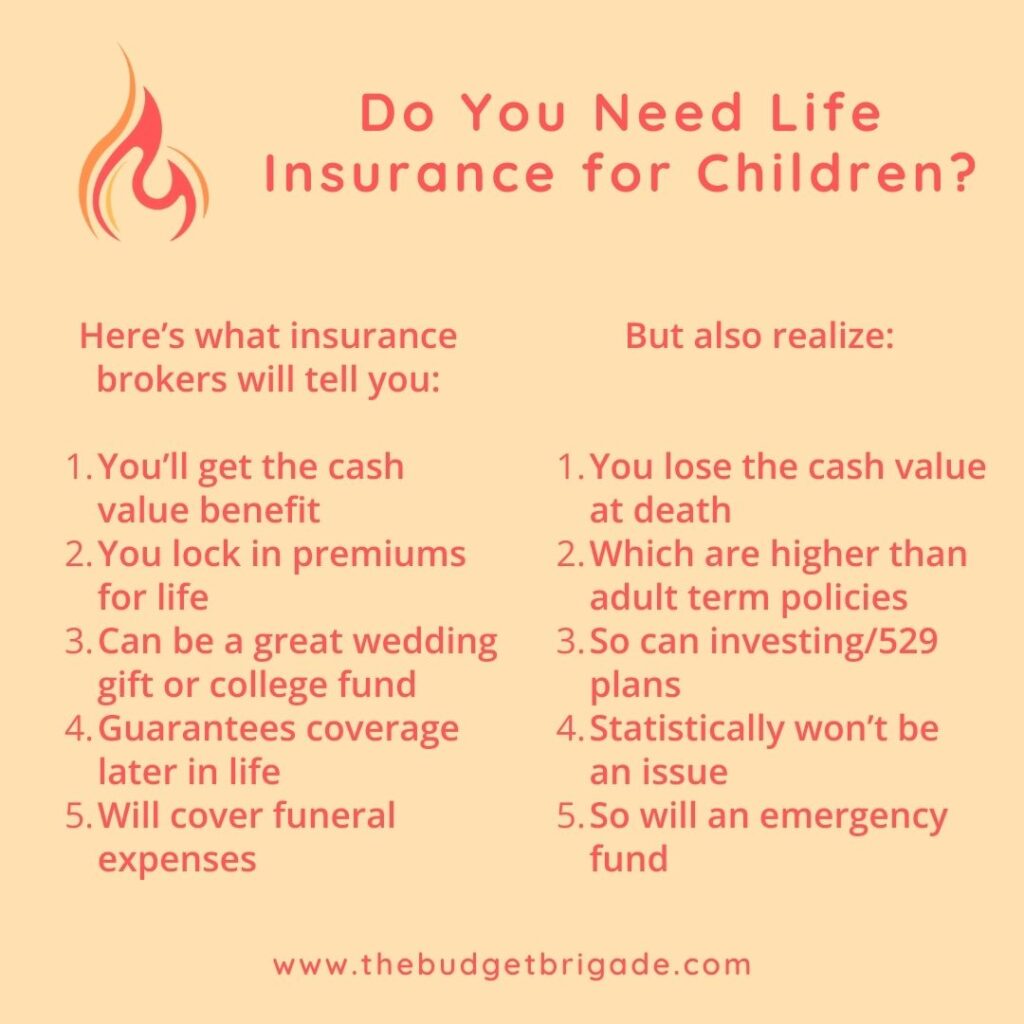

Because insurance agents and financial advisors tell us it’s a great way to save for your children’s future. Here are some sales lines pitched in the article that spurred this page, as well as others I’ve seen.

For the Cash Value

While a cash value accrues in whole life policies, it takes a few to several years before you see a cash value, as your premiums are front loaded into paying for the policy fee and the commissions paid to the broker who sold you the policy.

It’s important to note, if your experience is like mine, they’ll fail to mention that when the person named in the policy passes away, the cash value dies with them, reverting to the stated death benefit of the policy.

Because You Lock in Premiums for Life with Whole Life Insurance

While this is true, there are a few details to assess along with this fact.

- The death benefit/policy amount is also locked in with a whole life policy, which means they will only have around $10K – $50K in coverage for the entire life of the policy, which doesn’t go very far if your family depends on your salary. A general guideline for life insurance coverage is to get 10x-12x your annual income.

- If you invested the premium amount for the life of your child for the average mortality age in the United States, you’d likely have a much higher balance than the death benefit amount of the policy.

- By the time your child reaches the age of 18, their monthly premium amount for their whole life policy is likely to be around $14.50. In comparison, a 20-year term-life policy for a death benefit of more than double ($50,000) for them at the age of 20 would likely run them about $8.75 a month. So while you’re locking in premiums for life, it doesn’t mean they’re the cheapest.

To Gift Them as a Wedding Present or as a College Fund

While your child could take this gift and cash in the policy for the cash value, the returns on investments for whole life policies are typically around 1.5% annually.

1.5%. That’s less than my high-yield savings account, not to mention our brokerage account and retirement investments.

If you want to gift them something, you’d do better investing it yourself, especially for college in a 529 plan, which offers additional tax advantages.

Guarantees Coverage Later in Life

While this is true, statistically it’s unlikely your child will be ineligible for a term life insurance policy when they reach their 20s or 30s and need life insurance.

If they get a 30-year term policy in their 20s or 30s and follow the FIRE ladder, they should be self-insured by the time the term life policy expires. If they become ineligible later in life, they shouldn’t need coverage by the time their policy expires.

This is a concern if they are born with some kind of medical condition that would make them unable to get coverage later. This is one situation where a whole life insurance policy might be a suitable product to purchase. Though, as mentioned above, $50,000 (which is about the cap for most children’s life insurance policies) will not get their family that’s dependent on their income very far. It still might be worth considering investing the premium costs instead, depending on the situation.

To Pay for Funeral and Burial Expenses

We hope this is never a situation you have to face. I’m not Bobby Boucher’s mother, saying all funeral homes are the devil, but it is an industry that tends to prey on the highly emotional and vulnerable by upselling you to the heavens.

If you’ve seen *that* episode of Friday Night Lights, I know you remember Tami holding her calm in a heart wrenching situation at the funeral home, but we aren’t all the queen that is Tami Taylor. Funerals and services can be expensive.

While a life insurance policy would provide a death benefit, you could also save what you would pay in monthly premiums and beef up your emergency fund instead.

Make Sure You are Covered to Protect Your Children

While it doesn’t make sense for most parents to have life insurance for their children, unless they’re self-insured, they should have a policy on themselves to protect their children until they are adults and independent.

While most kids don’t need life insurance, most adults do. Check out our jobtown station page to learn more about life insurance, along with other insurances you should have in place to protect your loved ones.