It’s open enrollment season for a lot of Americans right now, which means it’s time to check your health insurance options, compare them, and pick your plan for the next coverage period (usually, but not always, January 1st – December 31st). Below, we walk you through the process of choosing a health insurance plan during open enrollment so you know how to assess which plan is the best for you for the upcoming year.

Overview of Open Enrollment

If your employer offers more than one health insurance plan, or your self-employed and/or getting insurance in the marketplace, you have the opportunity each open enrollment period to assess the different options and choose the best among them.

Several factors can play into your decision, including:

- Individual deductible

- Family deductible

- Out-of-pocket maximums

- Coinsurance/copays

- Prescription benefits

- Premium costs

- Your overall health

We encourage you to double check your options every year. Premiums often change year-to-year. Employers can drop and add different plans from year to year. Current plan limits can also change. Don’t assume that by not electing changes during open enrollment, your coverage will remain the same.

Also, what works for one season of life isn’t always the best plan for the following year. If you know you have a surgical procedure coming up or have a baby due, it might be time to consider changing plans, even if just for one year.

Choosing a Health Insurance Plan

Our employer offers four different choices this year.

Two we eliminated at the beginning because of premium costs for one and high deductibles for the costs/benefits for the other. Do the same in your research. Eliminate the obvious non-contenders first to narrow the options you have to consider.

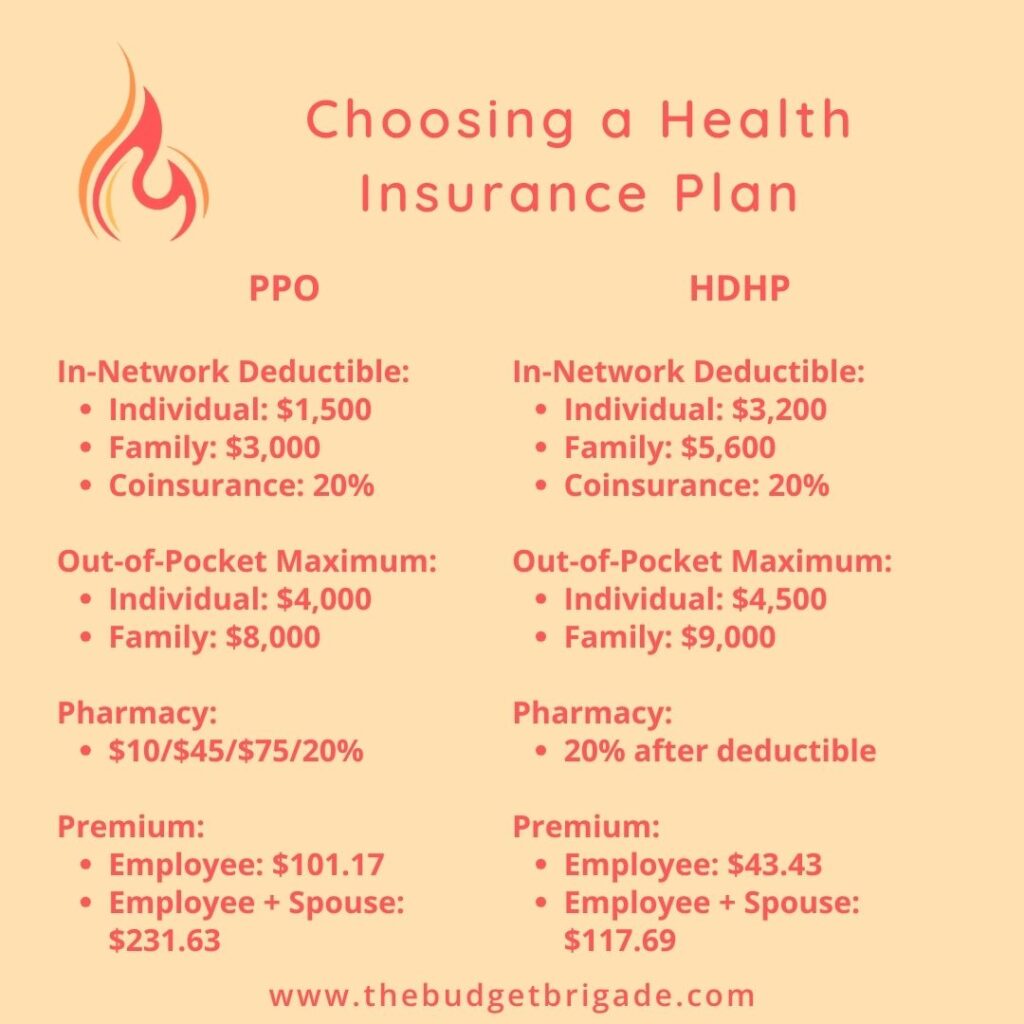

The other two, we sat down with and compared, using the factors outlined above. We’ll use our options as an example to walk you through the process of choosing a health insurance plan for your next coverage period.

Deductibles, Copays, and Coinsurance, Oh My!

If this is your first time having a choice between multiple plans, or if it’s the first time you’ve paid attention, here’s a quick primer on the different parts of health insurance coverage.

The deductible is the amount you pay toward health care/medical services before your insurance foots the bill.

As I found out earlier this year, not all deductibles are equal. Some are stacked, while others aren’t. With a stacked deductible, as soon as one member meets their deductible, their plan benefits cover future services under coinsurance. With a non-stacked, or aggregate, deductible, coinsurance doesn’t apply for any members of your family until you meet the family deductible. This can be the difference in thousands of dollars a year, so clarify what type of deductible comes with your plans.

Copays are a fixed amount you pay for health care/medical services when you receive the service. Policies like high-deductible health plans (HDHPs) typically don’t have copays. Instead, you pay the negotiated rate your insurance company has with the provider (if any) until you reach your deductible. Then coinsurance kicks in until you hit your out-of-pocket maximum.

Coinsurance is the amount you pay after you hit your deductible until you hit your out-of-pocket maximum. It’s usually a set percentage of the negotiated rate.

The out-of-pocket maximum is the amount you have to cover between your deductible + copays + co-insurance until your health insurance company foots the full cost of your medical expenses. There are typically a few out-of-pocket maximum amounts:

- The in-network out-of-pocket maximum for each family member on the plan

- The out-of-network out-of-pocket maximum for each family member on the plan

- The in-network out-of-pocket maximum for the family as a whole

- The out-of-network out-of-pocket maximum for the family as a whole

In-Network Vs. Out-of-Network Coverage

In-network providers (doctors, nurses, laboratories, imaging centers, hospitals, etc.) have signed a contract to work with your insurance at negotiated rates. Out-of-network providers have no such contract, so their services usually cost more. Your out-of-network, out-of-pocket maximums are thus usually higher than maximums for in-network providers.

We try to stay in network or cash pay, as cash pay is usually cheaper than out-of-network provider bills through insurance. If you have a doctor/specialists you prefer to see, it’s worth checking if they’re in network. While paying cash for services gets you a cheaper rate, it doesn’t count toward your deductible or out-of-pocket maximum, so it can add up over the course of a year, depending on how often you see the provider.

HMO plans in our experience have the most restrictive in-network coverage, including the requirement to select a single primary care physician who has to provide referrals for specialists. HMO plans can be a real PITA if you use your health insurance frequently, so our two cents: avoid them if you can.

Insurance has coverage exclusions, meaning they don’t cover all services available. If a service is excluded from your health insurance plan coverage, it doesn’t matter if the provider is in network or out of network, the cost won’t count toward your deductible or out-of-pocket maximum. It’s usually better to cash pay for these services to get a cheaper rate.

Since out-of-network deductibles and out-of-pocket maximums are usually more than their in-network counterparts, I always look up which hospitals in town are in network at the start of a new coverage period. Providers and insurance companies re-negotiate frequently. Just because a provider was in network on your last visit doesn’t mean they will be on your next, though they usually tell you if you schedule an appointment.

Some policies don’t offer any out-of-network coverage, so review your plans carefully and make sure you understand your coverage before scheduling appointments and services.

When you receive your medical bills, regardless of the type of plan you have, make sure you check them for accuracy. We’ve covered the staggering statistics on how many medical bills contain errors. We’ve had some of our own that were thousands of dollars off, so pay attention to your Explanation of Benefits (EOBs) and make sure they line up with your plan documents. Then make sure your bills reflect the same information. Healthcare providers love to charge patients estimated costs up front, but they aren’t so willing to follow up with you if you end up overpaying. Since you usually prepay, you rarely receive a bill to show a credit on account.

There is a somewhat recent No Surprises Act that tries to help protect us from surprise bills after certain emergency services and non-emergency services from out-of-network providers, so it’s worth reviewing, as that helped save my skin earlier this year from a thousands-of-dollars surprise bill I received.

Example Copays

Some in-network copays for the two example plans we reviewed for our open enrollment that were of interest in our current health situations are:

Primary Care Physician:

- PPO Plan: $15 copay

- High-Deductible Health Plan: 20% after deductible

Specialist:

- PPO Plan: $60 copay

- High-Deductible Health Plan: 20% after deductible

Inpatient Hospital Services:

- PPO Plan: 20% after deductible

- High-Deductible Health Plan: 20% after deductible

Minor Diagnostic Lab:

- PPO Plan: $35

- High-Deductible Health Plan: 20% after deductible

Outpatient Surgery:

- PPO Plan: 20% after deductible

- High-Deductible Health Plan: 20% after deductible

Pharmacy Coverage:

- PPO Plan: Tier 1: $10; Tier 2: $45

- High-Deductible Health Plan: 20% after deductible

While PPO plans can be nice as they offer smaller copays until you hit your deductible for certain services, they don’t offer copays for all services, which is why it’s important to assess your particular situation and the details of the plans available to find the best overall value.

Choosing a Health Insurance Plan That Fits Your Situation

When assessing your options and the costs of different coverages, consider:

- How often do you go to the doctor?

- Do you have a health concern you have to monitor regularly with bloodwork/imaging?

- Are you on any prescriptions? What tier(s) are they?

- Do you have a separate deductible you have to hit for your prescriptions?

- Can you take advantage of a HSA with a HDHP?

- Do the premium differences balance the deductibles/out-of-pocket maximums for how you’re likely to use your plan?

- Does your employer offer any incentives for an HSA?

Coming Up With a Realistic Projection

The more often you’re likely to use your insurance, and the more expensive those services are, the more likely a plan with a lower deductible, lower copay/coinsurance with a higher premium per month may make sense.

We’ll walk you through a few key questions we asked ourselves while comparing plans, and give you our numbers for an idea of how to assess and choose the best health insurance plan that fits your situation for the next coverage period. Remember, the plan you pick for next year doesn’t have to be the plan you pick forever.

Exception to the rule: if you’re a government contractor or a civil servant, you may have policy requirement of holding a particular plan for X number of years prior to retirement if you want to keep that plan when you retire, so check these special retirement benefit rules.

Are you likely to hit your deductible on either or both plans?

Estimate and add together:

1. How many times you usually go to a doctor and/or specialist during a year and how much those visits usually cost.

My dear husband barely goes to the doctor when he’s sick, so his average is about once a year for his wellness checkup, which should be covered under $0 cost on all health plans for preventative services.

I am starting hypothyroid treatment, so I will have quarterly appointments with my primary care physician (PCP) as we check and assess bloodwork. Those visits run about $78 on the HDHP before the deductible or $15 on the PPO plan.

I also have to check in with my gastroenterologist specialist about twice a year while we monitor Gus Gus the gallbladder to make sure his polyp is behaving and not trying to start a riot in my GI tract. These visits cost about $140 before the deductible on the HDHP, or $60 on the PPO.

2. What prescriptions do you have and how much do they cost?

My husband doesn’t have any prescriptions, the lucky duck.

I have the thyroid medication, which is actually cheaper on the HDHP. It’s about $3.50 every month before the deductible, or a Tier 1 drug for $10 on the PPO. My IBS (which, I’ve learned, means “It Be Something”) has made digestive enzymes necessary for the foreseeable future. That prescription is $2,400.00 a month before the deductible on the HDHP or a Tier 2 drug on the PPO for $45.

As you can see, a non-generic prescription can, on the surface, blow the comparison out of the water and make the PPO seem like the logical choice.

Except…

A lot of drugs that still have patent protections against generics offer copay assistance programs, as well as additional payment assistance for lower-income earners.

For my prescription, under the HDHP I’m eligible for a $3,000 copay assistance, which covers all but $200 of my deductible.

At 20% co-insurance, it’s still almost $500 a month, which is vomit inducing. But with an out-of-pocket maximum of $4,500 and $3,000 covered with the copay assistance, I only have to cover $1,500 for the year.

Don’t get me wrong. The $1,500 is still a lot, especially since my husband has his own individual deductible and we have the family out-of-pocket maximum until we’re completely covered.

But now let’s look at the premium differences between the PPO and HDHP.

The biweekly paycheck deduction for the PPO plan for my spouse and myself is $231.63 on the PPO, or $6,022.38 a year. For the HDHP plan, the premiums are $117.69 each paycheck, or a yearly total of $3,059.94. The difference is almost $3,000 in premiums, which is more than what our expected out-of-pocket medical expenses for the year will be.

Even with my current medical issues under treatment, the HDHP ends up being better financially for us. My husband’s previous employer used to contribute around $150 a month into our HSA with the HDHP as well, which saved us even more.

The Power of HSAs – RESUME HERE!!!!!

A HSA is a Health Savings Account, which is an amazing tax-advantaged savings accounts that can also let you invest. HSAs are only available for high-deductible plans and differ from FSAs (flexible savings accounts) as FSAs are use-it-or-lose-it accounts, while HSAs allow you to rollover and invest your savings. The IRS limits how much you can contribute to a HSA each year, but contributions go in before taxes, you don’t pay taxes when you spend the money on medical expenses, and if you invest your balance, all the earnings grow tax free as well.

HSAs are a great wealth building tool if a high-deductible plan is a good fit for you.

A Note About Newborns When Choosing a Health Insurance Plans

An interesting thing happens when you give birth to a child. As soon as your baby is born, they are a new individual on your health plan. So you’ll have your expenses for the hospital and delivery, but you’ll also get additional bills for your new kiddo under their name, stacking on top of your individual deductible and out-of-pocket maximum.

If you’re planning on having a child during your next coverage period, definitely assess the different premiums and family deductibles and out-of-pocket maximums when comparing plans.

Assess All Angles Before Choosing a Health Insurance Plan

Before we got the full sheet with our open enrollment options for next year, I’d convinced myself that we were going to have to sacrifice the tax benefits of the HSA for a year until Gus Gus the Gut Gut calmed the f-f down.

But when I dove into our actual situation of guaranteed and estimated expenses, as well as premium differences, staying on the HDHP ended up being the better deal by over $1,000.

$1,000 is well worth an hour of your time to sit down and review your plan options. I don’t know about you, but it’s for sure far more than I make in my day job.

Stay healthy this season my friends!